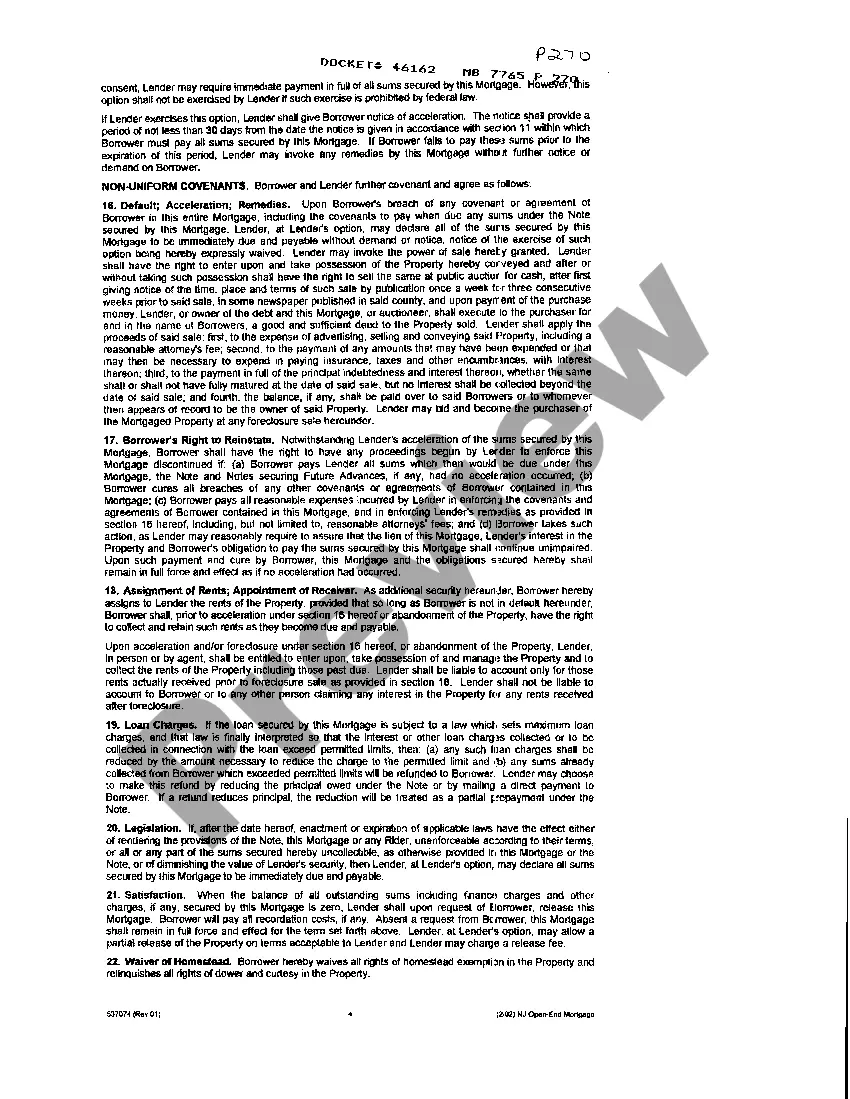

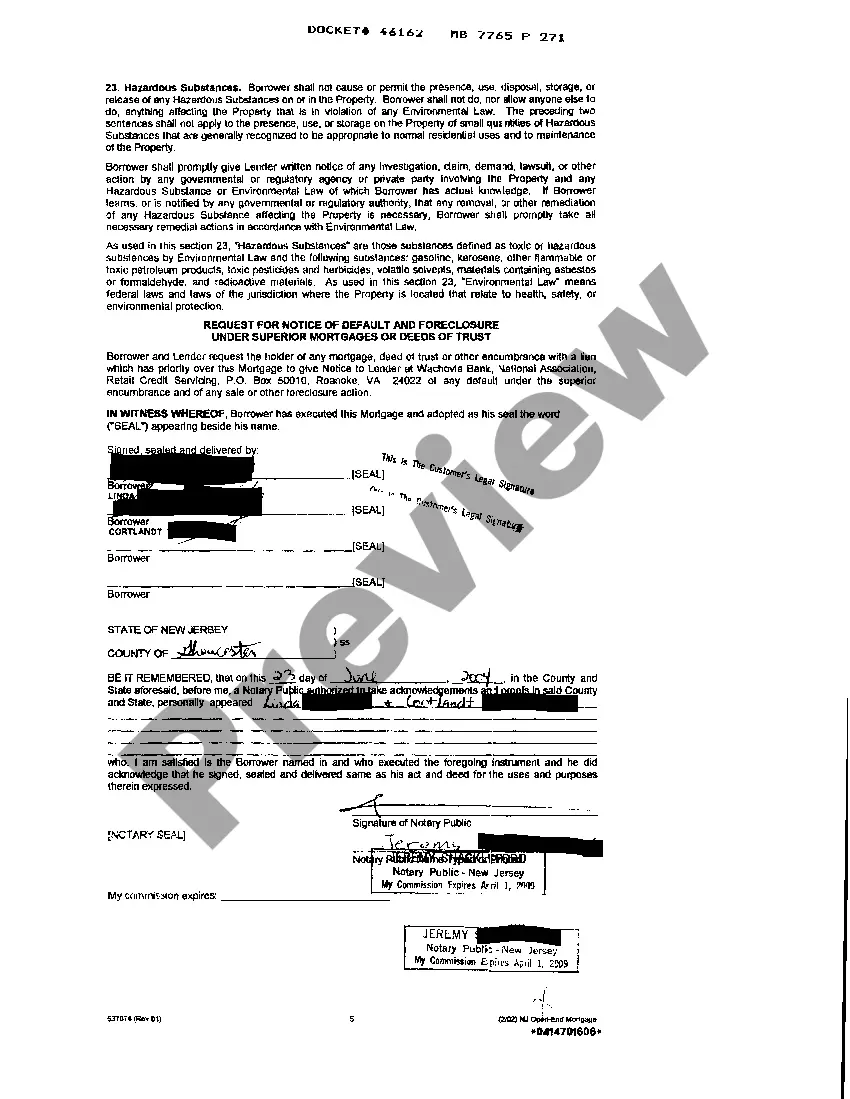

Elizabeth, New Jersey Open-End Mortgage: A Comprehensive Guide An open-end mortgage is a type of loan that provides homeowners in Elizabeth, New Jersey, with the flexibility of borrowing against the equity in their property over a specific period. It allows borrowers to access additional funds when needed without the need for refinancing or taking out a new loan. Let's delve into the various key aspects and types of open-end mortgages available in Elizabeth, New Jersey. Open-End Mortgage Features: 1. Flexibility: One of the primary advantages of an open-end mortgage in Elizabeth, New Jersey, is its flexibility. Homeowners can borrow funds up to a predetermined limit for various purposes, such as home renovations, education expenses, debt consolidation, or emergency expenses. 2. Equity Utilization: Unlike a traditional mortgage, an open-end mortgage enables borrowers to tap into the accumulated equity in their property. This means that as the homeowner pays down their mortgage, they can borrow more against the principle they have already paid, increasing their borrowing capability. 3. Adjustable Interest Rates: Open-end mortgage rates in Elizabeth, New Jersey, are typically adjustable, meaning they can fluctuate over the loan term based on prevailing market conditions. This feature can offer both advantages and disadvantages, depending on the interest rate environment. 4. Repayment Options: Repayment terms for open-end mortgages can vary. Some lenders may require interest-only payments during the draw period, while others may require principal plus interest payments. Additionally, some open-end mortgages may convert to conventional mortgages after a specified period, requiring full principal and interest repayments. Types of Open-End Mortgages in Elizabeth, New Jersey: 1. Home Equity Line of Credit (HELOT): A popular type of open-end mortgage, a HELOT allows borrowers to access funds as needed, up to a pre-approved credit limit. The interest rates are typically variable and can be withdrawn and repaid multiple times during the loan term. 2. Construction Line of Credit (CLOCK): This type of open-end mortgage is specifically designed for homeowners in Elizabeth, New Jersey, undertaking new construction or significant renovations. The CLOCK provides funds in stages throughout the construction process and converts to a traditional mortgage upon completion. 3. Shared Appreciation Mortgage (SAM): A SAM enables borrowers to access additional funds by sharing the future appreciation of their property with the lender. This type of open-end mortgage is ideal for homeowners who are confident that the value of their property will increase significantly in the future. 4. Combination Mortgage: Some lenders offer open-end mortgages that combine a traditional mortgage and a home equity line of credit. This hybrid loan allows borrowers in Elizabeth, New Jersey, to benefit from the security of a fixed-rate mortgage while also having the flexibility to access funds when required. In conclusion, an open-end mortgage in Elizabeth, New Jersey, offers homeowners the flexibility to tap into their property's equity as and when needed. With various types of open-end mortgages available, including Helots, Clock, SAM's, and combination mortgages, borrowers can choose the option that best suits their financial needs. As with any financial decision, prospective borrowers are encouraged to carefully consider their circumstances and consult with a qualified mortgage professional to find the most suitable open-end mortgage for their situation.

Elizabeth New Jersey Open-End Mortgage

State:

New Jersey

City:

Elizabeth

Control #:

NJ-CC-005

Format:

PDF

Instant download

This form is available by subscription

Description

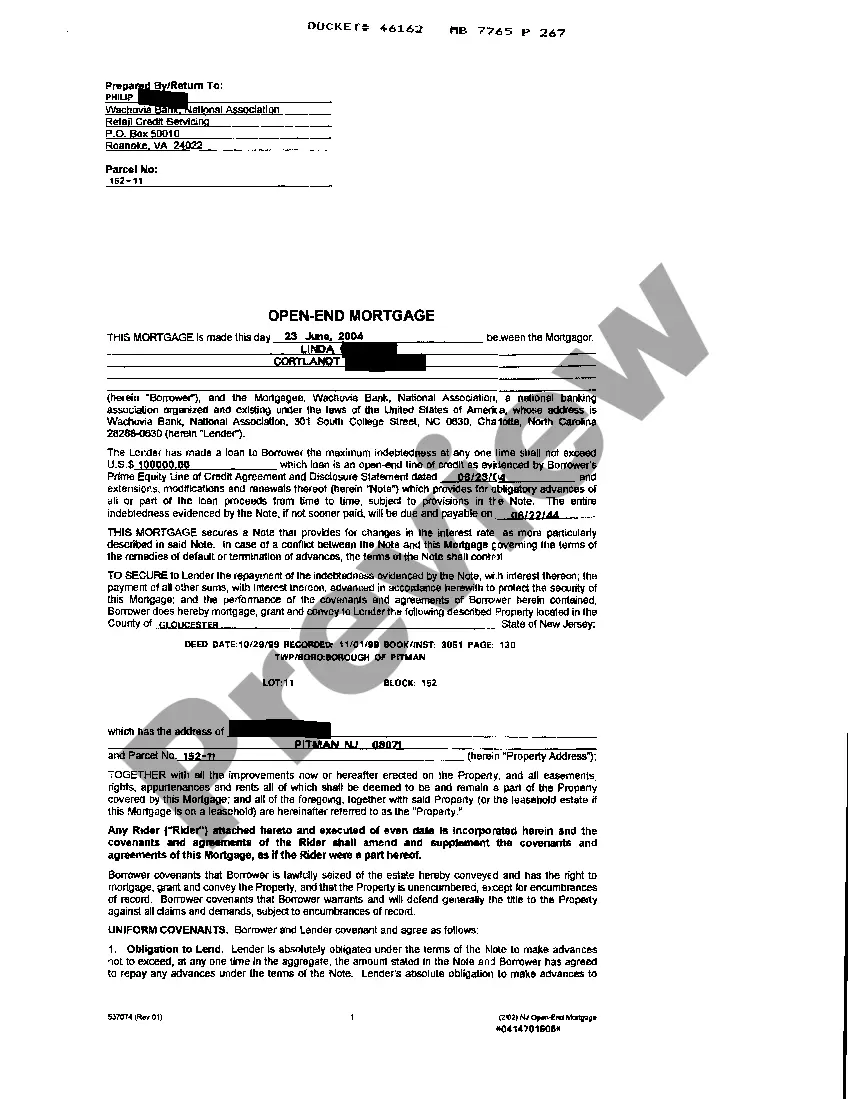

Open-End Mortgage

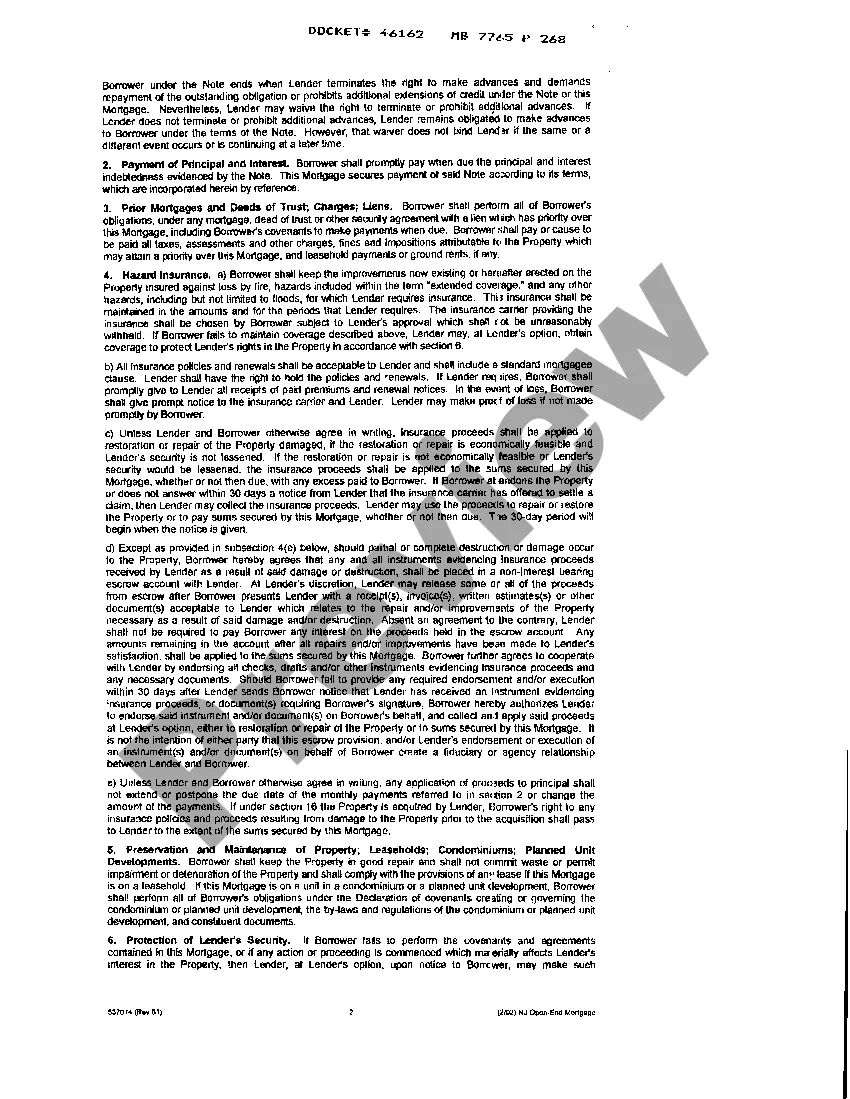

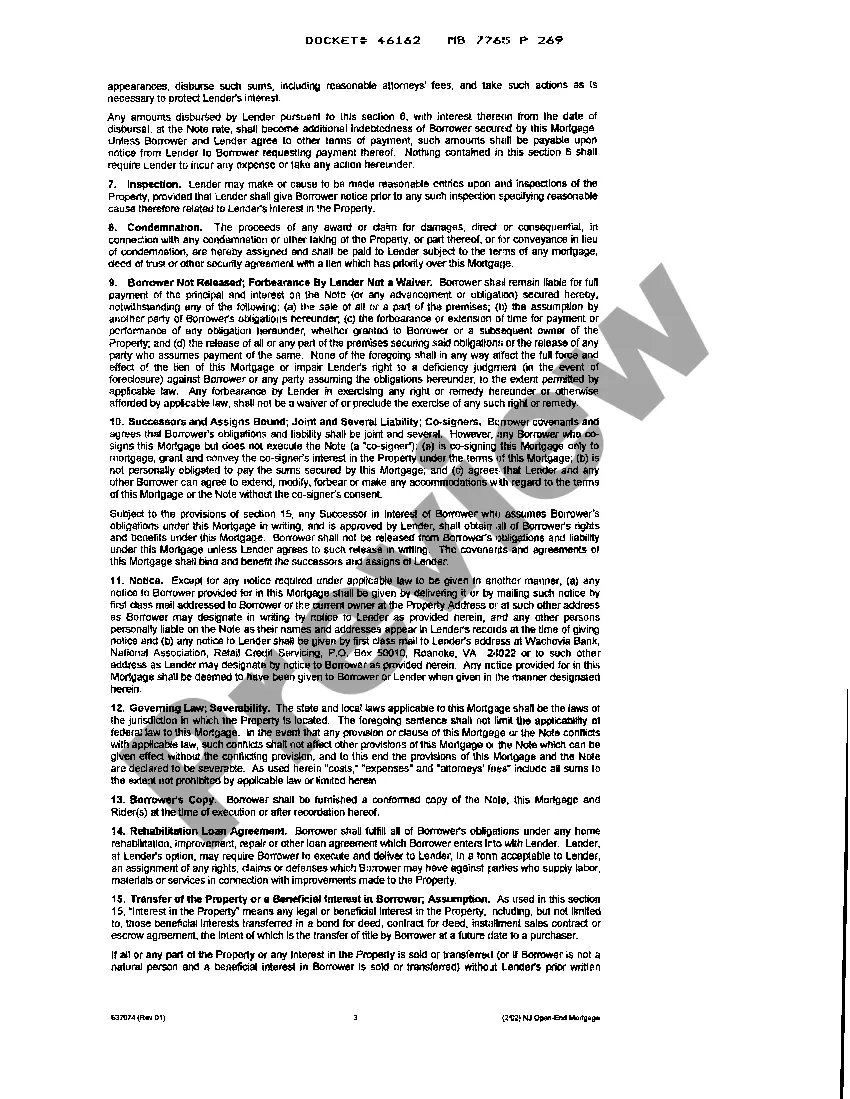

Elizabeth, New Jersey Open-End Mortgage: A Comprehensive Guide An open-end mortgage is a type of loan that provides homeowners in Elizabeth, New Jersey, with the flexibility of borrowing against the equity in their property over a specific period. It allows borrowers to access additional funds when needed without the need for refinancing or taking out a new loan. Let's delve into the various key aspects and types of open-end mortgages available in Elizabeth, New Jersey. Open-End Mortgage Features: 1. Flexibility: One of the primary advantages of an open-end mortgage in Elizabeth, New Jersey, is its flexibility. Homeowners can borrow funds up to a predetermined limit for various purposes, such as home renovations, education expenses, debt consolidation, or emergency expenses. 2. Equity Utilization: Unlike a traditional mortgage, an open-end mortgage enables borrowers to tap into the accumulated equity in their property. This means that as the homeowner pays down their mortgage, they can borrow more against the principle they have already paid, increasing their borrowing capability. 3. Adjustable Interest Rates: Open-end mortgage rates in Elizabeth, New Jersey, are typically adjustable, meaning they can fluctuate over the loan term based on prevailing market conditions. This feature can offer both advantages and disadvantages, depending on the interest rate environment. 4. Repayment Options: Repayment terms for open-end mortgages can vary. Some lenders may require interest-only payments during the draw period, while others may require principal plus interest payments. Additionally, some open-end mortgages may convert to conventional mortgages after a specified period, requiring full principal and interest repayments. Types of Open-End Mortgages in Elizabeth, New Jersey: 1. Home Equity Line of Credit (HELOT): A popular type of open-end mortgage, a HELOT allows borrowers to access funds as needed, up to a pre-approved credit limit. The interest rates are typically variable and can be withdrawn and repaid multiple times during the loan term. 2. Construction Line of Credit (CLOCK): This type of open-end mortgage is specifically designed for homeowners in Elizabeth, New Jersey, undertaking new construction or significant renovations. The CLOCK provides funds in stages throughout the construction process and converts to a traditional mortgage upon completion. 3. Shared Appreciation Mortgage (SAM): A SAM enables borrowers to access additional funds by sharing the future appreciation of their property with the lender. This type of open-end mortgage is ideal for homeowners who are confident that the value of their property will increase significantly in the future. 4. Combination Mortgage: Some lenders offer open-end mortgages that combine a traditional mortgage and a home equity line of credit. This hybrid loan allows borrowers in Elizabeth, New Jersey, to benefit from the security of a fixed-rate mortgage while also having the flexibility to access funds when required. In conclusion, an open-end mortgage in Elizabeth, New Jersey, offers homeowners the flexibility to tap into their property's equity as and when needed. With various types of open-end mortgages available, including Helots, Clock, SAM's, and combination mortgages, borrowers can choose the option that best suits their financial needs. As with any financial decision, prospective borrowers are encouraged to carefully consider their circumstances and consult with a qualified mortgage professional to find the most suitable open-end mortgage for their situation.

Free preview

How to fill out Elizabeth New Jersey Open-End Mortgage?

If you’ve already utilized our service before, log in to your account and download the Elizabeth New Jersey Open-End Mortgage on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Elizabeth New Jersey Open-End Mortgage. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!