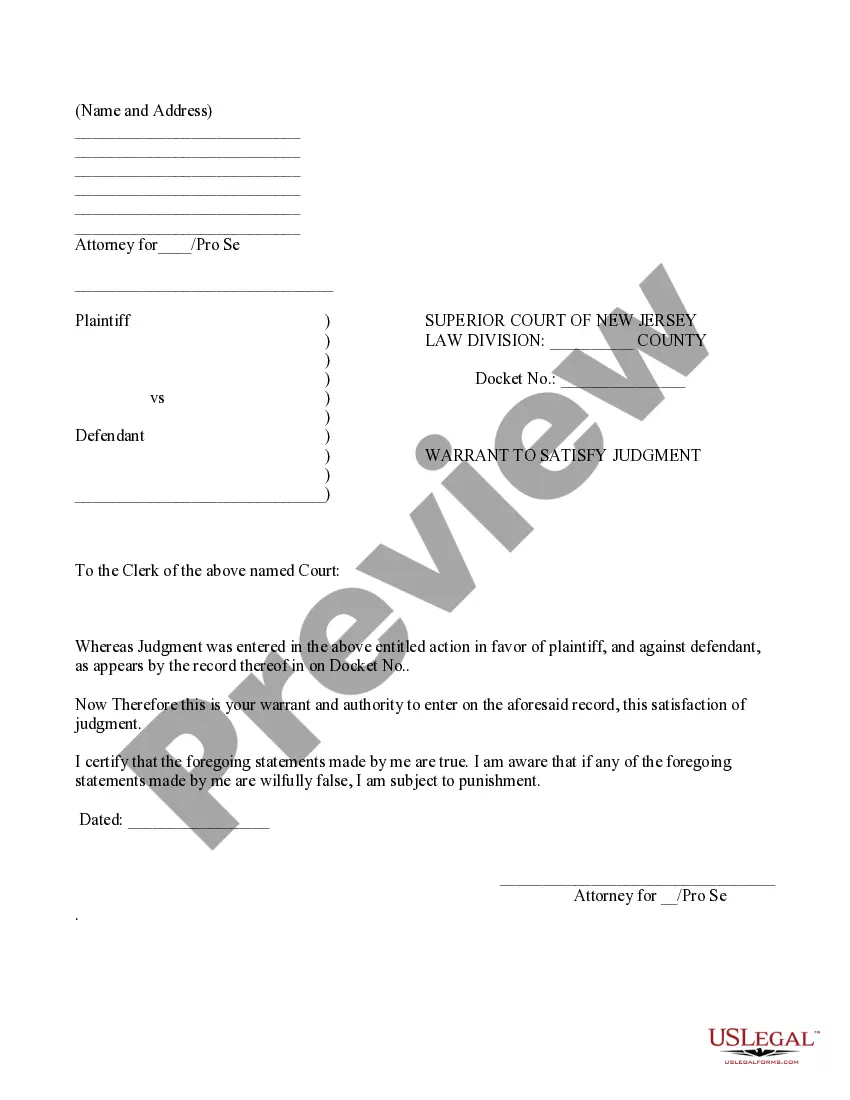

Jersey City New Jersey Warranty to Satisfy Judgment is a legal mechanism designed to ensure that individuals or businesses comply with court-ordered judgments. When a judgment is obtained against someone in a civil lawsuit, they are legally obligated to compensate the aggrieved party for damages or debts owed. However, the process of collecting this judgment can be challenging, especially if the judgment debtor refuses to pay or lacks sufficient assets. In such cases, a warranty to satisfy judgment in Jersey City, New Jersey offers an additional layer of protection for the judgment creditor. This warranty serves as a guarantee that if the judgment debtor fails to fulfill their payment obligations, the warranty provider will step in and cover the outstanding amount. It provides peace of mind for the judgment creditor, ensuring they will receive the compensation they are due. There are primarily two types of warranties to satisfy judgment available in Jersey City, New Jersey: 1. Judicial Bond Warranty: This type of warranty is often required by the court before allowing a judgment debtor to appeal the judgment. By obtaining a judicial bond, the judgment debtor guarantees that they will fulfill the original judgment if the appeal is unsuccessful. This bond ensures the judgment creditor's rights are protected, even if the debtor attempts to delay payment through the appeals process. 2. Collateral Warranty: In some cases, a judgment creditor may require the judgment debtor to provide collateral as a warranty to satisfy judgment. This collateral serves as a form of security that the creditor can claim in case the debtor defaults on payment. It can be in the form of real estate, vehicles, bank accounts, or any other valuable assets. By securing the collateral, the creditor ensures they have a means to recover the owed amount if the debtor fails to fulfill their obligations. To obtain a warranty to satisfy judgment in Jersey City, New Jersey, individuals or businesses typically work with insurance companies or specialized bond providers. These providers assess the risk associated with the judgment debtor and offer the necessary warranty based on various factors such as the judgment amount, the debtor's financial stability, and other relevant information. In conclusion, a Jersey City New Jersey Warranty to Satisfy Judgment is an essential tool for judgment creditors seeking reassurance in receiving their rightful compensation. It acts as a safeguard, guaranteeing that they will be properly compensated even if the judgment debtor fails to fulfill their obligations. By understanding the different types of warranties available, individuals and businesses can navigate the complex process of enforcing judgments and protecting their financial interests.

Jersey City New Jersey Warranty to Satisfy Judgment

Description

How to fill out Jersey City New Jersey Warranty To Satisfy Judgment?

If you are looking for a relevant form template, it’s impossible to find a better platform than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can find a huge number of form samples for business and personal purposes by categories and states, or key phrases. With our high-quality search function, finding the latest Jersey City New Jersey Warranty to Satisfy Judgment is as easy as 1-2-3. Moreover, the relevance of each and every document is confirmed by a team of skilled lawyers that on a regular basis check the templates on our website and revise them based on the latest state and county laws.

If you already know about our system and have a registered account, all you should do to receive the Jersey City New Jersey Warranty to Satisfy Judgment is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the form you require. Look at its description and utilize the Preview feature to explore its content. If it doesn’t suit your needs, use the Search option at the top of the screen to find the needed document.

- Affirm your selection. Choose the Buy now button. Following that, select your preferred pricing plan and provide credentials to register an account.

- Make the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Pick the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Jersey City New Jersey Warranty to Satisfy Judgment.

Each and every template you add to your profile has no expiration date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you need to receive an additional copy for editing or printing, feel free to come back and export it again whenever you want.

Make use of the US Legal Forms professional catalogue to gain access to the Jersey City New Jersey Warranty to Satisfy Judgment you were looking for and a huge number of other professional and state-specific templates on a single website!