Jersey City, located in New Jersey, offers an array of mortgage options, including the popular Open End Mortgage. This mortgage type allows borrowers to have access to a predetermined amount of funds, which they can withdraw multiple times over the loan term, making it highly flexible and convenient. Open End Mortgages are designed to serve homeowners in need of upfront funds for various purposes such as home improvements, debt consolidation, or unforeseen expenses. It provides the advantage of a relatively low-interest rate and the freedom to borrow additional funds whenever needed. The residents of Jersey City can choose from different subtypes of Open End Mortgages, each tailored to specific financial circumstances and preferences. Some common variants are: 1. Fixed-Rate Open End Mortgage: This type offers a fixed interest rate throughout the loan term, ensuring predictable monthly payments and stability in the borrowing cost. It is ideal for individuals who prefer a consistent repayment structure. 2. Adjustable-Rate Open End Mortgage: With an adjustable interest rate, this option allows for potential changes in the interest rate based on market fluctuations. Borrowers benefit from initial lower rates, but should be prepared for possible rate adjustments in the future. 3. Home Equity Line of Credit (HELOT): Often considered a form of Open End Mortgage, a HELOT enables homeowners to borrow funds against the equity they have built in their property. Helots provide borrowers with a revolving line of credit, giving them the flexibility to borrow as needed and repay with interest. 4. Cash-Out Refinance: While not a traditional Open End Mortgage, cash-out refinances are another option for homeowners in Jersey City. With a cash-out refinance, borrowers replace their existing mortgage with a new loan that has a higher principal balance. The difference between the new loan amount and the previous outstanding mortgage is received by the homeowner in cash. Open End Mortgages in Jersey City give borrowers freedom and flexibility, allowing them to tap into their home equity for various financial needs. However, it is important for potential borrowers to carefully evaluate their financial circumstances and consult with mortgage professionals to determine the most suitable type of Open End Mortgage for their specific goals.

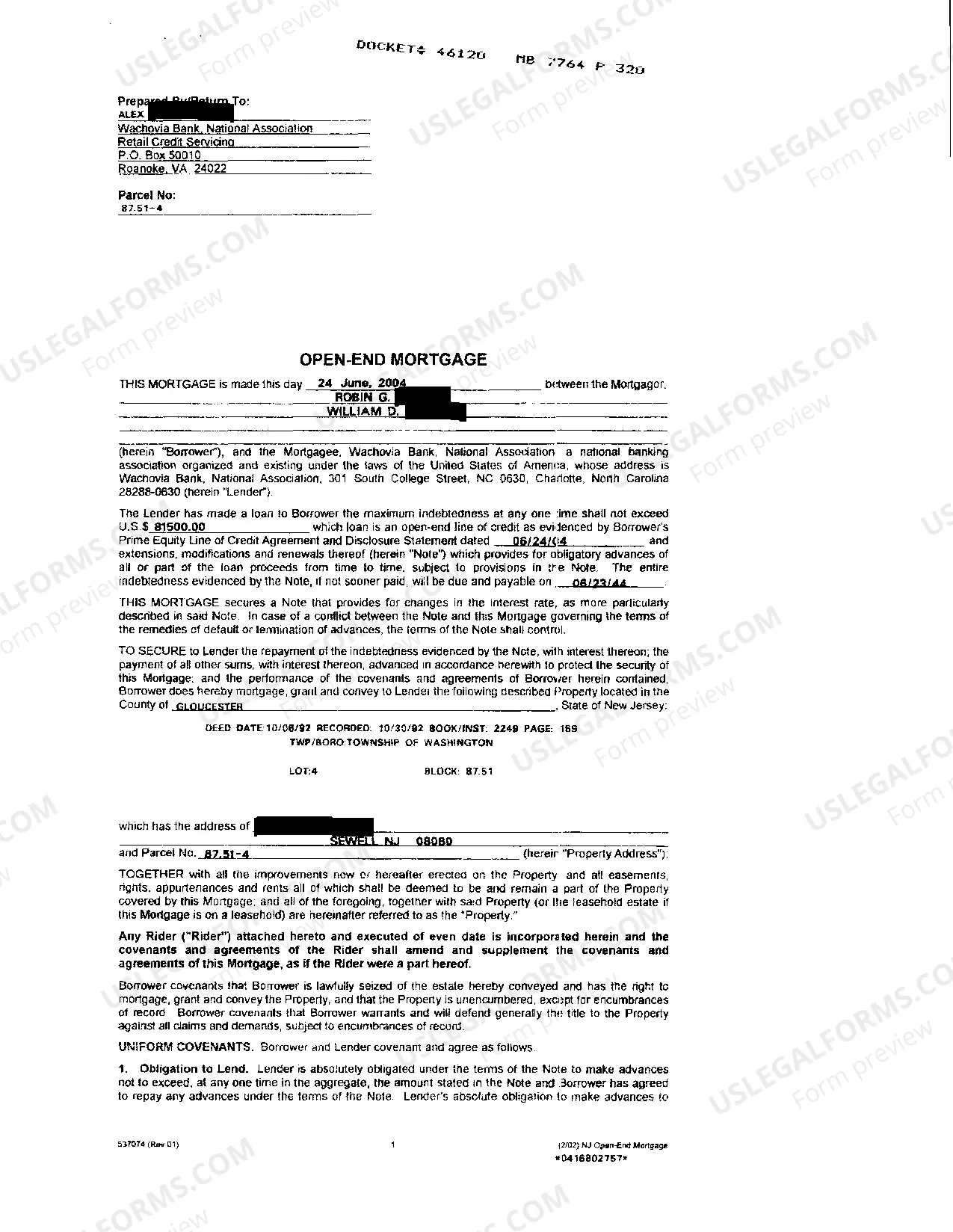

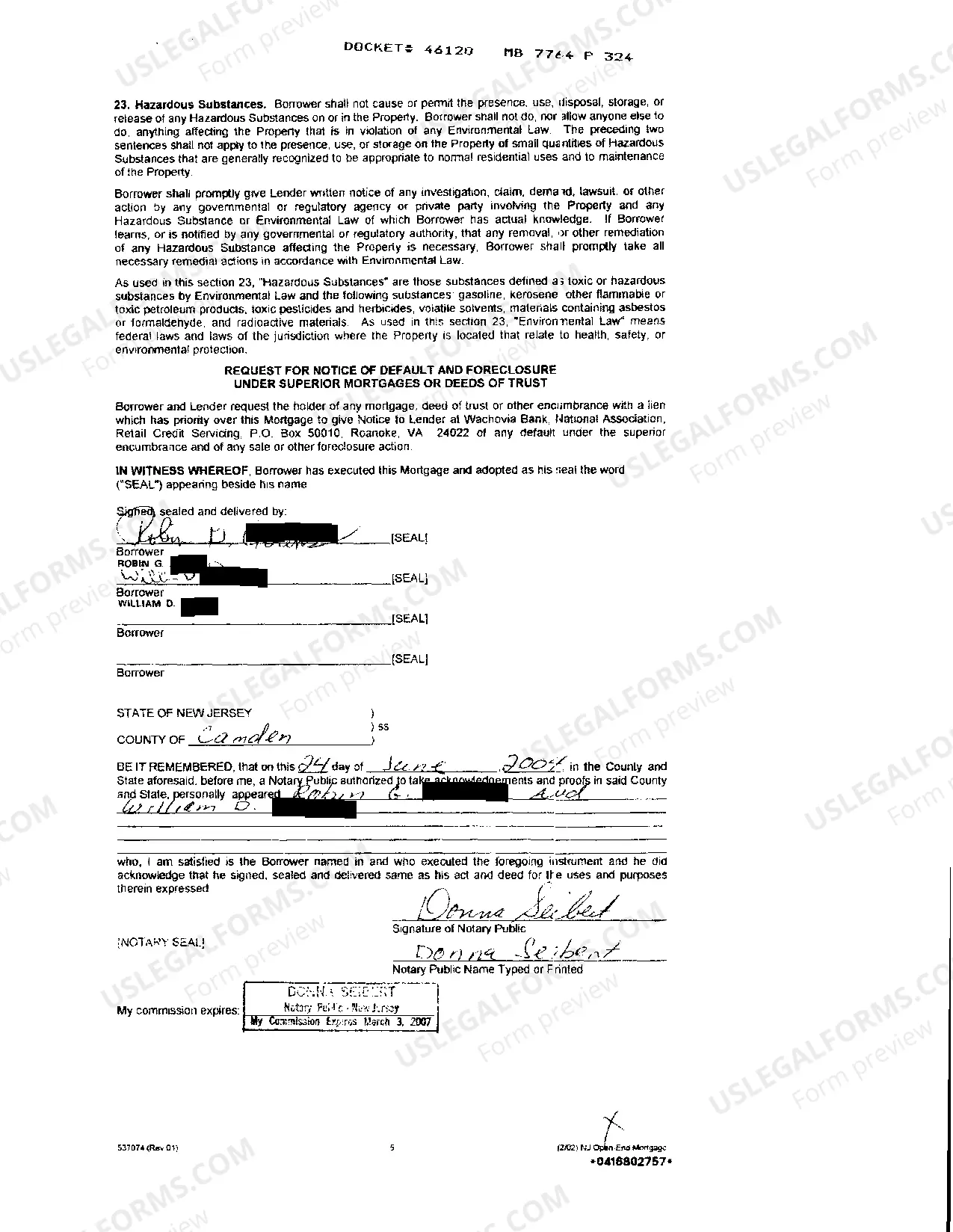

Jersey City New Jersey Open End Mortgage

Description

How to fill out Jersey City New Jersey Open End Mortgage?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney solutions that, as a rule, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Jersey City New Jersey Open End Mortgage or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Jersey City New Jersey Open End Mortgage adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Jersey City New Jersey Open End Mortgage is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!