- US Legal Forms

- Localized Forms

- New Jersey

- Newark

-

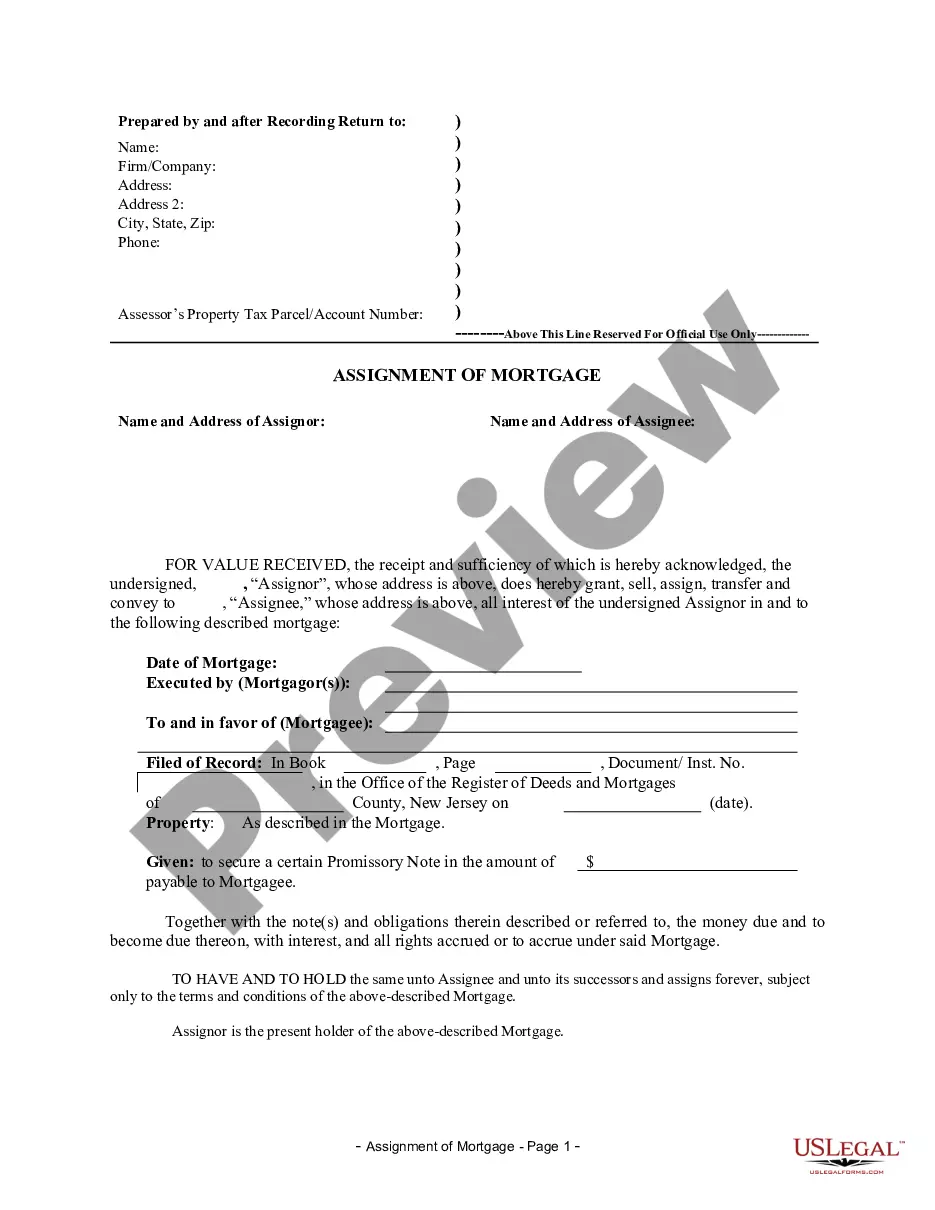

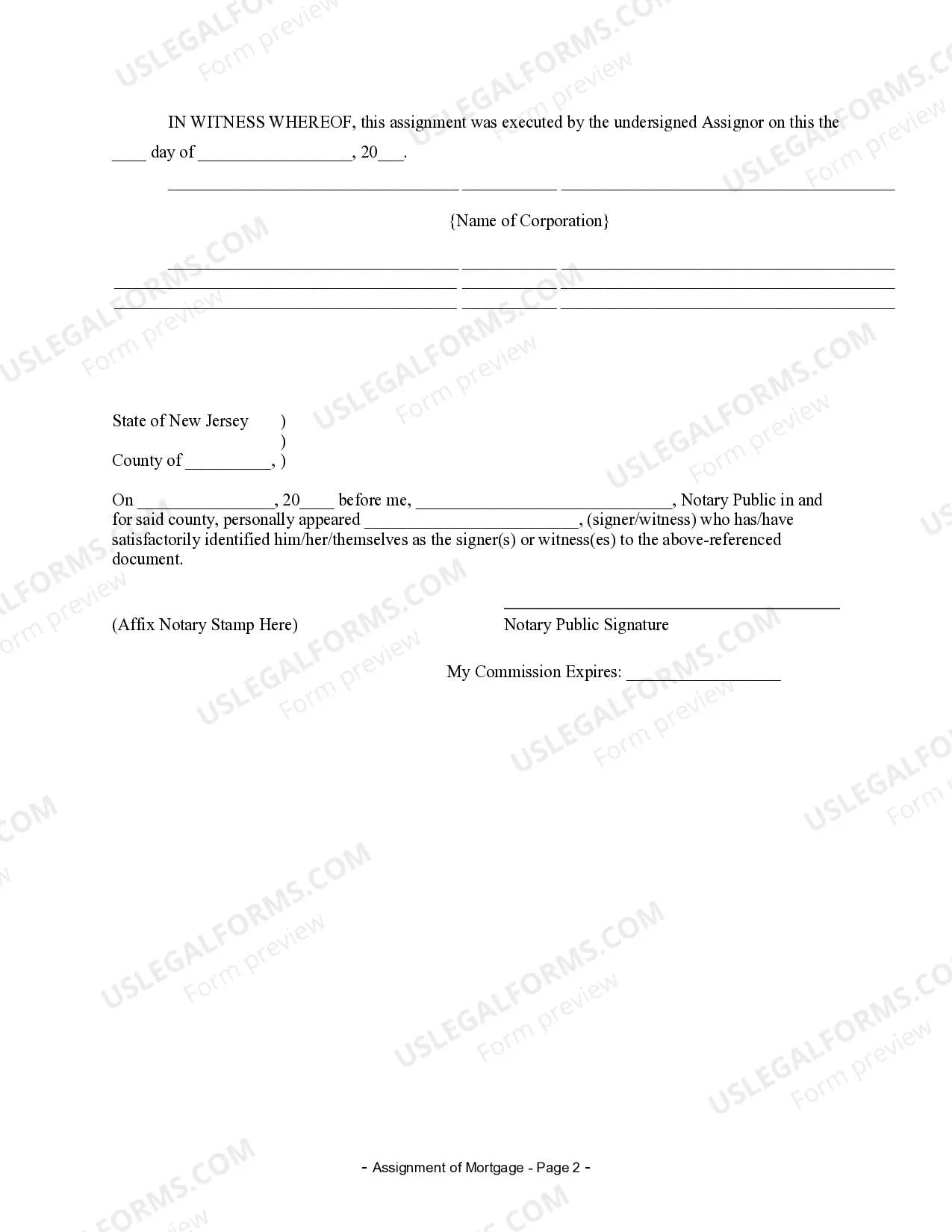

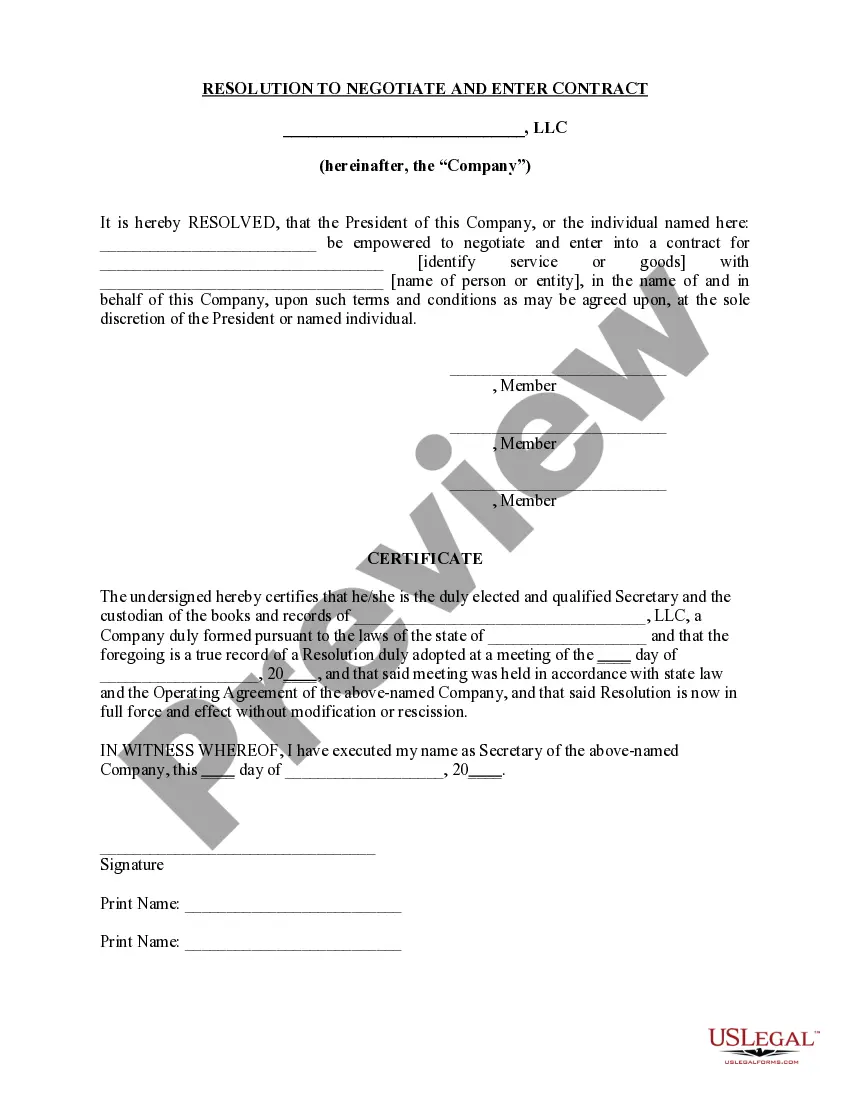

New Jersey Assignment of Mortgage by Corporate Mortgage Holder

Newark New Jersey Assignment of Mortgage by Corporate Mortgage Holder

Description

Related forms

View Assignment of Mortgage by Individual Mortgage Holder

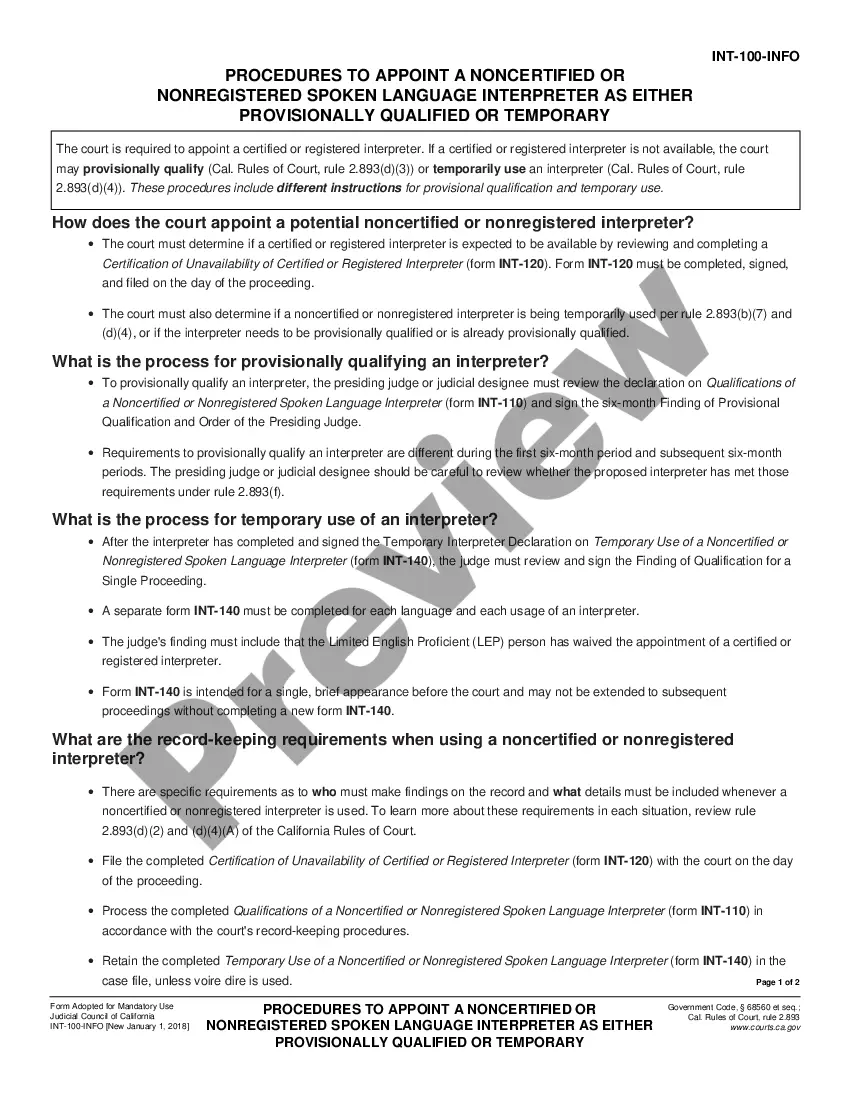

View Vista Procedures and Guidelines to Appoint a Noncertified or Nonregistered Interpreter in Criminal and Juvenile Delinquency Proceedings

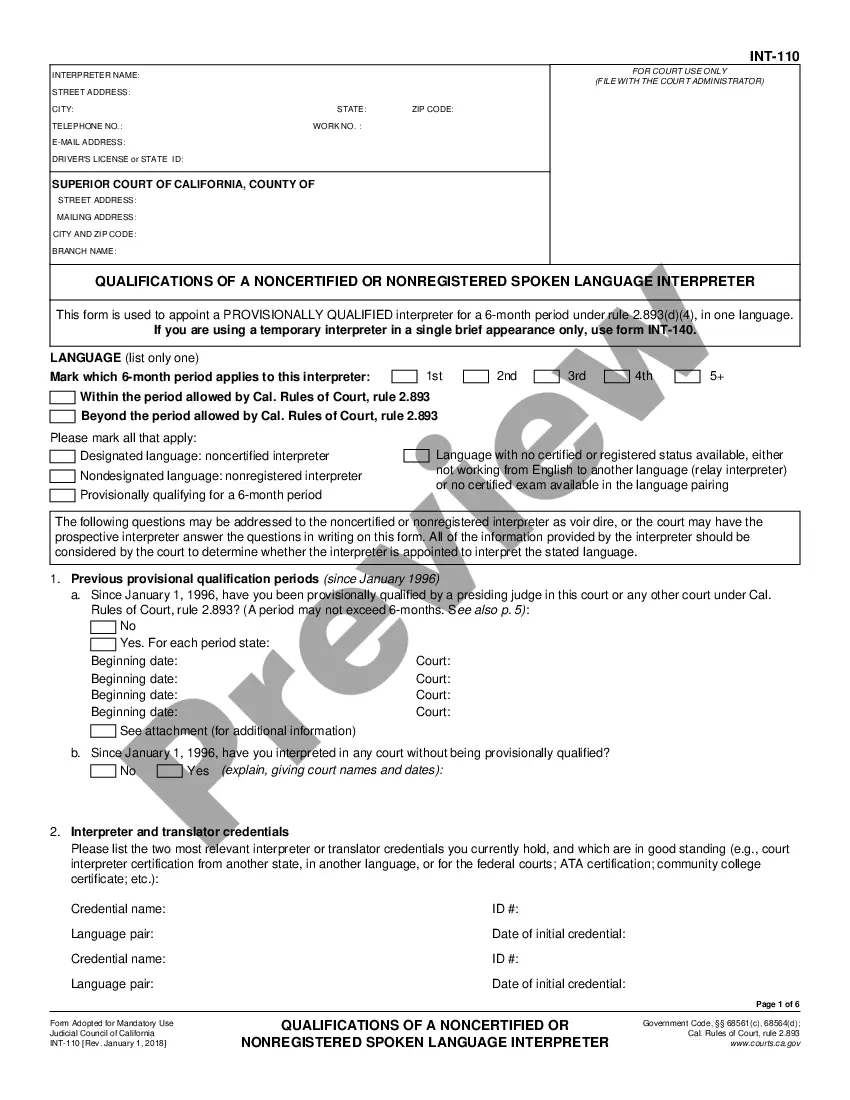

View Vista Qualifications of a Noncertified Interpreter

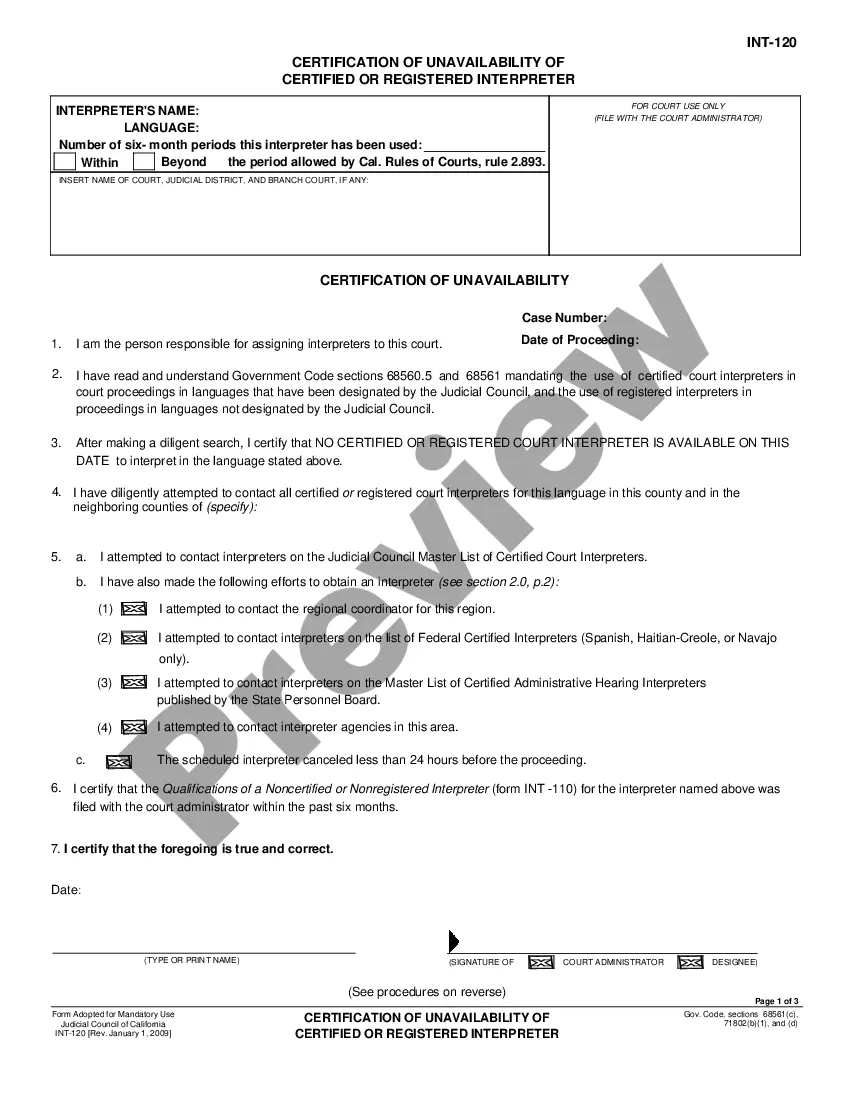

View Vista Certification of Unavailability of Certified Interpreters

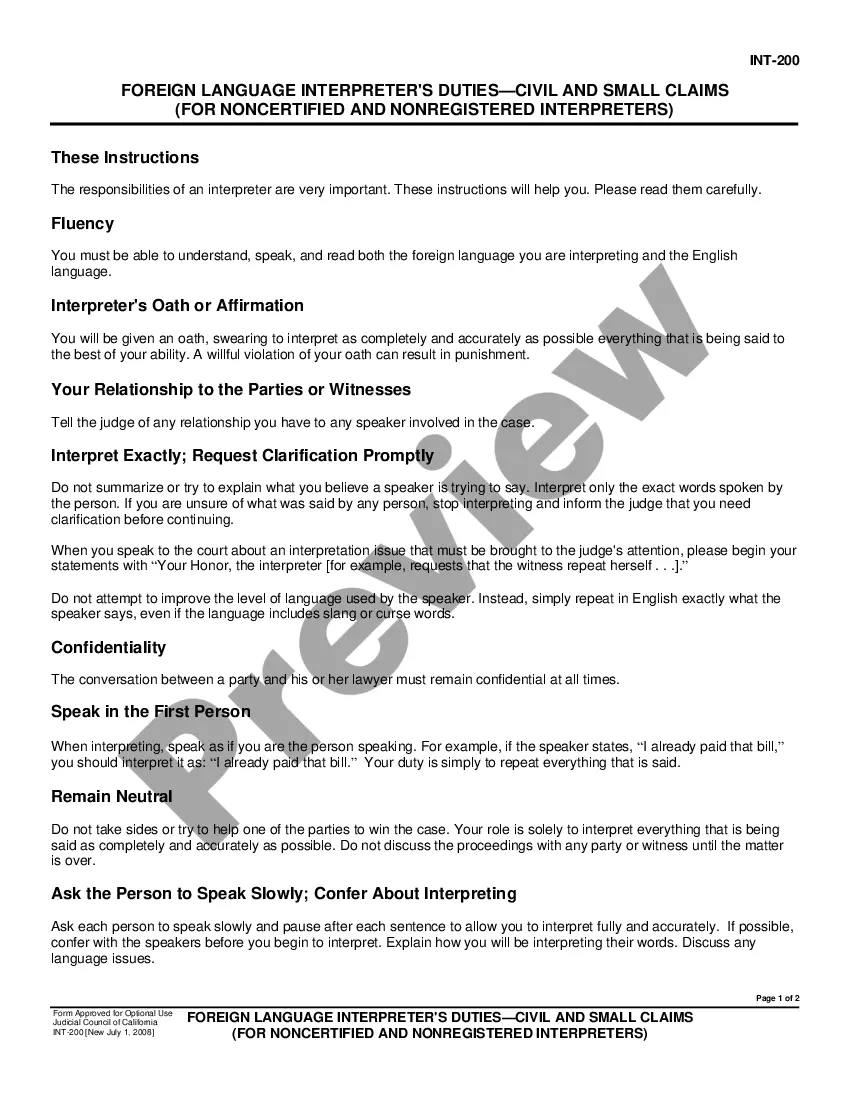

View Vista Foreign Language Interpreter's Duties - Civil And Small Claims (For Noncertified And Nonregistered Interpreters)

View Vista Acknowledgment for Individuals

How to fill out Newark New Jersey Assignment Of Mortgage By Corporate Mortgage Holder?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Newark New Jersey Assignment of Mortgage by Corporate Mortgage Holder becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Newark New Jersey Assignment of Mortgage by Corporate Mortgage Holder takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Newark New Jersey Assignment of Mortgage by Corporate Mortgage Holder. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form Rating

Form popularity

FAQ

An assignee is a person, company, or entity who receives the transfer of property, title, or rights from another according to the terms of a contract. The assignee receives the transfer from the assignor. For example, an assignee may receive the title to a piece of real estate from an assignor.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation. Again, this corporation might be a lender that is officially incorporated, or it might be some other business (or even individual) that is legally considered a corporation.

You, your lawyer or your notary must discharge the mortgage and add your new lender to your property's title. Some lenders charge other fees, including assignment fees when you switch to another lender. Ask your new lender if they will cover the costs of a mortgage discharge.

An allonge to promissory note is different from an assignment. An assignment in this context is what gives a party the legal designation and right to move forward with legal action on a property, whereas an allonge is an endorsement that allows you to collect on the promissory note.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

So whoever is a borrower on the Note is personally liable for paying back the debt to the lender. The Note is not recorded in the Courthouse, so the original Note is returned to the lender upon closing.

An award-winning writer with more than two decades of experience in real estate. The bank or other mortgage lender that provides a borrower with the funds to purchase a home often later transfers or assigns its interest in the mortgage to another firm.

An assignee is a person, company, or entity who receives the transfer of property, title, or rights from another according to the terms of a contract. The assignee receives the transfer from the assignor. For example, an assignee may receive the title to a piece of real estate from an assignor.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation. Again, this corporation might be a lender that is officially incorporated, or it might be some other business (or even individual) that is legally considered a corporation.

You, your lawyer or your notary must discharge the mortgage and add your new lender to your property's title. Some lenders charge other fees, including assignment fees when you switch to another lender. Ask your new lender if they will cover the costs of a mortgage discharge.

An allonge to promissory note is different from an assignment. An assignment in this context is what gives a party the legal designation and right to move forward with legal action on a property, whereas an allonge is an endorsement that allows you to collect on the promissory note.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

So whoever is a borrower on the Note is personally liable for paying back the debt to the lender. The Note is not recorded in the Courthouse, so the original Note is returned to the lender upon closing.

An award-winning writer with more than two decades of experience in real estate. The bank or other mortgage lender that provides a borrower with the funds to purchase a home often later transfers or assigns its interest in the mortgage to another firm.

Newark New Jersey Assignment of Mortgage by Corporate Mortgage Holder Related Searches

-

define mortgage

-

how to get a mortgage

-

mortgages

-

types of mortgage loans

-

what is an allonge

-

define mortgage

-

njhmfa site evaluator

-

nj mortgage assistance programs

-

njhmfa underwriting guidelines

-

new jersey housing and mortgage finance agency (njhmfa homeward bound program)

Interesting Questions

An Assignment of Mortgage is the legal transfer of the ownership rights of a mortgage from one party to another.

Corporate Mortgage Holder67515 is a corporate entity that currently holds the mortgage on the property in Newark.

Mortgages are typically assigned because the lender wants to transfer the rights and responsibilities of the mortgage to another party. This may happen due to various reasons such as loan sales, consolidations, or changes in servicing.

Yes, borrowers are generally notified about the Assignment of Mortgage. They will receive a formal notice from their original lender or the new mortgage holder indicating the transfer of the mortgage rights.

Generally, the terms and conditions of the mortgage remain the same after an assignment. However, it's essential to review the Assignment of Mortgage documents to ensure clarity on any changes, if applicable.

In most cases, borrowers don't need to take any immediate action. They are typically required to continue making mortgage payments to the new mortgage holder as specified in their original loan agreement.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

New Jersey

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the recorded mortgage, which is attested by the clerk.

New Jersey Law

Execution of Assignment or Satisfaction:

Must be signed by the mortgagee.

Assignment:

The county recording officers of the several counties are authorized to record, in suitable books to be provided for that purpose, any assignment of any mortgage upon real estate within their respective counties, the same having thereon such certificate of acknowledgment or proof of execution thereof as is or may be required by law for the recording of deeds, which certificate shall be recorded therewith.

Demand to Satisfy:

Written demand from mortgagor to mortgagee at least 20 days prior to filing suit.

Recording Satisfaction:

An instrument constituting a satisfaction of mortgage meeting the requirements for recordation, including acknowledgment or proof, is filed with the county recording officer. See detailed statutes, below.

Marginal Satisfaction:

The county recording officer shall forthwith enter in the margin opposite the original entry of such mortgage a note or memorandum setting forth such cancellation, release or discharge, together with a reference to the book and page wherein such cancellation, release or discharge is recorded. See section 46:18-12, below.

Penalty:

If the mortgagee has not complied within 15 business days after receipt of the written notice from the mortgagor or mortgagor's agent pursuant to this paragraph (1), the mortgagee or his assigns shall be subject to a fine of $50 per day for each day after the 15-day period until compliance, except that the total fine imposed pursuant to this paragraph (1) shall not exceed $1,000.

If Mortgagee fails to satisfy the recording requirements, he is liable for damages, including attorney fees, if 20 days written notice is given by Mortgagor prior to suit.

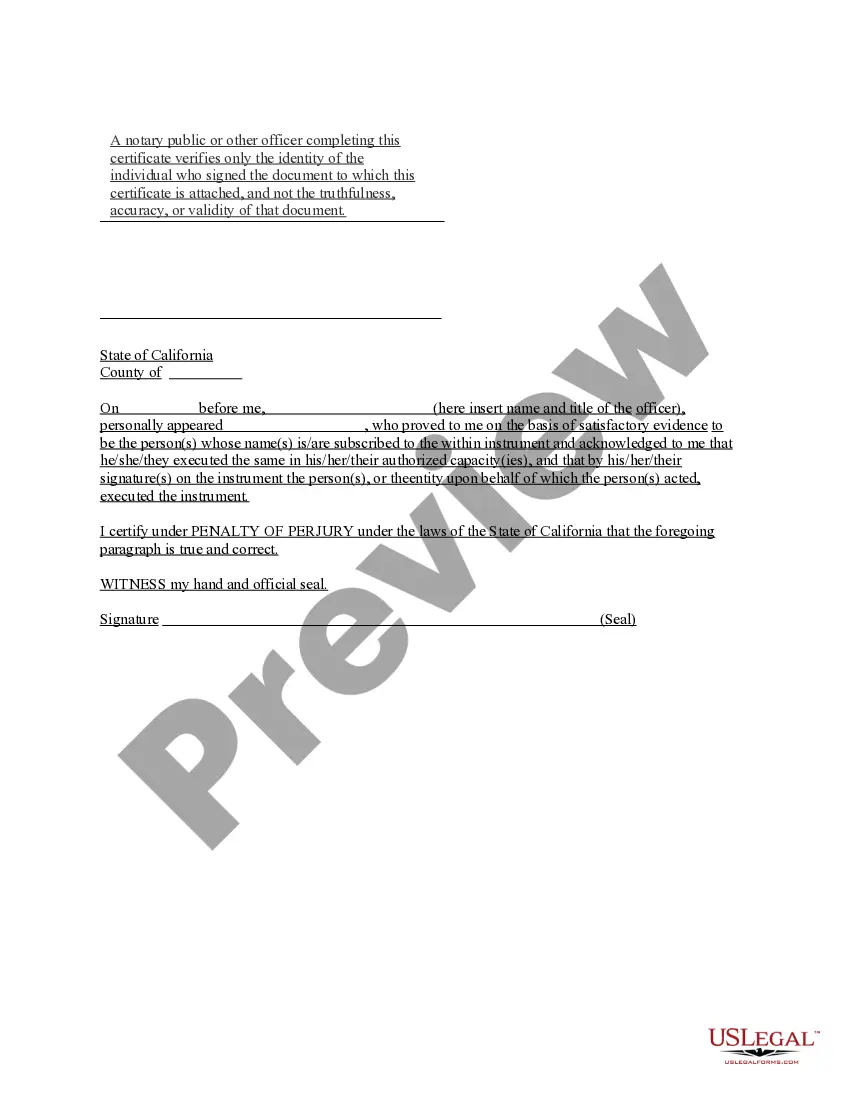

Acknowledgment:

An assignment or satisfaction must contain a proper New Jersey acknowledgment, or other acknowledgment approved by Statute.

New Jersey Statutes

46:18-2. Marginal notation on records of mortgages of recorded assignments, extensions or postponements thereof.

When any mortgage of record in the office of the county recording officer of any county shall be assigned, extended or postponed, and such assignment, extension or postponement shall be recorded in the office of such county recording officer, such county recording officer shall forthwith enter in the margin opposite the original entry of such mortgage a note or memorandum setting forth such assignment, extension or postponement, together with a reference to the book and page wherein such assignment, extension or postponement is recorded, and not until such note or memorandum is so entered in the margin as aforesaid shall such recording be notice to all persons concerned that such mortgage is assigned, extended or postponed.

46:18-3. Record of assignments of mortgages; indexes.

The county recording officers of the several counties are authorized to record, in suitable books to be provided for that purpose, any assignment of any mortgage upon real estate within their respective counties, the same having thereon such certificate of acknowledgment or proof of execution thereof as is or may be required by law for the recording of deeds, which certificate shall be recorded therewith. All such assignments shall be properly indexed. For recording such assignments and for copies thereof the county recording officer shall be entitled to the fees prescribed by section 22:4-4 of the title Fees and Costs.

46:18-4. Record of assignment of mortgage as notice of assignment.

The recording of any assignment of a mortgage upon real estate as provided by section 46:18-3 of this title shall, from the time such assignment is left with the county recording officer for record, be notice to all persons concerned that such mortgage is so assigned.

46:18-5.1. Cancellation of mortgages.

A mortgage shall be cancelled of record by the recording officer of any county in which the mortgage was recorded if:

a. The original mortgage bearing on it the

receipt given by the county recording officer at the time it was recorded

is presented to the county recording officer with an endorsement on it

authorizing its cancellation bearing the signature of the mortgagee

or, if the mortgage has been assigned of record, of the last assignee of

record of the mortgage. If the mortgagee or assignee of the mortgage is

a corporation or other entity, the signature for the entity on the endorsement

may be made by any person authorized by the entity to do so; or

b. An instrument constituting a satisfaction

of mortgage meeting the requirements for recordation, including acknowledgment

or proof, is filed with the county recording officer.

46:18-11.2. Cancellation of mortgage after satisfaction.

1.

a. When any mortgage registered or recorded pursuant to R.S.46:17-1

et seq. shall be redeemed, paid and satisfied, a mortgagee, other

than a bank, savings bank, savings and loan association, credit union or

other corporation engaged in the business of making or purchasing mortgage

loans, or his agents or assigns shall within 10 days notify the mortgagor

that he has the right to demand the mortgagee to cancel the mortgage of

record upon payment by the mortgagor of the fee required by the county

to effect the cancellation and the mortgagee shall within 30 days of the

receipt by the mortgagee of the required fee from the mortgagor:

(1) apply to the county recording officer to have the mortgage canceled

of record; and

(2) send to the mortgagor or mortgagor's agent at the same time

the mortgage is sent to the county recording officer for cancellation of

record a copy of the letter of transmittal which the mortgagee sent to

the county recording officer requesting the cancellation of the mortgage

of record.

b.

(1) When any mortgage registered or recorded pursuant to R.S.46:17-1

et seq. shall be redeemed, paid and satisfied and the mortgagee is a bank,

savings bank, savings and loan association, credit union or other corporation

in the business of making or purchasing mortgage loans, that mortgagee,

its agents or assigns shall:

(a) cause the mortgage to be submitted to

the county recording officer for cancellation of record within 30 days

of receipt of all fees which are required to be paid by the mortgagor pursuant

to this subsection; and

(b) send to the mortgagor or mortgagor's agent

at the same time the mortgage is sent to the county recording officer for

cancellation of record a copy of the letter of transmittal which the mortgagee

sent to the county recording officer requesting the cancellation of the

mortgage of record.

(2) The mortgagee shall have the right to receive from the mortgagor

the amount of the fee charged by the county recording officer to cancel

the mortgage plus an additional service fee from the mortgagor, which service

fee shall not exceed $25 or such higher amount which the Commissioner of

Banking and Insurance may approve by regulation, provided the mortgagor

has received notice of the fees required by the mortgagee. The mortgagee

may collect the service fee at the time of the mortgage transaction or

at the time the mortgage is redeemed, paid and satisfied. The fee charged

by the county recording officer to cancel the mortgage of record shall

be collectible at the time the mortgage is redeemed, paid and satisfied.

c. If the final payment is made in cash, by certified check or cashier's

check, the mortgage shall be deemed paid, satisfied and redeemed upon receipt

of the cash, certified check or cashier's check by the mortgagee, his agents

or assigns.

46:18-11.3. Penalty

2.

a.

(1) If the mortgagee, his agent or assigns fails to comply with

the applicable provisions of subsection a. or b. of section 1 of P.L.1975,

c.137 (C.46:18-11.2) , the mortgagor or the mortgagor's agent may serve

the mortgagee or his assigns with written notice of the noncompliance,

which notice shall identify the mortgage and the date and means of its

redemption, payment and satisfaction. If the mortgagee has not complied

within 15 business days after receipt of the written notice from the mortgagor

or mortgagor's agent pursuant to this paragraph (1) , the mortgagee

or his assigns shall be subject to a fine of $50 per day for each day after

the 15-day period until compliance, except that the total fine imposed

pursuant to this paragraph (1) shall not exceed $1,000.

(2) If the mortgagee, his agent or assigns fails to comply with

the applicable provisions of section 1 of P.L.1975, c.137 (C.46:18-11.2),

the purchaser or the purchaser's agent may serve the mortgagee or his assigns

with written notice of the noncompliance, which notice shall identify the

mortgage and the date and means of its redemption, payment and satisfaction.

If the mortgagee has not complied within 15 business days after receipt

of the written notice from the purchaser or purchaser's agent pursuant

to this paragraph (2), the mortgagee or his assigns shall be subject to

a fine of $50 per day for each day after the 15-day period until compliance,

except that the total fine imposed pursuant to this paragraph (2) shall

not exceed $1,000.

b. Of each fine collected pursuant to subsection a. of this section,

100% shall be payable to the private citizen instituting the action. The

fine may be collected by summary proceedings instituted by a private citizen

or the Attorney General in accordance with "the penalty enforcement law"

(N.J.S.2A:58-1 et seq.).

c.

(1) If a mortgagee, his agent or assigns has not applied to

the county recording officer to cancel the mortgage of record pursuant

to subsection a. or b. of section 1 of P.L.1975, c.137 (C.46:18-11.2),

within the 15 business day period provided by paragraph (1) of subsection

a. of this section, the mortgagee shall be liable to the mortgagor for

the greater of the mortgagor's actual damages or the sum of $1,000, less

any fines recovered by the mortgagor pursuant to paragraph (1) of

subsection a. and paragraph (1) of subsection b. of this section.

In any successful action to recover damages pursuant to this paragraph

(1), the mortgagee shall reimburse the mortgagor for the costs of the action

including the mortgagor's reasonable attorneys' fees.

(2) If a mortgagee, his agent or assigns has not applied to

the county recording officer to cancel the mortgage of record pursuant

to subsection a. or b. of section 1 of P.L.1975, c.137 (C.46:18-11.2),

within the 15 business day period provided by paragraph (2) of subsection

a. of this section, the mortgagee shall be liable to the purchaser for

the greater of the purchaser's actual damages or the sum of $1,000, less

any fines recovered by the purchaser pursuant to paragraph (2) of subsection

a. and paragraph (2) of subsection b. of this section. In any successful

action to recover damages pursuant to this paragraph (2), the mortgagee

shall reimburse the purchaser for the costs of the action including the

purchaser's reasonable attorneys' fees.

46:18-11.4. Failure to comply; liability for costs of action for cancellation

Any mortgagee or his assigns who fail to comply with section 1 of this act shall be liable to the mortgagor, or his heirs, successors or assigns who have an interest in the mortgaged premises for the cost of any legal action to have the mortgage canceled of record, including reasonable attorneys' fees, but no attorneys' fees shall be allowed unless 20 days written notice is given to the mortgagee prior to institution of suit.

46:18-11.5 Definitions relative to mortgage cancellations.

1. As used in this act: "Mortgage" means a residential mortgage,

security interest or the like, in which the security is a residential property

such as a house, real property or condominium, which is occupied, or is

to be occupied, by the debtor, who is a natural person, or a member of

the debtor's immediate family, as that person's residence. The provisions

of sections 2 and 3 of P.L.1999, c.40 (C.46:18-11.6 and C.46:18-11.7) shall

apply to all residential mortgages wherever made, which have as their security

a residence in the State of New Jersey, provided that the real property

which is the subject of the mortgage shall not have more than four dwelling

units, one of which shall be, or is planned to be, occupied by the debtor

or a member of the debtor's immediate family as the debtor's or family

member's residence at the time the loan is originated. "Pay-off letter"

means a written document prepared by the holder or servicer of the mortgage

being paid, which is dated not more than 60 days prior to the date the

mortgage is paid, and which contains a statement of all the sums due to

satisfy the mortgage debt, including, but not limited to, interest accrued

to the date the statement is prepared and a means of calculating per diem

interest accruing thereafter.

46:18-11.6 Conditions under which discharge of mortgage may be executed.

2.

a. A person which is entitled to receive payment of a mortgage

duly recorded or registered in this State pursuant to a written agreement,

whether or not recorded, entered into with the holder or owner of the mortgage

may execute a discharge, satisfaction-piece, release, subordination or

postponement on behalf of the holder or owner thereof, which instrument

shall be accepted for recording by the county clerk or register of deeds

and mortgages, so long as:

(1) it meets the requirements of section 2 of P.L.1991, c.308 (C.46:15-1.1);

and

(2) it contains the following wording in the body thereof: "_____________

is authorized to execute this instrument pursuant to the terms of a written

agreement dated ______, between _______________, as owner or holder of

the mortgage, and __________________, as servicer thereof."

b. A person which is the owner or holder of a mortgage duly recorded

or registered in this State for which a prior assignment thereof is unrecorded,

may execute a discharge, satisfaction-piece, release, subordination or

postponement thereof, which instrument shall be accepted for recording

by the county clerk or register of deeds and mortgages, so long as:

(1) it meets the requirements of section 2 of P.L.1991, c.308 (C.46:15-1.1);

and

(2) it contains wording in the body of the instrument setting forth

the particulars concerning all assignments of the mortgage, whether or

not recorded.

c. Upon payment of the appropriate fees therefor, the county clerk

or register of deeds and mortgages shall cause a marginal notation to be

made upon the record of a mortgage which is specifically described in an

instrument submitted in accordance with subsection a. or b. of this

section.

46:18-12. Marginal notations of cancellation, release or discharge of mortgage.

When any mortgage of record in the office of the county recording officer of any county shall be canceled, released or discharged, and such cancellation, release or discharge shall be recorded in the office of such county recording officer, such county recording officer shall forthwith enter in the margin opposite the original entry of such mortgage a note or memorandum setting forth such cancellation, release or discharge, together with a reference to the book and page wherein such cancellation, release or discharge is recorded, and not until such note or memorandum is so entered in the margin as aforesaid shall such recording be notice to all persons concerned that such mortgage is canceled, released or discharged.

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the recorded mortgage, which is attested by the clerk.

New Jersey Law

Execution of Assignment or Satisfaction:

Must be signed by the mortgagee.

Assignment:

The county recording officers of the several counties are authorized to record, in suitable books to be provided for that purpose, any assignment of any mortgage upon real estate within their respective counties, the same having thereon such certificate of acknowledgment or proof of execution thereof as is or may be required by law for the recording of deeds, which certificate shall be recorded therewith.

Demand to Satisfy:

Written demand from mortgagor to mortgagee at least 20 days prior to filing suit.

Recording Satisfaction:

An instrument constituting a satisfaction of mortgage meeting the requirements for recordation, including acknowledgment or proof, is filed with the county recording officer. See detailed statutes, below.

Marginal Satisfaction:

The county recording officer shall forthwith enter in the margin opposite the original entry of such mortgage a note or memorandum setting forth such cancellation, release or discharge, together with a reference to the book and page wherein such cancellation, release or discharge is recorded. See section 46:18-12, below.

Penalty:

If the mortgagee has not complied within 15 business days after receipt of the written notice from the mortgagor or mortgagor's agent pursuant to this paragraph (1), the mortgagee or his assigns shall be subject to a fine of $50 per day for each day after the 15-day period until compliance, except that the total fine imposed pursuant to this paragraph (1) shall not exceed $1,000.

If Mortgagee fails to satisfy the recording requirements, he is liable for damages, including attorney fees, if 20 days written notice is given by Mortgagor prior to suit.

Acknowledgment:

An assignment or satisfaction must contain a proper New Jersey acknowledgment, or other acknowledgment approved by Statute.

New Jersey Statutes

46:18-2. Marginal notation on records of mortgages of recorded assignments, extensions or postponements thereof.

When any mortgage of record in the office of the county recording officer of any county shall be assigned, extended or postponed, and such assignment, extension or postponement shall be recorded in the office of such county recording officer, such county recording officer shall forthwith enter in the margin opposite the original entry of such mortgage a note or memorandum setting forth such assignment, extension or postponement, together with a reference to the book and page wherein such assignment, extension or postponement is recorded, and not until such note or memorandum is so entered in the margin as aforesaid shall such recording be notice to all persons concerned that such mortgage is assigned, extended or postponed.

46:18-3. Record of assignments of mortgages; indexes.

The county recording officers of the several counties are authorized to record, in suitable books to be provided for that purpose, any assignment of any mortgage upon real estate within their respective counties, the same having thereon such certificate of acknowledgment or proof of execution thereof as is or may be required by law for the recording of deeds, which certificate shall be recorded therewith. All such assignments shall be properly indexed. For recording such assignments and for copies thereof the county recording officer shall be entitled to the fees prescribed by section 22:4-4 of the title Fees and Costs.

46:18-4. Record of assignment of mortgage as notice of assignment.

The recording of any assignment of a mortgage upon real estate as provided by section 46:18-3 of this title shall, from the time such assignment is left with the county recording officer for record, be notice to all persons concerned that such mortgage is so assigned.

46:18-5.1. Cancellation of mortgages.

A mortgage shall be cancelled of record by the recording officer of any county in which the mortgage was recorded if:

a. The original mortgage bearing on it the

receipt given by the county recording officer at the time it was recorded

is presented to the county recording officer with an endorsement on it

authorizing its cancellation bearing the signature of the mortgagee

or, if the mortgage has been assigned of record, of the last assignee of

record of the mortgage. If the mortgagee or assignee of the mortgage is

a corporation or other entity, the signature for the entity on the endorsement

may be made by any person authorized by the entity to do so; or

b. An instrument constituting a satisfaction

of mortgage meeting the requirements for recordation, including acknowledgment

or proof, is filed with the county recording officer.

46:18-11.2. Cancellation of mortgage after satisfaction.

1.

a. When any mortgage registered or recorded pursuant to R.S.46:17-1

et seq. shall be redeemed, paid and satisfied, a mortgagee, other

than a bank, savings bank, savings and loan association, credit union or

other corporation engaged in the business of making or purchasing mortgage

loans, or his agents or assigns shall within 10 days notify the mortgagor

that he has the right to demand the mortgagee to cancel the mortgage of

record upon payment by the mortgagor of the fee required by the county

to effect the cancellation and the mortgagee shall within 30 days of the

receipt by the mortgagee of the required fee from the mortgagor:

(1) apply to the county recording officer to have the mortgage canceled

of record; and

(2) send to the mortgagor or mortgagor's agent at the same time

the mortgage is sent to the county recording officer for cancellation of

record a copy of the letter of transmittal which the mortgagee sent to

the county recording officer requesting the cancellation of the mortgage

of record.

b.

(1) When any mortgage registered or recorded pursuant to R.S.46:17-1

et seq. shall be redeemed, paid and satisfied and the mortgagee is a bank,

savings bank, savings and loan association, credit union or other corporation

in the business of making or purchasing mortgage loans, that mortgagee,

its agents or assigns shall:

(a) cause the mortgage to be submitted to

the county recording officer for cancellation of record within 30 days

of receipt of all fees which are required to be paid by the mortgagor pursuant

to this subsection; and

(b) send to the mortgagor or mortgagor's agent

at the same time the mortgage is sent to the county recording officer for

cancellation of record a copy of the letter of transmittal which the mortgagee

sent to the county recording officer requesting the cancellation of the

mortgage of record.

(2) The mortgagee shall have the right to receive from the mortgagor

the amount of the fee charged by the county recording officer to cancel

the mortgage plus an additional service fee from the mortgagor, which service

fee shall not exceed $25 or such higher amount which the Commissioner of

Banking and Insurance may approve by regulation, provided the mortgagor

has received notice of the fees required by the mortgagee. The mortgagee

may collect the service fee at the time of the mortgage transaction or

at the time the mortgage is redeemed, paid and satisfied. The fee charged

by the county recording officer to cancel the mortgage of record shall

be collectible at the time the mortgage is redeemed, paid and satisfied.

c. If the final payment is made in cash, by certified check or cashier's

check, the mortgage shall be deemed paid, satisfied and redeemed upon receipt

of the cash, certified check or cashier's check by the mortgagee, his agents

or assigns.

46:18-11.3. Penalty

2.

a.

(1) If the mortgagee, his agent or assigns fails to comply with

the applicable provisions of subsection a. or b. of section 1 of P.L.1975,

c.137 (C.46:18-11.2) , the mortgagor or the mortgagor's agent may serve

the mortgagee or his assigns with written notice of the noncompliance,

which notice shall identify the mortgage and the date and means of its

redemption, payment and satisfaction. If the mortgagee has not complied

within 15 business days after receipt of the written notice from the mortgagor

or mortgagor's agent pursuant to this paragraph (1) , the mortgagee

or his assigns shall be subject to a fine of $50 per day for each day after

the 15-day period until compliance, except that the total fine imposed

pursuant to this paragraph (1) shall not exceed $1,000.

(2) If the mortgagee, his agent or assigns fails to comply with

the applicable provisions of section 1 of P.L.1975, c.137 (C.46:18-11.2),

the purchaser or the purchaser's agent may serve the mortgagee or his assigns

with written notice of the noncompliance, which notice shall identify the

mortgage and the date and means of its redemption, payment and satisfaction.

If the mortgagee has not complied within 15 business days after receipt

of the written notice from the purchaser or purchaser's agent pursuant

to this paragraph (2), the mortgagee or his assigns shall be subject to

a fine of $50 per day for each day after the 15-day period until compliance,

except that the total fine imposed pursuant to this paragraph (2) shall

not exceed $1,000.

b. Of each fine collected pursuant to subsection a. of this section,

100% shall be payable to the private citizen instituting the action. The

fine may be collected by summary proceedings instituted by a private citizen

or the Attorney General in accordance with "the penalty enforcement law"

(N.J.S.2A:58-1 et seq.).

c.

(1) If a mortgagee, his agent or assigns has not applied to

the county recording officer to cancel the mortgage of record pursuant

to subsection a. or b. of section 1 of P.L.1975, c.137 (C.46:18-11.2),

within the 15 business day period provided by paragraph (1) of subsection

a. of this section, the mortgagee shall be liable to the mortgagor for

the greater of the mortgagor's actual damages or the sum of $1,000, less

any fines recovered by the mortgagor pursuant to paragraph (1) of

subsection a. and paragraph (1) of subsection b. of this section.

In any successful action to recover damages pursuant to this paragraph

(1), the mortgagee shall reimburse the mortgagor for the costs of the action

including the mortgagor's reasonable attorneys' fees.

(2) If a mortgagee, his agent or assigns has not applied to

the county recording officer to cancel the mortgage of record pursuant

to subsection a. or b. of section 1 of P.L.1975, c.137 (C.46:18-11.2),

within the 15 business day period provided by paragraph (2) of subsection

a. of this section, the mortgagee shall be liable to the purchaser for

the greater of the purchaser's actual damages or the sum of $1,000, less

any fines recovered by the purchaser pursuant to paragraph (2) of subsection

a. and paragraph (2) of subsection b. of this section. In any successful

action to recover damages pursuant to this paragraph (2), the mortgagee

shall reimburse the purchaser for the costs of the action including the

purchaser's reasonable attorneys' fees.

46:18-11.4. Failure to comply; liability for costs of action for cancellation

Any mortgagee or his assigns who fail to comply with section 1 of this act shall be liable to the mortgagor, or his heirs, successors or assigns who have an interest in the mortgaged premises for the cost of any legal action to have the mortgage canceled of record, including reasonable attorneys' fees, but no attorneys' fees shall be allowed unless 20 days written notice is given to the mortgagee prior to institution of suit.

46:18-11.5 Definitions relative to mortgage cancellations.

1. As used in this act: "Mortgage" means a residential mortgage,

security interest or the like, in which the security is a residential property

such as a house, real property or condominium, which is occupied, or is

to be occupied, by the debtor, who is a natural person, or a member of

the debtor's immediate family, as that person's residence. The provisions

of sections 2 and 3 of P.L.1999, c.40 (C.46:18-11.6 and C.46:18-11.7) shall

apply to all residential mortgages wherever made, which have as their security

a residence in the State of New Jersey, provided that the real property

which is the subject of the mortgage shall not have more than four dwelling

units, one of which shall be, or is planned to be, occupied by the debtor

or a member of the debtor's immediate family as the debtor's or family

member's residence at the time the loan is originated. "Pay-off letter"

means a written document prepared by the holder or servicer of the mortgage

being paid, which is dated not more than 60 days prior to the date the

mortgage is paid, and which contains a statement of all the sums due to

satisfy the mortgage debt, including, but not limited to, interest accrued

to the date the statement is prepared and a means of calculating per diem

interest accruing thereafter.

46:18-11.6 Conditions under which discharge of mortgage may be executed.

2.

a. A person which is entitled to receive payment of a mortgage

duly recorded or registered in this State pursuant to a written agreement,

whether or not recorded, entered into with the holder or owner of the mortgage

may execute a discharge, satisfaction-piece, release, subordination or

postponement on behalf of the holder or owner thereof, which instrument

shall be accepted for recording by the county clerk or register of deeds

and mortgages, so long as:

(1) it meets the requirements of section 2 of P.L.1991, c.308 (C.46:15-1.1);

and

(2) it contains the following wording in the body thereof: "_____________

is authorized to execute this instrument pursuant to the terms of a written

agreement dated ______, between _______________, as owner or holder of

the mortgage, and __________________, as servicer thereof."

b. A person which is the owner or holder of a mortgage duly recorded

or registered in this State for which a prior assignment thereof is unrecorded,

may execute a discharge, satisfaction-piece, release, subordination or

postponement thereof, which instrument shall be accepted for recording

by the county clerk or register of deeds and mortgages, so long as:

(1) it meets the requirements of section 2 of P.L.1991, c.308 (C.46:15-1.1);

and

(2) it contains wording in the body of the instrument setting forth

the particulars concerning all assignments of the mortgage, whether or

not recorded.

c. Upon payment of the appropriate fees therefor, the county clerk

or register of deeds and mortgages shall cause a marginal notation to be

made upon the record of a mortgage which is specifically described in an

instrument submitted in accordance with subsection a. or b. of this

section.

46:18-12. Marginal notations of cancellation, release or discharge of mortgage.

When any mortgage of record in the office of the county recording officer of any county shall be canceled, released or discharged, and such cancellation, release or discharge shall be recorded in the office of such county recording officer, such county recording officer shall forthwith enter in the margin opposite the original entry of such mortgage a note or memorandum setting forth such cancellation, release or discharge, together with a reference to the book and page wherein such cancellation, release or discharge is recorded, and not until such note or memorandum is so entered in the margin as aforesaid shall such recording be notice to all persons concerned that such mortgage is canceled, released or discharged.