Newark New Jersey Open End Mortgage is a type of mortgage loan that provides borrowers with the flexibility to borrow funds against the equity of their home over a prolonged period. It is a secured loan, where the borrower's property acts as collateral. This type of mortgage is specifically popular in Newark, New Jersey, due to its numerous benefits and versatile nature. The key distinguishing feature of an open end mortgage is that it allows the borrower to access additional funds to meet various financial needs, based on the accumulated equity in their property. This flexibility makes it an ideal mortgage option for individuals who anticipate future expenses or require funds for home improvements, education, debt consolidation, or other personal or investment purposes. In Newark New Jersey, different types of open end mortgages are available to cater to various requirements: 1. Traditional Open End Mortgage: This is the standard type where borrowers can access funds up to a pre-approved credit limit, determined by the equity in their property. Interest rates are typically competitive, and borrowers can make interest-only payments or choose to repay both the principal and interest. 2. Construction Open End Mortgage: Specifically designed for individuals building a new home or completing significant renovations, this type of open end mortgage offers financing throughout the construction process. Funds are disbursed in increments, known as draws, as the construction progresses, providing liquidity for material and labor expenses. 3. Home Equity Line of Credit (HELOT): While not directly referred to as an open end mortgage, a HELOT functionally operates similarly. It allows homeowners in Newark, New Jersey, to borrow up to a predetermined credit limit using the equity in their property. Helots offer greater flexibility with easy access to funds, allowing borrowers to draw as needed and make interest-only payments. 4. Reverse Mortgage Line of Credit (RM LOC): Primarily designed for senior homeowners aged 62 and above, this open end mortgage enables them to access the equity they have built up in their property. The RM LOC allows borrowers to receive funds regularly or as a lump sum, providing a financial cushion for retirement or senior care expenses. In summary, Newark New Jersey Open End Mortgage is an advantageous loan product that offers homeowners the flexibility to borrow against their property's equity for various purposes. With different types available, borrowers can choose the one that suits their specific needs, enabling them to tap into the financial potential of their home.

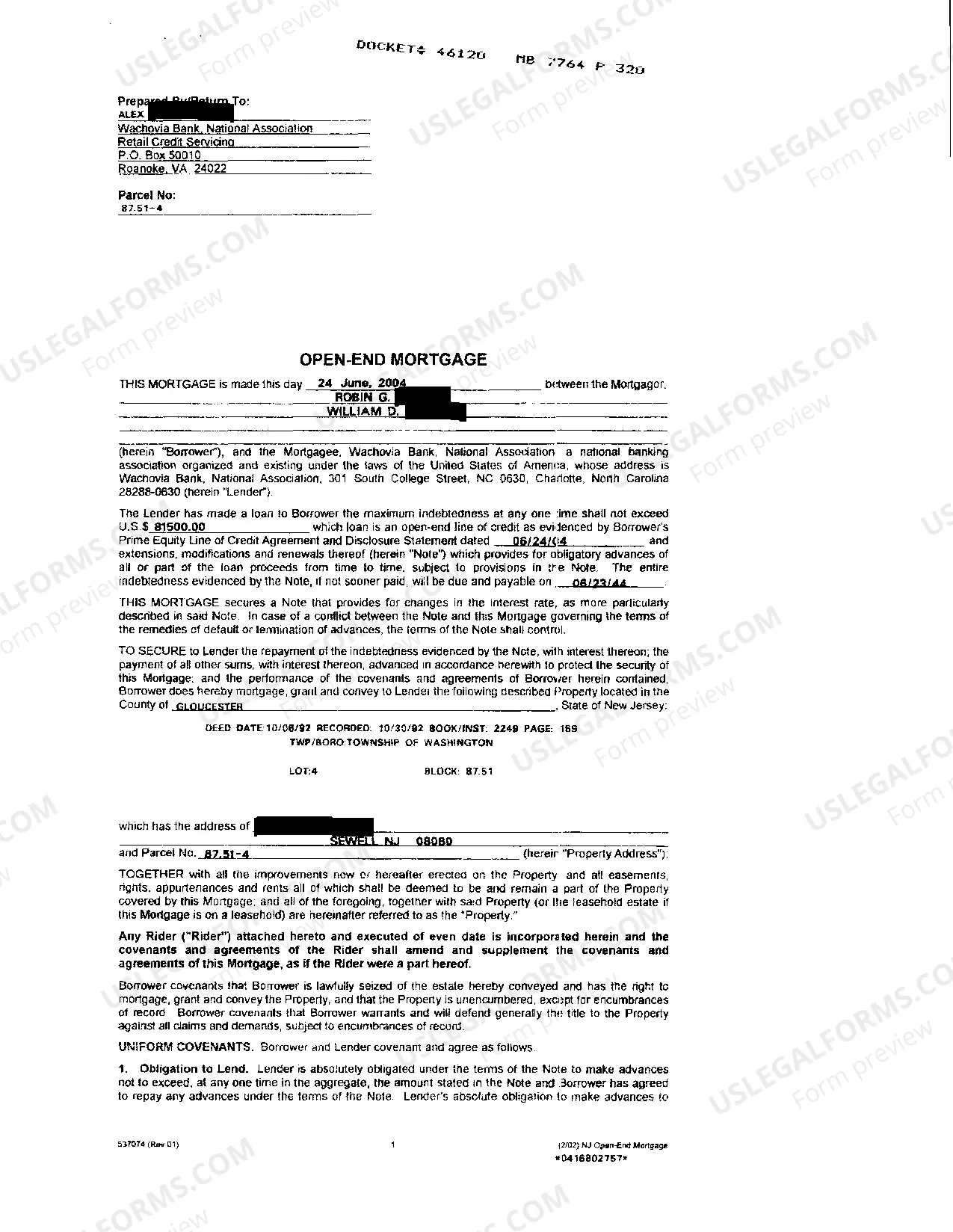

Newark New Jersey Open End Mortgage

Description

How to fill out Newark New Jersey Open End Mortgage?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Newark New Jersey Open End Mortgage gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Newark New Jersey Open End Mortgage takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Newark New Jersey Open End Mortgage. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!