Elizabeth New Jersey Order Reforming Mortgage is a legal process that enables homeowners in Elizabeth, New Jersey, to modify the terms of their existing mortgage loans to make them more affordable and manageable. This order reforming mortgage is governed by specific laws and regulations in the state of New Jersey and offers homeowners the opportunity to renegotiate their mortgage terms with their lenders, typically due to financial hardships or changes in their financial circumstances. The process of Elizabeth New Jersey Order Reforming Mortgage involves submitting an application to the lender, providing relevant financial documentation, and working closely with a housing counselor or attorney to understand the eligibility requirements and negotiate with the lender. This order reforming mortgage aims to help homeowners avoid foreclosure and maintain homeownership by making the mortgage payments more affordable. There are different types of Elizabeth New Jersey Order Reforming Mortgage that homeowners can explore based on their specific situations. These may include the following: 1. Loan Modification: This type of order reforming mortgage involves modifying the existing mortgage terms, such as interest rates, monthly payments, or loan duration, to make them more affordable for the homeowner. The lender may agree to lower the interest rate or extend the loan term to reduce the monthly mortgage payments. 2. Principal Reduction: In certain cases, homeowners facing significant financial hardships may qualify for a principal reduction, where a portion of the outstanding mortgage balance is forgiven. This reduction helps homeowners by reducing the overall loan amount, making the mortgage more manageable. 3. Refinancing: Another option for order reforming mortgage is refinancing the existing mortgage loan. Homeowners can explore refinancing options to secure a new loan with more favorable terms, such as lower interest rates, which can result in reduced monthly mortgage payments. 4. Forbearance Agreement: In some cases, homeowners may temporarily face financial difficulties. In such situations, lenders may offer a forbearance agreement, where the mortgage payments are temporarily suspended or reduced for a specific period. This temporary relief allows homeowners to stabilize their finances before resuming regular mortgage payments. 5. Short Sale: If a homeowner is unable to afford their mortgage payments even after considering other order reforming mortgage options, a short sale may be considered. This involves selling the property for less than the outstanding mortgage balance, with the lender's approval. The proceeds from the sale are used to settle the debt partially, and the homeowner is relieved of the remaining mortgage obligation. It is essential for homeowners in Elizabeth, New Jersey, to understand that the eligibility requirements and processes for Elizabeth New Jersey Order Reforming Mortgage may vary depending on the lender, specific mortgage terms, and individual circumstances. Seeking guidance from housing counselors or legal professionals experienced in order reforming mortgage is crucial to ensure a smooth and successful process.

Elizabeth New Jersey Order Reforming Mortgage

State:

New Jersey

City:

Elizabeth

Control #:

NJ-1146

Format:

Word;

Rich Text

Instant download

Description

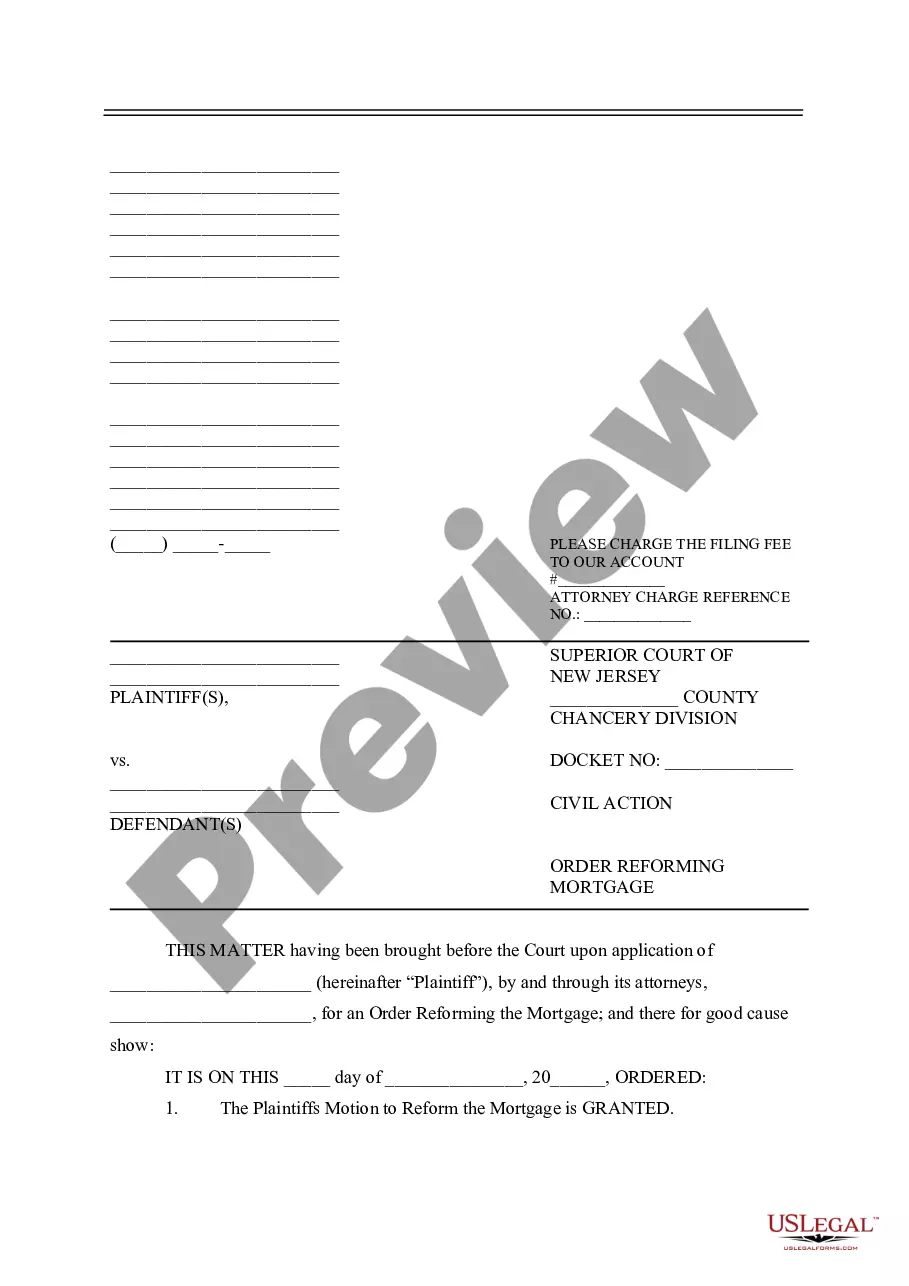

This order is entered by the chancery court to reform the terms of a mortgage to include the legal description from the recorded deed.

Elizabeth New Jersey Order Reforming Mortgage is a legal process that enables homeowners in Elizabeth, New Jersey, to modify the terms of their existing mortgage loans to make them more affordable and manageable. This order reforming mortgage is governed by specific laws and regulations in the state of New Jersey and offers homeowners the opportunity to renegotiate their mortgage terms with their lenders, typically due to financial hardships or changes in their financial circumstances. The process of Elizabeth New Jersey Order Reforming Mortgage involves submitting an application to the lender, providing relevant financial documentation, and working closely with a housing counselor or attorney to understand the eligibility requirements and negotiate with the lender. This order reforming mortgage aims to help homeowners avoid foreclosure and maintain homeownership by making the mortgage payments more affordable. There are different types of Elizabeth New Jersey Order Reforming Mortgage that homeowners can explore based on their specific situations. These may include the following: 1. Loan Modification: This type of order reforming mortgage involves modifying the existing mortgage terms, such as interest rates, monthly payments, or loan duration, to make them more affordable for the homeowner. The lender may agree to lower the interest rate or extend the loan term to reduce the monthly mortgage payments. 2. Principal Reduction: In certain cases, homeowners facing significant financial hardships may qualify for a principal reduction, where a portion of the outstanding mortgage balance is forgiven. This reduction helps homeowners by reducing the overall loan amount, making the mortgage more manageable. 3. Refinancing: Another option for order reforming mortgage is refinancing the existing mortgage loan. Homeowners can explore refinancing options to secure a new loan with more favorable terms, such as lower interest rates, which can result in reduced monthly mortgage payments. 4. Forbearance Agreement: In some cases, homeowners may temporarily face financial difficulties. In such situations, lenders may offer a forbearance agreement, where the mortgage payments are temporarily suspended or reduced for a specific period. This temporary relief allows homeowners to stabilize their finances before resuming regular mortgage payments. 5. Short Sale: If a homeowner is unable to afford their mortgage payments even after considering other order reforming mortgage options, a short sale may be considered. This involves selling the property for less than the outstanding mortgage balance, with the lender's approval. The proceeds from the sale are used to settle the debt partially, and the homeowner is relieved of the remaining mortgage obligation. It is essential for homeowners in Elizabeth, New Jersey, to understand that the eligibility requirements and processes for Elizabeth New Jersey Order Reforming Mortgage may vary depending on the lender, specific mortgage terms, and individual circumstances. Seeking guidance from housing counselors or legal professionals experienced in order reforming mortgage is crucial to ensure a smooth and successful process.

Free preview

How to fill out Elizabeth New Jersey Order Reforming Mortgage?

If you’ve already used our service before, log in to your account and save the Elizabeth New Jersey Order Reforming Mortgage on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Elizabeth New Jersey Order Reforming Mortgage. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!