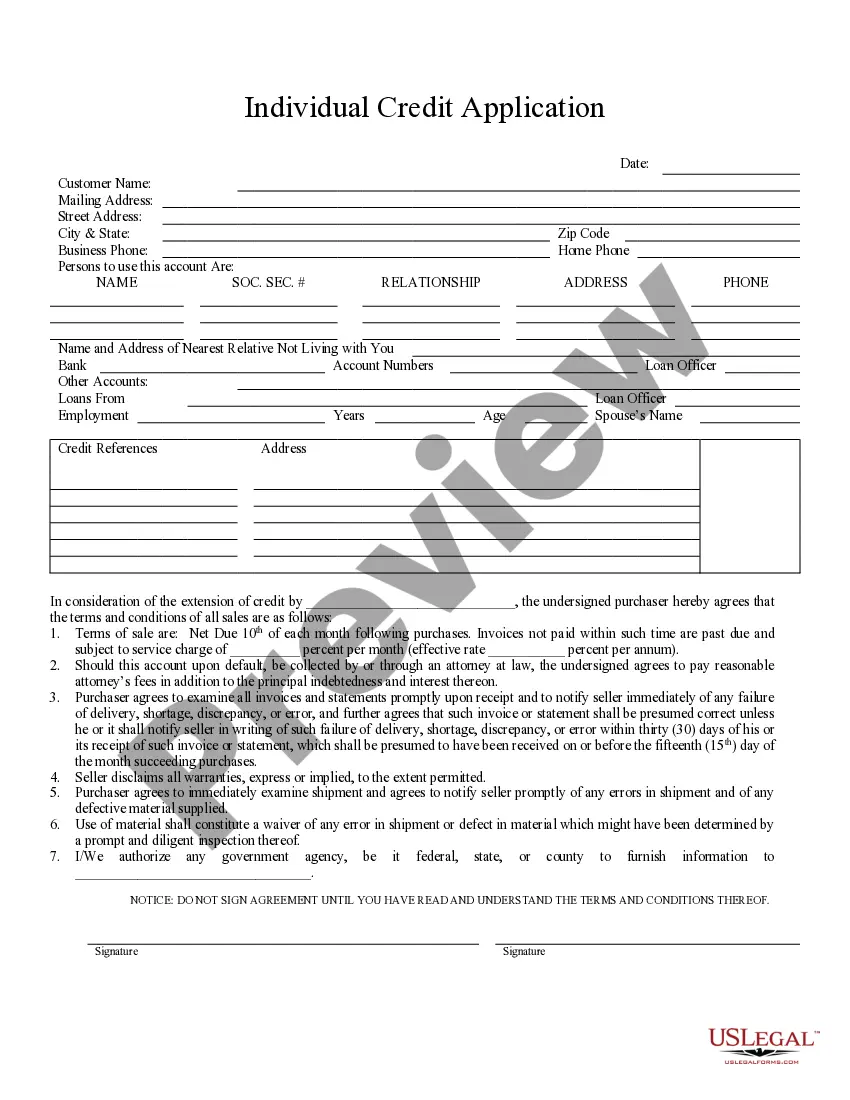

Jersey City New Jersey Individual Credit Application is a comprehensive financial document that enables individuals residing in Jersey City, New Jersey, to apply for credit from financial institutions, banks, or credit unions. This application form is used to assess an individual's creditworthiness, personal financial information, and overall suitability for credit offerings. Keywords: Jersey City, New Jersey, individual credit application, financial document, creditworthiness, personal financial information, credit offerings. There are several types of Individual Credit Applications commonly used in Jersey City, New Jersey, to cater to different credit needs. Some of these may include: 1. Personal Loan Credit Application: This type of credit application is used when individuals require a loan for personal reasons like home renovations, debt consolidation, medical expenses, or education fees. 2. Mortgage Loan Credit Application: This application is used specifically for individuals seeking financing to purchase a property or refinance an existing mortgage in Jersey City, New Jersey. 3. Credit Card Application: This type of credit application is used when individuals are interested in obtaining a credit card to make purchases and build their credit history. Various credit card providers offer tailored credit cards with different rewards and interest rates. 4. Auto Loan Credit Application: Individuals looking to finance the purchase of a new or used vehicle can utilize this application to apply for an auto loan specifically designed for such purchases. 5. Small Business Loan Credit Application: Entrepreneurs and small business owners residing in Jersey City, New Jersey, can utilize this application form to apply for credit to support and expand their business operations. All of these credit applications typically require individuals to provide personal information such as name, contact details, social security number, employment details, income, monthly expenses, current debts, and references. The information provided in the credit application is evaluated by the lender to determine the applicant's creditworthiness, repayment capacity, and overall financial stability. The approval of credit would be subject to the lender's assessment and compliance with their specific lending criteria. In conclusion, Jersey City New Jersey Individual Credit Application is a crucial document that enables individuals to apply for various forms of credit in compliance with their financial needs. Whether it's a personal loan, mortgage loan, credit card, auto loan, or small business loan, this application helps individuals apply for credit responsibly, ensuring that their financial requirements are met while maintaining adherence to the lender's guidelines and regulations.

Jersey City New Jersey Individual Credit Application

Description

How to fill out Jersey City New Jersey Individual Credit Application?

Are you looking for a reliable and affordable legal forms supplier to buy the Jersey City New Jersey Individual Credit Application? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Jersey City New Jersey Individual Credit Application conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the form is intended for.

- Start the search over in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Jersey City New Jersey Individual Credit Application in any available file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal paperwork online once and for all.