Title: Understanding Paterson, New Jersey Civil Action Complaint in Rem Foreclosure Introduction: In Paterson, New Jersey, a civil action complaint in rem foreclosure is a legal process by which a lender seeks to foreclose on a property due to the borrower's default on mortgage payments. This article aims to provide a detailed description of the Paterson, New Jersey civil action complaint in rem foreclosure process, including its procedures, requirements, and different types that may exist. 1. Paterson, New Jersey Civil Action Complaint in Rem Foreclosure Process: The civil action complaint in rem foreclosure process in Paterson, New Jersey typically follows these steps: a) Filing of Complaint: The lender initiates the foreclosure process by filing a civil action complaint in rem with the appropriate court. b) Li's pendent: Notice of the pending foreclosure action is recorded against the property in the county records, informing potential buyers and other parties about the foreclosure proceedings. c) Service of Complaint: The lender serves the complaint to the borrower and any other interested parties, such as lien holders, allowing them a chance to respond. d) Answer and Defenses: The borrower must file an answer to the complaint within a specified period, presenting any defenses or counterclaims they may have. e) Discovery Phase: Both parties engage in the discovery phase, exchanging relevant information and documents related to the case. f) Motion for Summary Judgment: Either party may file a motion requesting a summary judgment if they believe there is no genuine dispute about the material facts and that they are entitled to judgment as a matter of law. g) Trial: If a summary judgment is not granted, the case proceeds to trial, allowing both parties to present their arguments and evidence. h) Judgment: The court renders a judgment either in favor of the lender, resulting in foreclosure, or in favor of the borrower, dismissing the foreclosure action. 2. Types of Paterson, New Jersey Civil Action Complaint in Rem Foreclosure: a) Residential Foreclosure: This type of foreclosure pertains to residential properties like single-family homes, townhouses, or condominiums. b) Commercial Foreclosure: Commercial foreclosure involves the foreclosure of properties primarily used for commercial purposes, such as office buildings, retail spaces, or industrial properties. c) Tax Foreclosure: In cases of delinquent property tax payments, the local government may initiate a tax foreclosure action to recover the overdue taxes. d) Judicial Foreclosure: Judicial foreclosure refers to the foreclosure process that is overseen and approved by the court, requiring the lender to file a civil action complaint in rem. Conclusion: Understanding the Paterson, New Jersey civil action complaint in rem foreclosure process is crucial for borrowers, lenders, and other parties involved in foreclosure proceedings. It is essential to seek legal advice and consult the relevant laws and regulations when navigating through the complexities of a foreclosure case to protect one's interests effectively.

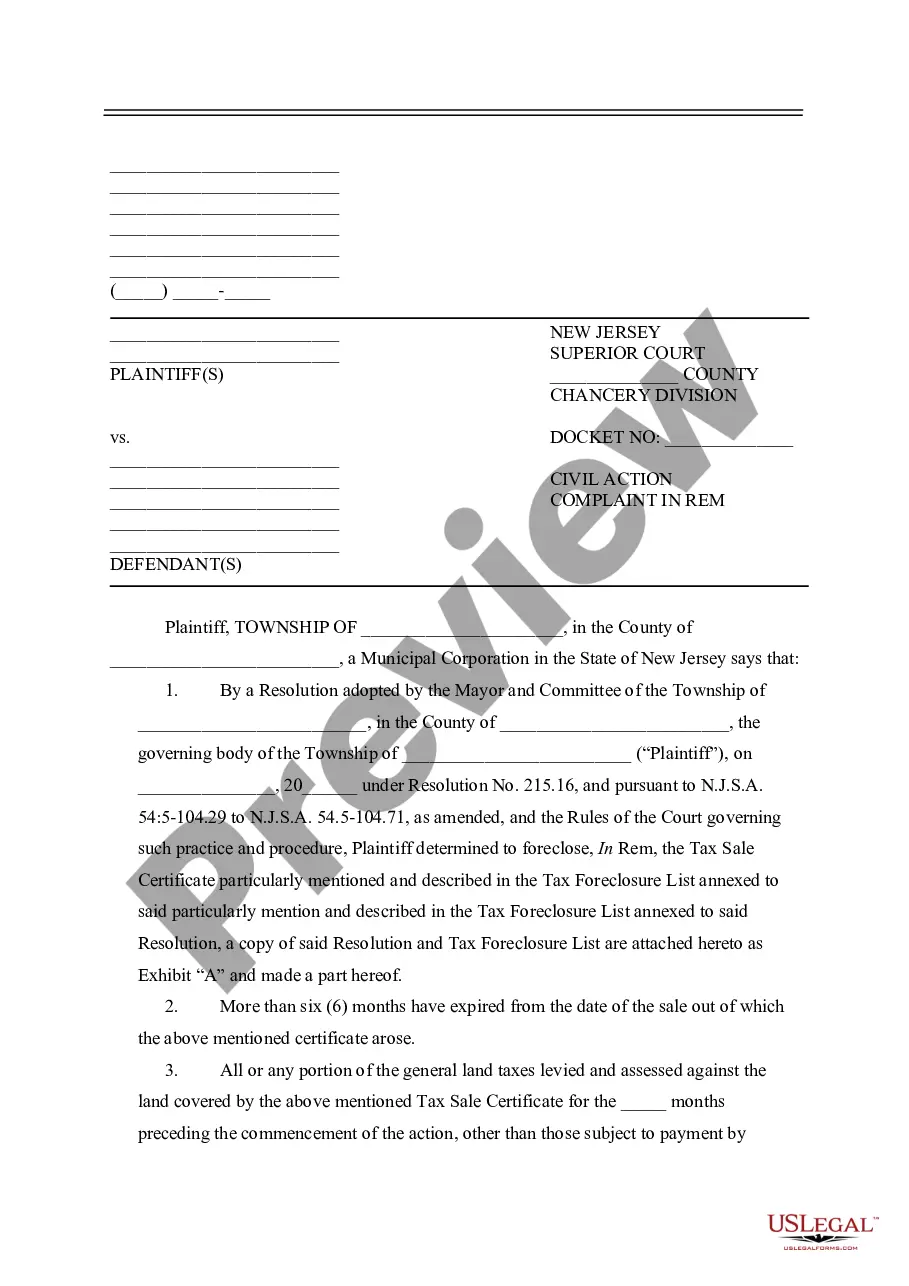

Paterson New Jersey Civil Action Complaint in Rem Foreclosure

Description

How to fill out Paterson New Jersey Civil Action Complaint In Rem Foreclosure?

Benefit from the US Legal Forms and obtain instant access to any form you require. Our beneficial website with a large number of templates makes it easy to find and obtain almost any document sample you require. You are able to export, fill, and certify the Paterson New Jersey Civil Action Complaint in Rem Foreclosure in a couple of minutes instead of browsing the web for many hours searching for a proper template.

Utilizing our collection is an excellent strategy to raise the safety of your record filing. Our experienced attorneys on a regular basis review all the documents to make sure that the templates are relevant for a particular region and compliant with new acts and polices.

How do you get the Paterson New Jersey Civil Action Complaint in Rem Foreclosure? If you already have a subscription, just log in to the account. The Download button will appear on all the documents you view. In addition, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction below:

- Find the form you require. Ensure that it is the template you were looking for: examine its headline and description, and use the Preview function if it is available. Otherwise, use the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Indicate the format to obtain the Paterson New Jersey Civil Action Complaint in Rem Foreclosure and edit and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and reliable template libraries on the web. Our company is always happy to help you in any legal case, even if it is just downloading the Paterson New Jersey Civil Action Complaint in Rem Foreclosure.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!

Form popularity

FAQ

To get a foreclosure dismissed, you need to present a valid defense that the court finds compelling. This may include showing improper procedures were followed or that the lender lacks the right to foreclose. In cases involving a Paterson New Jersey Civil Action Complaint in Rem Foreclosure, using platforms like US Legal Forms can provide valuable resources to help prepare your case effectively.

Foreclosure by action is a legal process where the mortgage lender initiates a lawsuit to obtain a court order for foreclosure. This typically involves filing a civil action complaint, like a Paterson New Jersey Civil Action Complaint in Rem Foreclosure, where the court reviews the case's merits. The outcome can determine if the property is sold to satisfy the mortgage debt.

In New Jersey, several defenses can be utilized to challenge a foreclosure, including improper notice, lack of standing, and failure to meet the legal requirements for a foreclosure. Residents are encouraged to consult legal resources to understand their options fully. A Paterson New Jersey Civil Action Complaint in Rem Foreclosure may involve unique defenses that reflect the circumstances of each case.

To prove wrongful foreclosure in Texas, you need to establish that the foreclosure process lacked proper legal grounds or that the lender failed to follow required protocols. Documenting communication with the lender and demonstrating any violations of your mortgage rights are essential steps. If you've faced similar issues in a Paterson New Jersey Civil Action Complaint in Rem Foreclosure, understanding your local laws will help bolster your case.

Responding to a foreclosure lawsuit requires careful consideration. You must file a response with the court that outlines your objections, defenses, and any claims against the lender. With a Paterson New Jersey Civil Action Complaint in Rem Foreclosure, effectively addressing the complaint within the specified timeframe is crucial to protect your rights.

A wrongful foreclosure cause of action occurs when a lender or servicer initiates foreclosure proceedings without legal justification, often violating state laws or the mortgage agreement. In the context of a Paterson New Jersey Civil Action Complaint in Rem Foreclosure, individuals can contest improper actions taken by the lender. This may involve addressing issues like lack of notice or failure to comply with foreclosure procedures.

To answer a court summons for foreclosure related to the Paterson New Jersey Civil Action Complaint in Rem Foreclosure, you should first carefully read the summons and complaint documents. Identify the deadlines for your response and gather any necessary evidence or documentation to support your case. Next, draft your answer, ensuring you address each point raised in the complaint and include any defenses you may have. Lastly, submit your answer to the court by the deadline, and ensure you provide a copy to the plaintiff, so you fulfill your legal obligations.

If you fail to respond to a foreclosure summons, the court may issue a default judgment against you. This typically means that the lender will win the case by default, allowing them to proceed with the foreclosure process without your input. In the context of a Paterson New Jersey Civil Action Complaint in Rem Foreclosure, it's important to actively engage with this process to protect your rights and interests. Ignoring a summons could lead to losing your home without any chance for negotiation.

Foreclosure primarily impacts the borrower, who often faces the loss of their home and significant financial damage. However, it also affects the lender, who may incur losses and legal fees, as well as the neighborhood’s property values. If you find yourself in a Paterson New Jersey Civil Action Complaint in Rem Foreclosure situation, consider reaching out to uslegalforms for assistance. They can provide resources to help you navigate this difficult process.

During a foreclosure process, the ownership of the house is typically contested. Initially, the borrower retains ownership until the court rules otherwise. However, in a Paterson New Jersey Civil Action Complaint in Rem Foreclosure, if the lender wins the case, they gain legal ownership of the property. This can significantly impact the borrower’s financial future, making it vital to understand your rights and options.