The Elizabeth New Jersey Commercial Rental Lease Application Questionnaire is a comprehensive document used to collect necessary information from prospective tenants applying for commercial rental leases in Elizabeth, New Jersey. This questionnaire is specifically designed to ensure that landlords or property managers gather all crucial details about potential tenants to make informed decisions. This application questionnaire covers various categories, including personal information, business details, rental history, financial background, references, and consent for background checks. By requiring applicants to complete this questionnaire, landlords can assess their eligibility and credibility as tenants. Some key sections of the Elizabeth New Jersey Commercial Rental Lease Application Questionnaire may include: 1. Personal Information: — Full name, address, contact details of the applicant — Social security number or taxpayer identification number Catbirdsrt— - Any previous names used 2. Business Information: — Name of the businesentityit— - Type of business (e.g., corporation, partnership, sole proprietorship) — Business address and contact detail— - Length of time the business has been operating 3. Rental History: — Current residential address and landlord's contact details — Previous commercial rental addresses and landlord's contact details — Reason for leaving previous rental properties, if applicable 4. Financial Background: — Annual incombusinesseses— - Bank account information — Credit references and contact detail— - Any outstanding debts, bankruptcies, or legal actions 5. References: — Professional references from individuals or organizations familiar with the applicant's business — Personal references from individuals who can vouch for the applicant's character and reliability 6. Consent for Background Checks: — Authorization for the landlord to conduct credit checks, criminal records checks, or other necessary investigations Different types of Elizabeth New Jersey Commercial Rental Lease Application Questionnaires may exist depending on the preferences of individual landlords or property management companies. Some variations may include additional sections such as: — Specific questions regarding the nature of the business and its compatibility with the rental property — Supplementary questions related to insurance coverage, licensing, or certifications — Requests for additional documentation such as financial statements, business plans, or marketing strategies of the applicant's business. Overall, the Elizabeth New Jersey Commercial Rental Lease Application Questionnaire acts as an invaluable tool for landlords in evaluating potential tenants and protecting their commercial property investment.

Elizabeth New Jersey Commercial Rental Lease Application Questionnaire

State:

New Jersey

City:

Elizabeth

Control #:

NJ-827ALT

Format:

Word;

PDF;

Rich Text

Instant download

Description

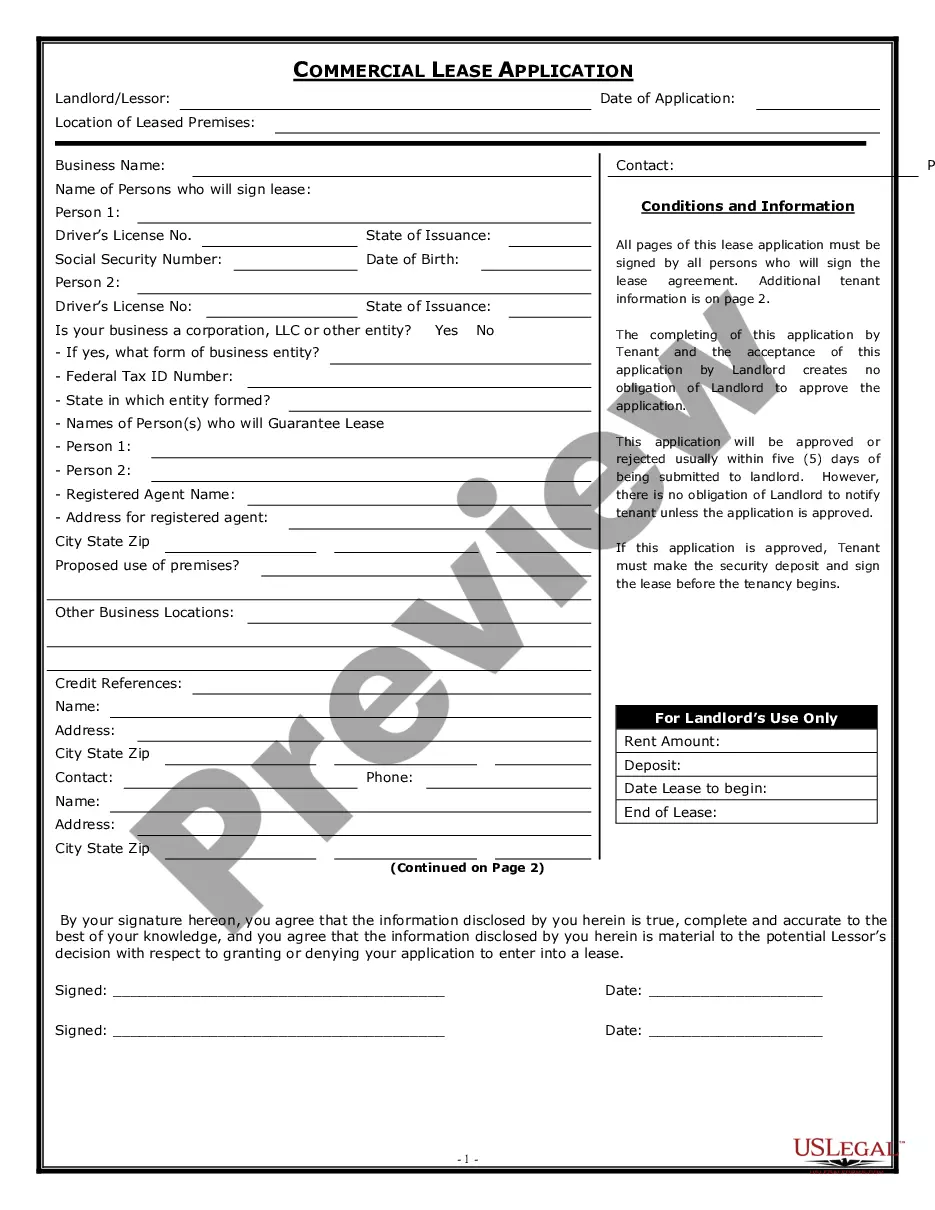

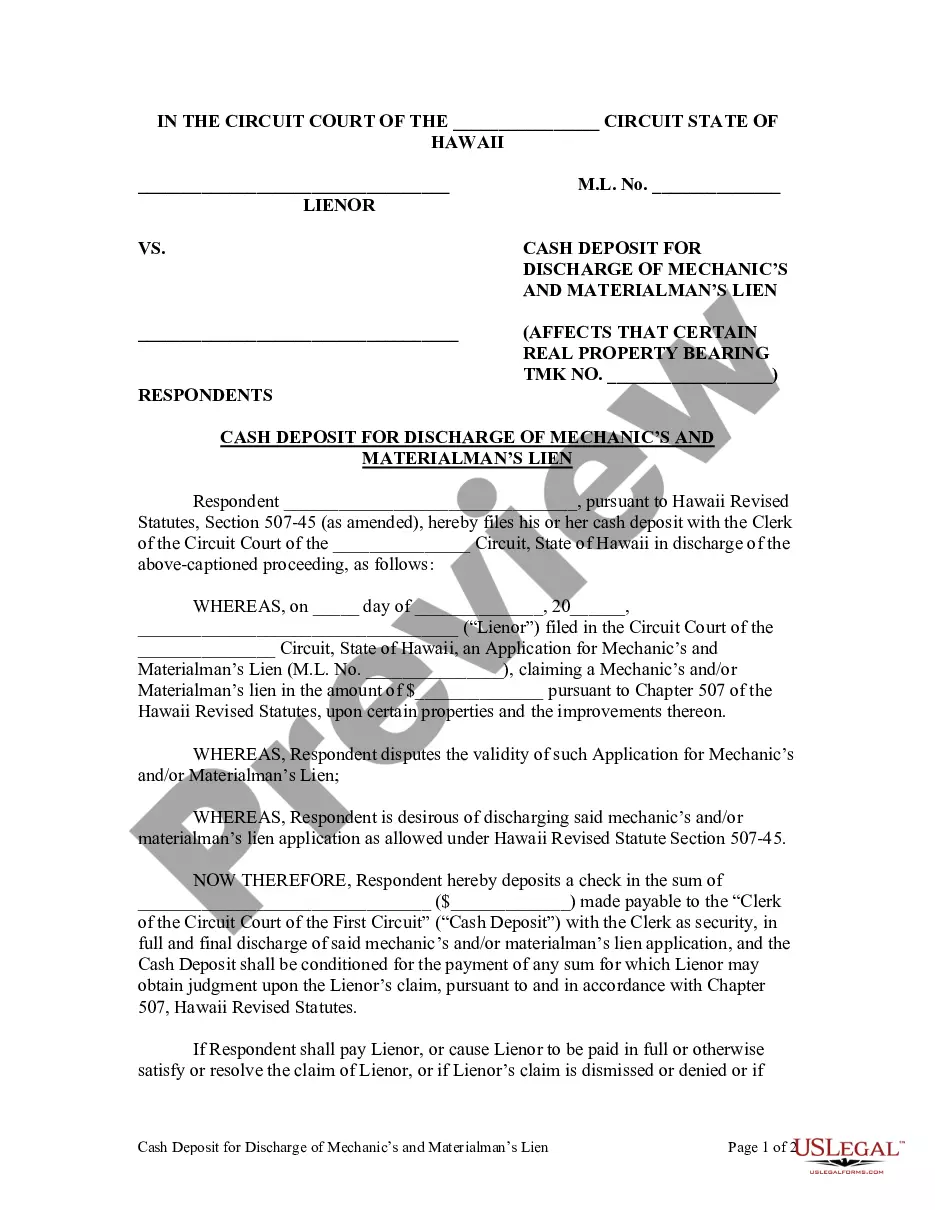

This is a Commercial Lease Application for a Lessor to have the proposed Lessee sign. It contains required disclosures and an authorization for release of information. A commercial lease is a detailed written agreement for the rental by a tenant of commercial property owned by the landlord. Commercial property differs from residential property in that the property's primary or only use is commercial (business oriented), rather than serving as a residence. Commercial leases are often more complex than residential leases, have longer lease terms, and may provide for the rental price to be tied to the tenant business's profitability or other factors, rather than a uniform monthly payment (though this is also quite ordinary in commercial leases).

The Elizabeth New Jersey Commercial Rental Lease Application Questionnaire is a comprehensive document used to collect necessary information from prospective tenants applying for commercial rental leases in Elizabeth, New Jersey. This questionnaire is specifically designed to ensure that landlords or property managers gather all crucial details about potential tenants to make informed decisions. This application questionnaire covers various categories, including personal information, business details, rental history, financial background, references, and consent for background checks. By requiring applicants to complete this questionnaire, landlords can assess their eligibility and credibility as tenants. Some key sections of the Elizabeth New Jersey Commercial Rental Lease Application Questionnaire may include: 1. Personal Information: — Full name, address, contact details of the applicant — Social security number or taxpayer identification number Catbirdsrt— - Any previous names used 2. Business Information: — Name of the businesentityit— - Type of business (e.g., corporation, partnership, sole proprietorship) — Business address and contact detail— - Length of time the business has been operating 3. Rental History: — Current residential address and landlord's contact details — Previous commercial rental addresses and landlord's contact details — Reason for leaving previous rental properties, if applicable 4. Financial Background: — Annual incombusinesseses— - Bank account information — Credit references and contact detail— - Any outstanding debts, bankruptcies, or legal actions 5. References: — Professional references from individuals or organizations familiar with the applicant's business — Personal references from individuals who can vouch for the applicant's character and reliability 6. Consent for Background Checks: — Authorization for the landlord to conduct credit checks, criminal records checks, or other necessary investigations Different types of Elizabeth New Jersey Commercial Rental Lease Application Questionnaires may exist depending on the preferences of individual landlords or property management companies. Some variations may include additional sections such as: — Specific questions regarding the nature of the business and its compatibility with the rental property — Supplementary questions related to insurance coverage, licensing, or certifications — Requests for additional documentation such as financial statements, business plans, or marketing strategies of the applicant's business. Overall, the Elizabeth New Jersey Commercial Rental Lease Application Questionnaire acts as an invaluable tool for landlords in evaluating potential tenants and protecting their commercial property investment.

Free preview

How to fill out Elizabeth New Jersey Commercial Rental Lease Application Questionnaire?

If you’ve already utilized our service before, log in to your account and download the Elizabeth New Jersey Commercial Rental Lease Application Questionnaire on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Elizabeth New Jersey Commercial Rental Lease Application Questionnaire. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!