A Paterson New Jersey Loan Modification Agreement for Fixed Rate Loan is a legal document that outlines the terms and conditions of modifying an existing fixed-rate loan in Paterson, New Jersey. It provides the borrower with the opportunity to revise certain aspects of the loan, such as interest rate, repayment period, or monthly payments, in order to make it more manageable and affordable. This type of loan modification agreement is generally offered to borrowers who are struggling to meet their financial obligations due to changes in their income, unexpected expenses, or other factors that affect their ability to repay the loan as originally agreed upon. The specific terms and conditions of a Paterson New Jersey Loan Modification Agreement for Fixed Rate Loan may vary depending on the lender and the individual circumstances of the borrower. However, some common elements often included in such agreements are: 1. Interest Rate Modification: The agreement may provide for a reduction or increase in the interest rate of the loan to adjust monthly payments accordingly. This modification aims to help borrowers lower their financial burden or better align the loan with their current financial situation. 2. Extension of Loan Term: In some cases, the agreement may extend the loan term, allowing borrowers to spread out their payments over a longer period. This modification can help reduce monthly payments and provide relief to borrowers who are struggling to meet their current obligations. 3. Change in Monthly Payments: The agreement may modify the amount of the borrower's monthly payments to an affordable level. This could be achieved by adjusting the loan's interest rate, extending the loan term, or reducing the principal balance. 4. Waiver of Fees or Penalties: Depending on the circumstances, the lender may agree to waive certain fees or penalties associated with the modification process or missed payments. This reduces the financial burden on the borrower and helps them get back on track with their loan. It is important to note that there may be variations or additional terms in different Paterson New Jersey Loan Modification Agreements for Fixed Rate Loan, depending on the lender, the borrower's financial situation, and the specific type of loan being modified. Therefore, it is crucial for borrowers to carefully review and understand the terms of the agreement before signing it. Overall, a Paterson New Jersey Loan Modification Agreement for Fixed Rate Loan provides borrowers with a valuable opportunity to adjust the terms of their existing loan in order to make it more manageable and avoid defaulting on payments. It offers financial relief and helps borrowers stay on track with their loan obligations.

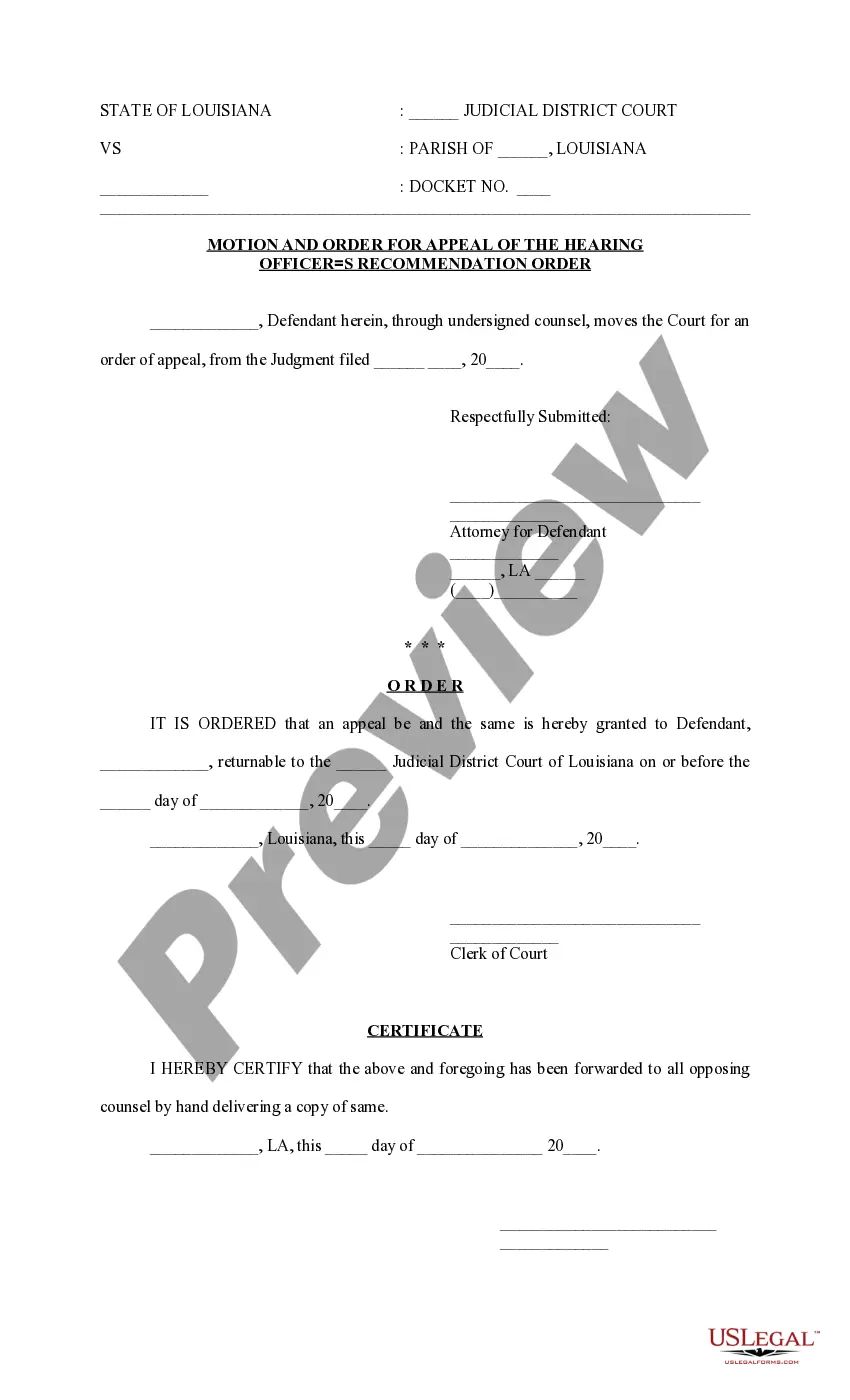

Modification Agreement Sample

Description

How to fill out Paterson New Jersey Loan Modification Agreement For Fixed Rate Loan?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no legal education to draft such paperwork cfrom the ground up, mainly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you need the Paterson New Jersey Loan Modification Agreement For Fixed Rate Loan or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Paterson New Jersey Loan Modification Agreement For Fixed Rate Loan in minutes using our reliable platform. If you are already an existing customer, you can proceed to log in to your account to get the appropriate form.

However, if you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Paterson New Jersey Loan Modification Agreement For Fixed Rate Loan:

- Ensure the form you have found is good for your area because the regulations of one state or county do not work for another state or county.

- Preview the document and read a short outline (if available) of cases the paper can be used for.

- If the one you picked doesn’t suit your needs, you can start again and look for the suitable form.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment method and proceed to download the Paterson New Jersey Loan Modification Agreement For Fixed Rate Loan as soon as the payment is completed.

You’re good to go! Now you can proceed to print the document or fill it out online. Should you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.