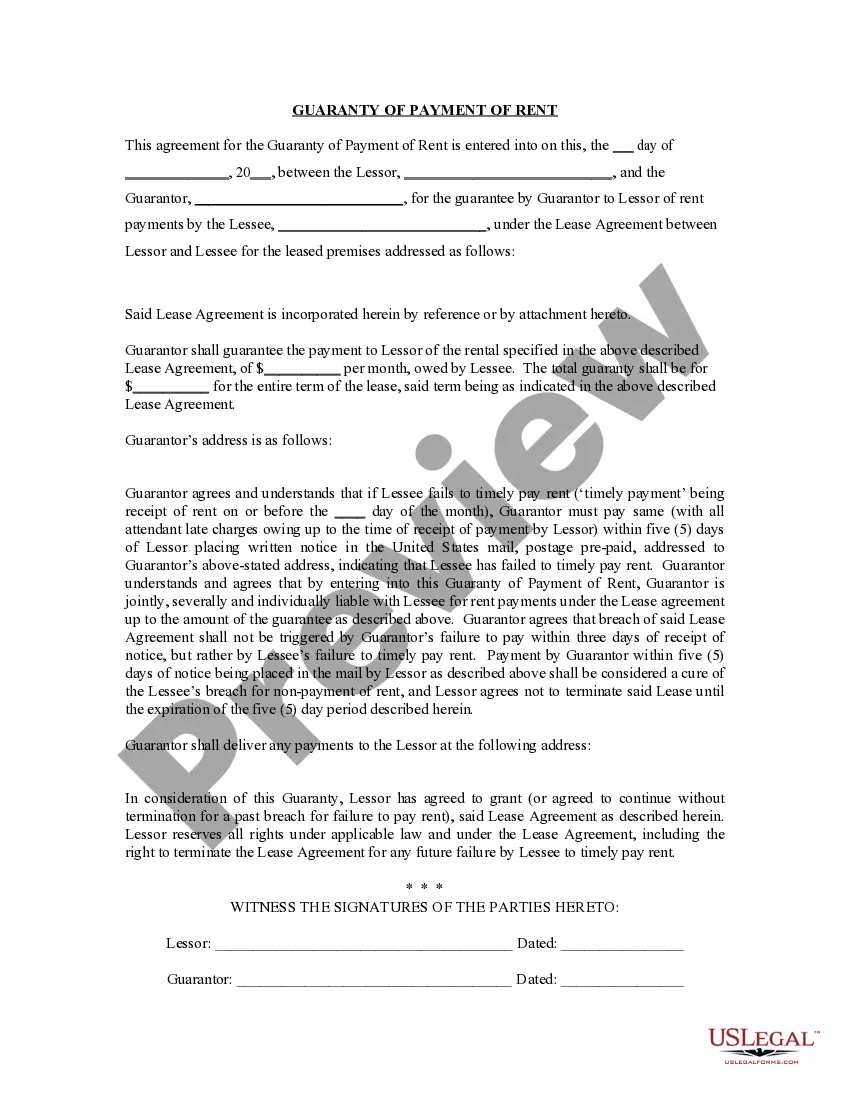

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). Jersey City, New Jersey is known for its vibrant and diverse community, offering a wide range of residential and commercial properties for rent. To ensure landlords are protected from potential rental default, the concept of Guaranty or Guarantee of Payment of Rent becomes significant. A Guaranty or Guarantee of Payment of Rent is a legally binding document that ensures landlords receive the full rent payment, even in case the tenant fails to make the payment. This provides landlords with the assurance of a consistent income stream and protects their financial interests. There are various types of Guaranty or Guarantee of Payment of Rent available in Jersey City, New Jersey. These include: 1. Personal Guaranty: A common type of rental Guaranty, a personal Guaranty involves a third party, often a family member or close friend of the tenant, who guarantees to cover the tenant's rent in case they default. This person becomes legally bound to fulfill the obligations of the tenant and is subject to the same legal consequences if they fail to meet the rental payment obligations. 2. Corporate Guaranty: In the case of commercial properties or leased spaces, where the tenant is a company or corporation, a corporate Guaranty is often required. This type of Guaranty involves the business entity's owners, directors, or a parent company guaranteeing to pay the rent on behalf of the tenant. 3. Lease Guaranty Insurance: This type of Guaranty involves purchasing an insurance policy specifically designed to cover any rental losses incurred due to tenant default. The landlord pays a premium to the insurance company in exchange for coverage in the event of non-payment of rent. 4. Security Deposit Account: Although not a traditional Guaranty, landlords can require tenants to deposit a certain amount of money as security against potential financial losses resulting from missed rental payments. This deposit acts as collateral and can be used to cover any unpaid rent or damages caused by the tenant. It is essential for landlords in Jersey City, New Jersey, to ensure that a thorough and legally-binding Guaranty or Guarantee of Payment of Rent is in place to safeguard their financial interests. By carefully selecting the appropriate type of Guaranty suited to their specific rental situation, landlords can mitigate the risks associated with potential default and maintain a steady source of rental income throughout the lease term.

Jersey City, New Jersey is known for its vibrant and diverse community, offering a wide range of residential and commercial properties for rent. To ensure landlords are protected from potential rental default, the concept of Guaranty or Guarantee of Payment of Rent becomes significant. A Guaranty or Guarantee of Payment of Rent is a legally binding document that ensures landlords receive the full rent payment, even in case the tenant fails to make the payment. This provides landlords with the assurance of a consistent income stream and protects their financial interests. There are various types of Guaranty or Guarantee of Payment of Rent available in Jersey City, New Jersey. These include: 1. Personal Guaranty: A common type of rental Guaranty, a personal Guaranty involves a third party, often a family member or close friend of the tenant, who guarantees to cover the tenant's rent in case they default. This person becomes legally bound to fulfill the obligations of the tenant and is subject to the same legal consequences if they fail to meet the rental payment obligations. 2. Corporate Guaranty: In the case of commercial properties or leased spaces, where the tenant is a company or corporation, a corporate Guaranty is often required. This type of Guaranty involves the business entity's owners, directors, or a parent company guaranteeing to pay the rent on behalf of the tenant. 3. Lease Guaranty Insurance: This type of Guaranty involves purchasing an insurance policy specifically designed to cover any rental losses incurred due to tenant default. The landlord pays a premium to the insurance company in exchange for coverage in the event of non-payment of rent. 4. Security Deposit Account: Although not a traditional Guaranty, landlords can require tenants to deposit a certain amount of money as security against potential financial losses resulting from missed rental payments. This deposit acts as collateral and can be used to cover any unpaid rent or damages caused by the tenant. It is essential for landlords in Jersey City, New Jersey, to ensure that a thorough and legally-binding Guaranty or Guarantee of Payment of Rent is in place to safeguard their financial interests. By carefully selecting the appropriate type of Guaranty suited to their specific rental situation, landlords can mitigate the risks associated with potential default and maintain a steady source of rental income throughout the lease term.