A Paterson New Jersey Warranty Deed from Husband and Wife to a Corporation is a legal document that transfers ownership of a property from a married couple to a corporation, providing a warranty of title. This type of deed is commonly used when a married couple wishes to transfer a property they jointly own to a corporation they establish or are affiliated with. The warranty deed guarantees that the property is free from any liens or claims and assures the corporation that they are receiving clear title to the property. There are two main types of Paterson New Jersey Warranty Deeds from Husband and Wife to a Corporation: 1. General Warranty Deed: This type of deed offers the highest level of protection to the corporation, as it warrants that the property is free from any defects in title, except those explicitly mentioned in the deed. The husband and wife, as granters, affirm that they have full authority to sell the property, and they will defend the title against any adverse claims. 2. Special Warranty Deed: Also known as a limited warranty deed, this type of deed provides a narrower warranty. The husband and wife still guarantee that they have not encumbered the property during their ownership, but they only warrant against defects or claims arising during their period of ownership. This means that any defects or claims arising before their ownership are not their responsibility. When creating a Paterson New Jersey Warranty Deed from Husband and Wife to Corporation, important information to include would be the legal names of the husband and wife, as granters, and the exact name and legal structure of the corporation, as the grantee. The deed should also provide a detailed description of the property being transferred, including its address, parcel number, and any relevant property boundaries. It is crucial to consult an attorney or a real estate professional familiar with New Jersey laws to ensure the accuracy and compliance of the deed.

Paterson New Jersey Warranty Deed from Husband and Wife to Corporation

State:

New Jersey

City:

Paterson

Control #:

NJ-08-78

Format:

Word;

Rich Text

Instant download

Description

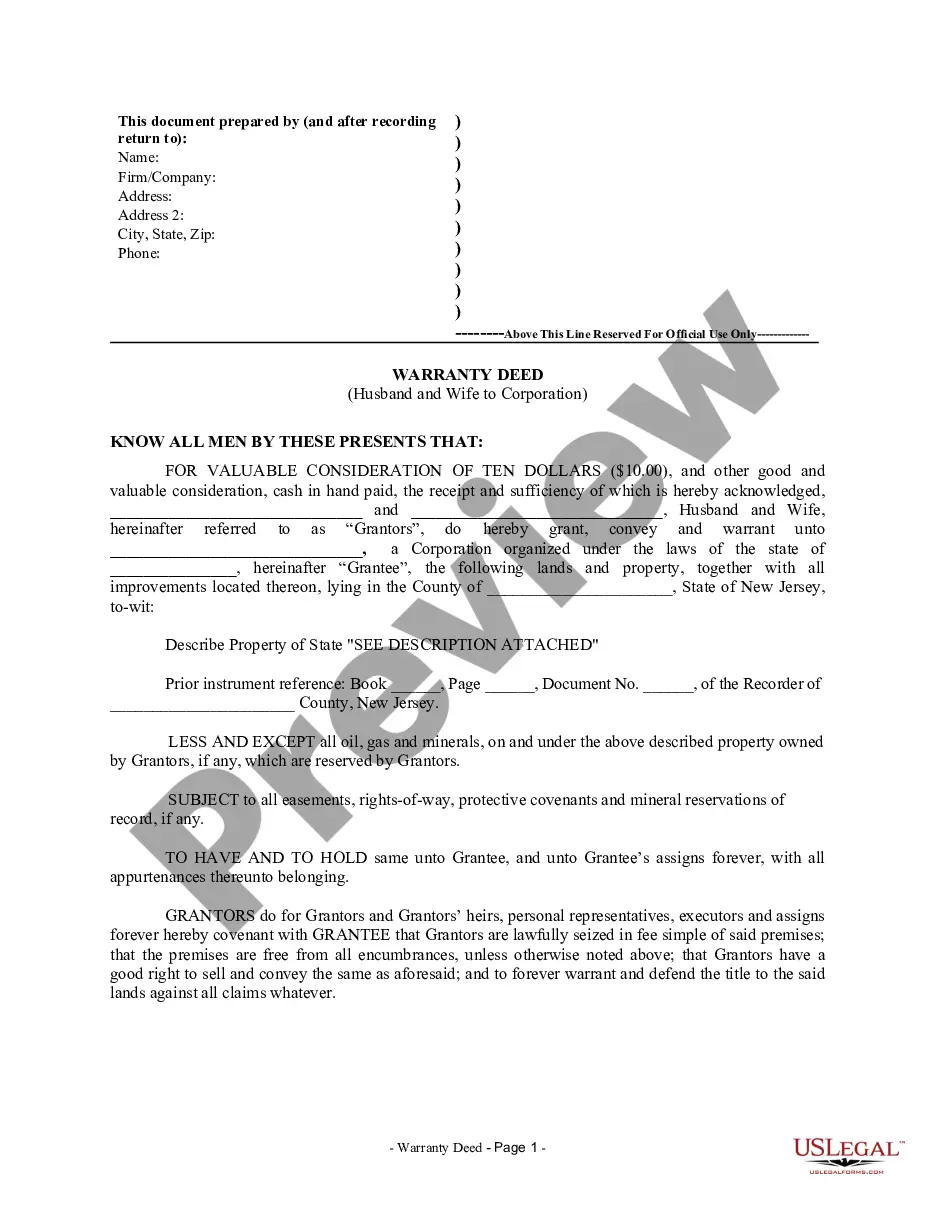

This Warranty Deed from Husband and Wife to Corporation form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Grantors warrant and convey the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Paterson New Jersey Warranty Deed from Husband and Wife to a Corporation is a legal document that transfers ownership of a property from a married couple to a corporation, providing a warranty of title. This type of deed is commonly used when a married couple wishes to transfer a property they jointly own to a corporation they establish or are affiliated with. The warranty deed guarantees that the property is free from any liens or claims and assures the corporation that they are receiving clear title to the property. There are two main types of Paterson New Jersey Warranty Deeds from Husband and Wife to a Corporation: 1. General Warranty Deed: This type of deed offers the highest level of protection to the corporation, as it warrants that the property is free from any defects in title, except those explicitly mentioned in the deed. The husband and wife, as granters, affirm that they have full authority to sell the property, and they will defend the title against any adverse claims. 2. Special Warranty Deed: Also known as a limited warranty deed, this type of deed provides a narrower warranty. The husband and wife still guarantee that they have not encumbered the property during their ownership, but they only warrant against defects or claims arising during their period of ownership. This means that any defects or claims arising before their ownership are not their responsibility. When creating a Paterson New Jersey Warranty Deed from Husband and Wife to Corporation, important information to include would be the legal names of the husband and wife, as granters, and the exact name and legal structure of the corporation, as the grantee. The deed should also provide a detailed description of the property being transferred, including its address, parcel number, and any relevant property boundaries. It is crucial to consult an attorney or a real estate professional familiar with New Jersey laws to ensure the accuracy and compliance of the deed.

Free preview

How to fill out Paterson New Jersey Warranty Deed From Husband And Wife To Corporation?

If you’ve already used our service before, log in to your account and save the Paterson New Jersey Warranty Deed from Husband and Wife to Corporation on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Paterson New Jersey Warranty Deed from Husband and Wife to Corporation. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!