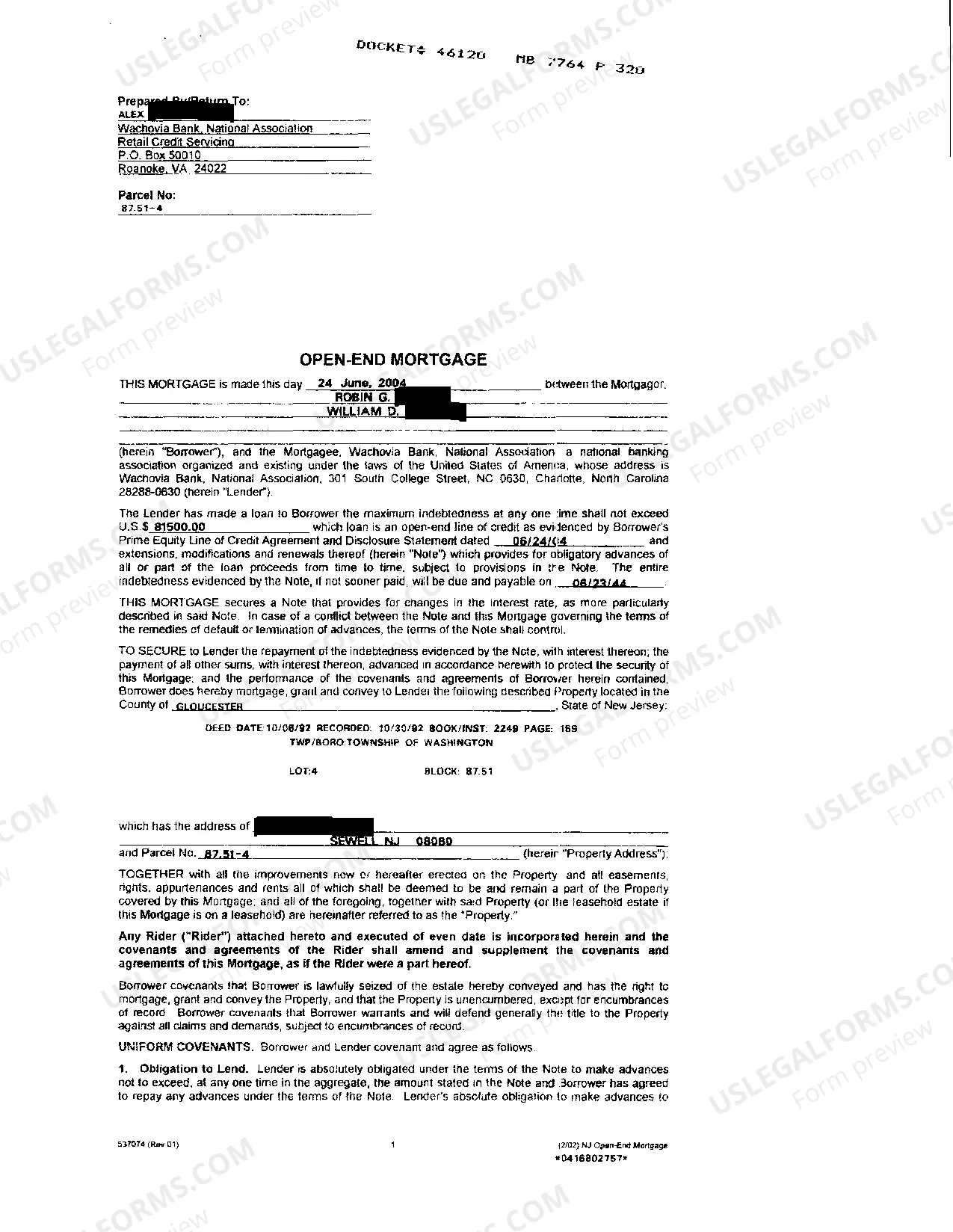

An Elizabeth, New Jersey open end mortgage is a mortgage agreement that allows homeowners in Elizabeth, New Jersey, to borrow additional funds on top of their existing mortgage. This type of mortgage is also known as an open-end home equity loan and is secured by the equity the homeowner has built up in their property. Keywords: Elizabeth, New Jersey, open end mortgage, home equity loan, additional funds, secured, equity. There are several types of open end mortgages available to borrowers in Elizabeth, New Jersey. These include: 1. Traditional Open End Mortgage: This is the most common type and allows homeowners to borrow funds as needed, up to a predetermined credit limit. The borrower can withdraw money from the equity in their home whenever necessary, similar to a line of credit. 2. Fixed-Rate Open End Mortgage: With this type, homeowners can borrow additional funds from their equity at a fixed interest rate. This can provide stability and predictability as the interest rate remains constant throughout the loan term. 3. Adjustable-Rate Open End Mortgage: Unlike fixed-rate mortgages, adjustable-rate open end mortgages have interest rates that fluctuate based on market conditions. This type of mortgage often starts with a lower interest rate, which can be beneficial if rates decline. However, the rate can increase over time, potentially increasing the borrower's monthly payments. 4. Combination Open End Mortgage: This mortgage type combines a traditional mortgage with an open end line of credit. Homeowners have a primary mortgage for a specific amount and a credit line that they can tap into when needed. This type offers flexibility in accessing additional funds while ensuring a structured repayment plan. 5. Reverse Mortgage: A reverse mortgage is a unique type of open end mortgage available to senior citizens aged 62 or older. Homeowners can borrow against the equity in their home, receiving funds as a lump sum, line of credit, or regular payments. The loan is paid back when the homeowner sells the property, moves out, or passes away. So, whether homeowners in Elizabeth, New Jersey require additional funds for home improvements, debt consolidation, or other financial needs, an open end mortgage provides a flexible borrowing solution. By leveraging the equity in their property, residents can access funds while potentially benefiting from tax advantages and favorable interest rates. It is essential to consult with a reputable lender who can provide personalized advice and guide borrowers in choosing the right type of open end mortgage that suits their specific financial circumstances and goals.

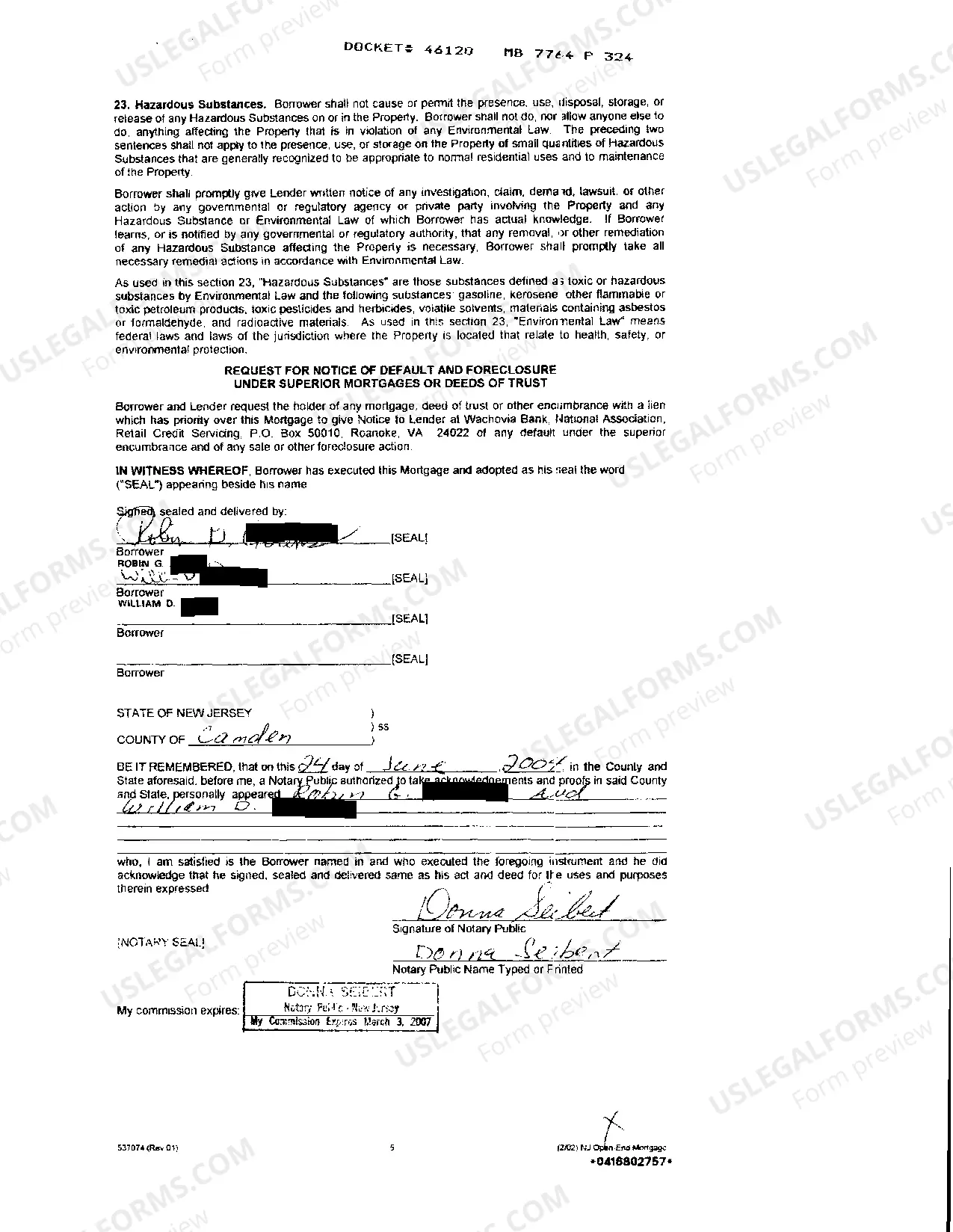

Elizabeth New Jersey Open End Mortgage

Description

How to fill out Elizabeth New Jersey Open End Mortgage?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Elizabeth New Jersey Open End Mortgage gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Elizabeth New Jersey Open End Mortgage takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Elizabeth New Jersey Open End Mortgage. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!