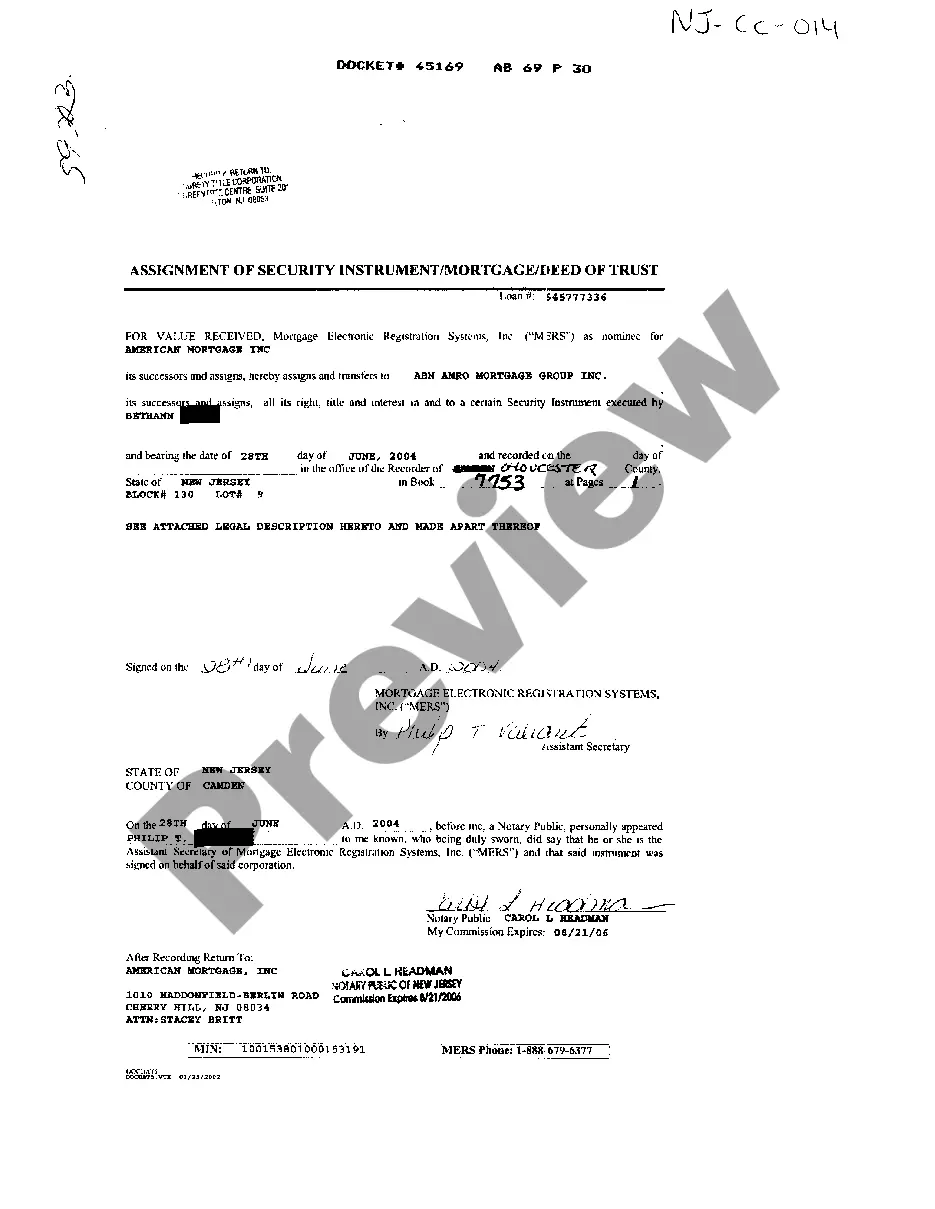

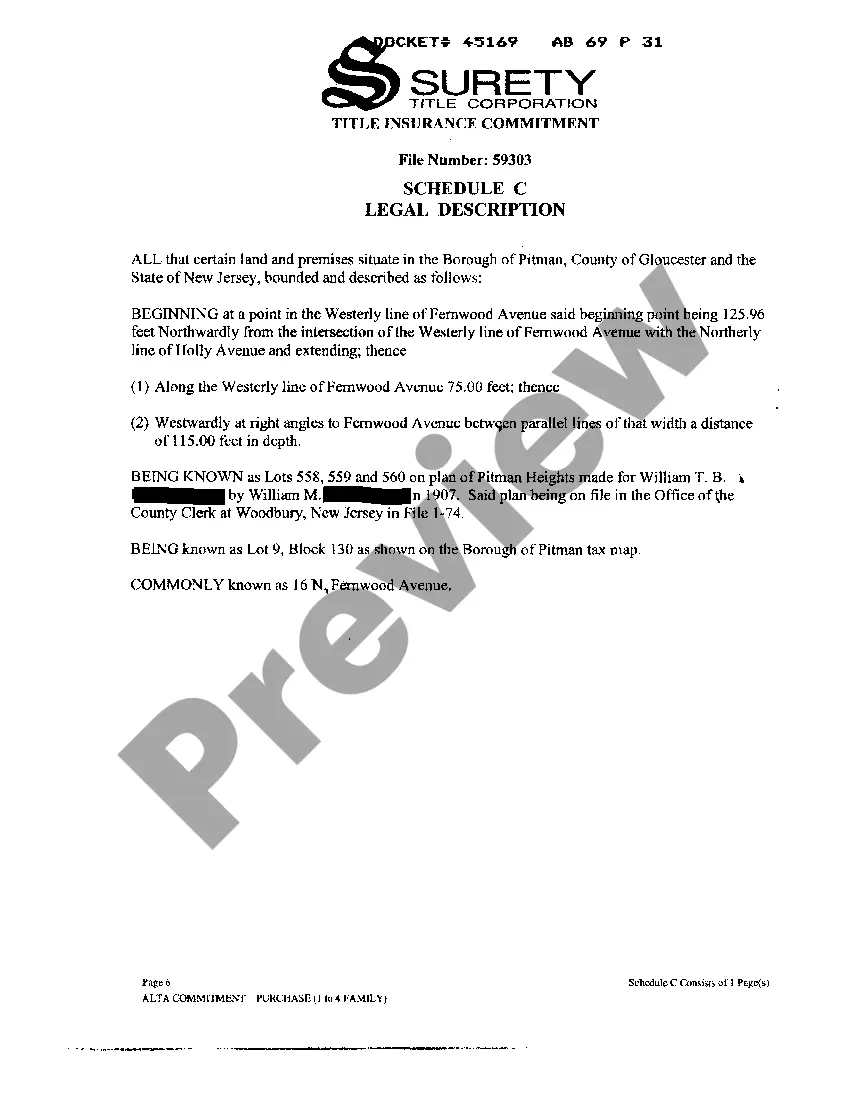

The Assignment of Security Instrument Mortgage Deed of Trust is an essential legal document applicable to real estate transactions in Newark, New Jersey. It involves the transferring of a mortgage deed of trust from one party to another, often when a loan or mortgage is being assigned or sold. This document serves as a legal proof of the transfer of rights, obligations, and ownership interests related to the mortgage. When it comes to Newark, New Jersey, Assignment of Security Instrument Mortgage Deed of Trust, there are mainly two types: the Assignment of Mortgage and the Assignment of Deed of Trust. Here is an overview of each: 1. Assignment of Mortgage: This type of assignment refers to the transfer of the mortgage loan obligation from the original lender or mortgagee to a new party, typically a financial institution or a loan servicing company. The original mortgagee assigns the rights, title, and interest in the mortgage to another entity, allowing them to collect payments, enforce the terms, and receive any outstanding balance. It essentially transfers the beneficial interest in a loan while maintaining the original terms and conditions. 2. Assignment of Deed of Trust: Similar to an Assignment of Mortgage, an Assignment of Deed of Trust involves the transfer of a borrower's loan obligation to a new party. However, unlike a mortgage, Newark, New Jersey operates under a Deed of Trust system. This means that in addition to the borrower and the lender, there is a third party involved (a trustee). The trustee holds the property's legal title until the loan is repaid, at which point it is released to the borrower. An Assignment of Deed of Trust allows for the transfer of this trustee's position and rights to another entity. Both types of assignments require proper documentation and legal procedures to ensure the transfer is valid and enforceable. This involves drafting an Assignment of Security Instrument Mortgage Deed of Trust document that outlines the parties involved, the property details, the terms of the original mortgage or deed of trust, and the rights and obligations being transferred. In conclusion, the Newark, New Jersey Assignment of Security Instrument Mortgage Deed of Trust is crucial in facilitating the transfer of mortgage loan obligations and interest from one party to another. By understanding the different types of assignments, individuals can navigate the legal requirements associated with these transactions effectively.

Newark New Jersey Assignment Of Security Instrument Mortgage Deed of Trust

Description

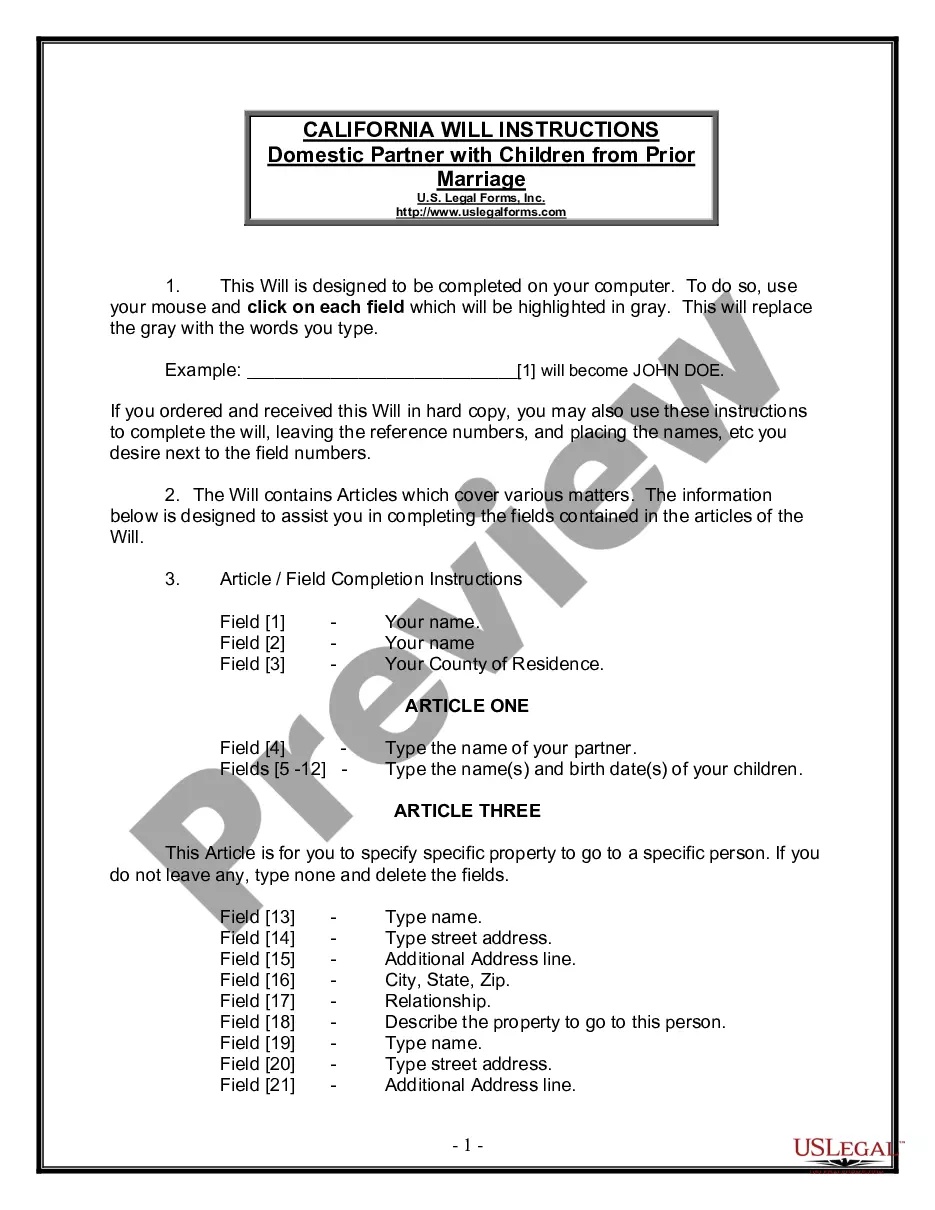

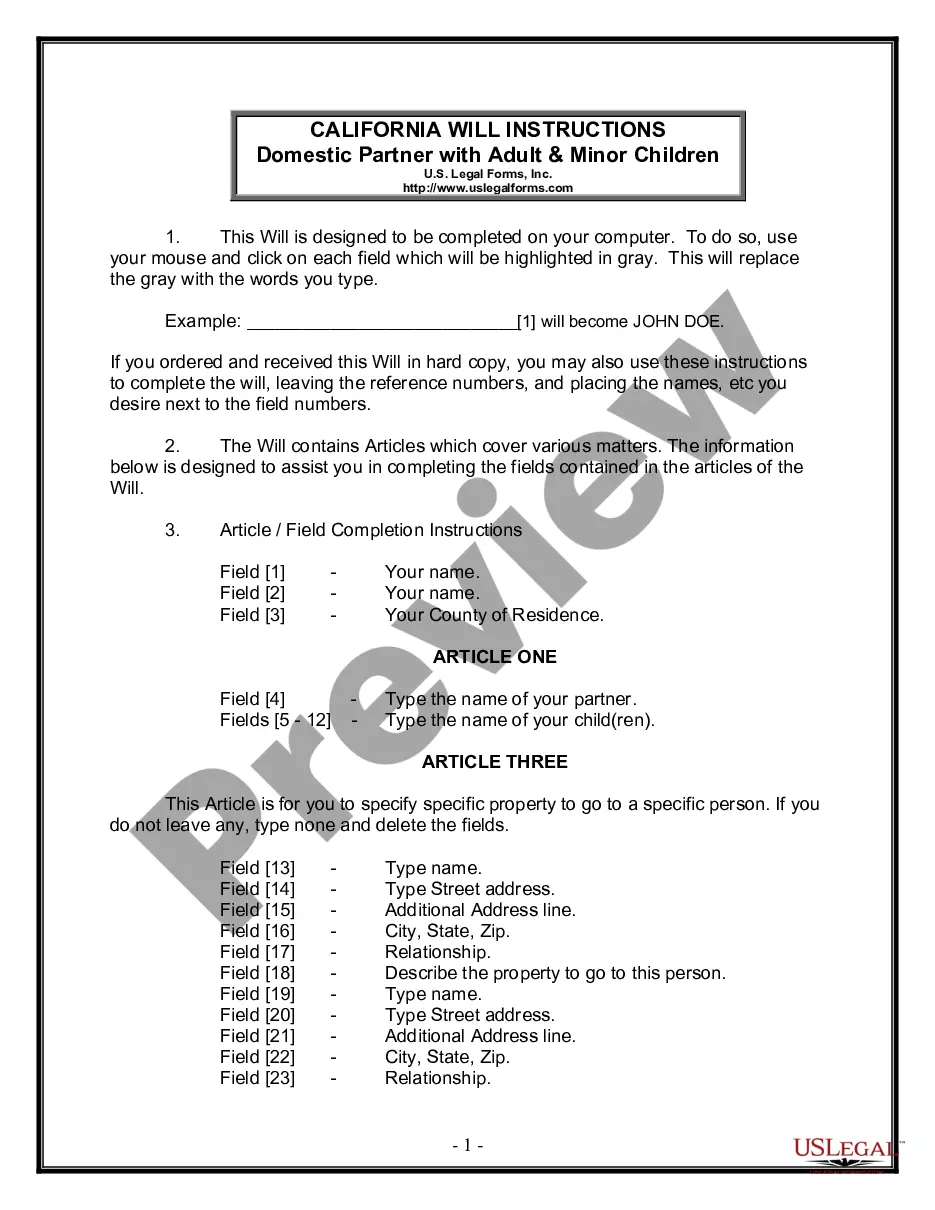

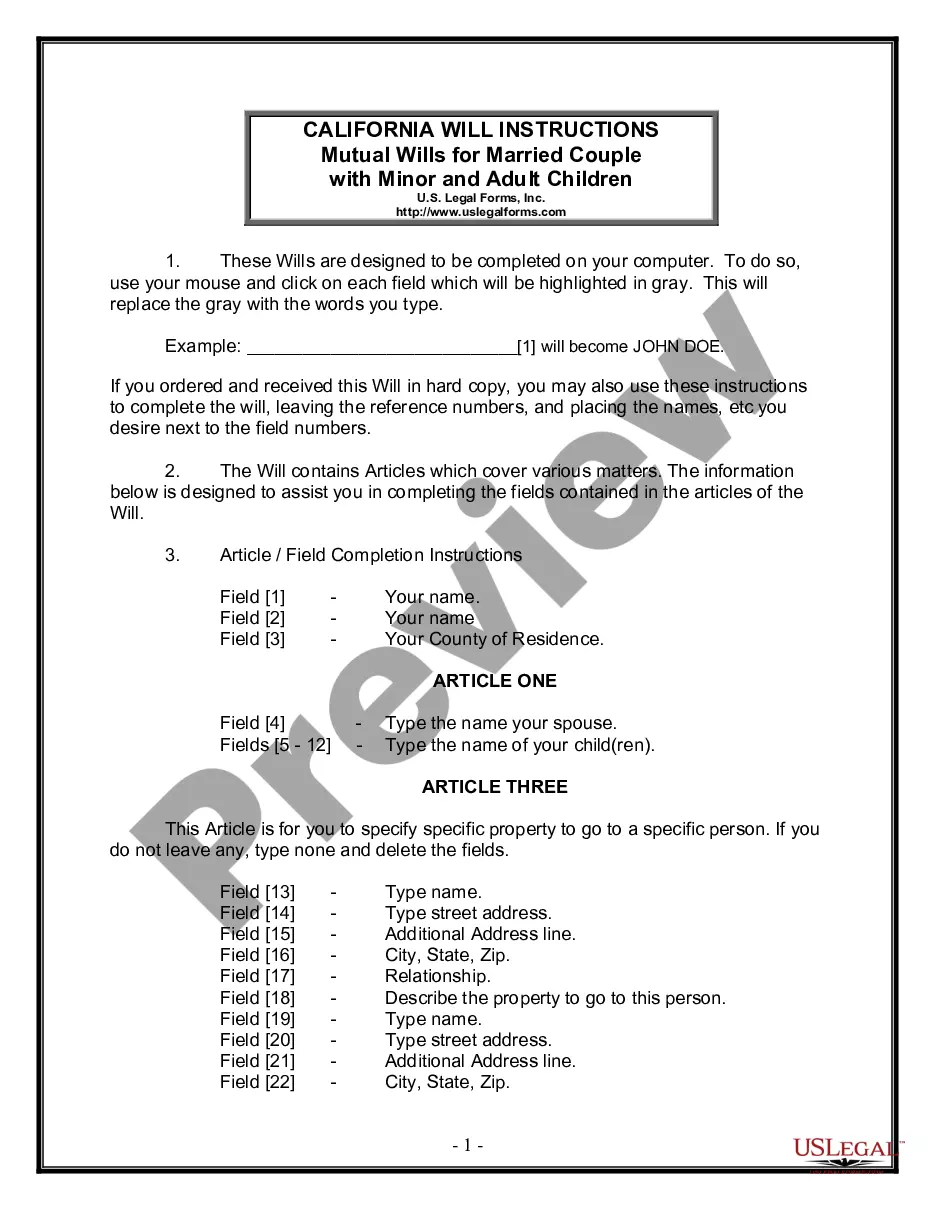

How to fill out Newark New Jersey Assignment Of Security Instrument Mortgage Deed Of Trust?

Benefit from the US Legal Forms and get instant access to any form template you require. Our helpful website with a large number of templates allows you to find and get almost any document sample you need. You can save, complete, and certify the Newark New Jersey Assignment Of Security Instrument Mortgage Deed of Trust in just a matter of minutes instead of surfing the Net for several hours searching for a proper template.

Utilizing our library is a wonderful way to improve the safety of your form filing. Our experienced attorneys regularly review all the records to ensure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How can you obtain the Newark New Jersey Assignment Of Security Instrument Mortgage Deed of Trust? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. In addition, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Open the page with the template you require. Ensure that it is the form you were looking for: examine its title and description, and take take advantage of the Preview option when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving process. Click Buy Now and select the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Export the file. Select the format to get the Newark New Jersey Assignment Of Security Instrument Mortgage Deed of Trust and change and complete, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable document libraries on the internet. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Newark New Jersey Assignment Of Security Instrument Mortgage Deed of Trust.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!