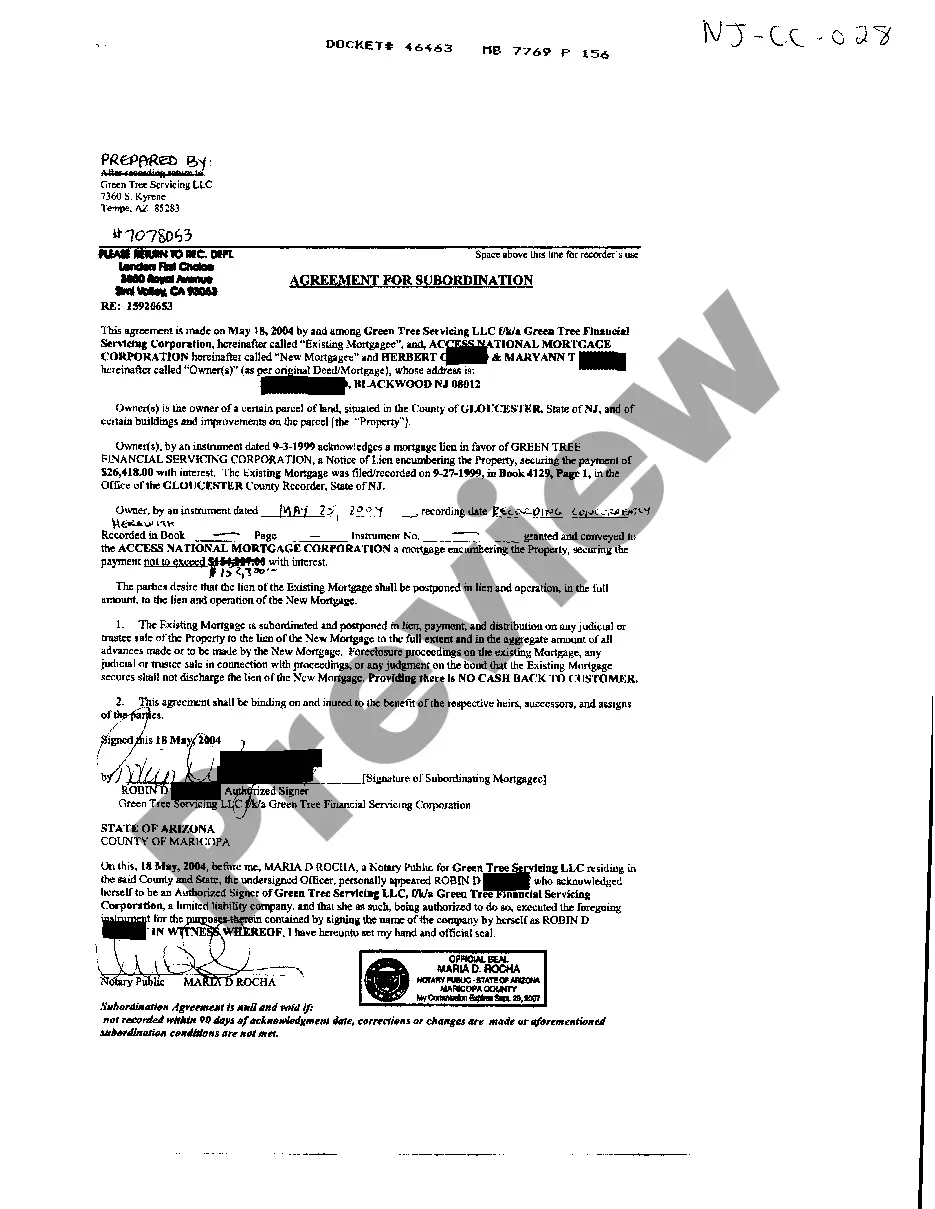

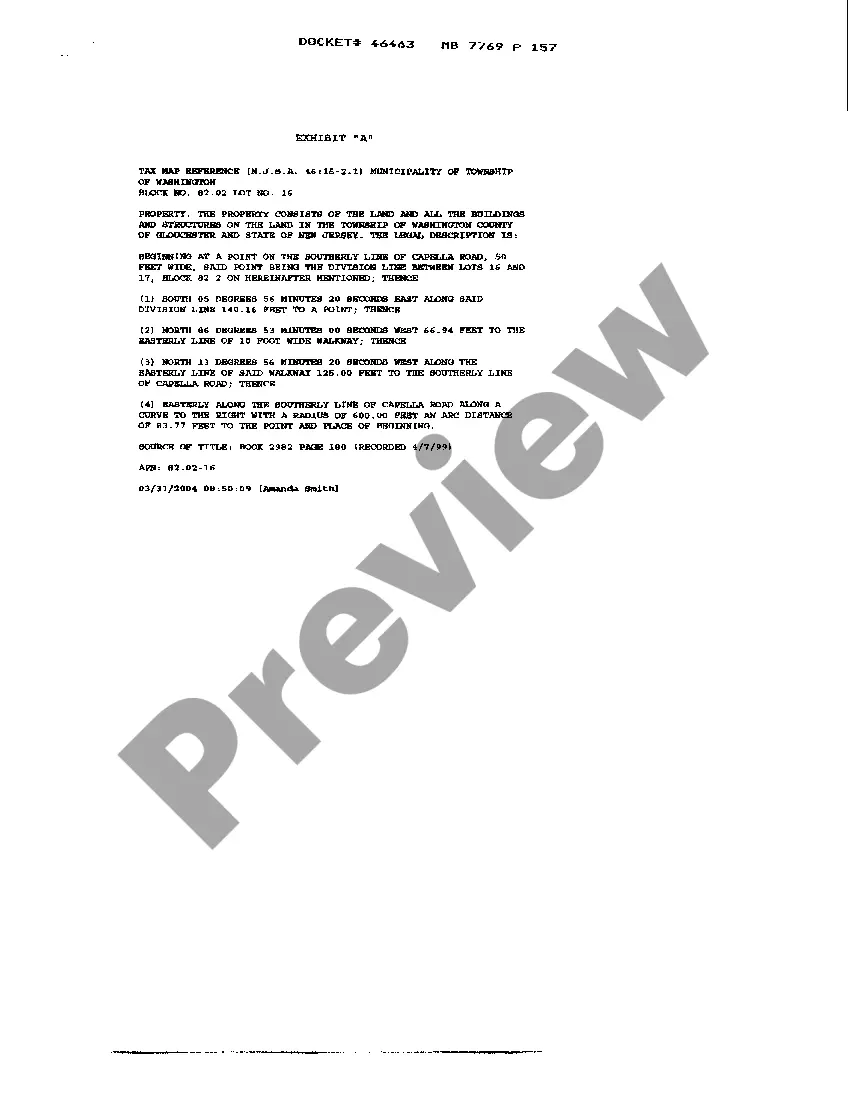

Title: Understanding the Paterson, New Jersey Agreement for Subordination of Mortgage Keywords: Paterson, New Jersey, agreement, subordination, mortgage, detailed description, types Introduction: The Paterson, New Jersey Agreement for Subordination of Mortgage is a legal document that outlines the terms and conditions of mortgage subordination. This agreement plays a vital role in real estate transactions and allows lenders to modify the priority of their lien on a property. Let's delve into the details of this agreement and explore its various types. Types of Paterson, New Jersey Agreement for Subordination of Mortgage: 1. General Subordination Agreement: This is the most commonly used type of subordination agreement in Paterson, New Jersey. It permits a subsequent lender to claim priority on a mortgage, effectively placing the original mortgage in a secondary position. 2. Specific Subordination Agreement: This type of agreement is employed when a specific circumstance necessitates subordination. It outlines the conditions under which the existing mortgage holder agrees to subordinate their lien, usually in favor of a subsequent lender. 3. Commercial Subordination Agreement: Primarily used in commercial real estate transactions, this agreement allows for the subordination of one mortgage to another, typically to secure additional funding for the property. It lays out the terms under which the lenders agree to modify their priority. 4. Residential Subordination Agreement: This agreement is specifically designed for residential properties in Paterson, New Jersey. Homeowners may utilize it to secure a second mortgage or home equity line of credit while keeping the existing mortgage intact. Key Elements of the Agreement: 1. Parties: The agreement identifies all parties involved, including the original mortgage holder, subsequent lenders, and property owners or occupants. 2. Description of Property: The agreement provides a legal description of the property involved, including the relevant address, lot number, and any necessary property identification details. 3. Terms and Conditions: It outlines the terms under which the existing mortgage holder agrees to subordinate their lien on the property in favor of the subsequent lender, such as loan interest rates, repayment terms, and actions taken in case of default. 4. Recording: The agreement specifies that it be recorded in the county land records to ensure its enforceability and transparency. 5. Signatures: All parties involved must sign the agreement voluntarily and with full understanding, acknowledging their consent to the terms and conditions. Conclusion: The Paterson, New Jersey Agreement for Subordination of Mortgage is an essential legal tool in the world of real estate transactions. Whether it be a general, specific, commercial, or residential subordination agreement, each serves different purposes to accommodate the needs of property owners and lenders. By understanding the intricacies of this agreement, individuals can navigate mortgage subordination processes with clarity and confidence.

Paterson New Jersey Agreement For Subordination of Mortgage

State:

New Jersey

City:

Paterson

Control #:

NJ-CC-028

Format:

PDF

Instant download

This form is available by subscription

Description

Agreement For Subordination of Mortgage

Title: Understanding the Paterson, New Jersey Agreement for Subordination of Mortgage Keywords: Paterson, New Jersey, agreement, subordination, mortgage, detailed description, types Introduction: The Paterson, New Jersey Agreement for Subordination of Mortgage is a legal document that outlines the terms and conditions of mortgage subordination. This agreement plays a vital role in real estate transactions and allows lenders to modify the priority of their lien on a property. Let's delve into the details of this agreement and explore its various types. Types of Paterson, New Jersey Agreement for Subordination of Mortgage: 1. General Subordination Agreement: This is the most commonly used type of subordination agreement in Paterson, New Jersey. It permits a subsequent lender to claim priority on a mortgage, effectively placing the original mortgage in a secondary position. 2. Specific Subordination Agreement: This type of agreement is employed when a specific circumstance necessitates subordination. It outlines the conditions under which the existing mortgage holder agrees to subordinate their lien, usually in favor of a subsequent lender. 3. Commercial Subordination Agreement: Primarily used in commercial real estate transactions, this agreement allows for the subordination of one mortgage to another, typically to secure additional funding for the property. It lays out the terms under which the lenders agree to modify their priority. 4. Residential Subordination Agreement: This agreement is specifically designed for residential properties in Paterson, New Jersey. Homeowners may utilize it to secure a second mortgage or home equity line of credit while keeping the existing mortgage intact. Key Elements of the Agreement: 1. Parties: The agreement identifies all parties involved, including the original mortgage holder, subsequent lenders, and property owners or occupants. 2. Description of Property: The agreement provides a legal description of the property involved, including the relevant address, lot number, and any necessary property identification details. 3. Terms and Conditions: It outlines the terms under which the existing mortgage holder agrees to subordinate their lien on the property in favor of the subsequent lender, such as loan interest rates, repayment terms, and actions taken in case of default. 4. Recording: The agreement specifies that it be recorded in the county land records to ensure its enforceability and transparency. 5. Signatures: All parties involved must sign the agreement voluntarily and with full understanding, acknowledging their consent to the terms and conditions. Conclusion: The Paterson, New Jersey Agreement for Subordination of Mortgage is an essential legal tool in the world of real estate transactions. Whether it be a general, specific, commercial, or residential subordination agreement, each serves different purposes to accommodate the needs of property owners and lenders. By understanding the intricacies of this agreement, individuals can navigate mortgage subordination processes with clarity and confidence.

Free preview

How to fill out Paterson New Jersey Agreement For Subordination Of Mortgage?

If you’ve already utilized our service before, log in to your account and save the Paterson New Jersey Agreement For Subordination of Mortgage on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Paterson New Jersey Agreement For Subordination of Mortgage. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!