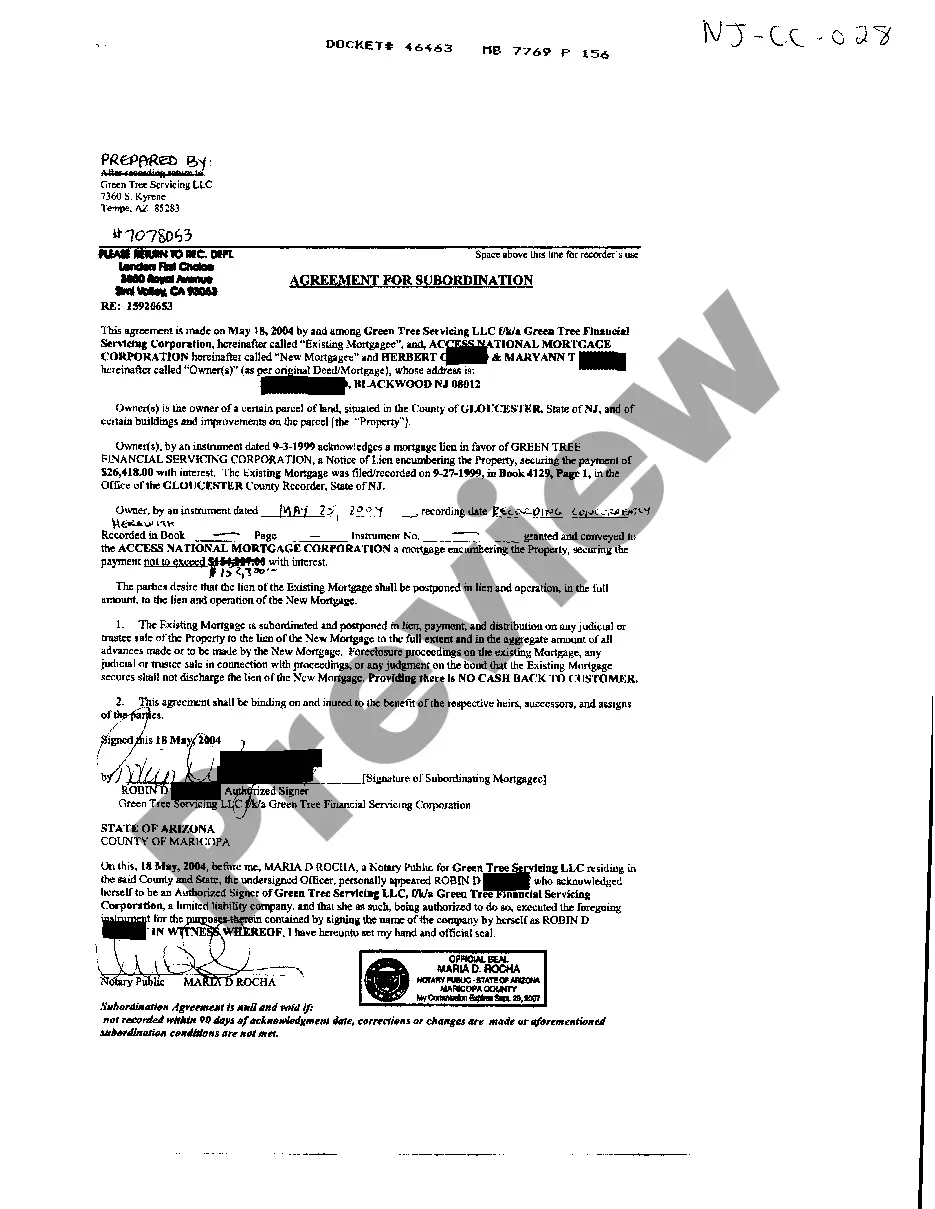

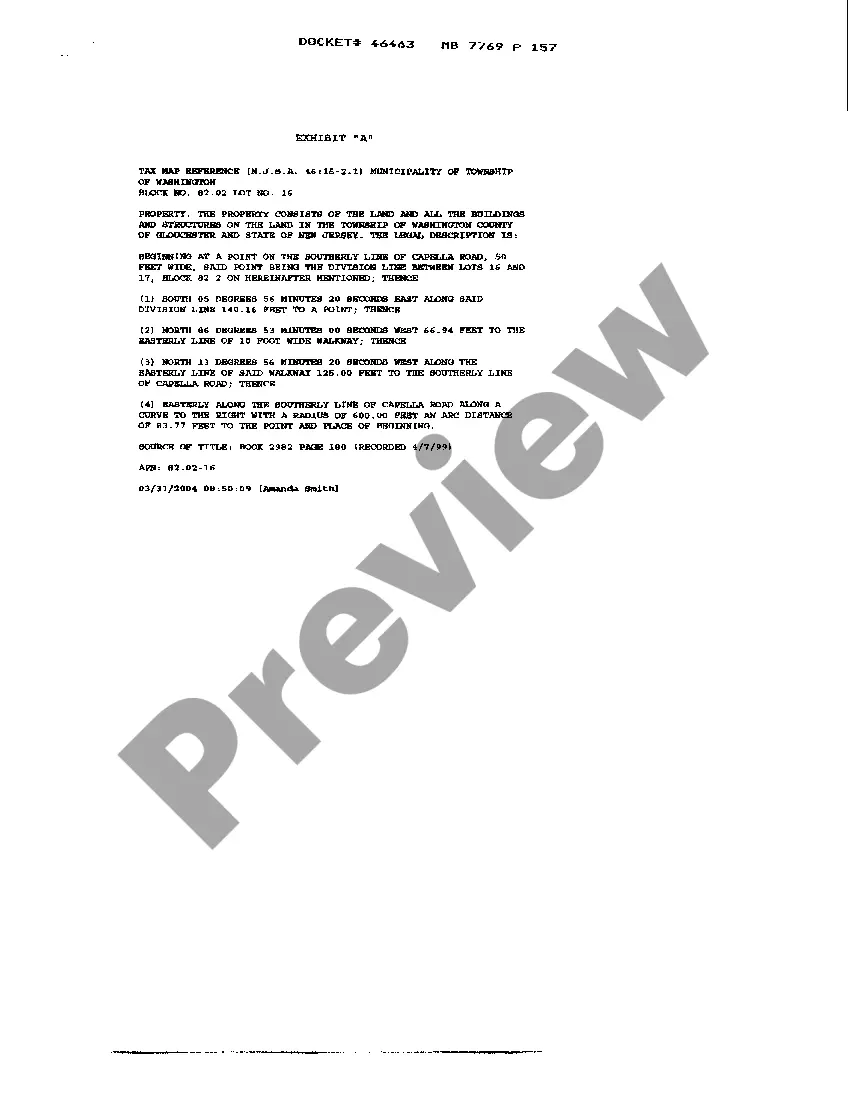

The Jersey City New Jersey Agreement for Subordination of Mortgage is a legally binding document that establishes the priority of multiple mortgages on a property located in Jersey City, New Jersey. This agreement is particularly important when there are refinancing or additional loans involved and ensures that lenders are aware of their respective positions in the repayment hierarchy. The agreement outlines the terms and conditions under which a primary mortgage (also known as the first lien) can be subordinated to a secondary mortgage (known as a second lien or subordinate lien). By entering into this agreement, the primary mortgage holder agrees to relinquish its priority position and allow the subordinate mortgage to take precedence in case of foreclosure or sale of the property. The Jersey City New Jersey Agreement for Subordination of Mortgage typically contains the following key elements: 1. Identification of the parties involved: The agreement will clearly identify the primary mortgage lender, the borrower, and the subordinate mortgage lender. It should include their legal names, addresses, and other contact information. 2. Description of the property: A detailed description of the property under consideration, including its address, legal description, and any relevant tax identification numbers, should be provided. 3. Mortgage details: The agreement should outline the terms of both the primary and subordinate mortgages, such as the principal amount, interest rate, repayment schedule, and any specific provisions related to balloon payments or prepayment penalties. 4. Subordination terms: This section will specify that the primary mortgage holder agrees to subordinate their lien position to the subordinate mortgage. It will include the effective date of the subordination, duration (if applicable), and any conditions under which the subordination may terminate. 5. Priority of liens: The agreement will establish the priority of the subordinate mortgage over other potential claims, such as judgment liens, tax liens, or mechanic's liens. It will clarify the specific order in which these liens will be paid in the event of a foreclosure or sale. 6. Representations and warranties: The parties involved will make certain statements and guarantees regarding their legal rights to enter into this agreement and the accuracy and completeness of their respective mortgage documents. 7. Governing law and jurisdiction: The agreement will specify that it is governed by the laws of Jersey City, New Jersey, and that any disputes arising from it will be resolved within the jurisdiction of the local courts. Different types of Jersey City New Jersey Agreement for Subordination of Mortgage may exist, depending on the specific circumstances of the property or the parties involved. Some common variations include: — Commercial property subordination agreement: This type of agreement is used when commercial properties, such as office buildings or retail spaces, are involved. It may have additional provisions related to business use, zoning regulations, and potential lease agreements. — Construction loan subordination agreement: Construction projects often require multiple lenders, and in such cases, a construction loan subordination agreement is used to establish the priority of each mortgage on the property. This type of agreement also addresses the release of funds for construction completion milestones. — Home equity loan subordination agreement: When homeowners obtain a home equity loan or line of credit on their primary residence, they may need to execute a subordination agreement with their existing mortgage lender. This agreement ensures that the home equity loan is appropriately subordinate to the primary mortgage. In summary, the Jersey City New Jersey Agreement for Subordination of Mortgage is a crucial legal document that clarifies the priority of mortgages on a property. It protects the rights and interests of lenders and borrowers while ensuring compliance with local laws and regulations.

Jersey City New Jersey Agreement For Subordination of Mortgage

Description

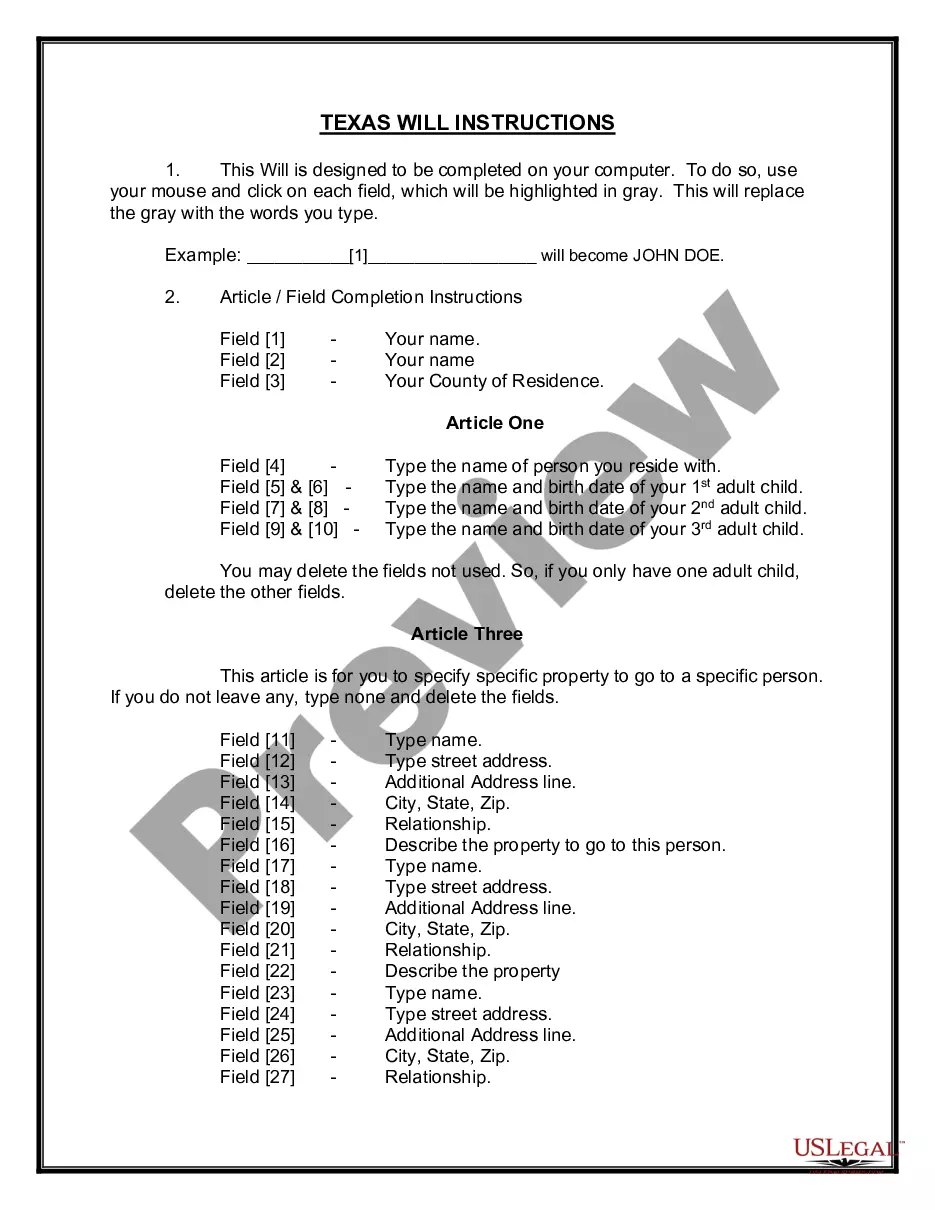

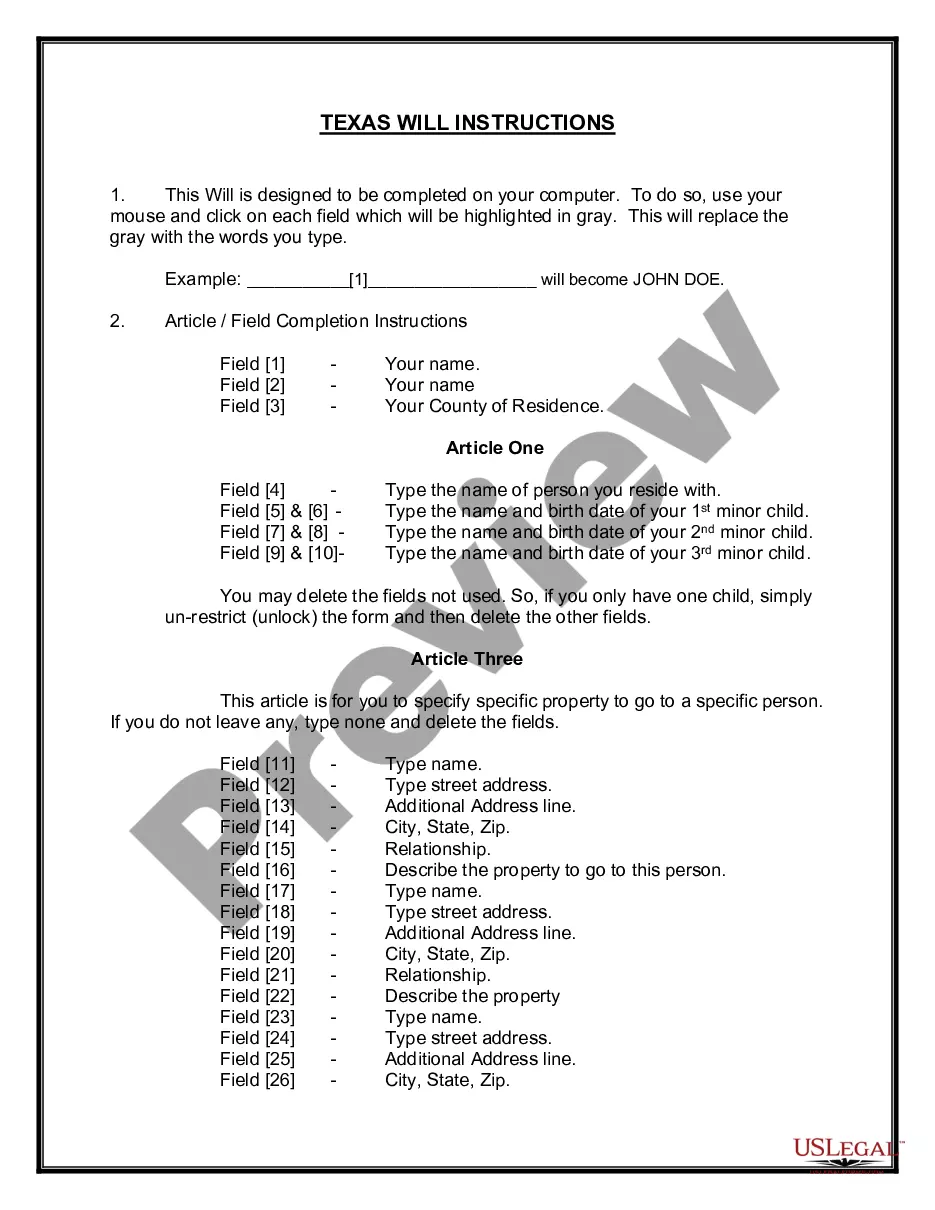

How to fill out Jersey City New Jersey Agreement For Subordination Of Mortgage?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone with no legal background to create this sort of papers from scratch, mostly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform provides a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Jersey City New Jersey Agreement For Subordination of Mortgage or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Jersey City New Jersey Agreement For Subordination of Mortgage in minutes using our trusted platform. If you are already an existing customer, you can go on and log in to your account to get the needed form.

However, if you are unfamiliar with our library, ensure that you follow these steps prior to obtaining the Jersey City New Jersey Agreement For Subordination of Mortgage:

- Ensure the form you have chosen is specific to your area since the regulations of one state or area do not work for another state or area.

- Review the form and read a short outline (if provided) of scenarios the paper can be used for.

- In case the form you picked doesn’t meet your needs, you can start over and look for the necessary document.

- Click Buy now and pick the subscription option that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Jersey City New Jersey Agreement For Subordination of Mortgage as soon as the payment is completed.

You’re all set! Now you can go on and print the form or fill it out online. If you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.