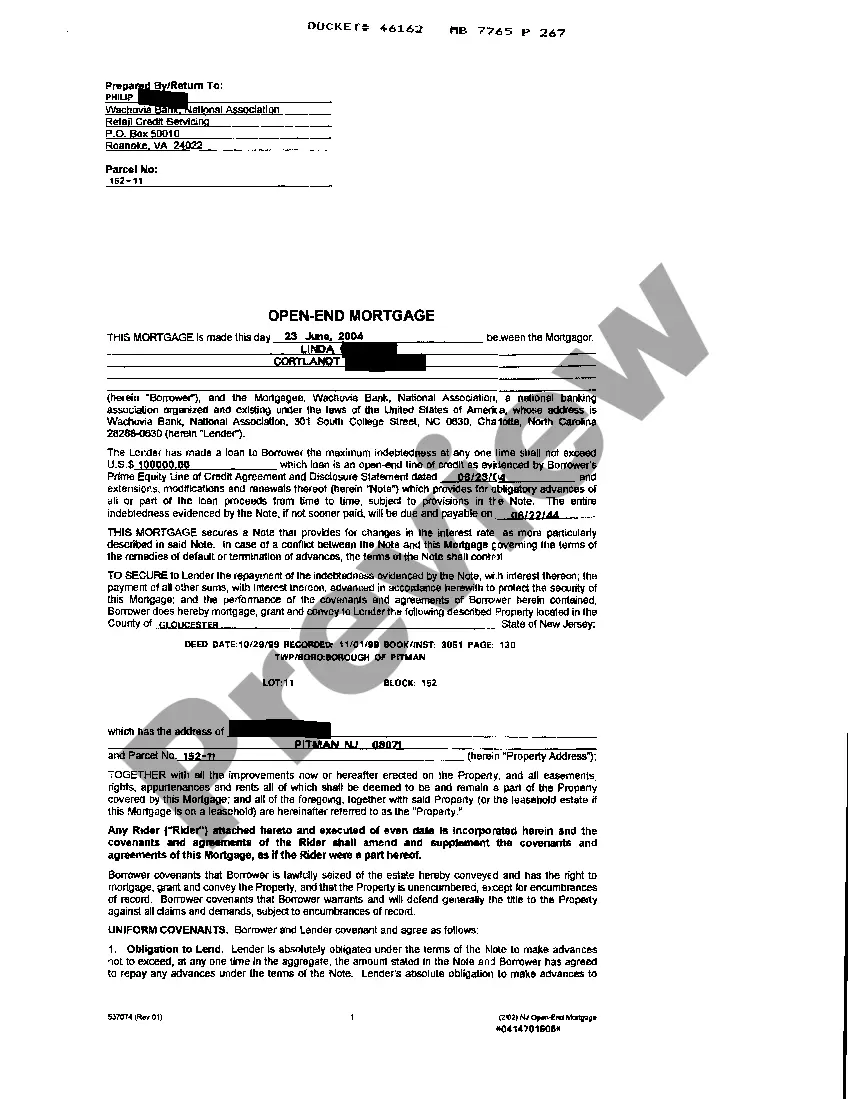

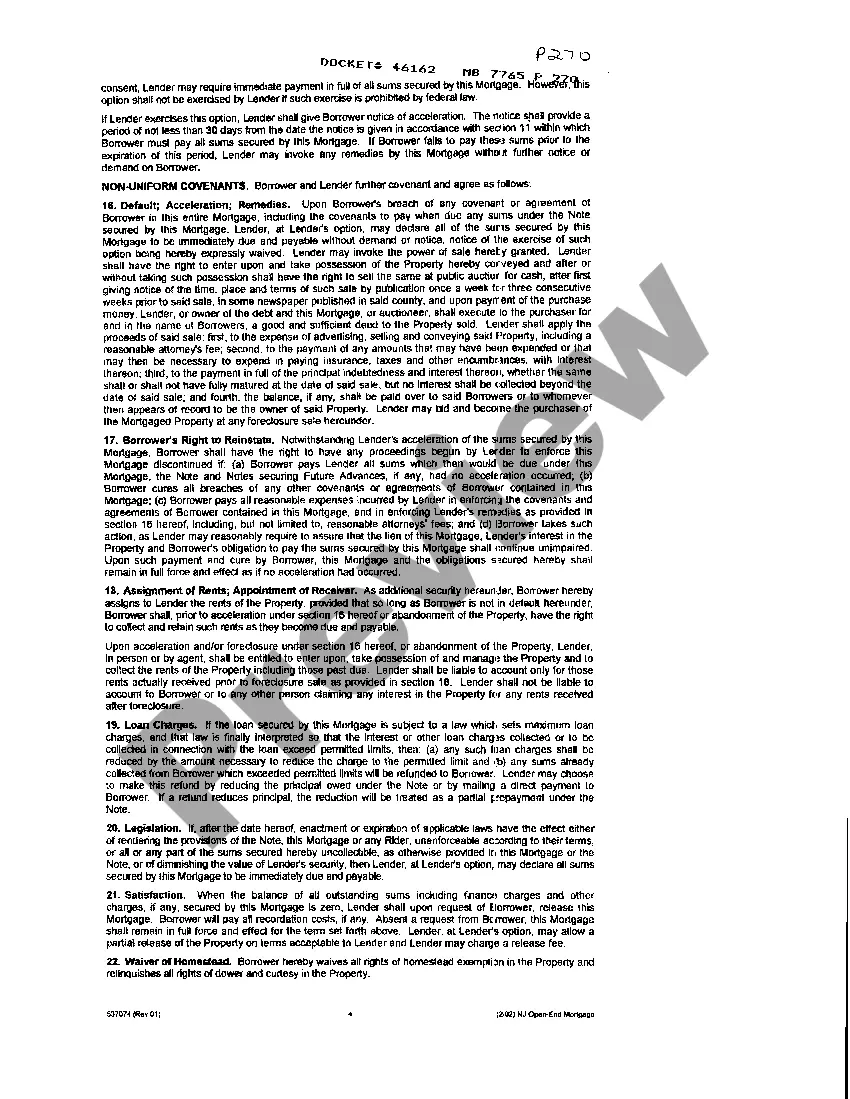

A Paterson, New Jersey open-end mortgage is a type of home loan that allows homeowners to borrow additional funds using their property as collateral. Unlike a traditional mortgage, an open-end mortgage provides borrowers with the flexibility to access more money without the need to refinance or obtain a separate loan. This type of mortgage can be advantageous for homeowners seeking additional funds for various purposes, such as home renovations, debt consolidation, or unforeseen expenses. By utilizing an open-end mortgage in Paterson, New Jersey, homeowners can avoid the lengthy and often costly process of refinancing their existing mortgage or obtaining a new loan altogether. One of the key features of a Paterson open-end mortgage is the ability to borrow against the already established equity in the property. The equity represents the difference between the property's appraised value and the outstanding mortgage balance. As homeowners gradually pay down their mortgage, the equity in their property increases, providing a valuable asset to borrow against when needed. With an open-end mortgage, homeowners have the flexibility to access this equity in a convenient and efficient manner. Rather than applying for a separate loan or refinancing, homeowners can use a line of credit established within the open-end mortgage to withdraw funds as needed. This allows for greater financial freedom and the ability to tap into the property's value without incurring additional closing costs or credit checks. There are different types of open-end mortgages available in Paterson, New Jersey, catering to different needs and financial situations. Some common variations include: 1. Traditional open-end mortgage: This type of open-end mortgage provides homeowners with a flexible line of credit based on the equity in their property. They can borrow and repay funds as needed, up to a pre-approved limit. 2. Adjustable-rate open-end mortgage: In this variation, the interest rate on the open-end mortgage fluctuates based on a specified index, usually tied to national financial markets. As a result, the borrower's monthly payments may vary, presenting both risks and potential cost savings depending on market conditions. 3. Fixed-rate open-end mortgage: Unlike an adjustable-rate mortgage, a fixed-rate open-end mortgage offers a consistent interest rate for the entire loan term. This provides borrowers with stability and predictable monthly payments, regardless of market fluctuations. In conclusion, a Paterson, New Jersey open-end mortgage is a flexible financial tool that allows homeowners to tap into their property's equity without the need for refinancing or obtaining a separate loan. With different variations available, borrowers can choose the type of open-end mortgage that aligns with their financial goals and circumstances.

Paterson New Jersey Open-End Mortgage

Description

How to fill out Paterson New Jersey Open-End Mortgage?

If you’ve already used our service before, log in to your account and download the Paterson New Jersey Open-End Mortgage on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Paterson New Jersey Open-End Mortgage. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!

Form popularity

FAQ

To get approved for a $500,000 mortgage, you usually need an income of around $100,000 to $120,000 annually. This income level helps you maintain a favorable debt-to-income ratio, which lenders prioritize when considering your application for a Paterson New Jersey Open-End Mortgage. Consider presenting comprehensive documentation of your financial background to enhance your approval chances.

With a $120,000 salary, you typically can afford a $500,000 house, depending on your other financial obligations. A Paterson New Jersey Open-End Mortgage might provide you with options to manage additional expenses and interest effectively. It's important to evaluate your budget and perhaps consult with a mortgage professional to ensure the mortgage aligns with your financial plans.

Yes, you can secure an open mortgage, which provides you with the flexibility to borrow and repay as needed. Many lenders offer Paterson New Jersey Open-End Mortgages, allowing you to access additional funds if your financial situation changes. If you are considering this option, reviewing your financial goals with a trusted lender can be beneficial.

Typically, to get pre-approved for a $500,000 mortgage, you should have an annual income of at least $100,000 to $120,000. This range helps ensure you meet the necessary debt-to-income ratio for a Paterson New Jersey Open-End Mortgage. Keep in mind, other factors like credit history and down payment also play important roles in the pre-approval process.

To qualify for a Paterson New Jersey Open-End Mortgage, you generally need a stable income, a good credit score, and sufficient equity in your property. Lenders often look for a debt-to-income ratio below 43%, which ensures you can manage your mortgage payments. Additionally, providing detailed documentation of your financial stability can strengthen your application.

Yes, a Paterson New Jersey Open-End Mortgage functions similarly to a line of credit. It allows homeowners to borrow against their home’s equity as needed, providing flexibility in accessing funds. Unlike traditional mortgages, this type can be drawn upon multiple times, making it a convenient choice for unexpected expenses or home improvements. However, it’s important to understand the terms and repayment options associated with this arrangement.

To secure a Paterson New Jersey Open-End Mortgage, start by checking your credit score and getting pre-approved from a lender. Next, gather your financial documents, such as income statements and tax returns. Once you have everything organized, contact a local lender who specializes in open-end mortgages and submit your application. This process typically involves a detailed review of your financial situation to determine the lending amount.

The $10,000 homebuyer access grant is a financial assistance program in New Jersey that offers new buyers funds for purchasing a home. This grant can help with important expenses like down payments and closing costs for eligible applicants. If you're eyeing a Paterson New Jersey open-end mortgage, this grant provides a significant boost to help you secure your new home.

The $10,000 grant for first-time home buyers in New Jersey is designed to assist those purchasing their first home by providing financial support for down payments or closing costs. This program aims to make homeownership more attainable for residents, including those seeking a Paterson New Jersey open-end mortgage. It's a valuable resource for easing the financial burden associated with buying a property.

In New Jersey, eligibility for the homeowner's assistance fund typically includes homeowners facing financial hardship due to circumstances like job loss or medical expenses. To qualify, you must demonstrate your need and meet specific income guidelines. The program aims to support residents, including those with Paterson New Jersey open-end mortgages, helping you stay in your home during tough times.