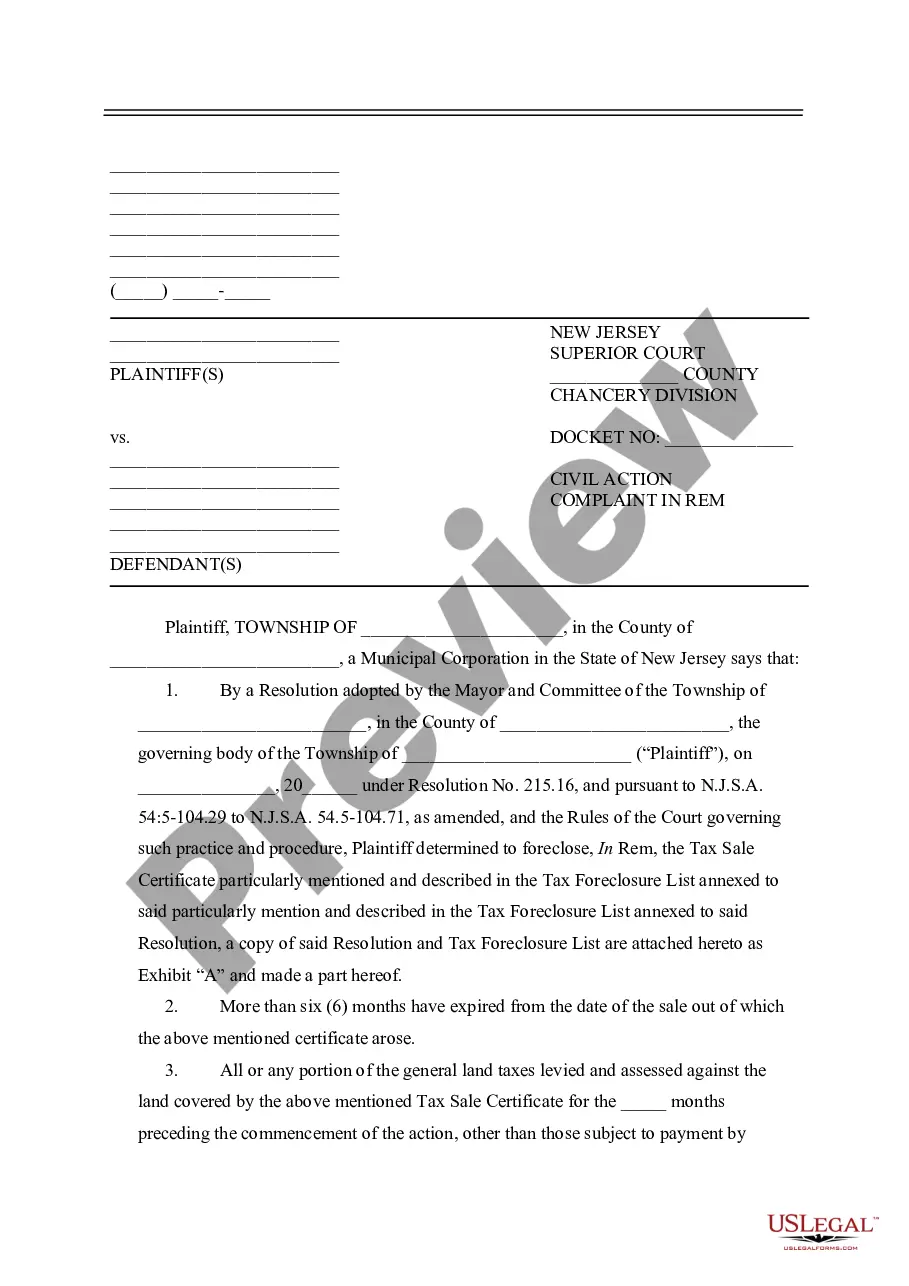

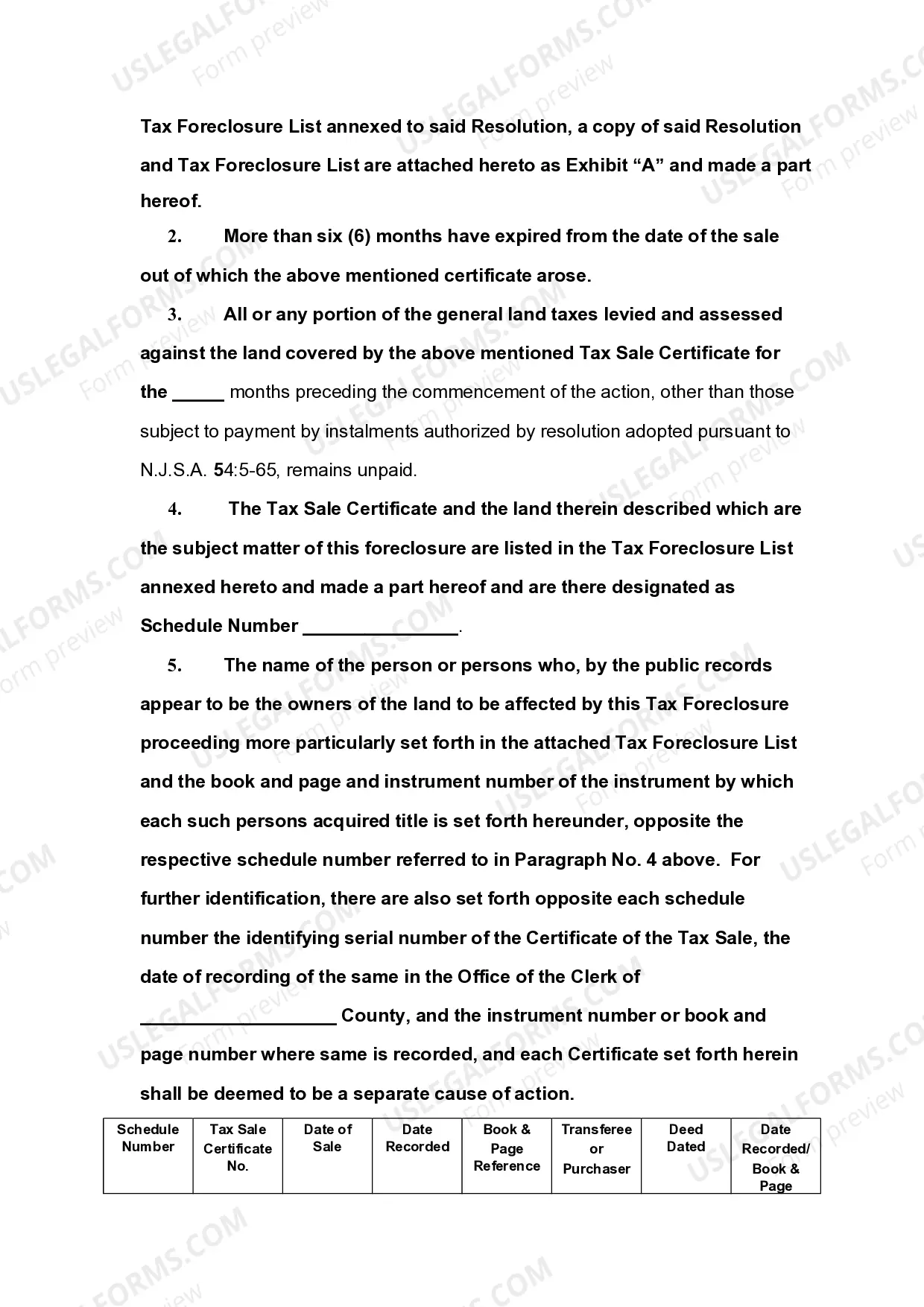

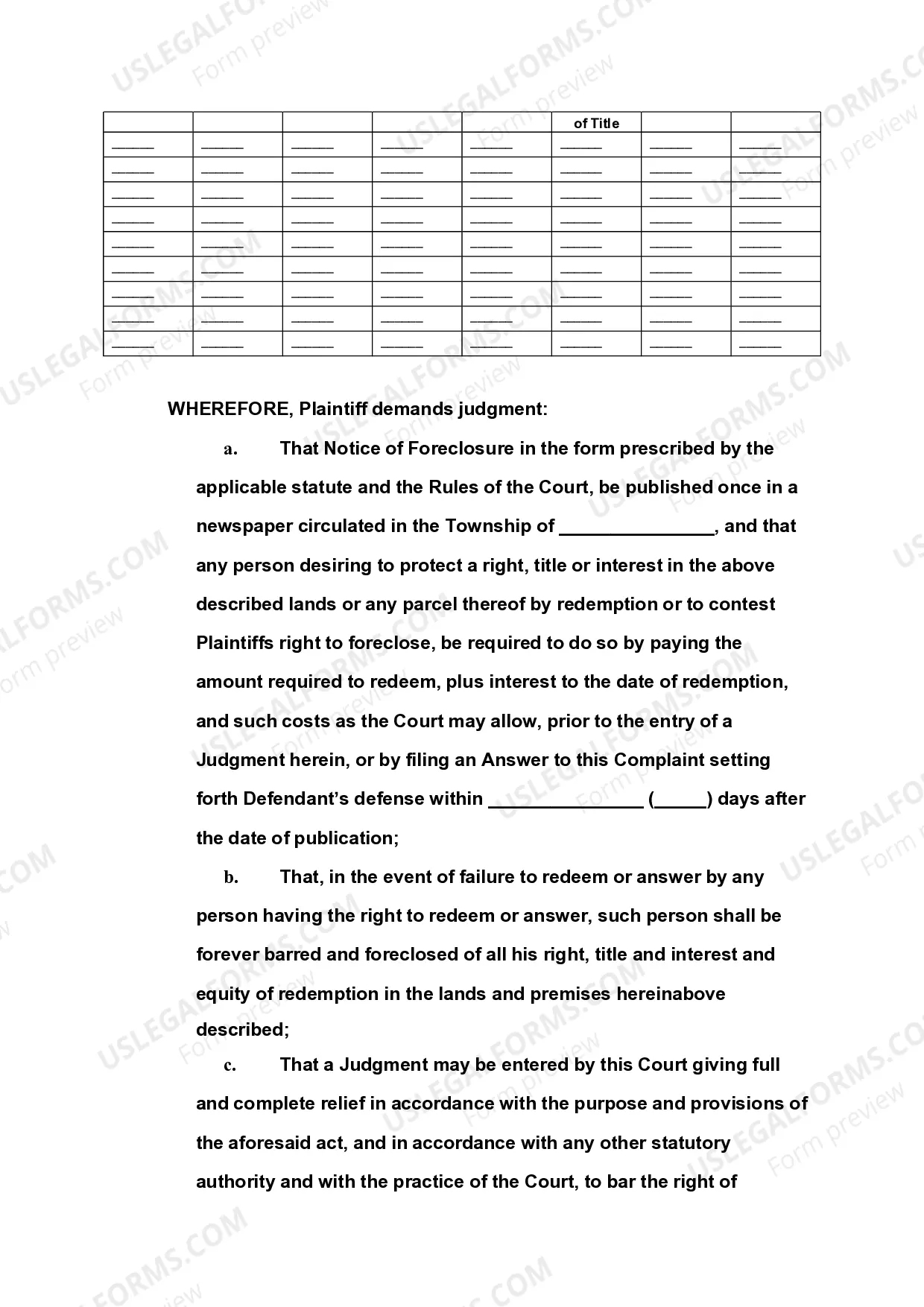

Keyword 1: Newark New Jersey Civil Action Complaint in Rem Foreclosure Keyword 2: Newark NJ foreclosure process Keyword 3: Foreclosure complaint in rem Newark NJ Keyword 4: Types of foreclosure complaints in Newark New Jersey Title: Understanding Newark New Jersey Civil Action Complaint in Rem Foreclosure Introduction: In Newark, New Jersey, a Civil Action Complaint in Rem Foreclosure serves as a legal proceeding initiated by a lender or bank to reclaim ownership of a property when the borrower has defaulted on their mortgage payments. This article aims to provide a detailed description of this process, including its purposes, requirements, and the different types of foreclosure complaints in Newark, New Jersey. I. Purpose of Newark New Jersey Civil Action Complaint in Rem Foreclosure: The primary objective of a Civil Action Complaint in Rem Foreclosure in Newark, New Jersey, is for the lender to legally regain the title and possession of a property due to the borrower's failure to meet their mortgage obligations. This legal action allows the lender to sell the property at auction or through other means to recoup the outstanding debt. II. Process of Newark NJ Civil Action Complaint in Rem Foreclosure: 1. Filing the Complaint: The lender must initiate the foreclosure process by filing a Civil Action Complaint Against the Property in the Newark Superior Court. This complaint outlines the reasons for foreclosure and establishes the court's jurisdiction over the property. 2. Service of Complaint: The lender must then provide a copy of the complaint to all parties with an interest in the property, including the borrower. This allows them to respond to the allegations and present their defense within a specified timeframe. 3. Court Proceedings: After proper service, the case proceeds to court, where the borrower can contest the foreclosure and present any valid defenses. The court will assess the validity of the lender's claims and evaluate the borrower's ability to rectify the default. 4. Judgment and Sale: If the court determines that the lender's claims are valid and the borrower fails to remedy the default, a judgment of foreclosure may be issued. This judgment allows the lender to sell the property at auction or through a sheriff's sale to recover the outstanding debt. III. Types of Newark New Jersey Civil Action Complaint in Rem Foreclosure: 1. Residential Foreclosure: This type of foreclosure complaint pertains to residential properties, such as single-family homes, townhouses, or condominiums, that are subject to foreclosure due to the borrower's mortgage default. 2. Commercial Foreclosure: Commercial foreclosure complaints involve properties used for business purposes, including office buildings, retail spaces, or industrial complexes. Lenders resort to this type of foreclosure when commercial borrowers fail to meet their mortgage obligations. 3. Vacant Property Foreclosure: In cases where a property is abandoned or vacant, lenders may file a vacant property foreclosure complaint, aiming to reclaim ownership of the neglected property and sell it to recover the outstanding debt. Conclusion: A Newark New Jersey Civil Action Complaint in Rem Foreclosure is a legal process where lenders seek to reclaim ownership of a property due to the borrower's default on mortgage payments. Understanding the intricacies of this process, including the purpose, requirements, and different types of foreclosure complaints, is crucial whether you are a borrower, lender, or simply seeking knowledge about the Newark, New Jersey foreclosure process.

Newark New Jersey Civil Action Complaint in Rem Foreclosure

Description

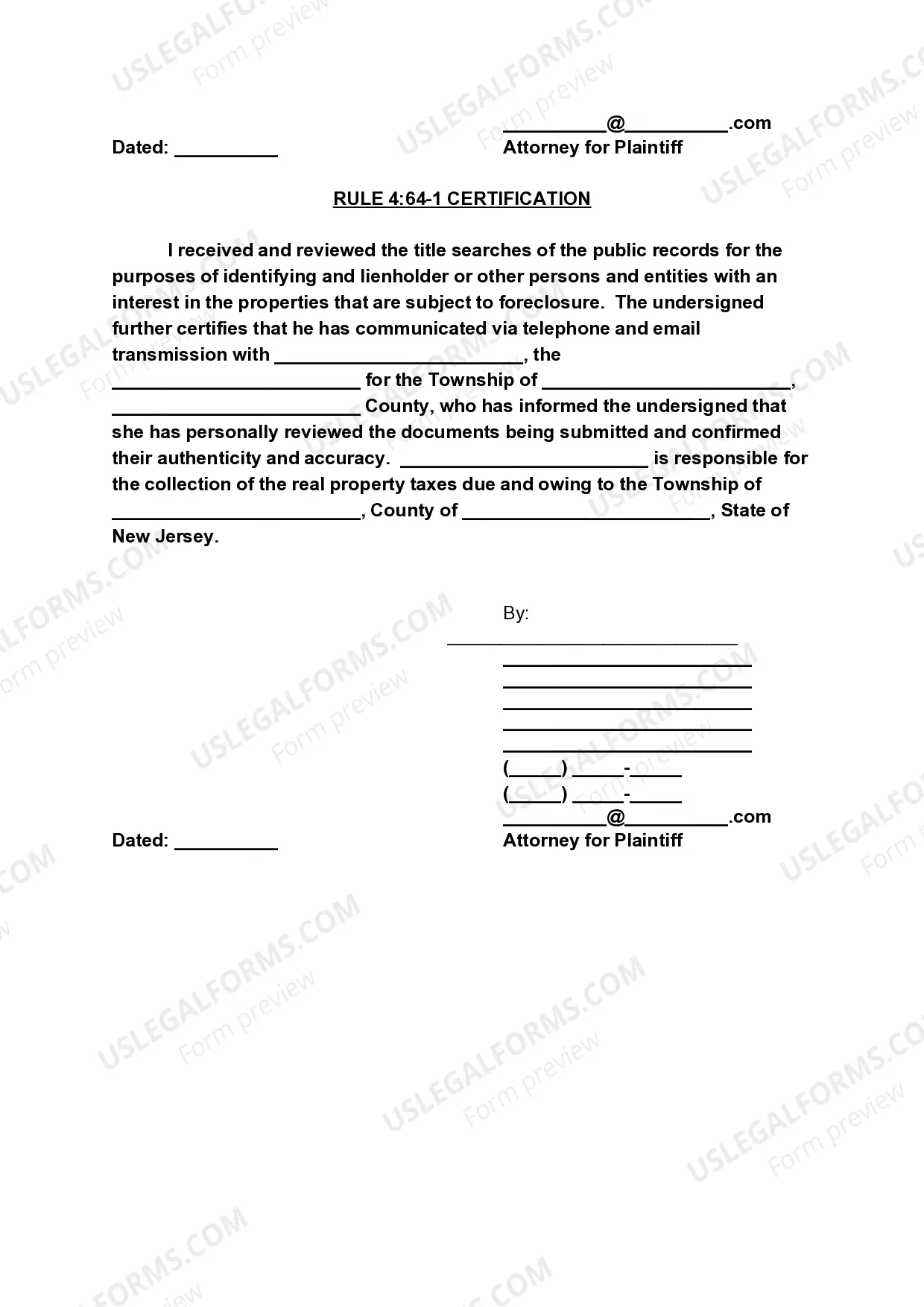

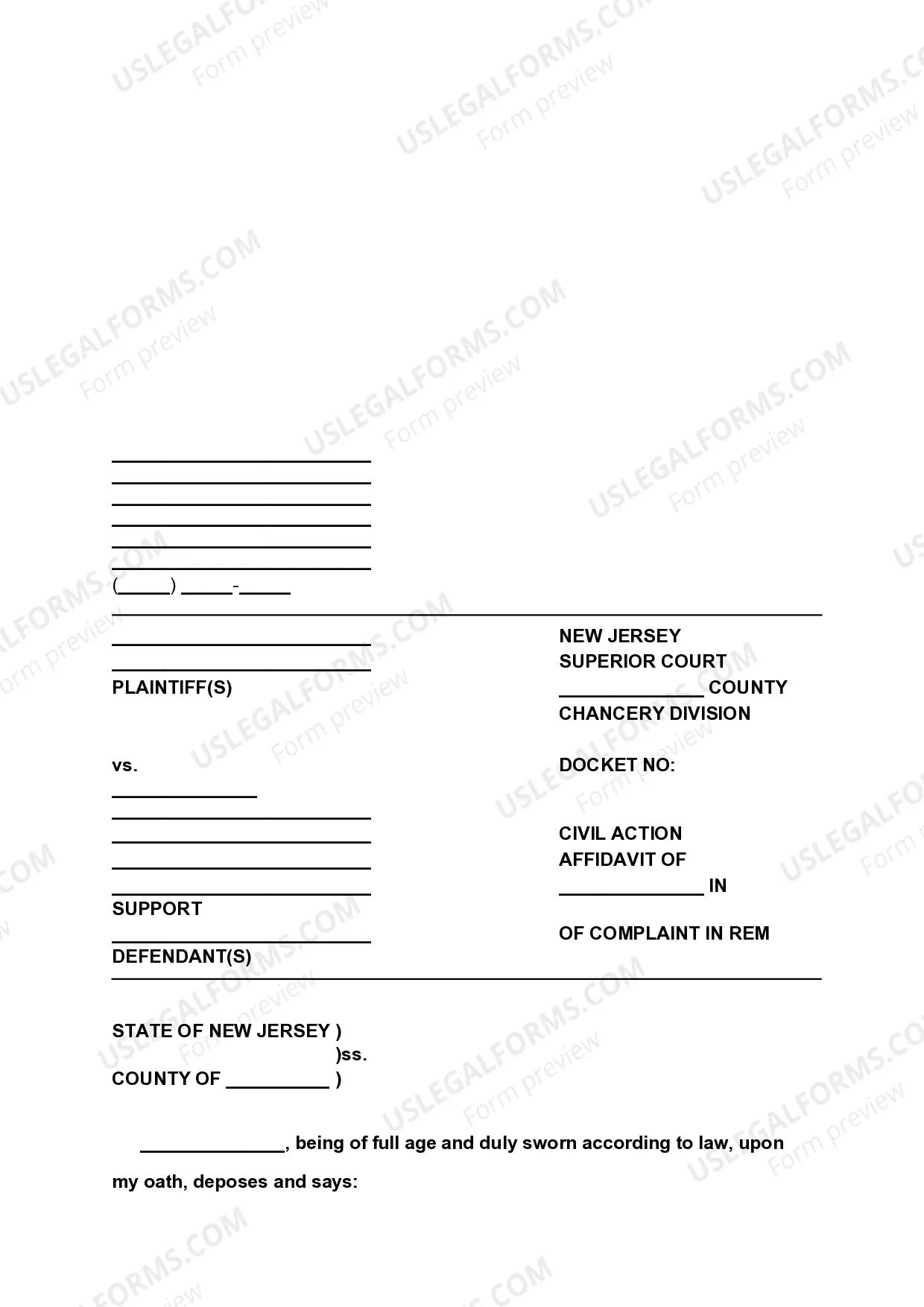

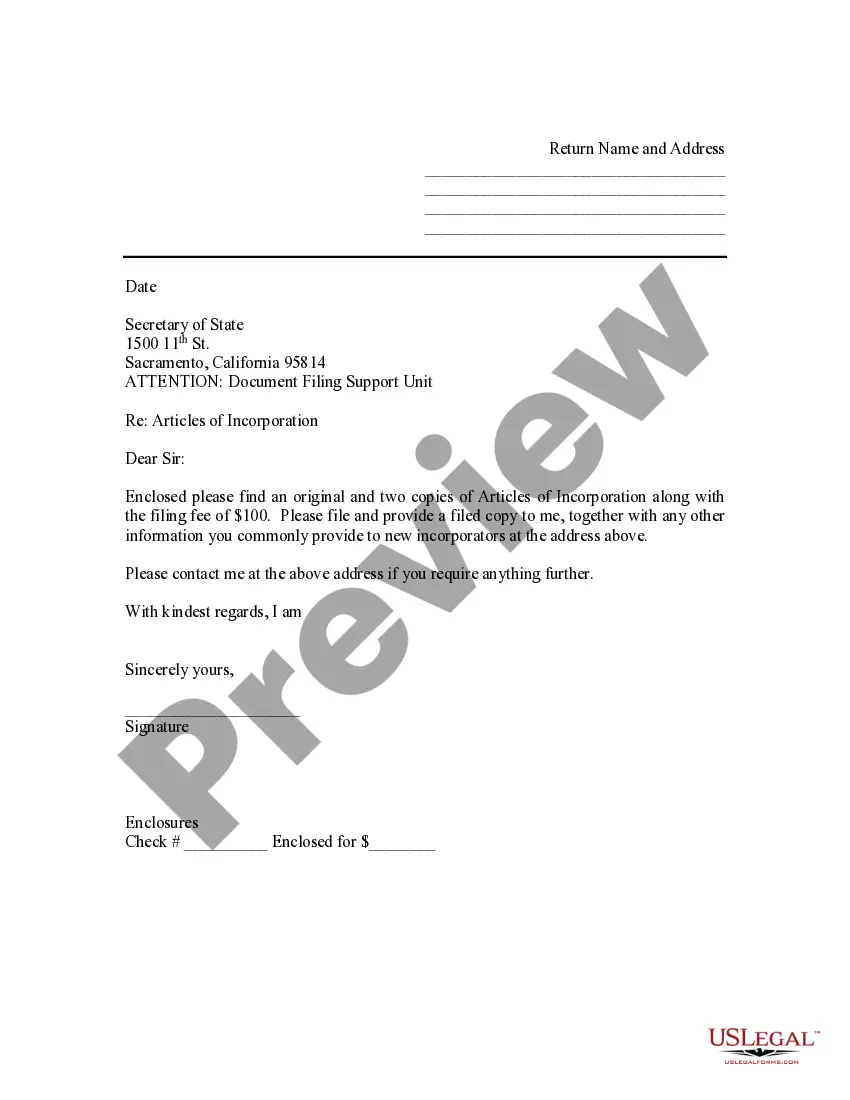

How to fill out Newark New Jersey Civil Action Complaint In Rem Foreclosure?

If you are looking for a relevant form, it’s extremely hard to choose a better place than the US Legal Forms site – one of the most extensive online libraries. Here you can get a large number of templates for business and individual purposes by categories and regions, or key phrases. With the high-quality search option, finding the most recent Newark New Jersey Civil Action Complaint in Rem Foreclosure is as elementary as 1-2-3. Moreover, the relevance of every file is confirmed by a group of professional attorneys that on a regular basis check the templates on our website and revise them in accordance with the latest state and county demands.

If you already know about our system and have an account, all you should do to receive the Newark New Jersey Civil Action Complaint in Rem Foreclosure is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the sample you require. Check its information and make use of the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to discover the appropriate record.

- Affirm your selection. Select the Buy now option. Next, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the form. Choose the file format and download it to your system.

- Make changes. Fill out, modify, print, and sign the received Newark New Jersey Civil Action Complaint in Rem Foreclosure.

Every form you add to your profile has no expiration date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you need to get an additional duplicate for enhancing or printing, feel free to return and export it again at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the Newark New Jersey Civil Action Complaint in Rem Foreclosure you were seeking and a large number of other professional and state-specific templates in a single place!