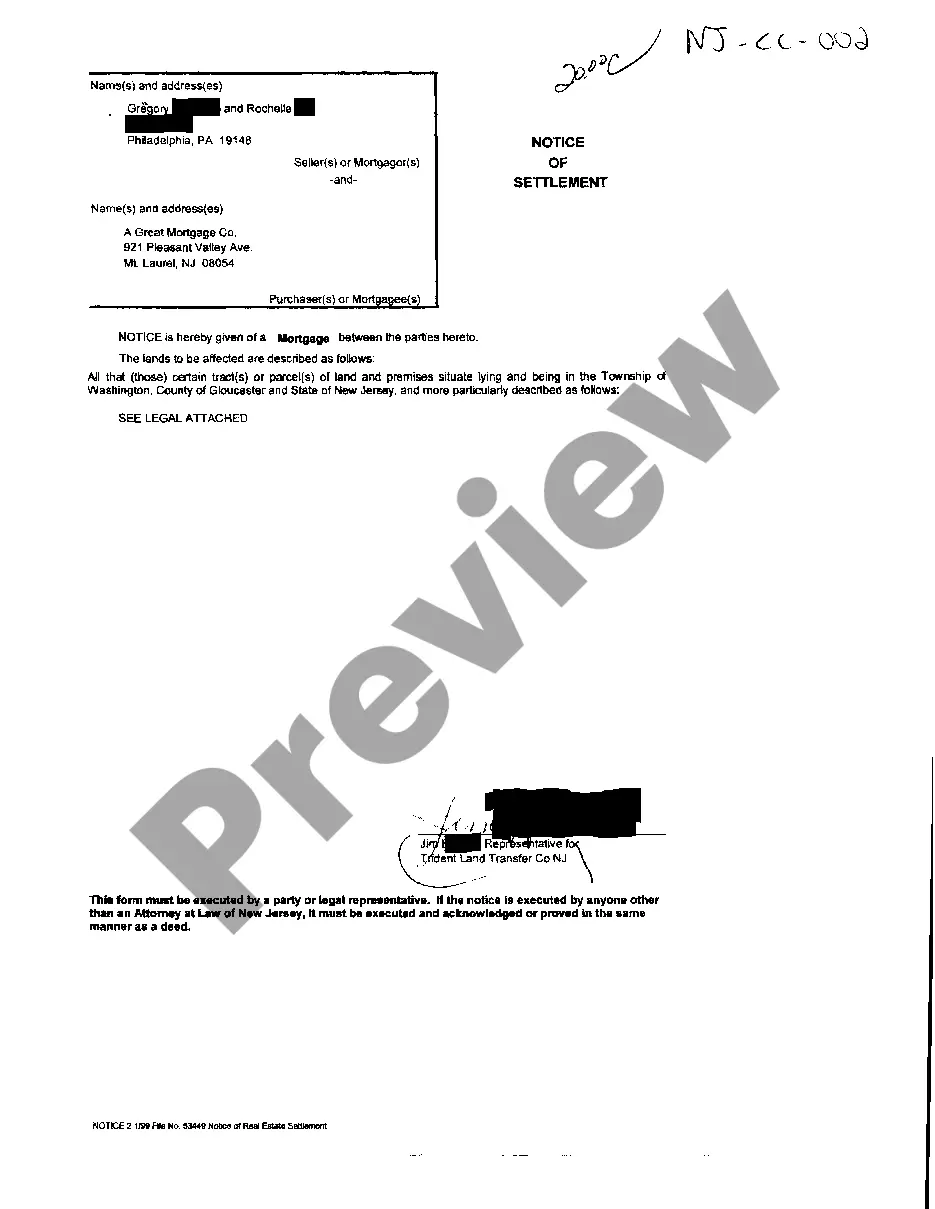

The Paterson New Jersey Notice of Settlement relating to Mortgage is an important legal document that outlines the terms and conditions of a mortgage settlement in Paterson, New Jersey. This notice serves as a notification to parties involved, providing them with detailed information regarding the settlement agreement. A Notice of Settlement is typically issued when a mortgage lender and borrower reach a resolution regarding a mortgage loan. It is essential for both parties involved to understand the content within this notice to ensure compliance with the agreed-upon terms. Some essential keywords relevant to the Paterson New Jersey Notice of Settlement relating to Mortgage include: 1. Mortgage settlement: This refers to the resolution reached between the mortgage lender and borrower regarding the terms of the mortgage loan. It often includes details about the payment schedule, interest rate, and any additional fees. 2. Notice of settlement: This notice serves as a legal document that officially informs all parties involved about the settlement agreement. It outlines the specific terms and conditions that have been agreed upon and provides a platform for understanding and compliance. 3. Paterson, New Jersey: This location is significant in this context as it refers to the specific area where the property and mortgage transaction took place. Each notice of settlement may be specific to the jurisdiction it falls under. 4. Mortgage lender: The entity or individual who provides the loan for the purchase of the property. The notice of settlement outlines the lender's role in the agreement and the responsibilities they hold. 5. Borrower: The individual or group that receives the mortgage loan to purchase the property. The notice of settlement outlines the borrower's responsibilities, including repayment terms and any additional obligations agreed upon. Different types of Paterson New Jersey Notice of Settlement relating to Mortgage may include: 1. Purchase mortgage settlement: This type of settlement outlines the terms and conditions of a mortgage loan when purchasing a property. It includes details such as loan amount, interest rate, repayment schedule, and any additional fees. 2. Refinance mortgage settlement: When a borrower decides to refinance their existing mortgage loan, a new settlement is required. This type of notice of settlement outlines the updated terms of the refinanced mortgage, including any changes in interest rates or loan amount. 3. Home equity loan settlement: In cases where a borrower seeks to borrow against the equity in their property, a home equity loan settlement notice is issued. This document outlines the terms and conditions specific to the borrowing of funds against the property's value. It is crucial for all parties involved to carefully review the Paterson New Jersey Notice of Settlement relating to Mortgage to ensure complete understanding and compliance with the terms outlined. Failure to adhere to the settlement agreement may lead to legal consequences and potential disputes.

Paterson New Jersey Notice Of Settlement relating to Mortgage

Description

How to fill out Paterson New Jersey Notice Of Settlement Relating To Mortgage?

If you are searching for a relevant form template, it’s impossible to choose a better service than the US Legal Forms website – one of the most considerable online libraries. Here you can find thousands of document samples for organization and individual purposes by categories and regions, or keywords. Using our advanced search function, finding the latest Paterson New Jersey Notice Of Settlement relating to Mortgage is as elementary as 1-2-3. In addition, the relevance of every document is confirmed by a team of expert lawyers that regularly review the templates on our website and update them according to the newest state and county laws.

If you already know about our platform and have a registered account, all you need to receive the Paterson New Jersey Notice Of Settlement relating to Mortgage is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the sample you require. Look at its explanation and make use of the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to discover the appropriate record.

- Affirm your selection. Choose the Buy now button. After that, choose your preferred subscription plan and provide credentials to register an account.

- Make the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the template. Indicate the file format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the received Paterson New Jersey Notice Of Settlement relating to Mortgage.

Each and every template you save in your profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to have an additional copy for modifying or creating a hard copy, feel free to return and download it again anytime.

Take advantage of the US Legal Forms professional catalogue to gain access to the Paterson New Jersey Notice Of Settlement relating to Mortgage you were looking for and thousands of other professional and state-specific templates on one platform!