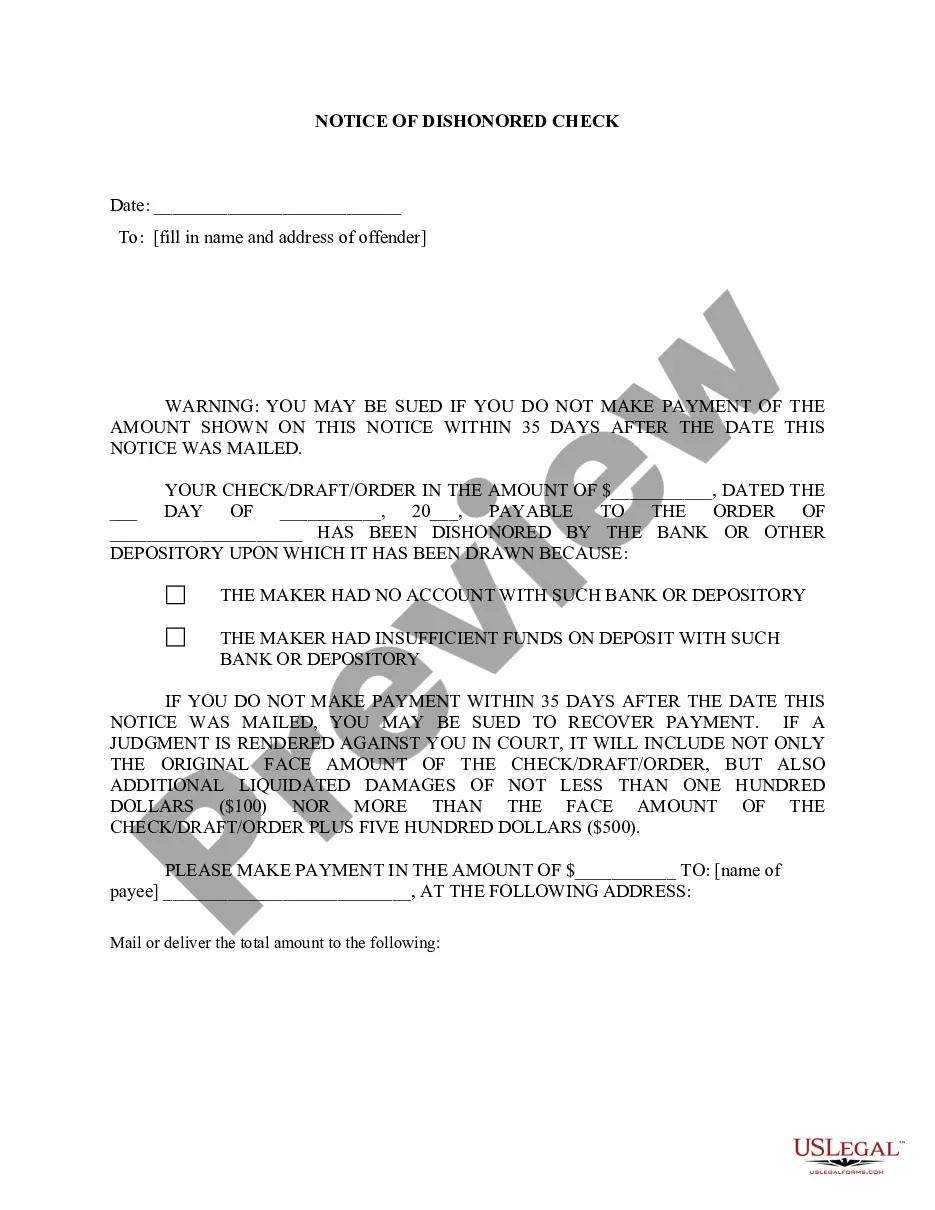

Title: Understanding the Newark, New Jersey Notice of Dishonored Check — Civil Introduction: A crucial part of financial transactions is ensuring the validity of checks. However, in cases when a check is dishonored or bounces due to insufficient funds, legal action may be pursued. This article provides a detailed description of the Newark, New Jersey Notice of Dishonored Check — Civil, focusing on keywords such as bad check and bounced check. We will also explore the different types of notices associated with dishonored checks in Newark. 1. What is a Dishonored Check? A dishonored check refers to a check that is returned by a bank unpaid due to insufficient funds, account closure, or other reasons, thus rendering it unusable. Newark, New Jersey provides legal processes to address such instances. 2. Newark, New Jersey Notice of Dishonored Check — Civil: The Notice of DishonoreCheckec— - Civil is a formal legal notice initiated by a recipient of a bounced check. It serves as a warning to the check issuer, informing them that a check they issued has been dishonored and demanding payment to prevent further legal action. 3. Types of Newark, New Jersey Notices: a. Initial Notice of Dishonored Check: This notice is the first step in the legal process regarding a bad check. It informs the check issuer that their check has been dishonored and requests immediate payment to avoid further consequences. b. Final Notice of Dishonored Check: If the check issuer fails to respond or make the required payment within a specified period, a final notice is sent. This notice indicates that legal action will be pursued if the check issuer does not settle the dispute promptly. c. Legal Action Notice: If the check issuer still does not respond or resolve the issue after the previous notices, a legal action notice is issued. This notice warns the check issuer about the commencement of legal proceedings, including potential monetary penalties, legal fees, and damage to their credit score. 4. Consequences and Penalties: Newark, New Jersey has specific laws and penalties associated with dishonored checks, including potential criminal charges. The penalties may include fines, restitution of the original amount, legal fees, and damaged credit history for the check issuer. Conclusion: Understanding the Newark, New Jersey Notice of Dishonored Check — Civil is crucial for both recipients and issuers of checks. A dishonored check can result in severe consequences, including legal action and financial penalties. It is vital to promptly address any dishonored checks to avoid further complications and to fulfill financial obligations responsibly.

Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Newark New Jersey Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Benefit from the US Legal Forms and get immediate access to any form template you want. Our useful platform with a large number of templates makes it easy to find and get virtually any document sample you want. It is possible to download, complete, and certify the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in a few minutes instead of browsing the web for hours attempting to find an appropriate template.

Utilizing our catalog is a great strategy to raise the safety of your document submissions. Our professional attorneys on a regular basis review all the documents to make sure that the templates are appropriate for a particular region and compliant with new acts and regulations.

How do you get the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Moreover, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction below:

- Find the template you need. Make certain that it is the template you were looking for: examine its title and description, and use the Preview function if it is available. Otherwise, use the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the file. Select the format to obtain the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable document libraries on the web. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!