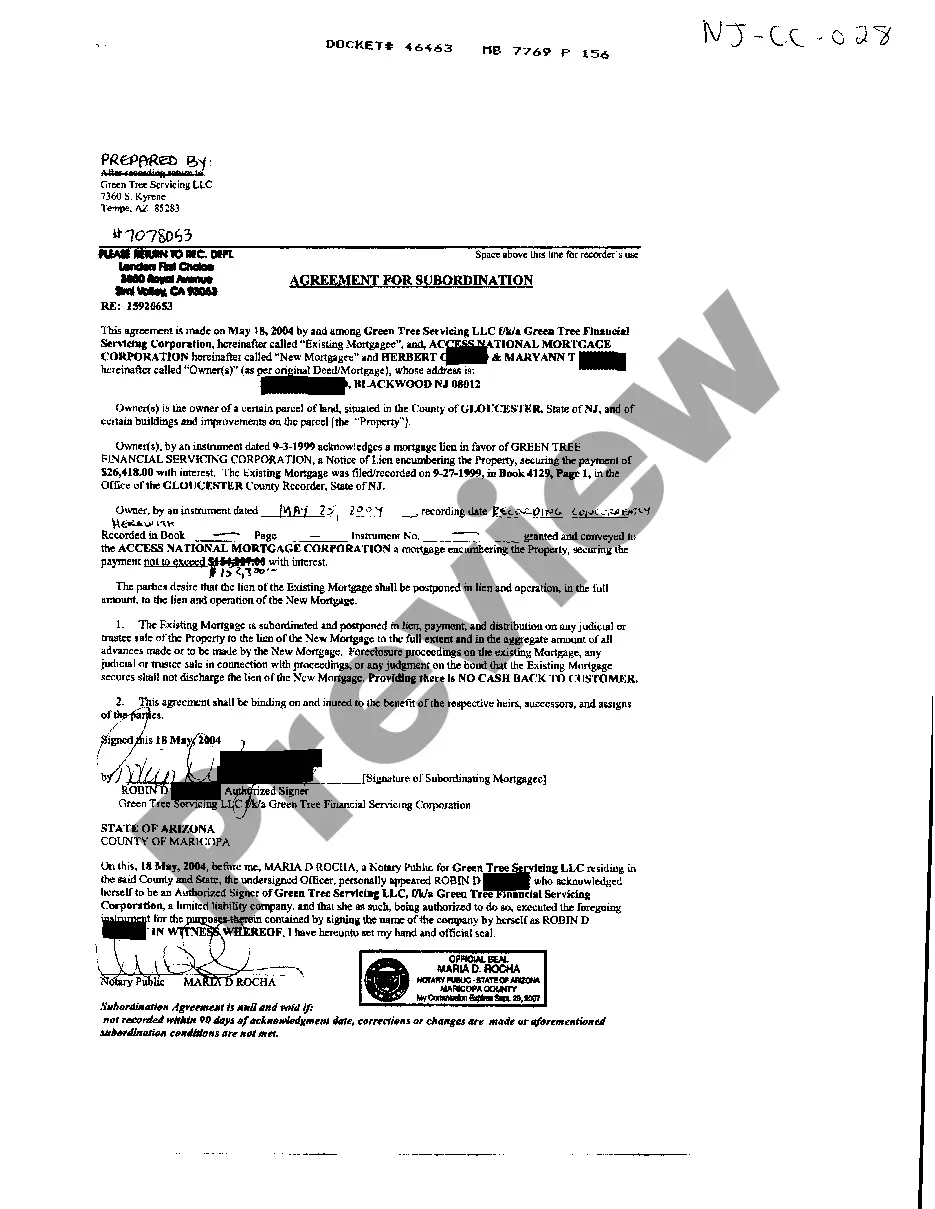

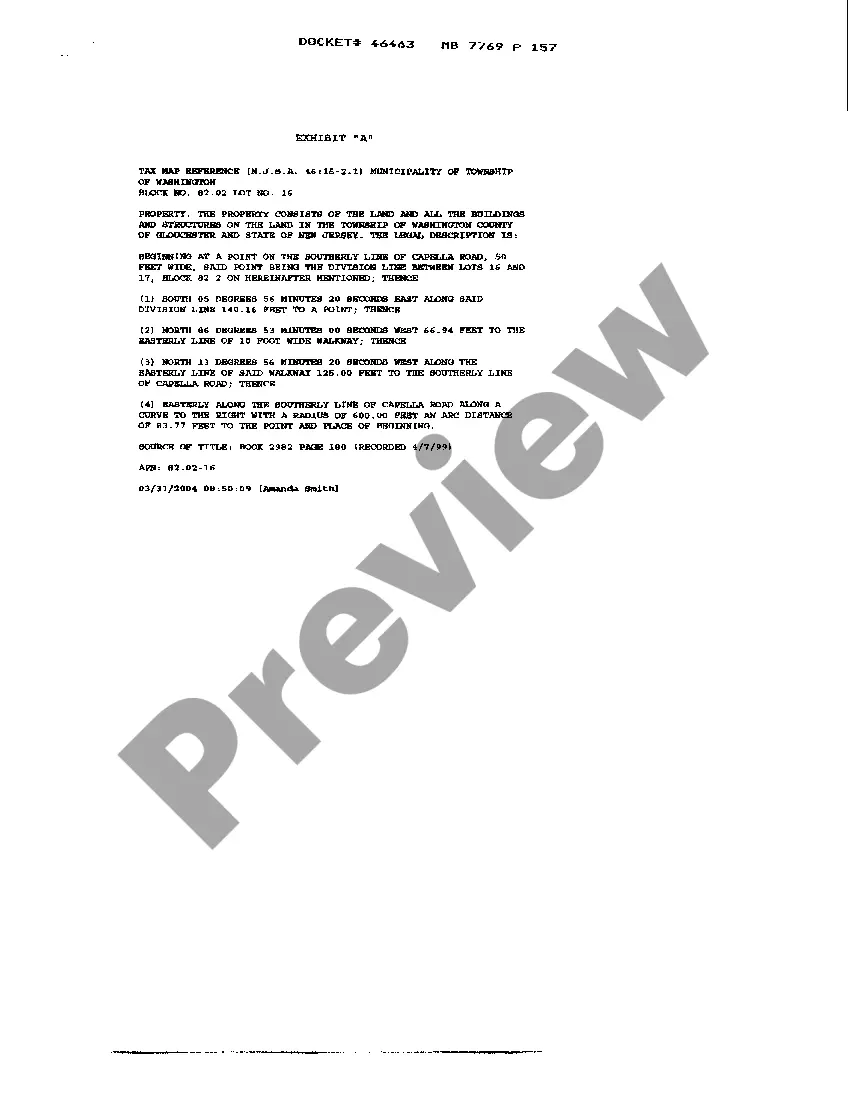

The Newark New Jersey Agreement For Subordination of Mortgage is a legal document that establishes the order of priority for multiple mortgages on a property. This agreement is crucial in real estate transactions, particularly when there is a need for additional financing or refinancing. In Newark, New Jersey, there are two main types of agreements for subordination of mortgage: 1. Newark Subordination Agreement for Home Equity Loans: This type of agreement is commonly used when a homeowner seeks to obtain a home equity loan, where the lender will require the existing mortgage to be subordinated to their lien. The subordination agreement ensures that the home equity loan lender will have priority over the existing mortgage in case of default or foreclosure. 2. Newark Subordination Agreement for Refinancing: This agreement comes into play when a homeowner decides to refinance their mortgage to take advantage of lower interest rates or better terms. In such cases, the existing lender is required to agree to subordinate their mortgage to the new lender's lien. The subordination agreement ensures the new lender will become the primary lien holder, providing security for the refinancing transaction. The Newark New Jersey Agreement For Subordination of Mortgage typically includes the following elements: 1. Parties Involved: The agreement identifies the parties involved, including the property owner, the existing mortgage holder, and the new lender. 2. Property Information: The agreement provides a detailed description of the property, including its legal description, address, and any relevant identifying details. 3. Mortgage Details: The existing mortgage details, such as the mortgage holder's name, the outstanding balance, interest rate, and any other relevant terms, are stated. 4. Subordination Terms: The agreement outlines the terms of the subordination, specifying that the existing mortgage will take a lower priority in favor of the new loan or lien. This ensures that the new loan or lien will have primary priority in case of default or foreclosure. 5. Release of Funds: If applicable, the agreement may include provisions for the release of funds to the property owner or borrower, depending on the purpose of the subordination agreement. 6. Signatures and Notarization: The agreement requires the signatures of all parties involved, including notarization to make it legally enforceable. In Newark, New Jersey, the Agreement For Subordination of Mortgage is a crucial legal tool in ensuring smooth real estate transactions, particularly in cases involving home equity loans or refinancing. Planning, drafting, and executing this agreement with the necessary attention to detail are essential for the successful completion of such transactions while protecting all parties' interests.

Newark New Jersey Agreement For Subordination of Mortgage

Description

How to fill out Newark New Jersey Agreement For Subordination Of Mortgage?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Newark New Jersey Agreement For Subordination of Mortgage? US Legal Forms is your go-to choice.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Newark New Jersey Agreement For Subordination of Mortgage conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is good for.

- Start the search over in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Newark New Jersey Agreement For Subordination of Mortgage in any provided file format. You can get back to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal paperwork online once and for all.