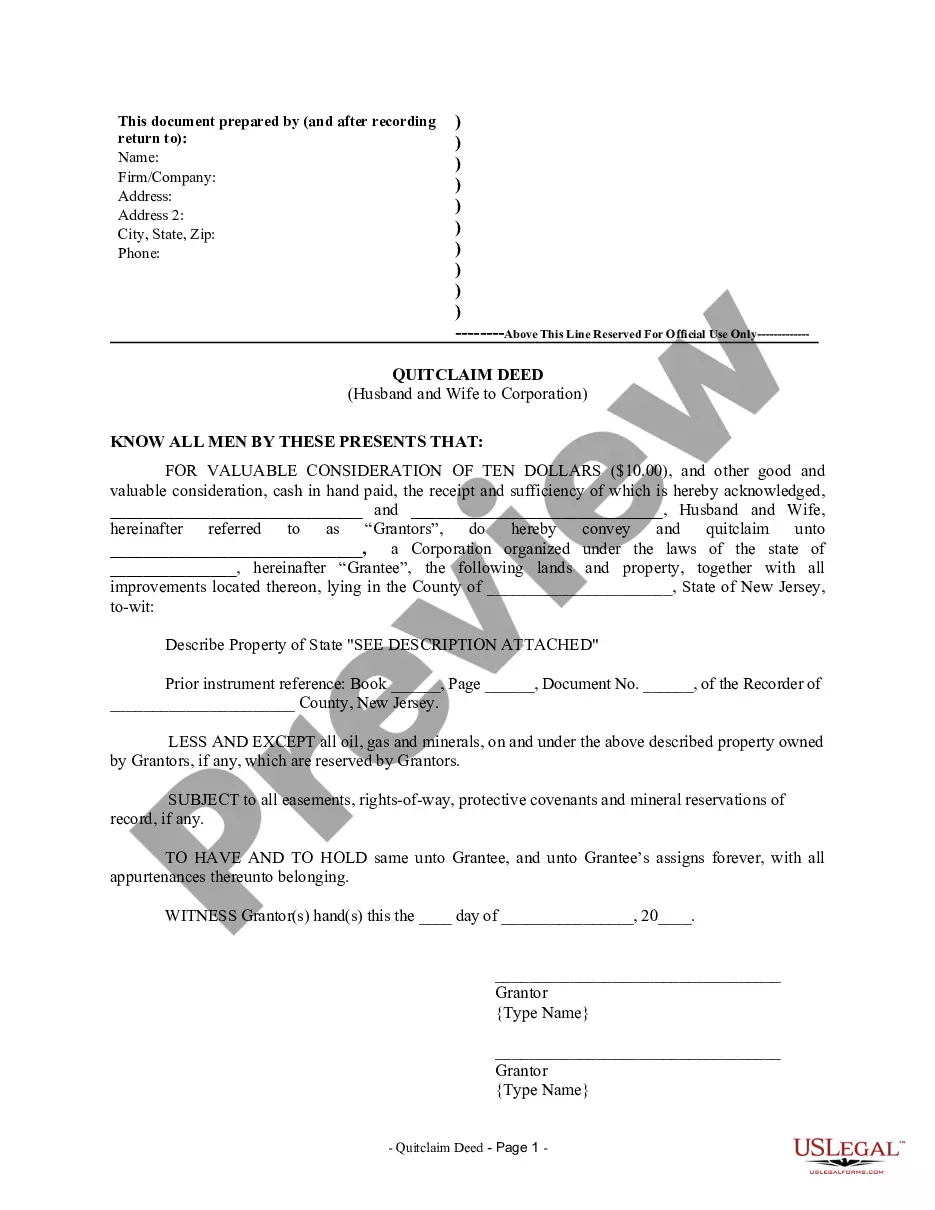

A Paterson New Jersey Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of a property from a married couple to a corporation using the quitclaim method. This type of deed is commonly used when a married couple wishes to transfer property to a corporation they own or establish. The Paterson Quitclaim Deed allows the husband and wife to relinquish any interest or claim they may have in the property and transfer it to the corporation without making any warranties or guarantees regarding the title. It is important to note that a quitclaim deed does not provide any guarantees of the property's ownership history or any existing liens, unlike a warranty deed. Using a quitclaim deed in this scenario offers flexibility and ease of transfer. The husband and wife, as granters, can quickly and efficiently transfer the property to their corporation, known as the grantee, without the need for extensive title searches or guaranteeing the title's validity. Different types of Paterson New Jersey Quitclaim Deed from Husband and Wife to Corporation may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used in Paterson, New Jersey. It transfers the property ownership without any specific conditions or warranties. 2. Enhanced Life Estate Quitclaim Deed: Also known as a "Ladybird Deed," this type of quitclaim deed allows the husband and wife to retain a life estate in the property. The corporation receives ownership only after the death of both spouses. 3. Corporate Restructuring Quitclaim Deed: This type of quitclaim deed may be used when a husband and wife already own the property individually, and they intend to transfer it to their corporation for restructuring or tax purposes. 4. Partial Interest Quitclaim Deed: If the husband and wife wish to transfer only a portion of their property's ownership to the corporation, they can opt for a partial interest quitclaim deed. It allows them to transfer a specified percentage or fraction of their interest while retaining the remaining ownership. When executing a Paterson New Jersey Quitclaim Deed from Husband and Wife to Corporation, it is crucial to consult with a qualified real estate attorney to ensure compliance with local regulations and to address any specific requirements or concerns related to the transfer.

Paterson New Jersey Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Paterson New Jersey Quitclaim Deed From Husband And Wife To Corporation?

Do you need a trustworthy and inexpensive legal forms supplier to get the Paterson New Jersey Quitclaim Deed from Husband and Wife to Corporation? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and area.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Paterson New Jersey Quitclaim Deed from Husband and Wife to Corporation conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the document is intended for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Paterson New Jersey Quitclaim Deed from Husband and Wife to Corporation in any provided format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online once and for all.