Jersey City, New Jersey Revolving Credit Mortgage refers to a specific type of mortgage offered in the city of Jersey City, New Jersey, that allows borrowers to access funds based on their home equity. These revolving credit mortgages are designed to provide homeowners with flexible access to cash as needed, offering a solution for various financial needs such as home renovations, debt consolidation, or unexpected expenses. Unlike traditional mortgages, revolving credit mortgages in Jersey City enable homeowners to borrow against the equity built up in their homes, much like a line of credit. This type of mortgage allows the borrower to withdraw funds as needed, pay the principal amount, and re-borrow funds repeatedly during the draw period, which typically lasts anywhere from 10 to 15 years. Jersey City, New Jersey offers different types of revolving credit mortgages tailored to accommodate diverse financial situations. Some types include: 1. Home Equity Lines of Credit (Helots): This popular choice allows homeowners to borrow against their home equity, using their property as collateral. Jersey City residents can access funds during the draw period, typically 10 years, and are only required to make interest payments during this time. After the draw period ends, borrowers enter the repayment phase where principal and interest payments become due. Helots offer variable interest rates, which can fluctuate based on market conditions. 2. Home Equity Loans: Also known as a second mortgage, this type of revolving credit mortgage enables homeowners to receive a lump sum loan based on the equity in their home. These loans often have a fixed interest rate and fixed monthly payments, providing stability and predictability for borrowers. Unlike a HELOT, a home equity loan doesn't allow for continuous borrowing and follows a more traditional loan structure. 3. Cash-Out Refinance: Another variation of revolving credit mortgage in Jersey City, cash-out refinancing involves replacing an existing mortgage with a new, larger loan. The difference between the old and new mortgage is paid to the homeowner in cash at closing. Cash-out refinancing allows homeowners to tap into their home equity, typically with a fixed interest rate, and receive a lump sum to be used for various purposes. Jersey City residents interested in obtaining a revolving credit mortgage should consult with local mortgage lenders or banks to explore the available options and determine the most suitable type of revolving credit mortgage based on their individual financial goals and circumstances. It's important to carefully consider the terms, interest rates, repayment schedules, and eligibility requirements associated with these mortgages before making a final decision.

Jersey City New Jersey Revolving Credit Mortgage

State:

New Jersey

City:

Jersey City

Control #:

NJ-32908

Format:

Word;

Rich Text

Instant download

Description

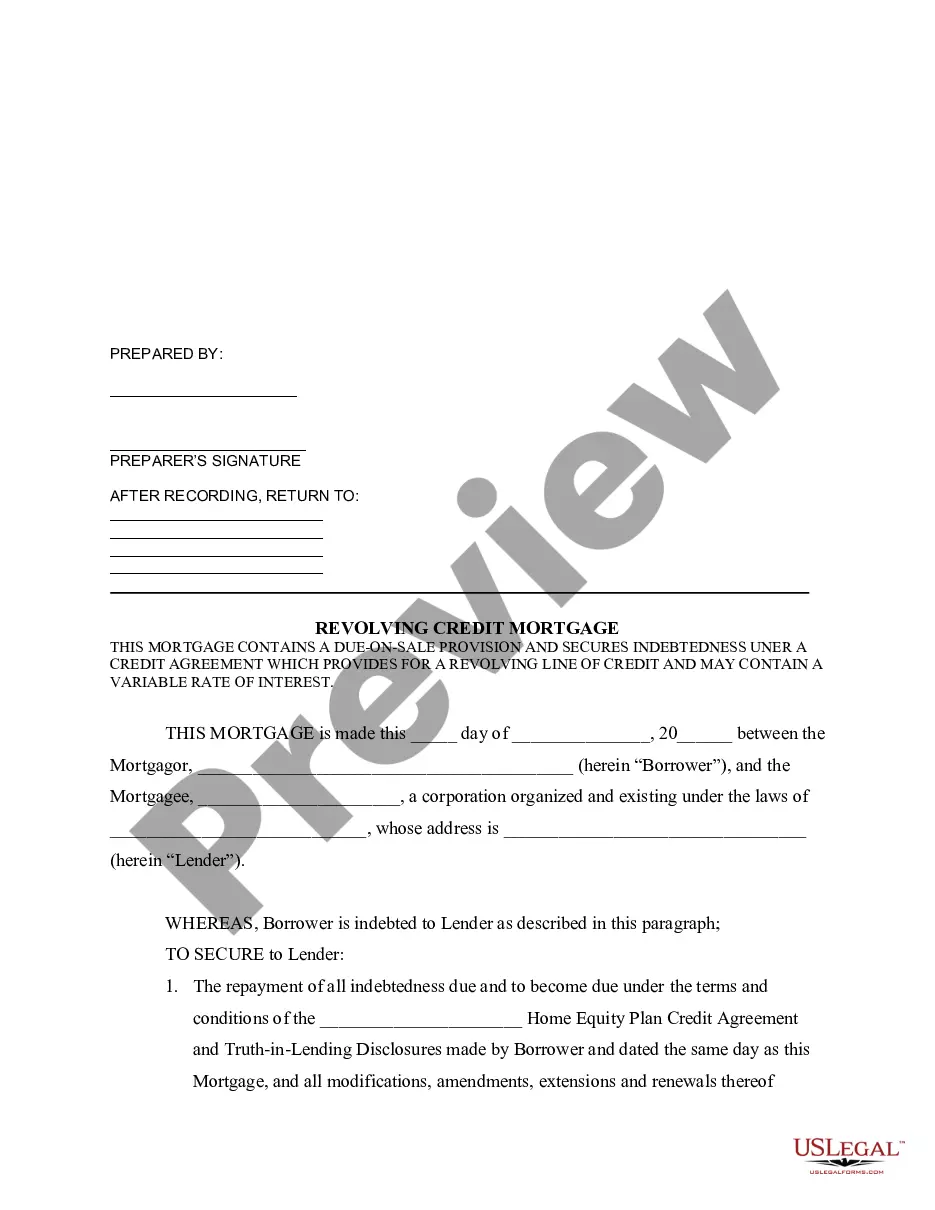

This type of mortgage lending grants to the borrower the ability to use and reuse the borrowing credit limit at their discretion. The mortgage remains open until either the lender or the borrower decide to close it. A revolving credit mortgage provides flexibility to use the home's equity.

Jersey City, New Jersey Revolving Credit Mortgage refers to a specific type of mortgage offered in the city of Jersey City, New Jersey, that allows borrowers to access funds based on their home equity. These revolving credit mortgages are designed to provide homeowners with flexible access to cash as needed, offering a solution for various financial needs such as home renovations, debt consolidation, or unexpected expenses. Unlike traditional mortgages, revolving credit mortgages in Jersey City enable homeowners to borrow against the equity built up in their homes, much like a line of credit. This type of mortgage allows the borrower to withdraw funds as needed, pay the principal amount, and re-borrow funds repeatedly during the draw period, which typically lasts anywhere from 10 to 15 years. Jersey City, New Jersey offers different types of revolving credit mortgages tailored to accommodate diverse financial situations. Some types include: 1. Home Equity Lines of Credit (Helots): This popular choice allows homeowners to borrow against their home equity, using their property as collateral. Jersey City residents can access funds during the draw period, typically 10 years, and are only required to make interest payments during this time. After the draw period ends, borrowers enter the repayment phase where principal and interest payments become due. Helots offer variable interest rates, which can fluctuate based on market conditions. 2. Home Equity Loans: Also known as a second mortgage, this type of revolving credit mortgage enables homeowners to receive a lump sum loan based on the equity in their home. These loans often have a fixed interest rate and fixed monthly payments, providing stability and predictability for borrowers. Unlike a HELOT, a home equity loan doesn't allow for continuous borrowing and follows a more traditional loan structure. 3. Cash-Out Refinance: Another variation of revolving credit mortgage in Jersey City, cash-out refinancing involves replacing an existing mortgage with a new, larger loan. The difference between the old and new mortgage is paid to the homeowner in cash at closing. Cash-out refinancing allows homeowners to tap into their home equity, typically with a fixed interest rate, and receive a lump sum to be used for various purposes. Jersey City residents interested in obtaining a revolving credit mortgage should consult with local mortgage lenders or banks to explore the available options and determine the most suitable type of revolving credit mortgage based on their individual financial goals and circumstances. It's important to carefully consider the terms, interest rates, repayment schedules, and eligibility requirements associated with these mortgages before making a final decision.

Free preview

How to fill out Jersey City New Jersey Revolving Credit Mortgage?

If you’ve already utilized our service before, log in to your account and download the Jersey City New Jersey Revolving Credit Mortgage on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Jersey City New Jersey Revolving Credit Mortgage. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!