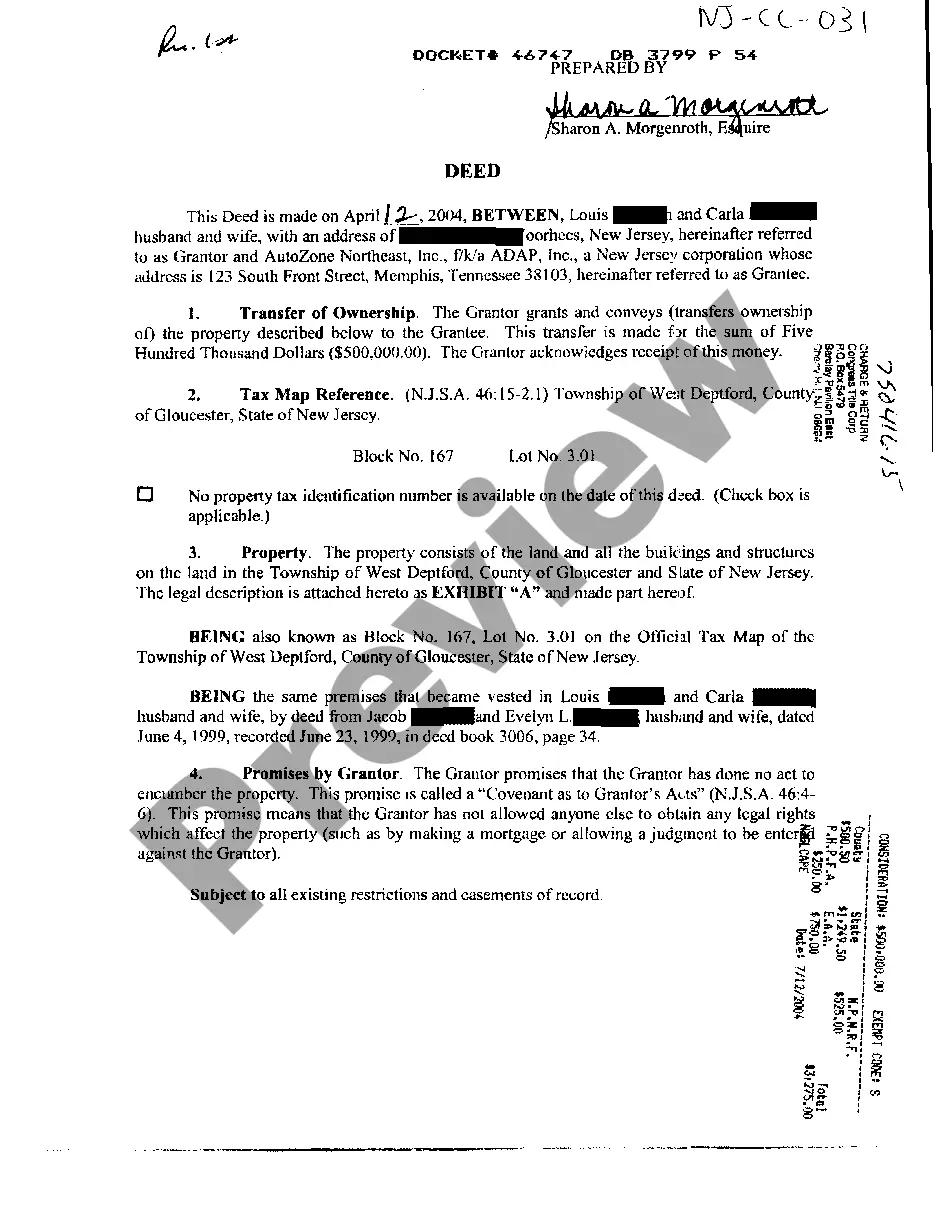

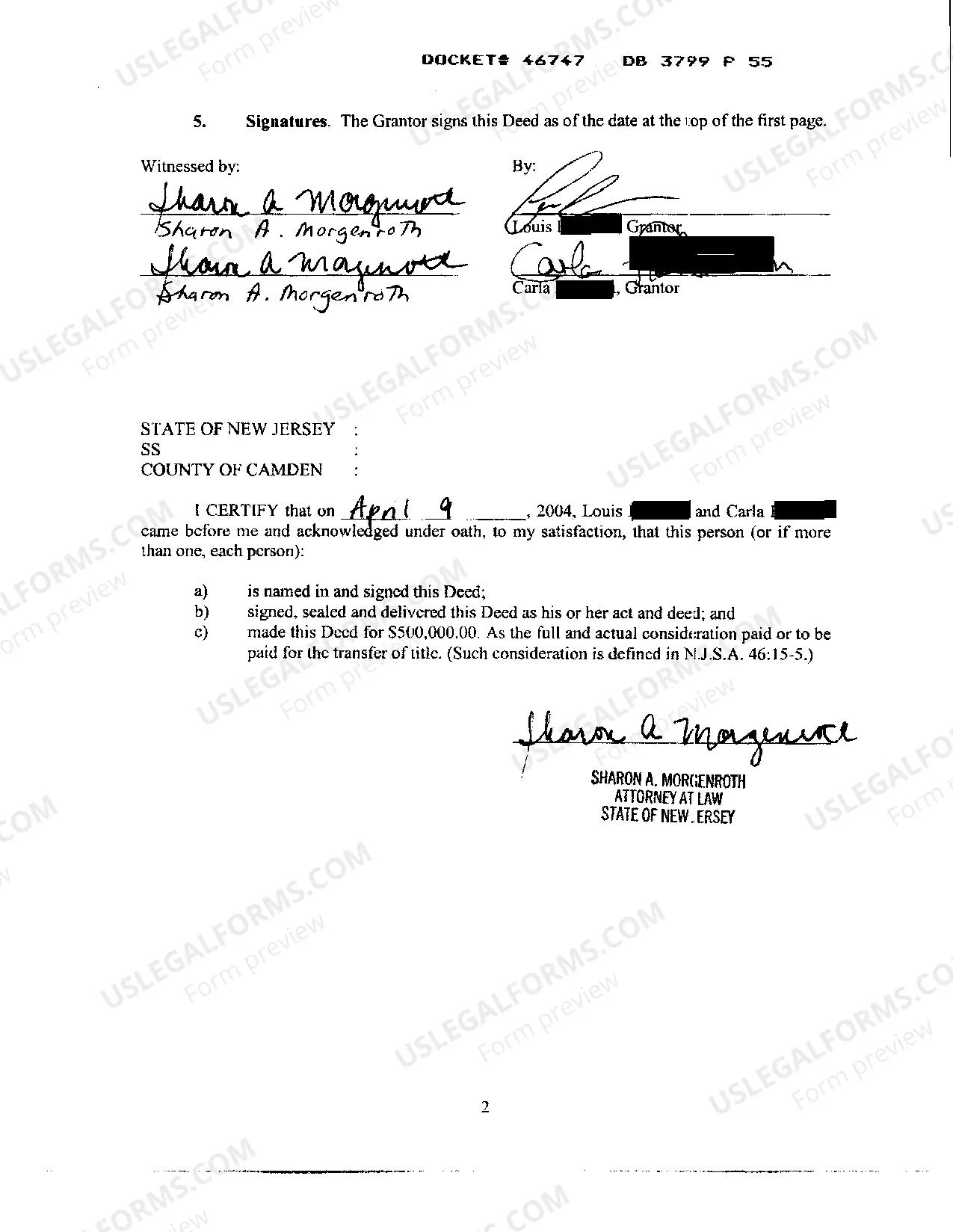

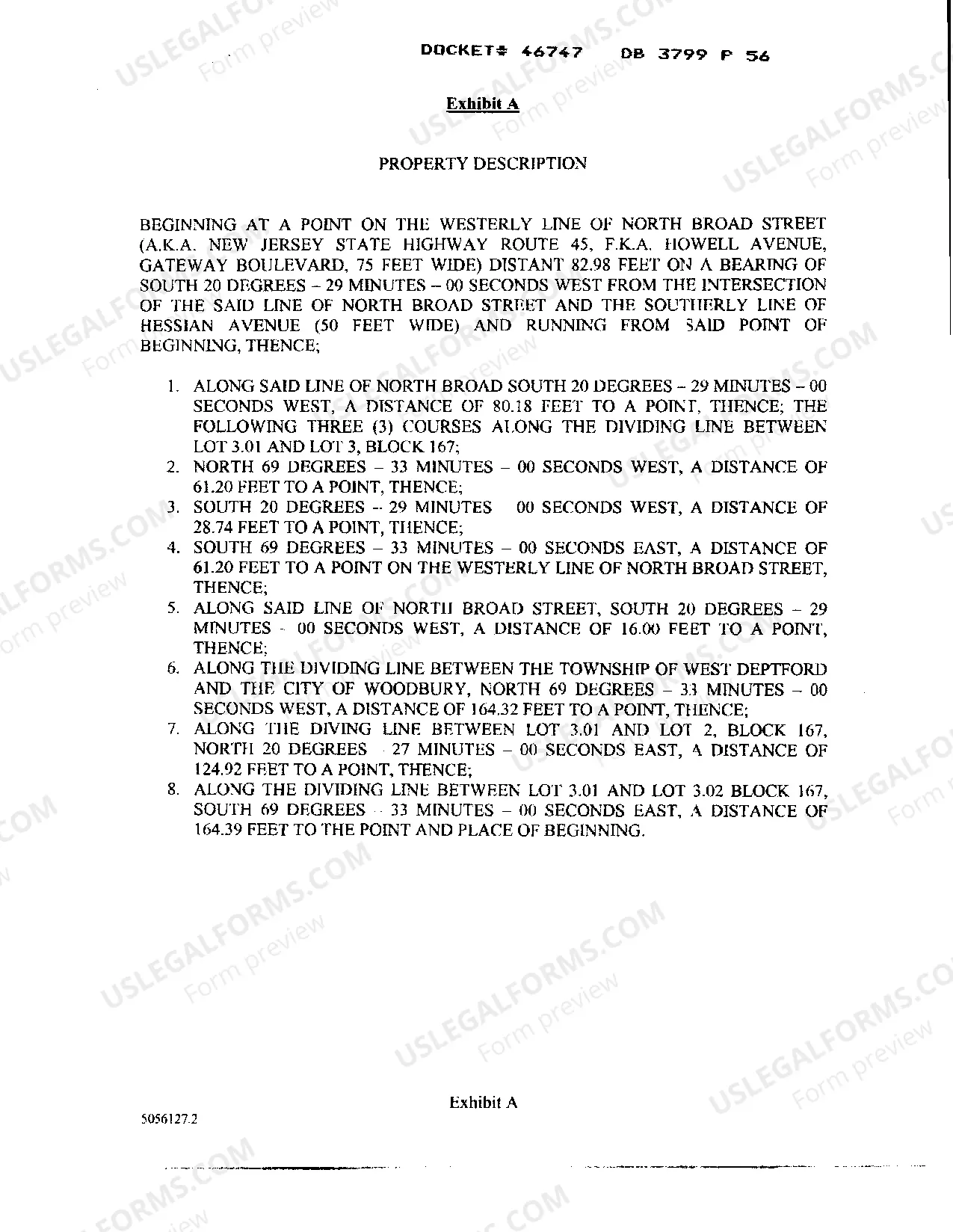

A Paterson New Jersey Deed Between Married Couple and Corporation refers to a legal document that establishes the transfer of property ownership from a married couple to a corporation in Paterson, New Jersey. This type of deed is commonly used when a couple wishes to transfer ownership of a property they own jointly to a corporation they either own or are affiliated with. There are several subtypes or variations of Paterson New Jersey Deeds Between Married Couple and Corporation, each serving a specific purpose. These include: 1. General Warranty Deed: This is a commonly used deed that provides the highest level of protection to the corporation acquiring the property. It guarantees that the married couple legally owns the property, and that there are no undisclosed encumbrances or claims against it. 2. Special Warranty Deed: This type of deed also assures the corporation that the married couple holds legal ownership of the property, but with a limited warranty. It means that the couple guarantees against any encumbrances or claims only during their period of ownership, and not before. 3. Quitclaim Deed: Unlike the warranty deeds mentioned above, a quitclaim deed does not provide any warranties or guarantees to the corporation. It simply transfers any ownership rights the married couple has in the property to the corporation, without making any claims about the property's title or history. 4. Grant Deed: This type of deed transfers the property from the married couple to the corporation and guarantees that the couple has not transferred or encumbered the property to anyone else. However, it does not protect against any claims that may arise from previous owners. A Paterson New Jersey Deed Between Married Couple and Corporation typically includes vital information such as the names and addresses of the married couple and the corporation, a legal description of the property being transferred, the purchase price or consideration amount, and any specific provisions or agreements related to the transfer. It is important to consult with a qualified attorney or real estate professional when drafting or executing a Paterson New Jersey Deed Between Married Couple and Corporation to ensure compliance with local laws and regulations.

Paterson New Jersey Deed Between Married Couple and Corporation

Description

How to fill out Paterson New Jersey Deed Between Married Couple And Corporation?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Paterson New Jersey Deed Between Married Couple and Corporation gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Paterson New Jersey Deed Between Married Couple and Corporation takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Paterson New Jersey Deed Between Married Couple and Corporation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

To obtain a copy of a deed in Passaic County, NJ, you can visit the county clerk's office or their website. You will need to provide details about the property, such as its address or the names involved in the transaction, especially when it concerns a Paterson New Jersey Deed Between Married Couple and Corporation. Additionally, you can also explore platforms like US Legal Forms, which can streamline the process and provide access to important legal documents efficiently. By using these resources, you ensure you have the necessary information readily available for your legal needs.

Yes, you can transfer a deed without an attorney in New Jersey, including a Paterson New Jersey Deed Between Married Couple and Corporation. However, if you choose to do so, make sure to follow all legal requirements closely. Use reputable online resources or forms, like those offered by US Legal Forms, to guide you through the process. Proper documentation and filing are crucial for a successful transfer.

The cheapest way to transfer a deed often involves handling the process on your own without hiring a lawyer. You can find templates and guidelines online to assist with a Paterson New Jersey Deed Between Married Couple and Corporation. Additionally, consider filing the deed directly with the county office to avoid service fees. Just be cautious and ensure all forms are properly filled out to avoid complications.

While it is not mandatory to hire a lawyer for a deed transfer, having legal assistance can be beneficial. A lawyer can help you navigate complex scenarios, such as those involving a Paterson New Jersey Deed Between Married Couple and Corporation. They can also ensure all legal terms and obligations are accurately addressed. If you prefer a DIY approach, be sure to use verified resources for guidance.

To add a spouse to a deed in New Jersey, first, prepare a new deed that includes both names. This type of transaction is often referred to as a Paterson New Jersey Deed Between Married Couple and Corporation, which simplifies the process of adding a spouse. Next, have the new deed notarized and then file it with the county clerk. Always double-check local regulations to ensure compliance.

In New Jersey, you are not required to hire a lawyer to transfer a deed. However, working with an attorney familiar with the Paterson New Jersey Deed Between Married Couple and Corporation can help avoid complications. A knowledgeable lawyer can ensure all paperwork is correctly completed and submitted, which can save you time and stress. Consider using platforms like US Legal Forms for templates and guidance.

Marital property in New Jersey includes all assets acquired during the marriage, regardless of whose name is on the title. This includes real estate, income, and retirement accounts. It’s crucial for couples to be informed about how a Paterson New Jersey Deed Between Married Couple and Corporation might impact their division of assets in case of a divorce or death.

The best deed for a married couple typically depends on their specific circumstances and goals. Joint tenancy with rights of survivorship is often recommended, as it allows a seamless transfer of property upon death and avoids probate. Understanding deeds in relation to a Paterson New Jersey Deed Between Married Couple and Corporation can assist couples in making informed decisions.

If you are married and your name is not on the deed, you may still have a significant claim to the property, depending on various factors like how the property was acquired. New Jersey offers protections to spouses, ensuring they cannot be easily excluded from ownership. To navigate this situation effectively, consider addressing your concerns through a consultation focused on the Paterson New Jersey Deed Between Married Couple and Corporation.

If your name is not on the deed in New Jersey, you might still possess legal rights as a spouse or dependent. The absence of your name does not eliminate your entitlement to property acquired during the marriage. Discussing your situation with a legal professional can provide clarity on your entitlements regarding the Paterson New Jersey Deed Between Married Couple and Corporation.