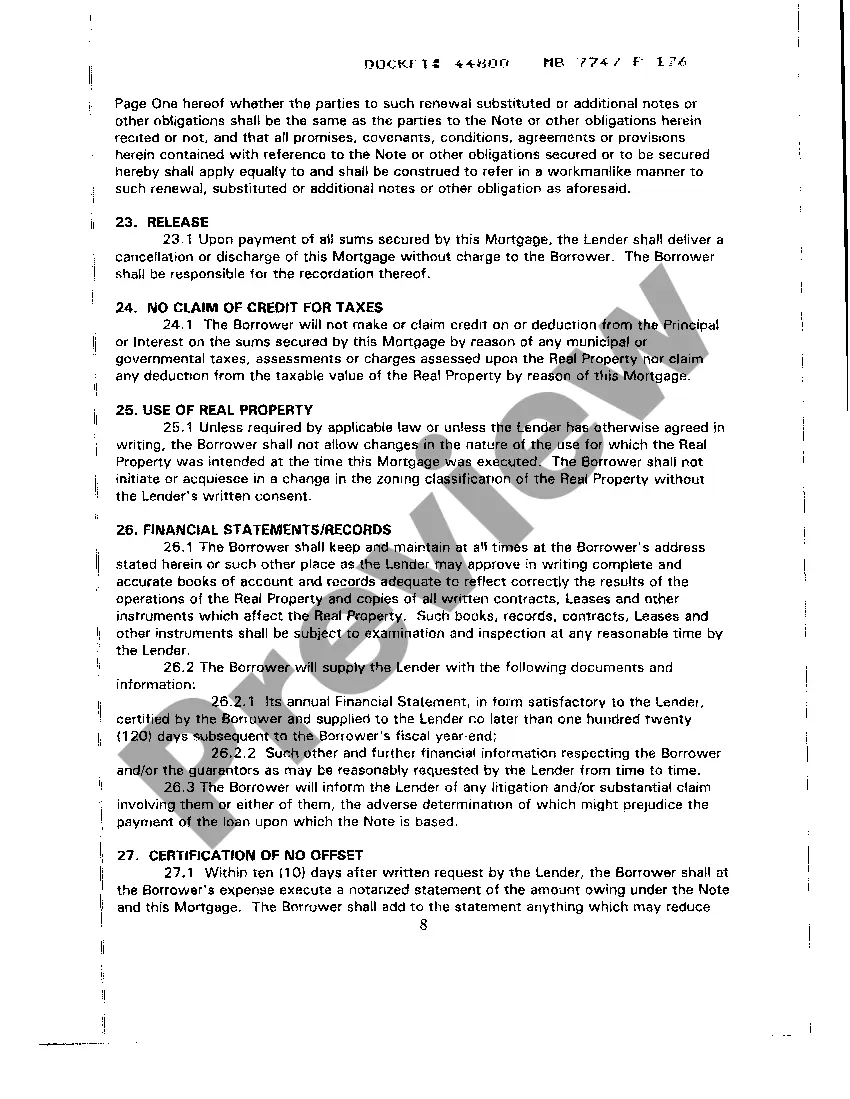

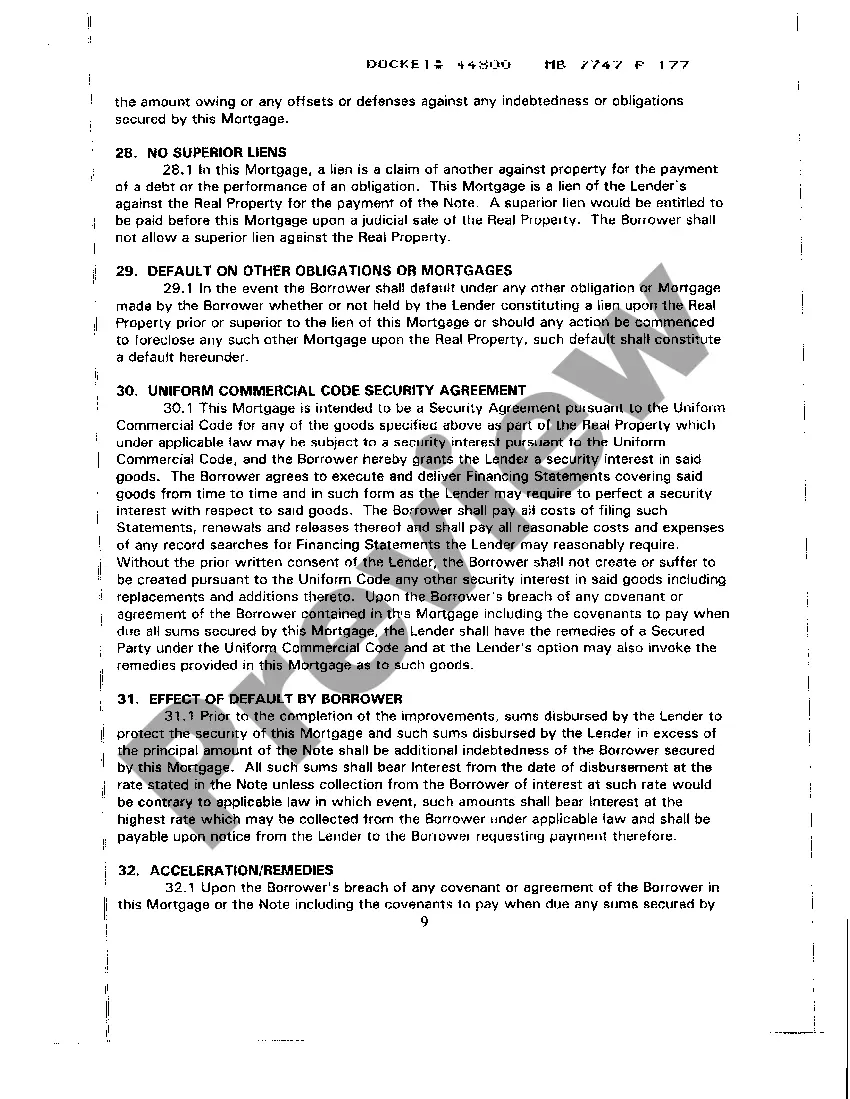

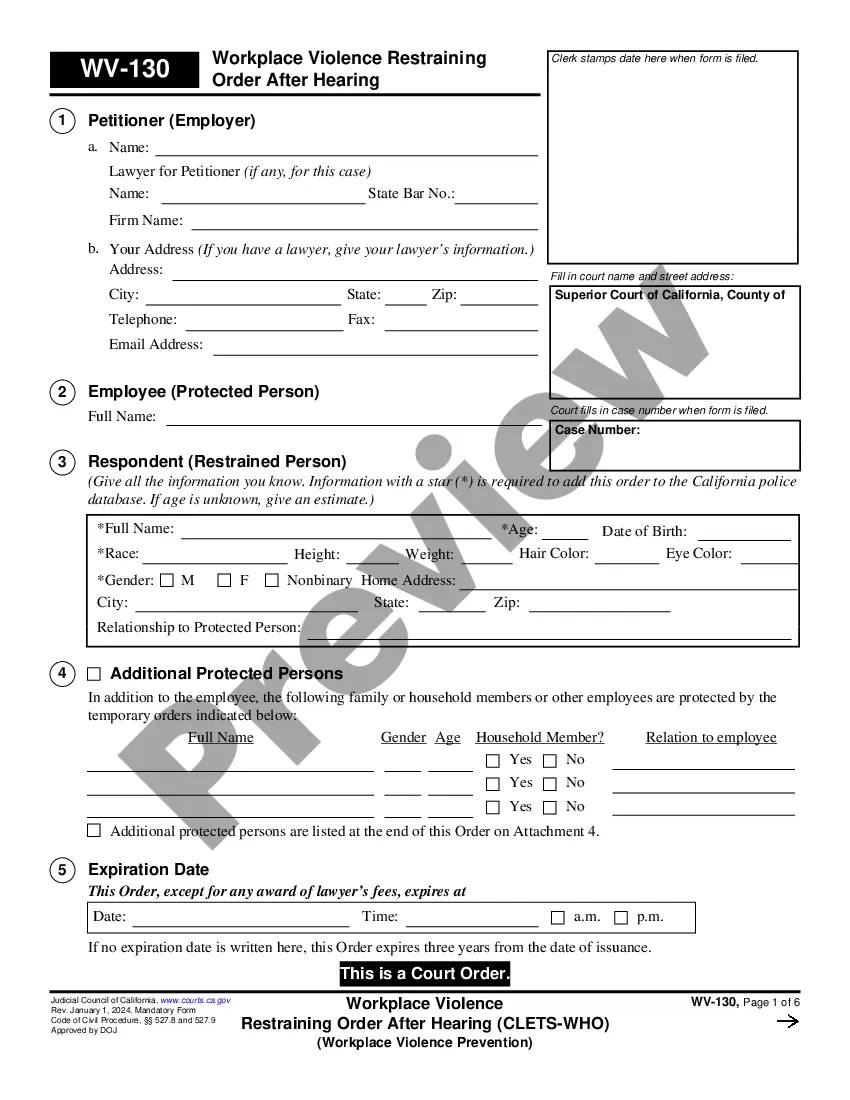

Newark, New Jersey Mortgage and Security Agreement — Part 1 A Newark, New Jersey Mortgage and Security Agreement (Part 1) is a legally binding document that sets out the terms and conditions for obtaining a mortgage loan and securing the property in Newark, New Jersey. This agreement serves as a crucial component of the overall mortgage process and ensures the lender's rights are protected in case of default by the borrower. There are several types of Newark, New Jersey Mortgage and Security Agreements — Part 1, primarily based on the purpose of the loan or the property involved: 1. Residential Mortgage and Security Agreement: This agreement is used when an individual or couple intends to finance the purchase of a residential property, such as a house or a condominium, in Newark, New Jersey. It outlines the terms of the loan, including the loan amount, interest rate, repayment schedule, and the rights and responsibilities of both the borrower and the lender. 2. Commercial Mortgage and Security Agreement: In the case of commercial properties like offices, retail spaces, or industrial buildings in Newark, New Jersey, the Commercial Mortgage and Security Agreement — Part 1 is employed. This agreement outlines the loan details and provisions specific to commercial real estate, such as lease terms, rental income considerations, and maintenance responsibilities. 3. Refinance Mortgage and Security Agreement: When a property owner wishes to refinance their existing mortgage loan in Newark, New Jersey, a Refinance Mortgage and Security Agreement — Part 1 is used. This agreement allows borrowers to renegotiate the terms of their current loan, potentially lowering interest rates, extending the loan duration, or changing other relevant aspects to suit their financial needs. 4. Construction Mortgage and Security Agreement: When seeking financing for new construction or significant renovations on a property in Newark, New Jersey, a Construction Mortgage and Security Agreement — Part 1 is employed. This agreement enables borrowers to fund the project while securing the loan against the property, considering the speculative nature of construction loans, and addressing potential risks unique to this type of loan. Regardless of the specific type, the Newark, New Jersey Mortgage and Security Agreement — Part 1 will typically contain sections covering property details, loan terms, interest rates, late payments, default remedies, insurance requirements, and borrower's representations and warranties. It is crucial for both parties involved to thoroughly review and understand the agreement, seeking legal advice if necessary, before signing to ensure clarity and protection of their rights and obligations.

Newark New Jersey Mortgage and Security Agreement - part 1

Description

How to fill out Newark New Jersey Mortgage And Security Agreement - Part 1?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal services that, as a rule, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Newark New Jersey Mortgage and Security Agreement - part 1 or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Newark New Jersey Mortgage and Security Agreement - part 1 adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Newark New Jersey Mortgage and Security Agreement - part 1 would work for you, you can pick the subscription plan and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!