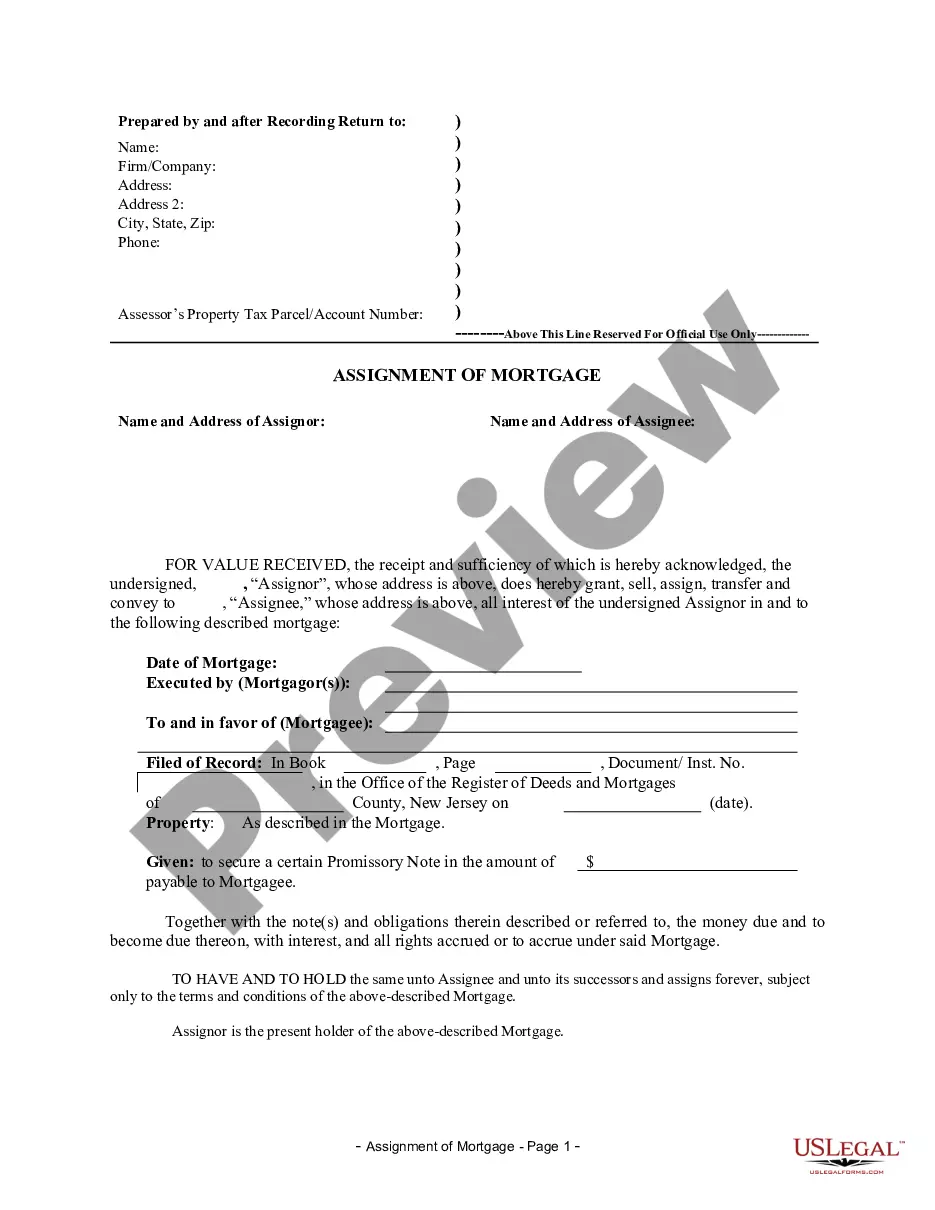

Assignment of Mortgage by Corporate Mortgage Holder

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rule

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the recorded mortgage, which is attested by the clerk.

New Jersey Law

Execution of Assignment or Satisfaction:

Must be signed by the mortgagee.

Assignment:

The county recording officers of the several counties are authorized to record, in suitable books to

be provided for that purpose, any assignment of any mortgage upon real

estate within their respective counties, the same having thereon such certificate

of acknowledgment or proof of execution thereof as is or may be required

by law for the recording of deeds, which certificate shall be recorded

therewith.

Demand to Satisfy:

Written demand from mortgagor to mortgagee at least 20 days prior to filing suit.

Recording Satisfaction:

An instrument constituting a satisfaction of mortgage meeting the requirements for recordation, including

acknowledgment or proof, is filed with the county recording officer. See

detailed statutes, below.

Marginal Satisfaction:

The county recording officer shall forthwith enter in the margin opposite the original

entry of such mortgage a note or memorandum setting forth such cancellation,

release or discharge, together with a reference to the book and page wherein

such cancellation, release or discharge is recorded. See section 46:18-12,

below.

Penalty:

If the mortgagee has not complied within 15 business days after receipt of the written notice from the mortgagor

or mortgagor's agent pursuant to this paragraph (1), the mortgagee

or his assigns shall be subject to a fine of $50 per day for each day after

the 15-day period until compliance, except that the total fine imposed

pursuant to this paragraph (1) shall not exceed $1,000.

If Mortgagee fails to satisfy the recording requirements, he is liable for damages,

including attorney fees, if 20 days written notice is given by Mortgagor

prior to suit.

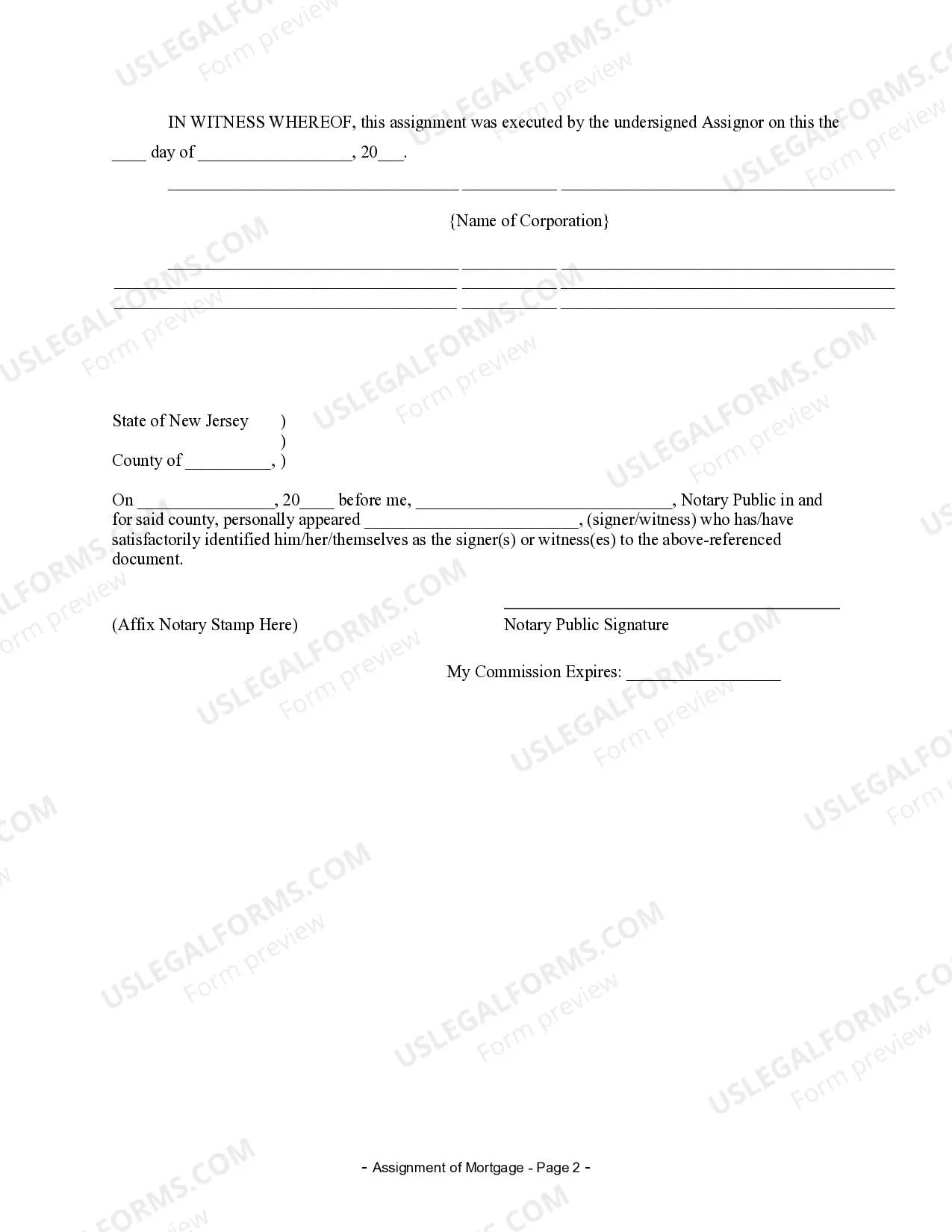

Acknowledgment:

An assignment or satisfaction must contain a proper New Jersey acknowledgment, or other acknowledgment

approved by Statute.

New Jersey Statutes

46:18-2. Marginal notation on records of mortgages of recorded

assignments, extensions or postponements thereof.

When any mortgage of record in the office of the county recording

officer of any county shall be assigned, extended or postponed, and such

assignment, extension or postponement shall be recorded in the office of

such county recording officer, such county recording officer shall forthwith

enter in the margin opposite the original entry of such mortgage a note

or memorandum setting forth such assignment, extension or postponement,

together with a reference to the book and page wherein such assignment,

extension or postponement is recorded, and not until such note or memorandum

is so entered in the margin as aforesaid shall such recording be notice

to all persons concerned that such mortgage is assigned, extended or postponed.

46:18-3. Record of assignments of mortgages; indexes.

The county recording officers of the several counties are authorized

to record, in suitable books to be provided for that purpose, any assignment

of any mortgage upon real estate within their respective counties, the

same having thereon such certificate of acknowledgment or proof of execution

thereof as is or may be required by law for the recording of deeds, which

certificate shall be recorded therewith. All such assignments shall

be properly indexed. For recording such assignments and for

copies thereof the county recording officer shall be entitled to the fees

prescribed by section 22:4-4 of the title Fees and Costs.

46:18-4. Record of assignment of mortgage as notice of

assignment.

The recording of any assignment of a mortgage upon real estate as

provided by section 46:18-3 of this title shall, from the time such assignment

is left with the county recording officer for record, be notice to all

persons concerned that such mortgage is so assigned.

46:18-5.1. Cancellation of mortgages.

A mortgage shall be cancelled of record by the recording officer

of any county in which the mortgage was recorded if:

a. The original mortgage bearing on it the

receipt given by the county recording officer at the time it was recorded

is presented to the county recording officer with an endorsement on it

authorizing its cancellation bearing the signature of the mortgagee

or, if the mortgage has been assigned of record, of the last assignee of

record of the mortgage. If the mortgagee or assignee of the mortgage is

a corporation or other entity, the signature for the entity on the endorsement

may be made by any person authorized by the entity to do so; or

b. An instrument constituting a satisfaction

of mortgage meeting the requirements for recordation, including acknowledgment

or proof, is filed with the county recording officer.

46:18-11.2. Cancellation of mortgage after satisfaction.

1.

a. When any mortgage registered or recorded pursuant to R.S.46:17-1

et seq. shall be redeemed, paid and satisfied, a mortgagee, other

than a bank, savings bank, savings and loan association, credit union or

other corporation engaged in the business of making or purchasing mortgage

loans, or his agents or assigns shall within 10 days notify the mortgagor

that he has the right to demand the mortgagee to cancel the mortgage of

record upon payment by the mortgagor of the fee required by the county

to effect the cancellation and the mortgagee shall within 30 days of the

receipt by the mortgagee of the required fee from the mortgagor:

(1) When any mortgage registered or recorded pursuant to R.S.46:17-1

et seq. shall be redeemed, paid and satisfied and the mortgagee is a bank,

savings bank, savings and loan association, credit union or other corporation

in the business of making or purchasing mortgage loans, that mortgagee,

its agents or assigns shall:

(2) The mortgagee shall have the right to receive from the mortgagor

the amount of the fee charged by the county recording officer to cancel

the mortgage plus an additional service fee from the mortgagor, which service

fee shall not exceed $25 or such higher amount which the Commissioner of

Banking and Insurance may approve by regulation, provided the mortgagor

has received notice of the fees required by the mortgagee. The mortgagee

may collect the service fee at the time of the mortgage transaction or

at the time the mortgage is redeemed, paid and satisfied. The fee charged

by the county recording officer to cancel the mortgage of record shall

be collectible at the time the mortgage is redeemed, paid and satisfied.

c. If the final payment is made in cash, by certified check or cashier's

check, the mortgage shall be deemed paid, satisfied and redeemed upon receipt

of the cash, certified check or cashier's check by the mortgagee, his agents

or assigns.

46:18-11.3. Penalty

2.

(1) If the mortgagee, his agent or assigns fails to comply with

the applicable provisions of subsection a. or b. of section 1 of P.L.1975,

c.137 (C.46:18-11.2) , the mortgagor or the mortgagor's agent may serve

the mortgagee or his assigns with written notice of the noncompliance,

which notice shall identify the mortgage and the date and means of its

redemption, payment and satisfaction. If the mortgagee has not complied

within 15 business days after receipt of the written notice from the mortgagor

or mortgagor's agent pursuant to this paragraph (1) , the mortgagee

or his assigns shall be subject to a fine of $50 per day for each day after

the 15-day period until compliance, except that the total fine imposed

pursuant to this paragraph (1) shall not exceed $1,000.

(2) If the mortgagee, his agent or assigns fails to comply with

the applicable provisions of section 1 of P.L.1975, c.137 (C.46:18-11.2),

the purchaser or the purchaser's agent may serve the mortgagee or his assigns

with written notice of the noncompliance, which notice shall identify the

mortgage and the date and means of its redemption, payment and satisfaction.

If the mortgagee has not complied within 15 business days after receipt

of the written notice from the purchaser or purchaser's agent pursuant

to this paragraph (2), the mortgagee or his assigns shall be subject to

a fine of $50 per day for each day after the 15-day period until compliance,

except that the total fine imposed pursuant to this paragraph (2) shall

not exceed $1,000.

b. Of each fine collected pursuant to subsection a. of this section,

100% shall be payable to the private citizen instituting the action. The

fine may be collected by summary proceedings instituted by a private citizen

or the Attorney General in accordance with "the penalty enforcement law"

(N.J.S.2A:58-1 et seq.).

(1) If a mortgagee, his agent or assigns has not applied to

the county recording officer to cancel the mortgage of record pursuant

to subsection a. or b. of section 1 of P.L.1975, c.137 (C.46:18-11.2),

within the 15 business day period provided by paragraph (1) of subsection

a. of this section, the mortgagee shall be liable to the mortgagor for

the greater of the mortgagor's actual damages or the sum of $1,000, less

any fines recovered by the mortgagor pursuant to paragraph (1) of

subsection a. and paragraph (1) of subsection b. of this section.

In any successful action to recover damages pursuant to this paragraph

(1), the mortgagee shall reimburse the mortgagor for the costs of the action

including the mortgagor's reasonable attorneys' fees.

(2) If a mortgagee, his agent or assigns has not applied to

the county recording officer to cancel the mortgage of record pursuant

to subsection a. or b. of section 1 of P.L.1975, c.137 (C.46:18-11.2),

within the 15 business day period provided by paragraph (2) of subsection

a. of this section, the mortgagee shall be liable to the purchaser for

the greater of the purchaser's actual damages or the sum of $1,000, less

any fines recovered by the purchaser pursuant to paragraph (2) of subsection

a. and paragraph (2) of subsection b. of this section. In any successful

action to recover damages pursuant to this paragraph (2), the mortgagee

shall reimburse the purchaser for the costs of the action including the

purchaser's reasonable attorneys' fees.

46:18-11.4. Failure to comply; liability for costs of action

for cancellation

Any mortgagee or his assigns who fail to comply with section 1 of

this act shall be liable to the mortgagor, or his heirs, successors

or assigns who have an interest in the mortgaged premises for the cost

of any legal action to have the mortgage canceled of record, including

reasonable attorneys' fees, but no attorneys' fees shall be allowed unless

20 days written notice is given to the mortgagee prior to institution of

suit.

46:18-11.5 Definitions relative to mortgage cancellations.

1. As used in this act: "Mortgage" means a residential mortgage,

security interest or the like, in which the security is a residential property

such as a house, real property or condominium, which is occupied, or is

to be occupied, by the debtor, who is a natural person, or a member of

the debtor's immediate family, as that person's residence. The provisions

of sections 2 and 3 of P.L.1999, c.40 (C.46:18-11.6 and C.46:18-11.7) shall

apply to all residential mortgages wherever made, which have as their security

a residence in the State of New Jersey, provided that the real property

which is the subject of the mortgage shall not have more than four dwelling

units, one of which shall be, or is planned to be, occupied by the debtor

or a member of the debtor's immediate family as the debtor's or family

member's residence at the time the loan is originated. "Pay-off letter"

means a written document prepared by the holder or servicer of the mortgage

being paid, which is dated not more than 60 days prior to the date the

mortgage is paid, and which contains a statement of all the sums due to

satisfy the mortgage debt, including, but not limited to, interest accrued

to the date the statement is prepared and a means of calculating per diem

interest accruing thereafter.

46:18-11.6 Conditions under which discharge of mortgage

may be executed.

2.

a. A person which is entitled to receive payment of a mortgage

duly recorded or registered in this State pursuant to a written agreement,

whether or not recorded, entered into with the holder or owner of the mortgage

may execute a discharge, satisfaction-piece, release, subordination or

postponement on behalf of the holder or owner thereof, which instrument

shall be accepted for recording by the county clerk or register of deeds

and mortgages, so long as:

(2) it contains the following wording in the body thereof: "_____________

is authorized to execute this instrument pursuant to the terms of a written

agreement dated ______, between _______________, as owner or holder of

the mortgage, and __________________, as servicer thereof."

b. A person which is the owner or holder of a mortgage duly recorded

or registered in this State for which a prior assignment thereof is unrecorded,

may execute a discharge, satisfaction-piece, release, subordination or

postponement thereof, which instrument shall be accepted for recording

by the county clerk or register of deeds and mortgages, so long as:

c. Upon payment of the appropriate fees therefor, the county clerk

or register of deeds and mortgages shall cause a marginal notation to be

made upon the record of a mortgage which is specifically described in an

instrument submitted in accordance with subsection a. or b. of this

section.

46:18-12. Marginal notations of cancellation, release or

discharge of mortgage.

When any mortgage of record in the office of the county recording

officer of any county shall be canceled, released or discharged, and such

cancellation, release or discharge shall be recorded in the office of such

county recording officer, such county recording officer shall

forthwith enter in the margin opposite the original entry of such mortgage

a note or memorandum setting forth such cancellation, release or

discharge, together with a reference to the book and page wherein such

cancellation, release or discharge is recorded, and not until such

note or memorandum is so entered in the margin as aforesaid shall such

recording be notice to all persons concerned that such mortgage is canceled,

released or discharged.