A Paterson New Jersey Open End Mortgage is a type of mortgage loan that offers borrowers the flexibility to borrow additional funds in the future without the need to refinance their existing loan. This financial product allows homeowners to leverage the equity in their property as collateral to secure additional financing when needed. The primary advantage of a Paterson New Jersey Open End Mortgage is that it provides homeowners with revolving credit, similar to a line of credit or a credit card. This means that borrowers can withdraw money from their home equity as needed, up to a predetermined limit, without having to go through the application process all over again or pay additional closing costs. With an Open End Mortgage, homeowners in Paterson, New Jersey can tap into the value of their property for various purposes such as home improvements, debt consolidation, educational expenses, medical bills, or any other financial need they might have. By using their home equity, borrowers can often benefit from lower interest rates compared to other types of loans. There are different types of Open End Mortgages available in Paterson, New Jersey, each catering to specific borrower needs: 1. Home Equity Line of Credit (HELOT): This is a common type of Open End Mortgage that allows homeowners to access funds as needed, up to a predetermined credit limit. Borrowers only pay interest on the amount borrowed and have the flexibility to pay back the principal at their own pace. 2. Cash-Out Refinance: This type of Open End Mortgage allows homeowners to refinance their existing mortgage, taking out a larger loan amount than the current balance. The excess funds can be used for any purpose, and homeowners will typically receive the difference in cash. 3. Construction Loan: This type of Open End Mortgage is specifically designed for individuals looking to build a new home or complete substantial renovations. The borrower can access funds throughout the construction process, rather than receiving a lump sum upfront. 4. Reverse Mortgage: Primarily available to homeowners aged 62 and above, this Open End Mortgage allows seniors to convert a portion of their home equity into cash. The funds can be received in monthly payments, a line of credit, or a lump sum, without the need for monthly repayments. The loan is typically repaid when the homeowner sells the property or passes away. In summary, a Paterson New Jersey Open End Mortgage provides homeowners with the ability to access additional funds as needed, using their home equity as collateral. Different types of Open End Mortgages cater to various borrower requirements, offering flexibility, lower interest rates, and the potential for significant financial benefits.

Paterson New Jersey Open End Mortgage

State:

New Jersey

City:

Paterson

Control #:

NJ-CC-016

Format:

PDF

Instant download

This form is available by subscription

Description

Open End Mortgage

A Paterson New Jersey Open End Mortgage is a type of mortgage loan that offers borrowers the flexibility to borrow additional funds in the future without the need to refinance their existing loan. This financial product allows homeowners to leverage the equity in their property as collateral to secure additional financing when needed. The primary advantage of a Paterson New Jersey Open End Mortgage is that it provides homeowners with revolving credit, similar to a line of credit or a credit card. This means that borrowers can withdraw money from their home equity as needed, up to a predetermined limit, without having to go through the application process all over again or pay additional closing costs. With an Open End Mortgage, homeowners in Paterson, New Jersey can tap into the value of their property for various purposes such as home improvements, debt consolidation, educational expenses, medical bills, or any other financial need they might have. By using their home equity, borrowers can often benefit from lower interest rates compared to other types of loans. There are different types of Open End Mortgages available in Paterson, New Jersey, each catering to specific borrower needs: 1. Home Equity Line of Credit (HELOT): This is a common type of Open End Mortgage that allows homeowners to access funds as needed, up to a predetermined credit limit. Borrowers only pay interest on the amount borrowed and have the flexibility to pay back the principal at their own pace. 2. Cash-Out Refinance: This type of Open End Mortgage allows homeowners to refinance their existing mortgage, taking out a larger loan amount than the current balance. The excess funds can be used for any purpose, and homeowners will typically receive the difference in cash. 3. Construction Loan: This type of Open End Mortgage is specifically designed for individuals looking to build a new home or complete substantial renovations. The borrower can access funds throughout the construction process, rather than receiving a lump sum upfront. 4. Reverse Mortgage: Primarily available to homeowners aged 62 and above, this Open End Mortgage allows seniors to convert a portion of their home equity into cash. The funds can be received in monthly payments, a line of credit, or a lump sum, without the need for monthly repayments. The loan is typically repaid when the homeowner sells the property or passes away. In summary, a Paterson New Jersey Open End Mortgage provides homeowners with the ability to access additional funds as needed, using their home equity as collateral. Different types of Open End Mortgages cater to various borrower requirements, offering flexibility, lower interest rates, and the potential for significant financial benefits.

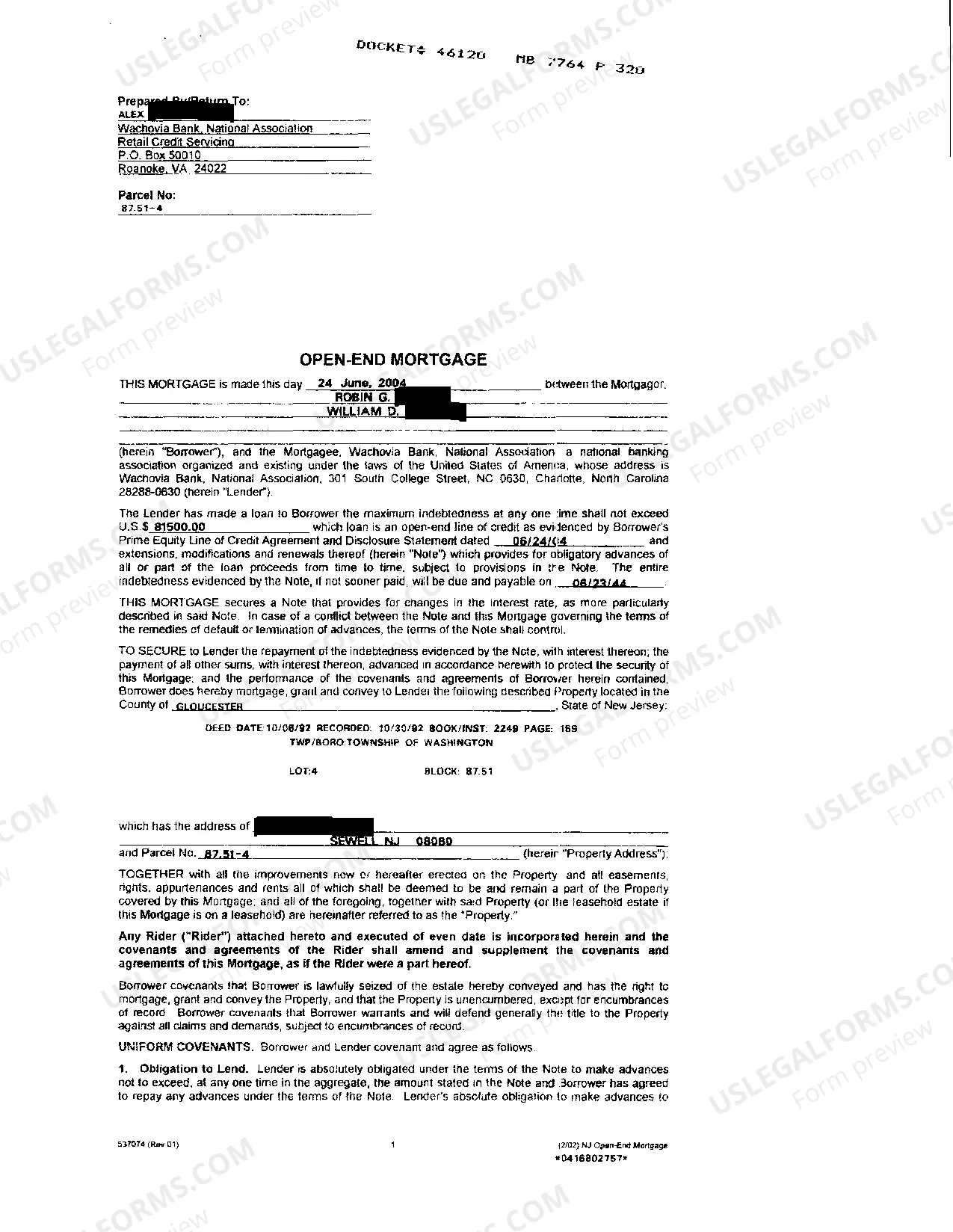

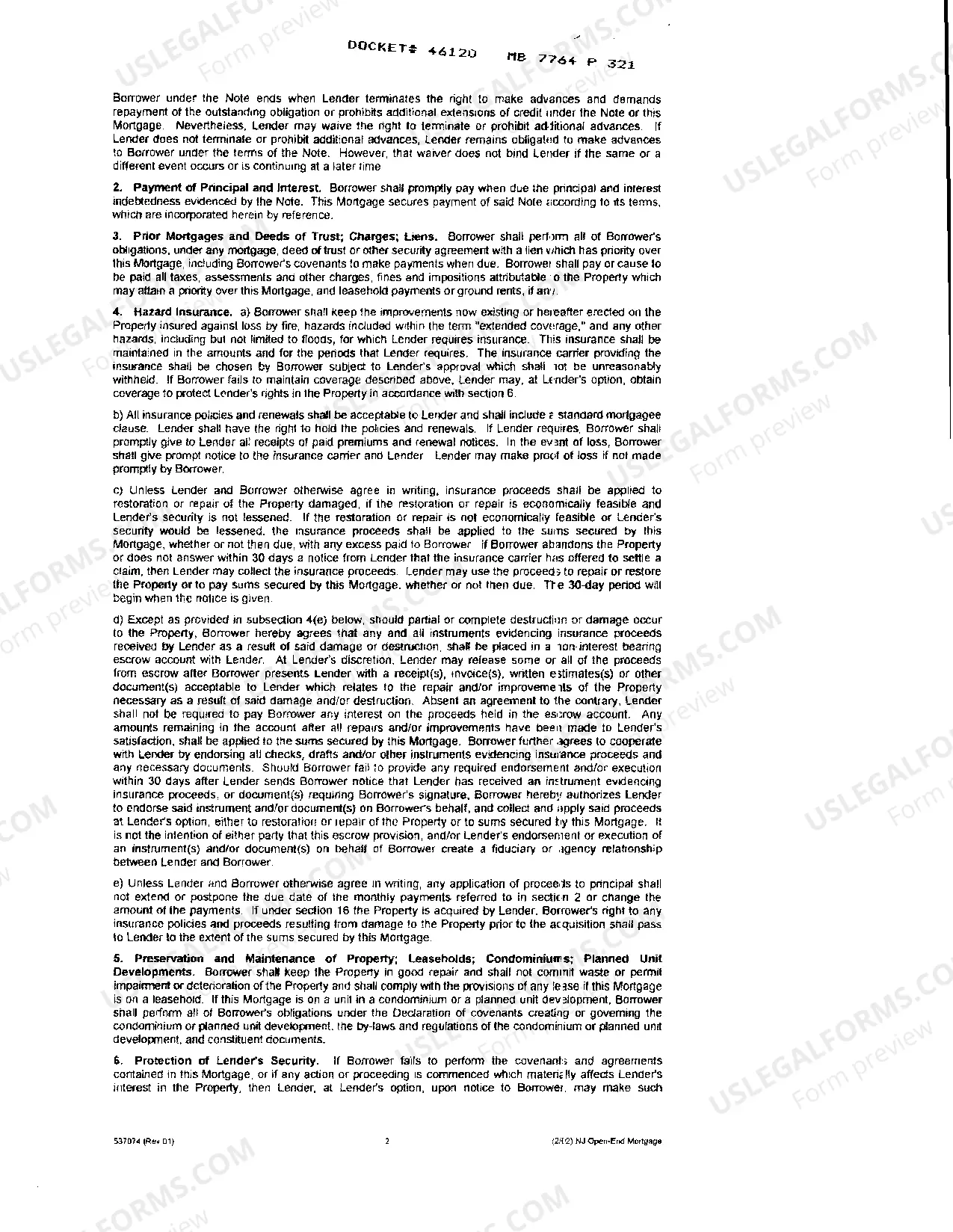

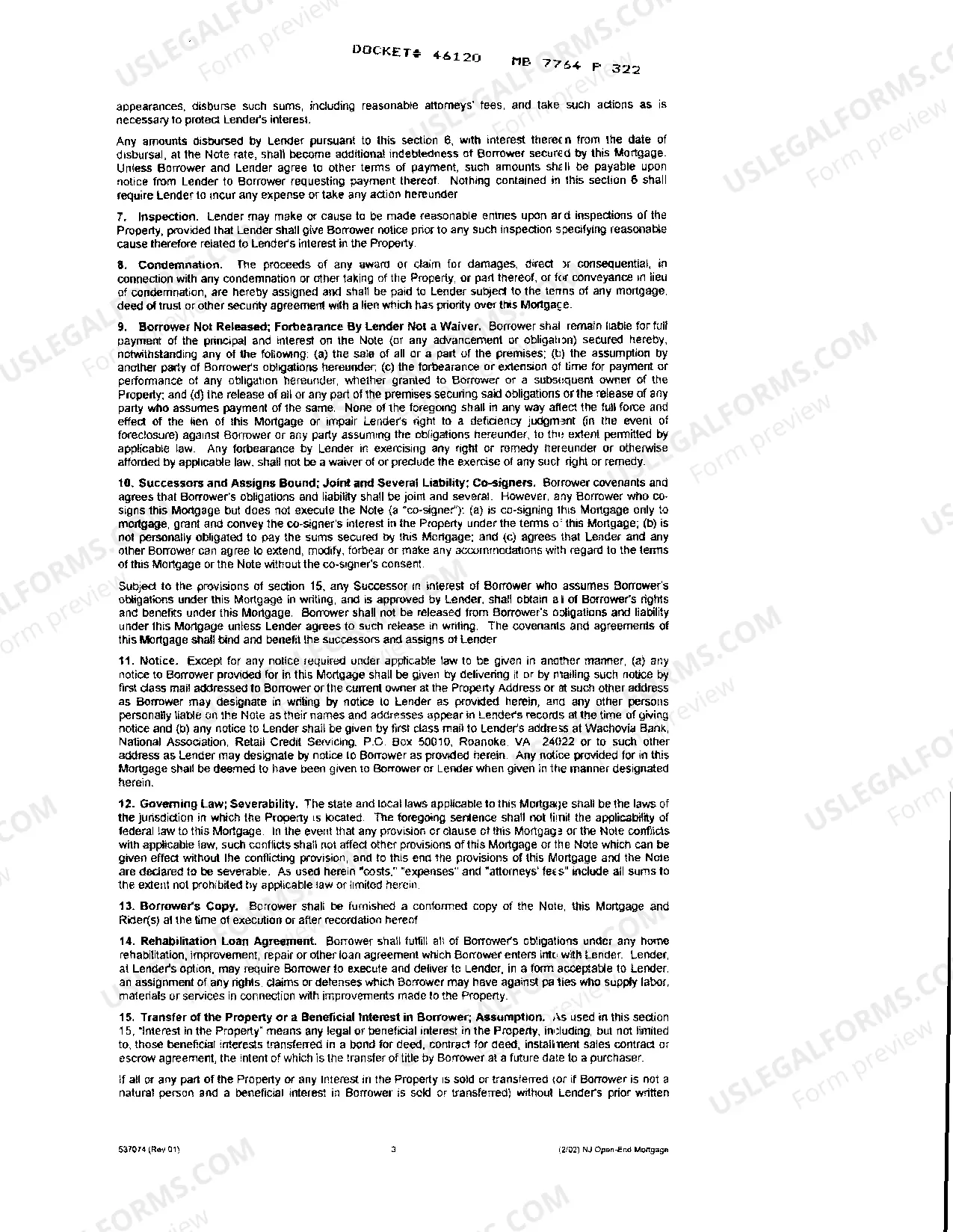

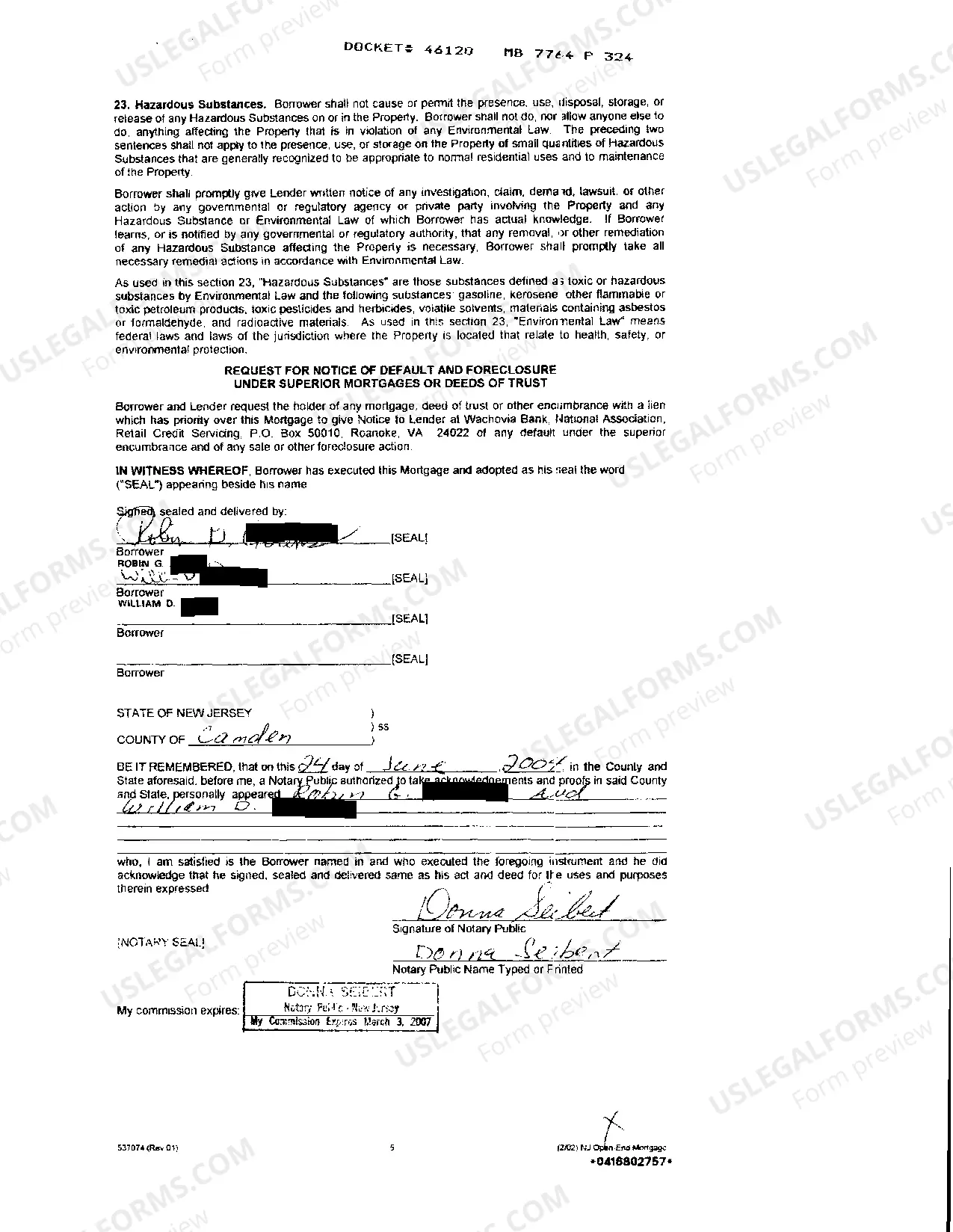

Free preview

How to fill out Paterson New Jersey Open End Mortgage?

If you’ve already utilized our service before, log in to your account and save the Paterson New Jersey Open End Mortgage on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Paterson New Jersey Open End Mortgage. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!