Title: Understanding Elizabeth New Jersey Final Judgment of Tax Sale Certificate Foreclosure Keywords: Elizabeth New Jersey, Final Judgment, Tax Sale Certificate, Foreclosure Introduction: The Final Judgment of Tax Sale Certificate Foreclosure is a legal process that occurs when a property owner in Elizabeth, New Jersey fails to pay their property taxes. This comprehensive guide aims to provide a detailed description of this foreclosure process, its implications, and the various types of Final Judgments associated with tax sale certificate foreclosures in Elizabeth, New Jersey. 1. Elizabeth New Jersey Tax Sale Certificate: In Elizabeth, New Jersey, unpaid property taxes result in the issuance of a tax sale certificate to an investor or municipality. The tax sale certificate represents the value of the outstanding taxes plus any penalties or interest accrued on the property. 2. Tax Sale Certificate Foreclosure: When property owners fail to redeem the tax sale certificate within the designated redemption period, foreclosure proceedings begin. The foreclosure process allows the holder of the tax sale certificate to pursue legal action to acquire ownership of the property. 3. Final Judgment of Tax Sale Certificate Foreclosure: The Final Judgment is the concluding stage in the tax sale certificate foreclosure process. It involves a court order that confirms the property's transfer from the previous owner to the holder of the tax sale certificate, granting them full ownership rights. Types of Elizabeth New Jersey Final Judgment of Tax Sale Certificate Foreclosure: a. Strict Foreclosure: In this type of Final Judgment, the property ownership is transferred directly to the holder of the tax sale certificate. No auction or sale is required, and the previous owner loses all rights to the property. b. Judicial Foreclosure: Judicial foreclosure involves a court-supervised auction where interested parties can bid on the property. The highest bidder, typically the holder of the tax sale certificate, becomes the new property owner upon the court's confirmation. c. Tax Deed Sale: If the property does not sell during the auction in judicial foreclosure, it may proceed to a tax deed sale. In this process, the municipality holds a public sale for the property, allowing interested buyers to bid on it. The highest bidder receives a tax deed, granting them ownership rights. Conclusion: Understanding the Final Judgment of Tax Sale Certificate Foreclosure in Elizabeth, New Jersey is essential for property owners and investors involved in these proceedings. Whether it's through strict foreclosure, judicial foreclosure, or a tax deed sale, this legal process ensures that unpaid property taxes are recovered and the property is transferred to the new owner. It's crucial to seek legal counsel and guidance throughout the foreclosure process to protect the rights and interests of all parties involved.

Elizabeth New Jersey Final Judgment of Tax Sale Certificate Foreclosure

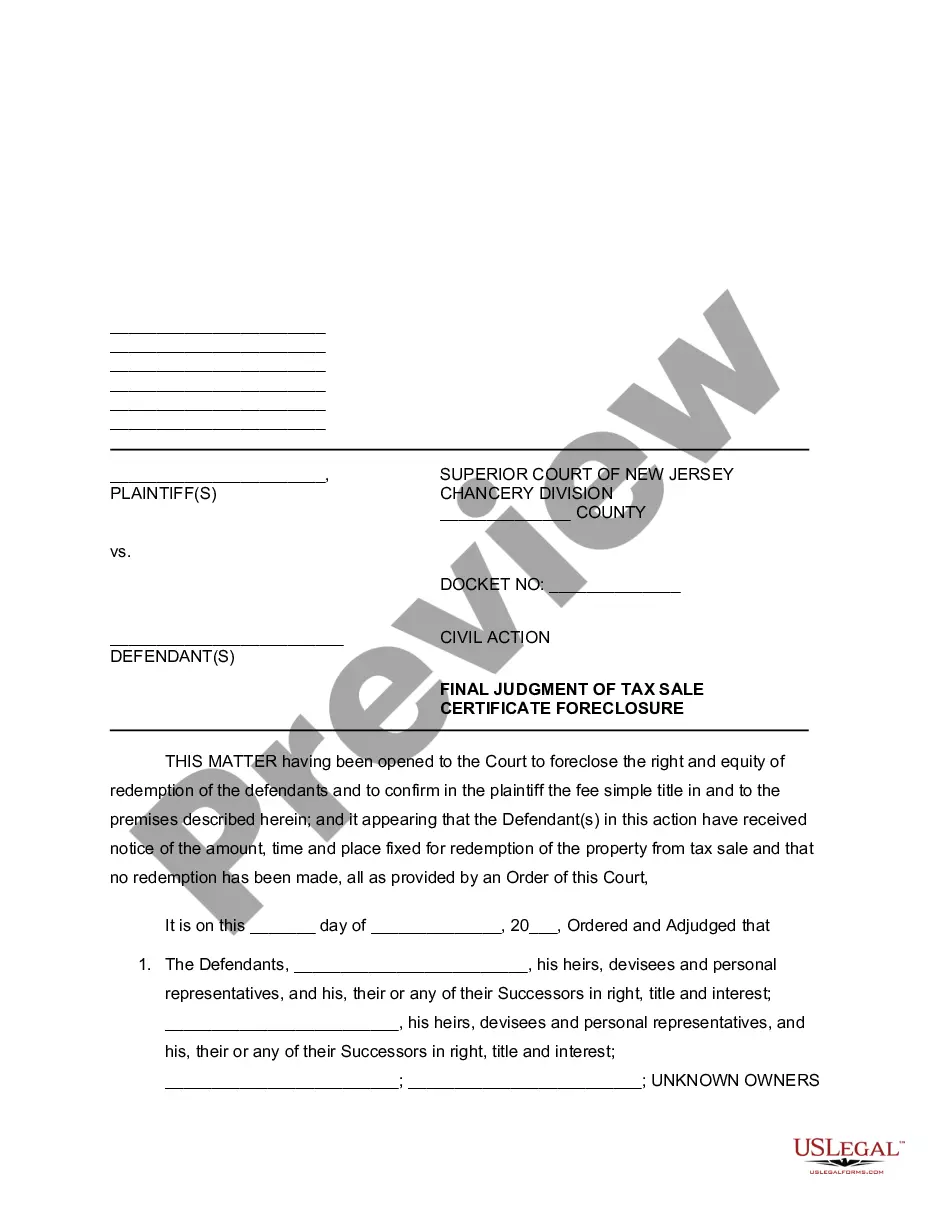

Description

How to fill out Elizabeth New Jersey Final Judgment Of Tax Sale Certificate Foreclosure?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Elizabeth New Jersey Final Judgment of Tax Sale Certificate Foreclosure gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Elizabeth New Jersey Final Judgment of Tax Sale Certificate Foreclosure takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Elizabeth New Jersey Final Judgment of Tax Sale Certificate Foreclosure. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!