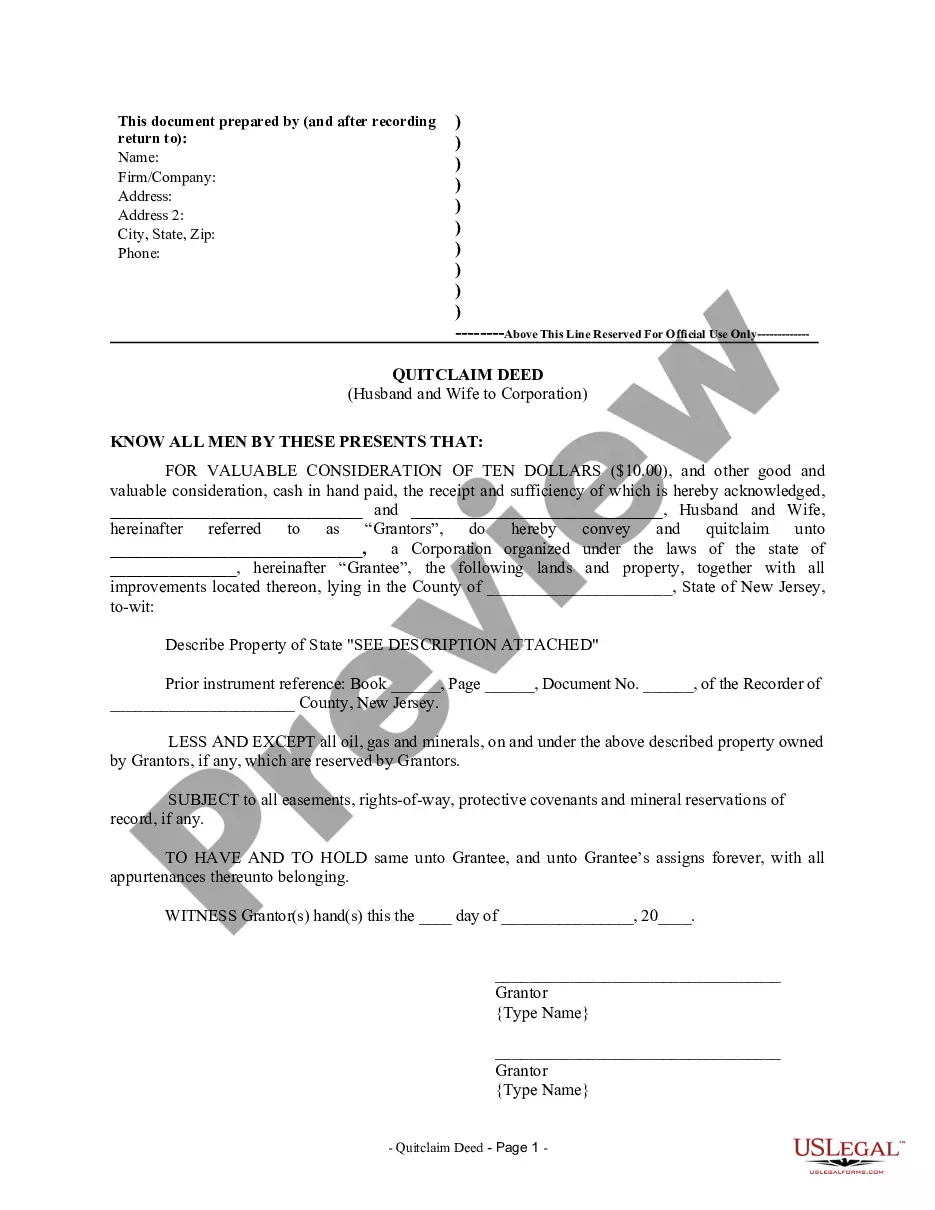

A Jersey City New Jersey Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of a property from a married couple to a corporation, relinquishing any claim to the property the spouses might have. This type of deed is commonly used when a married couple wishes to transfer property ownership to a corporation, either for estate planning purposes or to meet specific business requirements. By executing a quitclaim deed, the husband and wife effectively give up any present or future rights to the property, without making any guarantees about the title's validity or any potential encumbrances on the property. There are several variations of the Jersey City New Jersey Quitclaim Deed from Husband and Wife to Corporation, including: 1. General Jersey City New Jersey Quitclaim Deed: This is the most common type of quitclaim deed used in Jersey City. It transfers ownership without any warranties or guarantees about the property's title or condition. 2. Jersey City New Jersey Enhanced Life Estate or "Lady Bird" Deed: This specialized type of quitclaim deed allows the surviving spouse to retain a life estate in the property, while still allowing for easy transfer of ownership to the corporation upon their passing. It is commonly used for estate planning purposes. 3. Jersey City New Jersey Quitclaim Deed with a Reservation of Rights: In this scenario, the husband and wife transfer ownership to the corporation but reserve the right to live on the property for a specified period or under certain conditions. This type of deed is typically used for property that is owned by the couple but controlled by the corporation. When executing a Jersey City New Jersey Quitclaim Deed from Husband and Wife to Corporation, it is crucial to consult with a qualified real estate attorney or title agent to ensure the legality and accuracy of the document. Additionally, it is recommended to conduct a title search to uncover any potential encumbrances or issues that may affect the property's transfer.

Jersey City New Jersey Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Jersey City New Jersey Quitclaim Deed From Husband And Wife To Corporation?

No matter the social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal education to create such paperwork from scratch, mainly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a massive catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you want the Jersey City New Jersey Quitclaim Deed from Husband and Wife to Corporation or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Jersey City New Jersey Quitclaim Deed from Husband and Wife to Corporation quickly using our trustworthy service. If you are already a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are new to our platform, make sure to follow these steps before downloading the Jersey City New Jersey Quitclaim Deed from Husband and Wife to Corporation:

- Be sure the form you have chosen is good for your area considering that the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if provided) of cases the paper can be used for.

- If the form you chosen doesn’t meet your requirements, you can start again and look for the suitable document.

- Click Buy now and choose the subscription plan that suits you the best.

- Log in to your account login information or create one from scratch.

- Select the payment gateway and proceed to download the Jersey City New Jersey Quitclaim Deed from Husband and Wife to Corporation once the payment is completed.

You’re good to go! Now you can proceed to print out the form or fill it out online. In case you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.