Jersey City, New Jersey Discharge of Unpaid Balance on Lien A discharge of unpaid balance on lien in Jersey City, New Jersey refers to the official release of an outstanding debt or balance owed on a lien against a property within the city limits. This process is crucial for homeowners who have successfully paid off their liens or mortgages, enabling them to clear any encumbrances on the property's title and gain full ownership rights. There are different types of Jersey City, New Jersey Discharge of Unpaid Balance on Lien, each serving a specific purpose based on the nature of the debt or lien being discharged: 1. Mortgage Lien Discharge: This type of discharge occurs when a property owner has fully repaid their mortgage loan. The lender acknowledges the satisfaction of the debt and releases the lien, allowing the property owner to remove any encumbrances and have a clear title certificate. 2. Construction Lien Discharge: Whenever a property undergoes construction or renovation, contractors and suppliers often place a construction lien on it as a way to secure payment for their services or supplies. Once the contractor or supplier has been paid in full, they can file for a discharge of the unpaid balance on the lien, removing the encumbrance from the property's title. 3. Tax Lien Discharge: In cases where property owners fail to pay their property taxes, the government can place a tax lien on the property as a way to secure the unpaid amounts. If the owed taxes are eventually paid off, the property owner or their representative can file for a discharge of the unpaid balance on the lien, effectively clearing the property's title from any tax-related encumbrances. 4. Judgment Lien Discharge: If someone obtains a judgment against a property owner, a judgment lien may be filed against the property as a way to enforce the payment of the debt. Once the judgment has been fully satisfied, the property owner can apply for a discharge of the unpaid balance on the lien, removing the encumbrance from the property's title. To initiate the discharge process in Jersey City, New Jersey, individuals need to file the necessary documents with the appropriate local government office, such as the County Clerk's Office. These documents typically include a discharge of lien form, proof of payment or satisfaction, and any supporting documentation relevant to the type of lien being discharged. By obtaining a discharge of unpaid balance on lien in Jersey City, New Jersey, property owners can successfully remove any encumbrances on their properties, ensuring they have clear and marketable titles. This not only provides peace of mind but also enables them to freely sell, refinance, or transfer ownership of their property in the future.

Jersey City New Jersey Discharge of Unpaid Balance on Lien

Category:

State:

New Jersey

City:

Jersey City

Control #:

NJ-10065

Format:

Word;

Rich Text

Instant download

Description

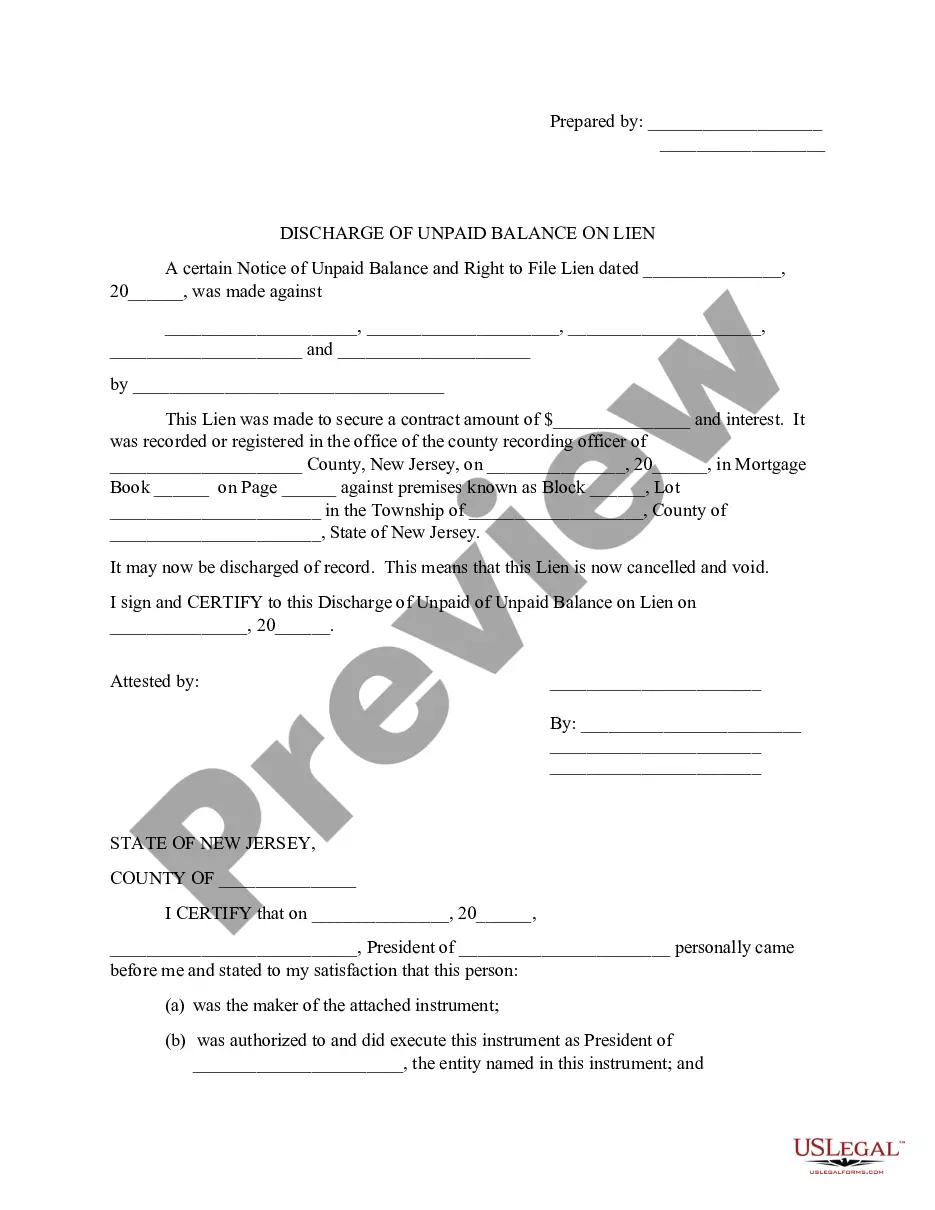

This notice details an existing lien to secure a contract amount but now the lien may be discharged. The lien is cancelled and void as a result of this filing.

Jersey City, New Jersey Discharge of Unpaid Balance on Lien A discharge of unpaid balance on lien in Jersey City, New Jersey refers to the official release of an outstanding debt or balance owed on a lien against a property within the city limits. This process is crucial for homeowners who have successfully paid off their liens or mortgages, enabling them to clear any encumbrances on the property's title and gain full ownership rights. There are different types of Jersey City, New Jersey Discharge of Unpaid Balance on Lien, each serving a specific purpose based on the nature of the debt or lien being discharged: 1. Mortgage Lien Discharge: This type of discharge occurs when a property owner has fully repaid their mortgage loan. The lender acknowledges the satisfaction of the debt and releases the lien, allowing the property owner to remove any encumbrances and have a clear title certificate. 2. Construction Lien Discharge: Whenever a property undergoes construction or renovation, contractors and suppliers often place a construction lien on it as a way to secure payment for their services or supplies. Once the contractor or supplier has been paid in full, they can file for a discharge of the unpaid balance on the lien, removing the encumbrance from the property's title. 3. Tax Lien Discharge: In cases where property owners fail to pay their property taxes, the government can place a tax lien on the property as a way to secure the unpaid amounts. If the owed taxes are eventually paid off, the property owner or their representative can file for a discharge of the unpaid balance on the lien, effectively clearing the property's title from any tax-related encumbrances. 4. Judgment Lien Discharge: If someone obtains a judgment against a property owner, a judgment lien may be filed against the property as a way to enforce the payment of the debt. Once the judgment has been fully satisfied, the property owner can apply for a discharge of the unpaid balance on the lien, removing the encumbrance from the property's title. To initiate the discharge process in Jersey City, New Jersey, individuals need to file the necessary documents with the appropriate local government office, such as the County Clerk's Office. These documents typically include a discharge of lien form, proof of payment or satisfaction, and any supporting documentation relevant to the type of lien being discharged. By obtaining a discharge of unpaid balance on lien in Jersey City, New Jersey, property owners can successfully remove any encumbrances on their properties, ensuring they have clear and marketable titles. This not only provides peace of mind but also enables them to freely sell, refinance, or transfer ownership of their property in the future.

Free preview

How to fill out Jersey City New Jersey Discharge Of Unpaid Balance On Lien?

If you’ve already used our service before, log in to your account and save the Jersey City New Jersey Discharge of Unpaid Balance on Lien on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Jersey City New Jersey Discharge of Unpaid Balance on Lien. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!