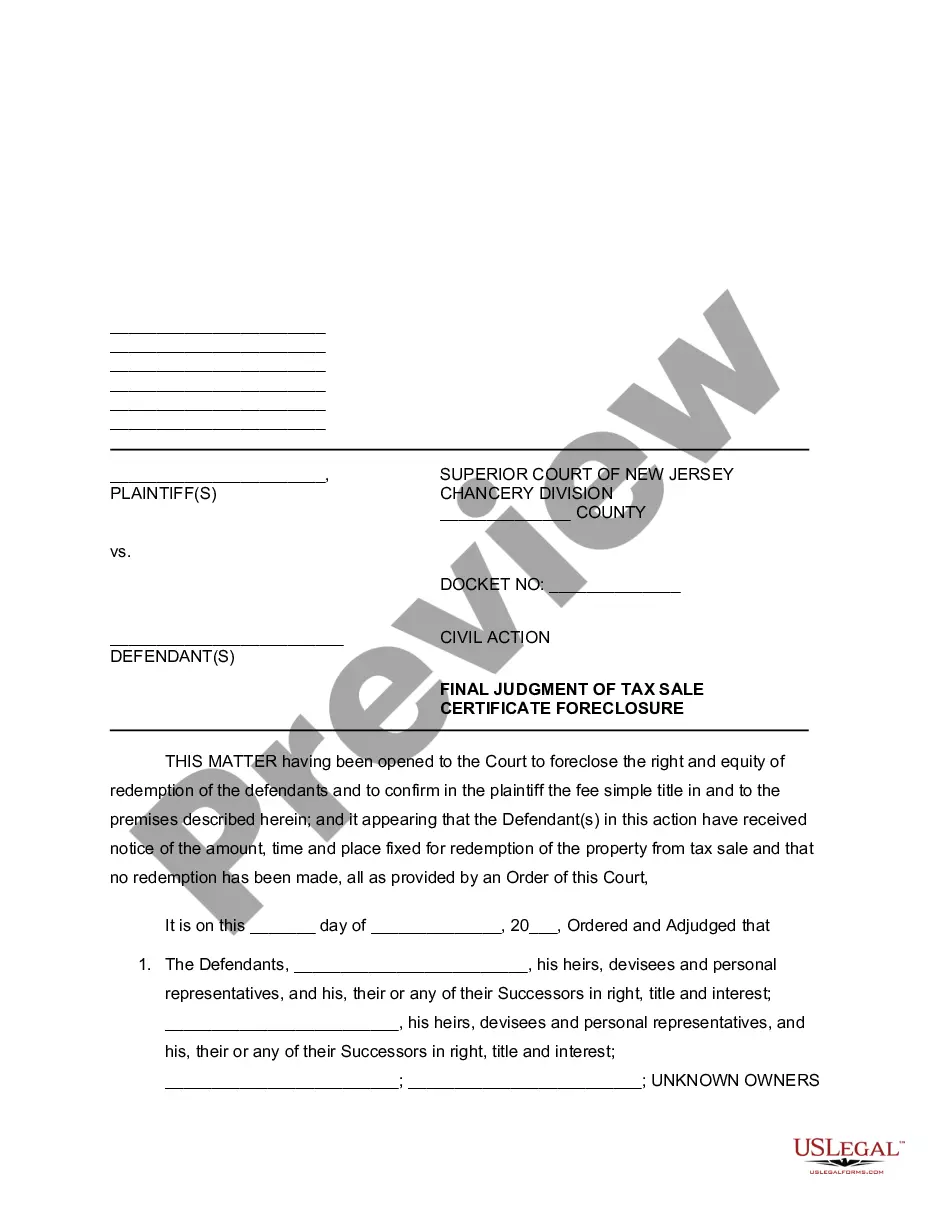

The Final Judgment of Tax Sale Certificate Foreclosure in Newark, New Jersey is a legal process that occurs when a property owner fails to pay their property taxes. When a property owner falls into delinquency, the local government may initiate the tax sale process. During this process, the property's tax debt is sold at auction to a third-party investor in the form of a tax sale certificate. The tax sale certificate represents a lien on the property, and the investor gains the right to collect the delinquent taxes, penalties, and interest. If the property owner fails to repay the outstanding debt within a specified period, typically two years, the investor may initiate a foreclosure proceeding. Once the foreclosure process is initiated, the investor files a complaint in court, and a judge will review the case. If the judge determines that all legal requirements have been met, a Final Judgment of Tax Sale Certificate Foreclosure is issued. This final judgment grants the investor full ownership of the property, allowing them to take possession, sell, or transfer it. There are a few different types of Newark New Jersey Final Judgment of Tax Sale Certificate Foreclosure, each related to specific circumstances or procedural steps: 1. Regular Foreclosure: This is the standard process where the investor initiates the foreclosure after the property owner fails to repay the tax sale certificate debt within the given timeframe. 2. Struck-Off Foreclosure: If no bidders purchase the tax sale certificate at auction, the municipality itself may strike-off the certificate. The municipality then has the authority to initiate foreclosure proceedings to recover the outstanding taxes. 3. Certificate Redemption: Prior to the issuance of a final judgment, property owners have the opportunity to redeem their tax sale certificate by paying the outstanding debt, including interest and fees. In such cases, the foreclosure process is halted, and the property owner retains ownership. 4. Excess Proceeding: When a tax sale certificate is foreclosed and the auction proceeds exceed the amount owed, the property owner may be entitled to claim the excess funds. An excess proceeding is then initiated to determine the rightful recipient of these surplus funds. In conclusion, the Newark New Jersey Final Judgment of Tax Sale Certificate Foreclosure represents the culmination of a legal process that allows third-party investors to obtain ownership of properties with delinquent taxes. By following specific procedures and meeting legal requirements, investors can acquire these properties, leading to potential real estate transactions or the recovery of tax debts.

Newark New Jersey Final Judgment of Tax Sale Certificate Foreclosure

Description

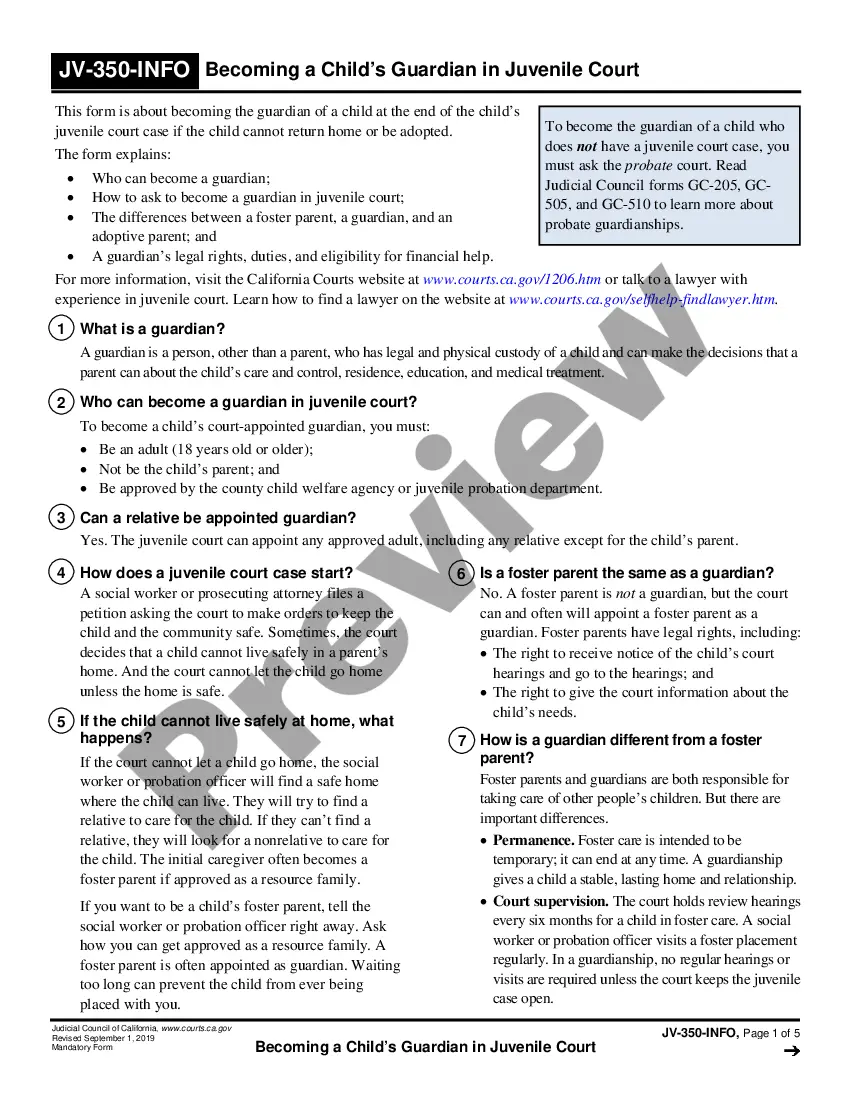

How to fill out Newark New Jersey Final Judgment Of Tax Sale Certificate Foreclosure?

Do you need a trustworthy and affordable legal forms supplier to buy the Newark New Jersey Final Judgment of Tax Sale Certificate Foreclosure? US Legal Forms is your go-to solution.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Newark New Jersey Final Judgment of Tax Sale Certificate Foreclosure conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the form is intended for.

- Start the search over in case the form isn’t good for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Newark New Jersey Final Judgment of Tax Sale Certificate Foreclosure in any available file format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal papers online for good.