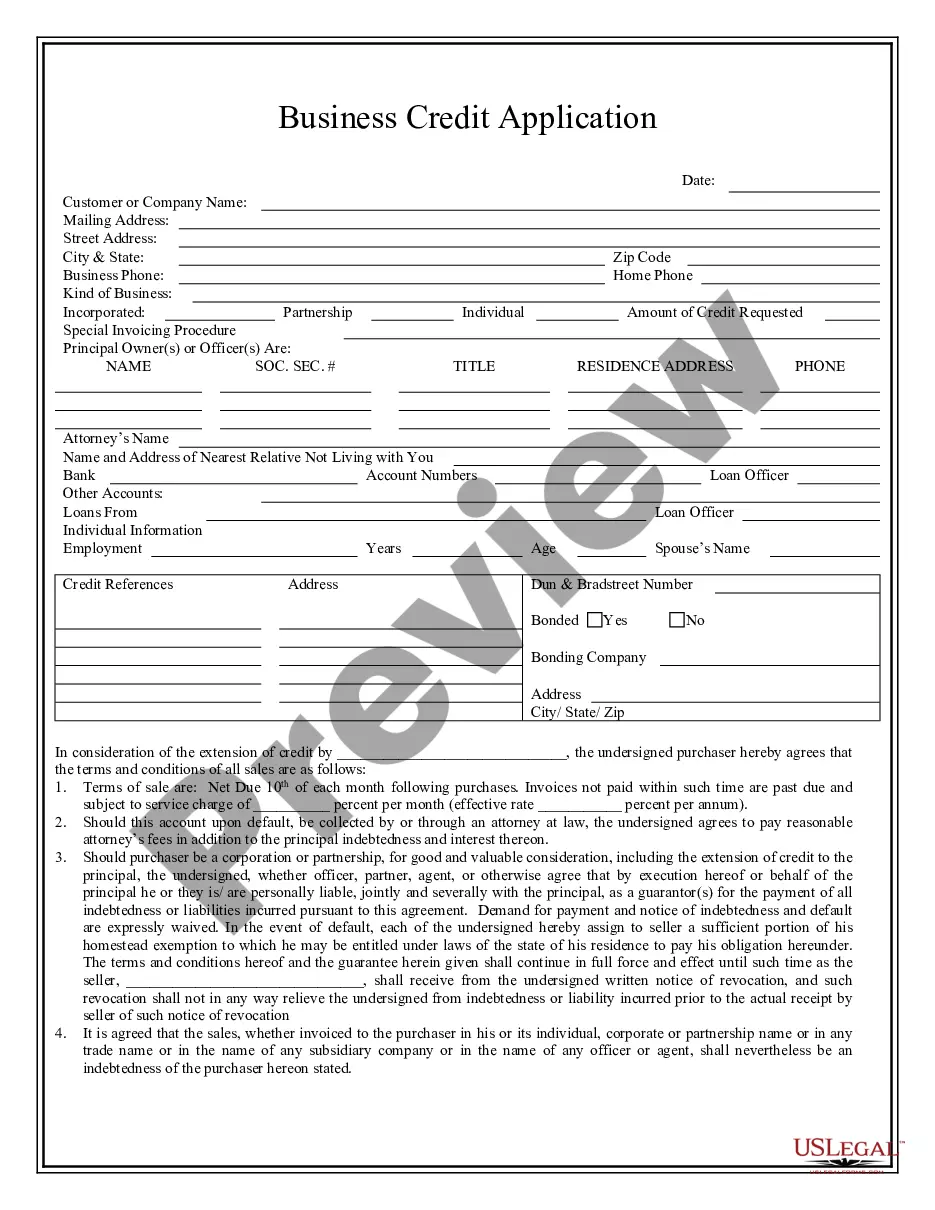

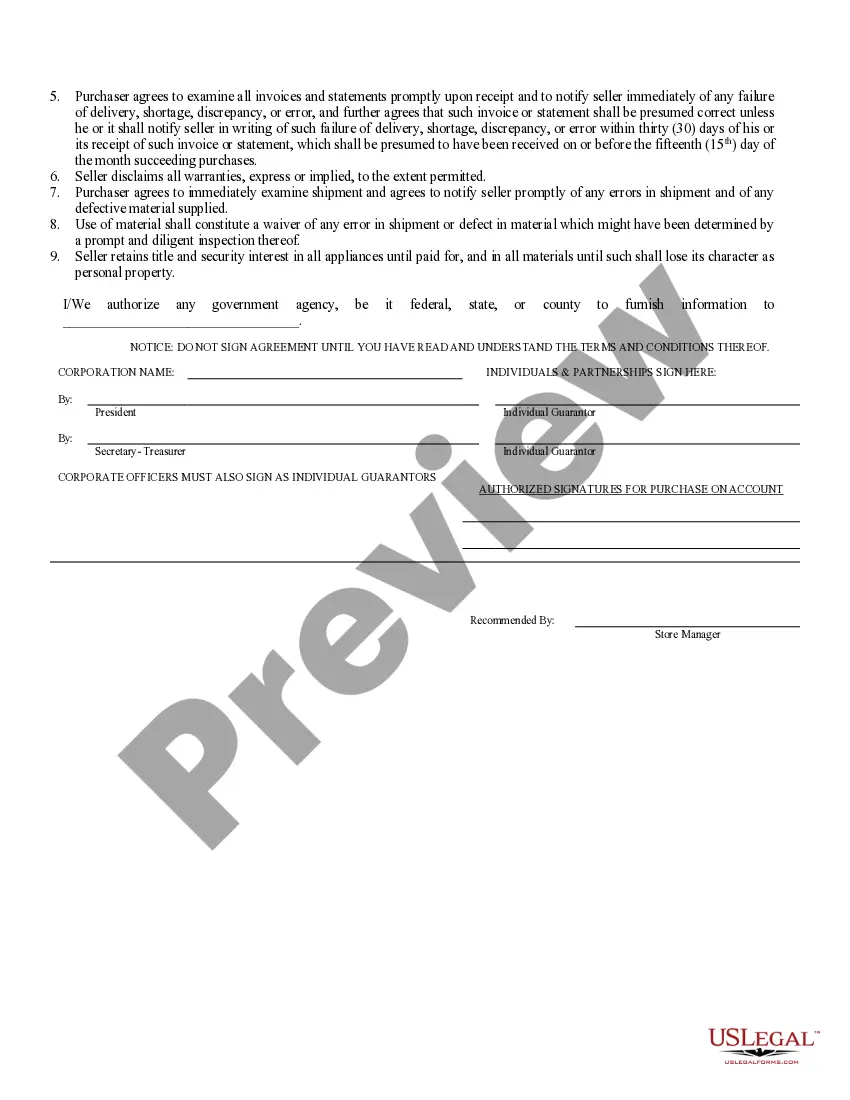

Jersey City, New Jersey, is a thriving hub for businesses of all sizes and industries. To facilitate their operations and financial needs, companies often require business credit applications. A business credit application serves as a comprehensive document, allowing organizations to apply for credit lines, loans, or financial assistance from banks, lenders, or suppliers. It assists businesses in establishing creditworthiness and building relationships with financial institutions to meet their financial objectives. There are different types of business credit applications available in Jersey City, New Jersey, catering to various business needs and specific situations. Some of these variations include: 1. Small Business Credit Application: Tailored specifically for small businesses or startups, this application emphasizes the organization's background, the owner's personal credit history, as well as the company's financials, such as income statements, balance sheets, and cash flow projections. 2. Corporate Credit Application: Meant for established corporations, this application encompasses a broader scope of financial information, including multiple years of financial statements, tax returns, and business bank account details. It may also require additional documentation such as legal agreements, articles of incorporation, and proof of business assets. 3. Supplier Credit Application: This type of credit application is specific to businesses that rely on suppliers or vendors for inventory or raw materials. It generally focuses on the company's ability to pay invoices promptly and their payment history with previous suppliers. 4. Construction Credit Application: Targeting businesses in the construction industry, this application provides lenders with an extensive overview of the company's construction projects, subcontractors, and payment terms. It may include details on bonding requirements, lien waivers, and certifications necessary for business operations. 5. Joint Credit Application: Applicable when two or more companies collaborate on a project or apply for credit together, a joint credit application consolidates the financial information of each entity. It requires signatures from authorized representatives of all involved businesses. When filling out a Jersey City, New Jersey business credit application, it is crucial to provide accurate and up-to-date information. This includes business details (name, address, industry), ownership structure, the number of employees, revenue, outstanding debts, and any legal or financial issues the company has encountered. Personal information about the business owner, such as Social Security number, contact details, and previous credit history, might also be required. Completing a business credit application demonstrates your business's financial responsibility and commitment to meeting contractual obligations. Therefore, it is essential to devote ample time and attention to compile all the necessary documents and information accurately.

Jersey City New Jersey Business Credit Application

Description

How to fill out Jersey City New Jersey Business Credit Application?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any legal background to create this sort of papers from scratch, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a huge library with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you require the Jersey City New Jersey Business Credit Application or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Jersey City New Jersey Business Credit Application in minutes using our reliable service. In case you are presently a subscriber, you can go ahead and log in to your account to download the appropriate form.

However, if you are unfamiliar with our platform, make sure to follow these steps prior to downloading the Jersey City New Jersey Business Credit Application:

- Ensure the form you have chosen is suitable for your location considering that the regulations of one state or area do not work for another state or area.

- Preview the form and go through a short description (if provided) of scenarios the document can be used for.

- In case the form you selected doesn’t meet your needs, you can start again and search for the necessary document.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Jersey City New Jersey Business Credit Application once the payment is completed.

You’re all set! Now you can go ahead and print out the form or fill it out online. In case you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.