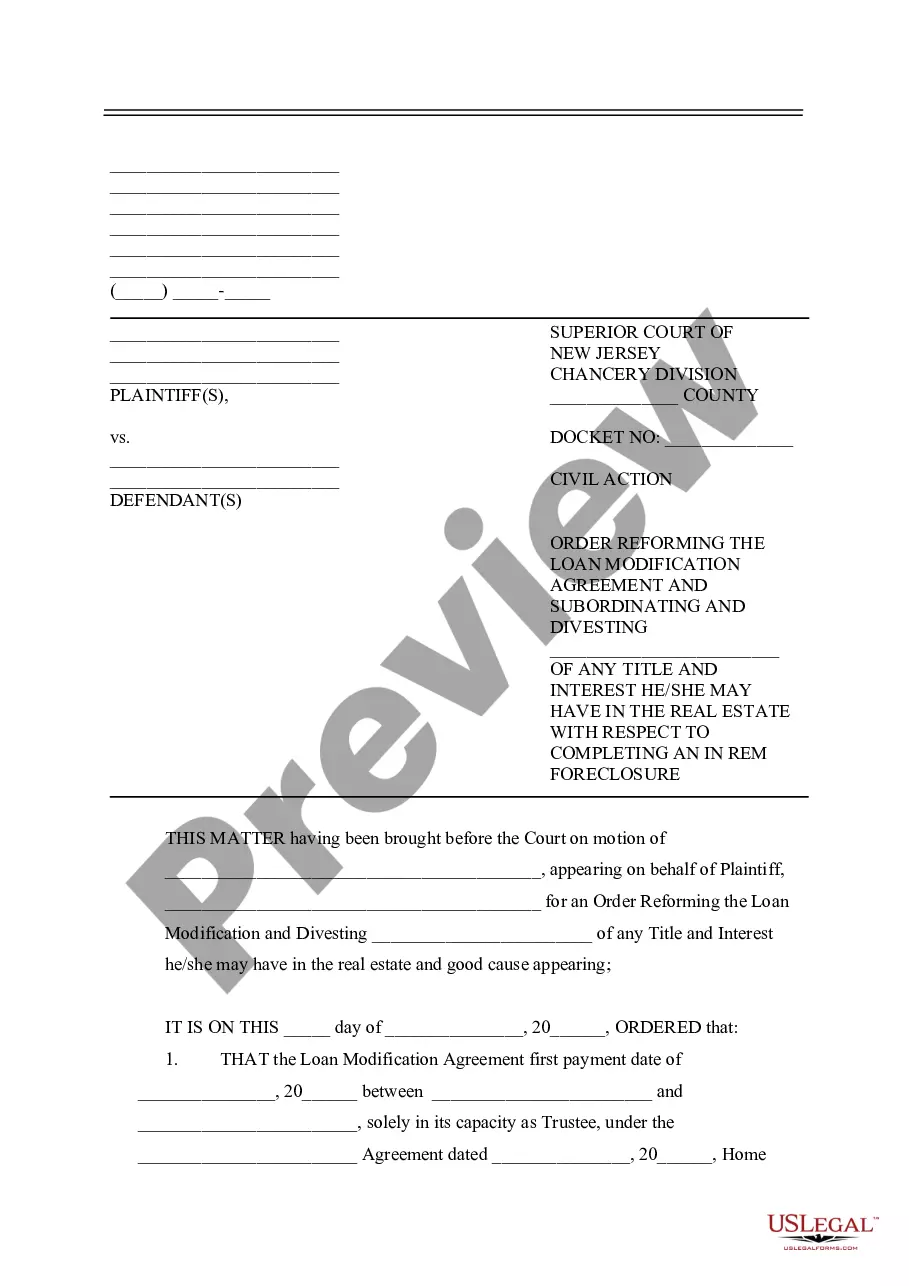

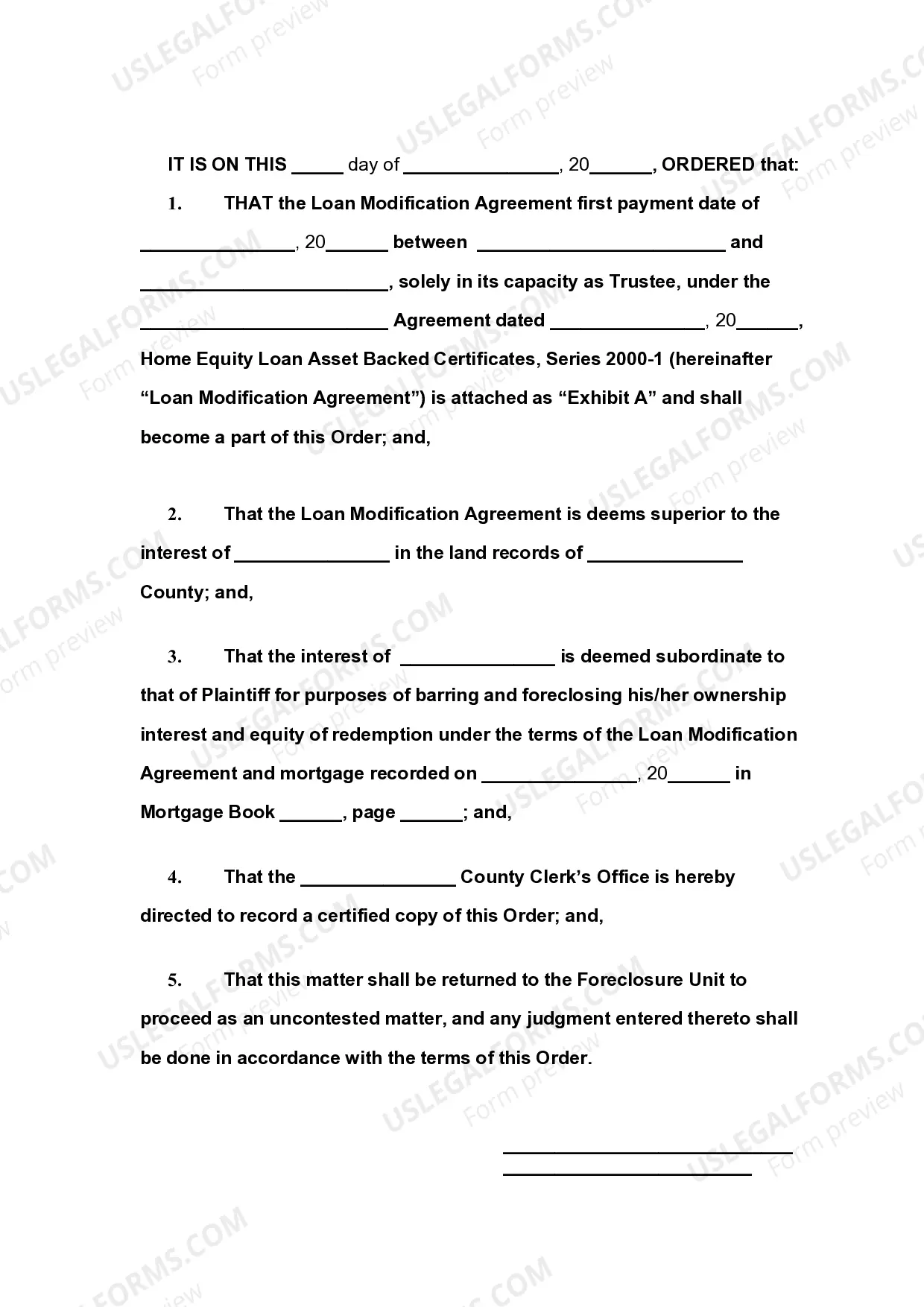

The Elizabeth New Jersey Order Reforming Loan Modification Agreement and Subordinating and Divesting Ownership Interest is a legal document that outlines the process and terms involved in restructuring a loan and transferring ownership interest in Elizabeth, New Jersey. This agreement is designed to provide a clear framework for individuals or entities involved in modifying an existing loan and rearranging the hierarchy of ownership rights. In the context of loan modification, the Elizabeth New Jersey Order Reforming Loan Modification Agreement allows borrowers to negotiate with lenders in order to change certain loan terms. This agreement enables parties to restructure their loan payments, interest rates, or even extend the loan's maturity date. The order ensures that all parties involved, including the borrower, lender, and any other stakeholders, are bound by the revised terms. Another aspect covered by this agreement is the subordination of ownership interest. In certain situations, an individual or entity's ownership rights may need to be subordinated to secure the loan modification. Subordination means that the priority or ranking of ownership interest is adjusted, often in favor of the lender or an external investor. This helps ensure that the loan modification is feasible for all parties involved and reduces the risk associated with the loan. Additionally, the Elizabeth New Jersey Order Reforming Loan Modification Agreement can also address the divesting of ownership interest. Divesting refers to the transfer or disposal of ownership rights from one party to another. In some cases, as part of the loan modification process, a borrower may need to divest a portion of their ownership interest to a lender or another entity involved in the restructuring. This ensures that the lender or investor has a more active role in managing the loan and mitigating their risk. Overall, the Elizabeth New Jersey Order Reforming Loan Modification Agreement and Subordinating and Divesting Ownership Interest aims to create a fair and transparent process for loan modification and the adjustment of ownership rights. It provides a legal framework for borrowers, lenders, and investors to renegotiate loan terms, redistribute ownership interests, and ensure proper risk management.

Elizabeth New Jersey Order Reforming Loan Modification Agreement and Subordinating and Divesting Ownership Interest

Description

How to fill out Elizabeth New Jersey Order Reforming Loan Modification Agreement And Subordinating And Divesting Ownership Interest?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Elizabeth New Jersey Order Reforming Loan Modification Agreement and Subordinating and Divesting Ownership Interest? US Legal Forms is your go-to option.

Whether you require a simple agreement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Elizabeth New Jersey Order Reforming Loan Modification Agreement and Subordinating and Divesting Ownership Interest conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to find out who and what the document is good for.

- Restart the search in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Elizabeth New Jersey Order Reforming Loan Modification Agreement and Subordinating and Divesting Ownership Interest in any provided file format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal papers online for good.