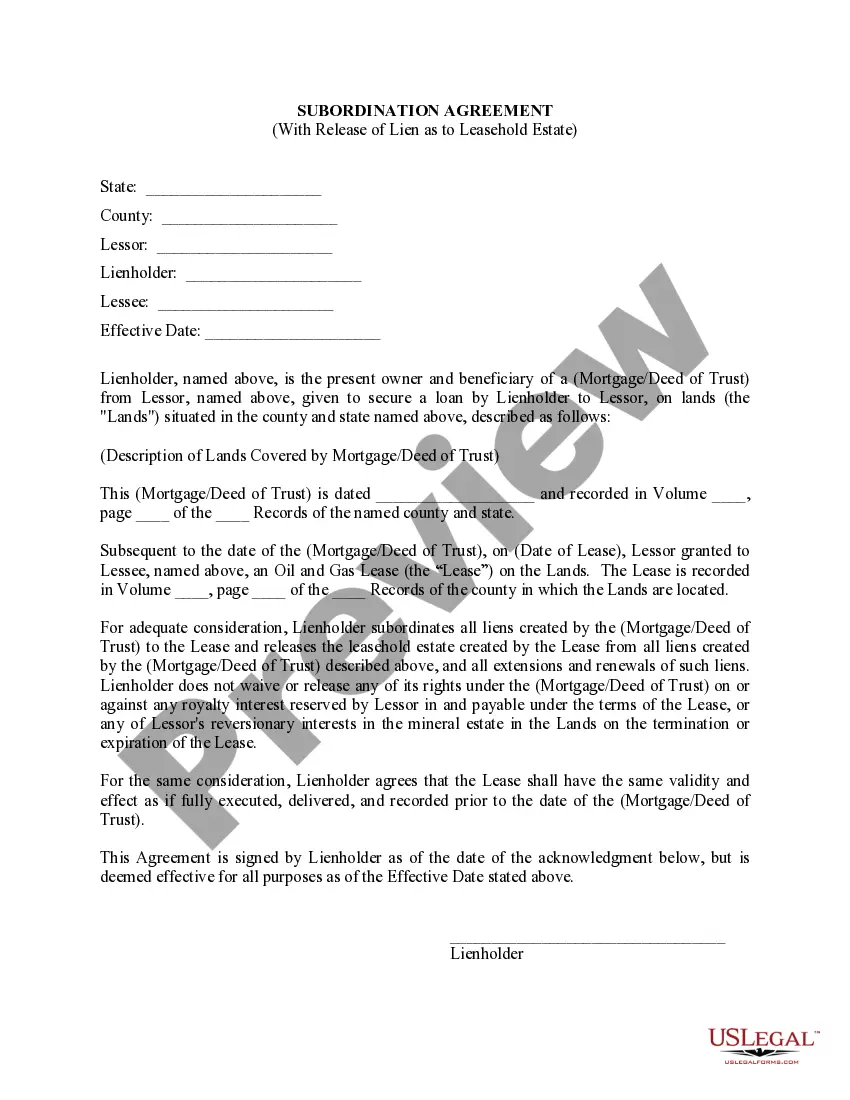

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan. A Newark New Jersey Lease Subordination Agreement is a legal document that outlines the process of subordinating a lease to a new mortgage or other form of financing. This agreement is commonly used in commercial real estate transactions to ensure that the new mortgage is prioritized over the lease in the event of default or foreclosure. In essence, a lease subordination agreement rearranges the priorities of the lease and the mortgage, giving the mortgage lender a higher priority claim on the property in case of default. This allows the lender to have more security and control over the property, making it easier for them to recover their investment. There are different types of Newark New Jersey Lease Subordination Agreements, depending on the specific terms and conditions agreed upon by the parties involved. Some common types include: 1. Absolute Subordination Agreement: This type of agreement subordinates the lease entirely to the new financing, meaning that the lease is effectively placed in a lower priority position. The lender holds the primary claim on the property, and the tenant's rights may be significantly limited in case of default. 2. Partial Subordination Agreement: In this type of agreement, only a portion of the lease is subordinated to the new financing. This means that the lender has priority over a specific portion of the lease, while the remaining terms and conditions of the lease remain unchanged. 3. Non-Disturbance Agreement: This agreement is often included in a lease subordination agreement to protect the tenant's rights in case of default. It ensures that if the property is foreclosed upon, the tenant can continue to occupy the premises and fulfill the terms of the lease as long as the tenant is not in default. It's important to note that Newark, New Jersey follows its own set of regulations and laws regarding lease subordination agreements. Furthermore, it is advisable to consult with a qualified attorney familiar with Newark real estate laws to ensure compliance with all relevant legal requirements. In summary, a Newark New Jersey Lease Subordination Agreement is a crucial document in commercial real estate transactions, allowing lenders to secure their investment by rearranging the priorities of the lease and the mortgage. Different types of subordination agreements exist, including absolute subordination, partial subordination, and non-disturbance agreements, each with its own specific terms and implications.

A Newark New Jersey Lease Subordination Agreement is a legal document that outlines the process of subordinating a lease to a new mortgage or other form of financing. This agreement is commonly used in commercial real estate transactions to ensure that the new mortgage is prioritized over the lease in the event of default or foreclosure. In essence, a lease subordination agreement rearranges the priorities of the lease and the mortgage, giving the mortgage lender a higher priority claim on the property in case of default. This allows the lender to have more security and control over the property, making it easier for them to recover their investment. There are different types of Newark New Jersey Lease Subordination Agreements, depending on the specific terms and conditions agreed upon by the parties involved. Some common types include: 1. Absolute Subordination Agreement: This type of agreement subordinates the lease entirely to the new financing, meaning that the lease is effectively placed in a lower priority position. The lender holds the primary claim on the property, and the tenant's rights may be significantly limited in case of default. 2. Partial Subordination Agreement: In this type of agreement, only a portion of the lease is subordinated to the new financing. This means that the lender has priority over a specific portion of the lease, while the remaining terms and conditions of the lease remain unchanged. 3. Non-Disturbance Agreement: This agreement is often included in a lease subordination agreement to protect the tenant's rights in case of default. It ensures that if the property is foreclosed upon, the tenant can continue to occupy the premises and fulfill the terms of the lease as long as the tenant is not in default. It's important to note that Newark, New Jersey follows its own set of regulations and laws regarding lease subordination agreements. Furthermore, it is advisable to consult with a qualified attorney familiar with Newark real estate laws to ensure compliance with all relevant legal requirements. In summary, a Newark New Jersey Lease Subordination Agreement is a crucial document in commercial real estate transactions, allowing lenders to secure their investment by rearranging the priorities of the lease and the mortgage. Different types of subordination agreements exist, including absolute subordination, partial subordination, and non-disturbance agreements, each with its own specific terms and implications.