Paterson, New Jersey Order Reforming Mortgage: An In-Depth Overview Introduction: The Paterson, New Jersey Order Reforming Mortgage is a legal process that aims to modify or restructure a mortgage agreement in the city of Paterson. This order provides homeowners with an opportunity to make changes to their existing mortgage terms, ensuring greater affordability and stability. By providing a detailed description of this reform and its various types, potential homeowners in Paterson can gain a comprehensive understanding of the options available to them. Types of Paterson, New Jersey Order Reforming Mortgage: 1. Rate Adjustment: — This type of mortgage reform focuses on modifying the interest rate associated with the loan. Homeowners can request a rate reduction, resulting in lower monthly payments and potential long-term savings. This reform is particularly beneficial when interest rates have decreased since the original loan was secured. 2. Term Extension: — With this type of mortgage reform, homeowners can extend the term or duration of their mortgage. By spreading out the remaining balance over a longer period, monthly payments can be reduced, making them more affordable in the short run. Term extension is a viable option for homeowners facing temporary financial difficulties. 3. Principal Reduction: — This type of reform involves reducing the outstanding balance or principal of the mortgage. It aims to allow homeowners to pay off their loan more quickly, potentially diminishing their overall debt load and saving on interest payments over time. Principal reduction is typically requested when homeowners experience a significant decrease in the value of their property. 4. Adjustable Rate to Fixed Rate Conversion: — Homeowners who initially opted for an adjustable-rate mortgage (ARM) may choose to convert it to a fixed-rate mortgage (FRM) through this type of mortgage reform. Converting to a fixed rate provides stability and predictability, safeguarding homeowners from future interest rate fluctuations. This conversion is commonly pursued when interest rates are relatively low, as it ensures a fixed rate over the remaining loan term. 5. Forbearance Agreement: — The forbearance agreement is a type of mortgage reform designed for homeowners experiencing temporary financial hardships. This agreement allows homeowners to temporarily suspend or reduce their mortgage payments until they can financially recover. Forbearance agreements are most often employed during unexpected events, such as job loss, illness, or natural disasters. Benefits of Paterson, New Jersey Order Reforming Mortgage: — Reduced monthly payments, providing increased affordability. — Potential long-term savings through interest rate reductions. — Enhanced financial stability and predictability with fixed-rate mortgages. — An opportunity to expedite mortgage repayment by reducing the principal balance. — Temporary relief for homeowners facing financial hardships through forbearance agreements. In conclusion, the Paterson, New Jersey Order Reforming Mortgage offers a range of options to homeowners seeking to modify their mortgage terms. Whether through rate adjustment, term extension, principal reduction, rate conversion, or forbearance agreements, this order strives to provide individuals in Paterson with more affordable and manageable mortgage solutions. Regardless of the specific type of reform pursued, homeowners can benefit from improved financial stability, reduced monthly payments, and potential long-term savings.

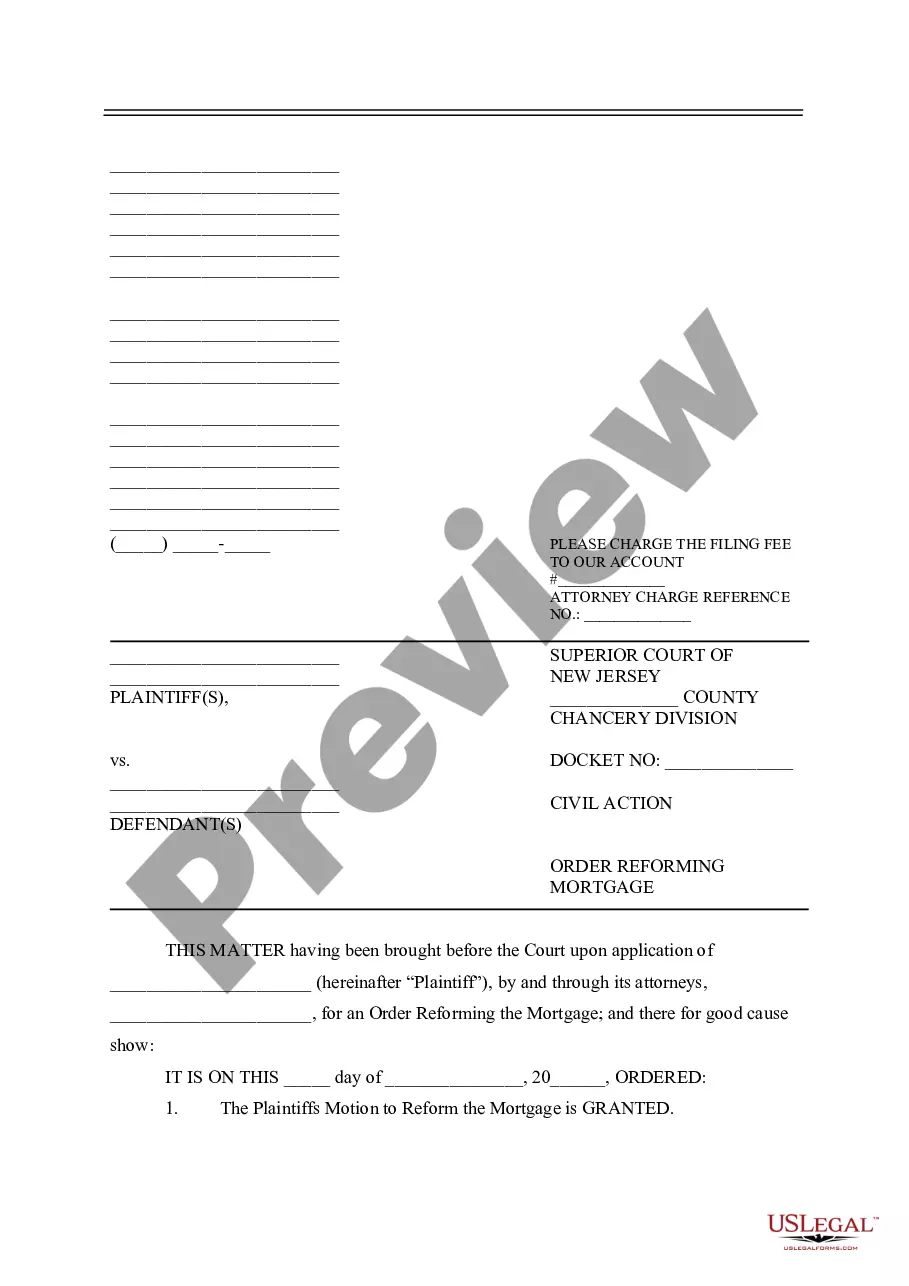

Paterson New Jersey Order Reforming Mortgage

Description

How to fill out Paterson New Jersey Order Reforming Mortgage?

Take advantage of the US Legal Forms and have immediate access to any form template you need. Our beneficial website with thousands of templates allows you to find and get virtually any document sample you want. You can export, complete, and certify the Paterson New Jersey Order Reforming Mortgage in just a couple of minutes instead of surfing the Net for hours seeking the right template.

Using our library is a superb way to increase the safety of your document filing. Our professional lawyers regularly review all the records to make sure that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you get the Paterson New Jersey Order Reforming Mortgage? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Additionally, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instruction listed below:

- Find the template you require. Ensure that it is the form you were looking for: check its headline and description, and utilize the Preview option if it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Export the document. Pick the format to get the Paterson New Jersey Order Reforming Mortgage and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most considerable and trustworthy form libraries on the web. We are always happy to assist you in any legal case, even if it is just downloading the Paterson New Jersey Order Reforming Mortgage.

Feel free to take full advantage of our form catalog and make your document experience as convenient as possible!