Jersey City, located in New Jersey, offers various types of mortgage modifications designed to assist homeowners facing financial challenges. A mortgage modification is a process by which the terms of an existing mortgage loan are modified to make it more affordable for the borrower. This can help homeowners avoid foreclosure and keep their homes. One type of mortgage modification available in Jersey City is a loan modification. A loan modification involves changing the terms of the loan, such as the interest rate, loan term, or monthly payment, to make it more manageable for the homeowner. It aims to provide a long-term solution for homeowners struggling to meet their mortgage obligations. Another type of mortgage modification available in Jersey City is a principal reduction. In this type of modification, the outstanding loan balance is reduced, often due to the decline in the property's value. A principal reduction can help homeowners who owe more on their mortgages than their homes are worth. Jersey City also offers a government-backed mortgage modification program called the Home Affordable Modification Program (CAMP). CAMP provides eligible homeowners with financial assistance to modify their mortgages and make them more affordable. It includes measures such as interest rate reductions, term extensions, and principal forbearance. Additionally, there are temporary mortgage modifications available in Jersey City, such as forbearance agreements. A forbearance agreement allows homeowners facing temporary financial hardships to pause or reduce their mortgage payments for a specific period. This can provide short-term relief during times of financial difficulty. Mortgage modifications in Jersey City aim to assist homeowners who are struggling to make their mortgage payments and avoid foreclosure. These modifications are designed to provide borrowers with more manageable loan terms and affordable monthly payments, allowing them to keep their homes and regain financial stability. In summary, Jersey City, New Jersey, offers various types of mortgage modifications including loan modifications, principal reduction, government-backed programs like CAMP, and temporary solutions like forbearance agreements. These modifications aim to help homeowners facing financial challenges to stay in their homes and overcome their mortgage difficulties.

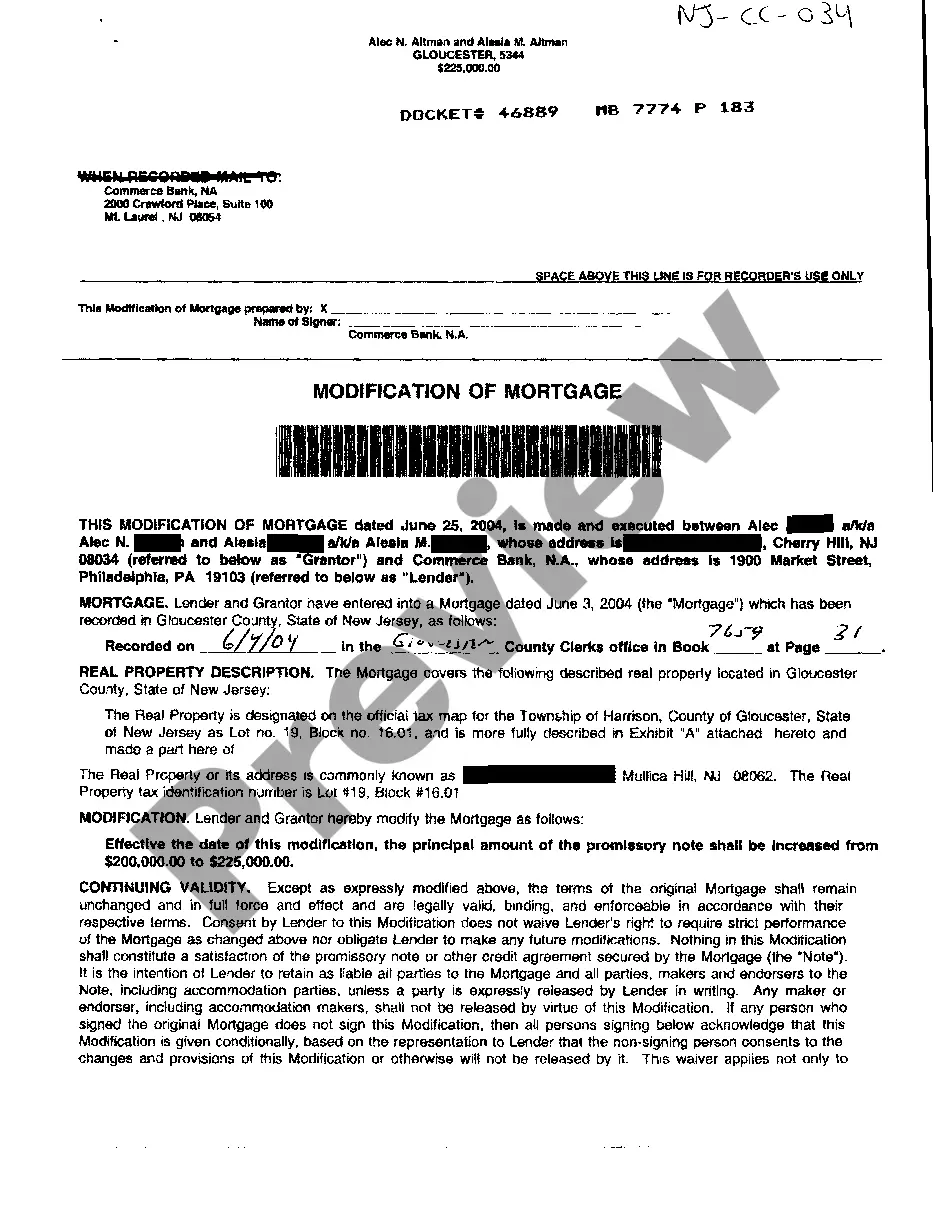

Jersey City New Jersey Modification Of Mortgage

Description

How to fill out New Jersey Modification Of Mortgage?

Irrespective of societal or occupational rank, completing legal-related paperwork is a regrettable requirement in the present-day era.

Frequently, it’s nearly impossible for an individual lacking any legal education to compose these types of documents from the ground up, primarily due to the intricate terminology and legal nuances they comprise.

At this point, US Legal Forms steps in to assist.

Verify that the template you have selected is tailored to your locality since the laws of one state or region do not apply to another.

You’re all set! You can now proceed to print the document or fill it out online. If you encounter any issues retrieving your purchased documents, you can conveniently find them in the My documents section.

- Our offering includes an extensive repository with over 85,000 ready-to-utilize state-specific forms suitable for nearly any legal situation.

- US Legal Forms also functions as an excellent resource for associates or legal advisors who aim to conserve time by employing our DIY templates.

- Whether you need the Jersey City New Jersey Modification Of Mortgage or another document that is recognized in your state or region, with US Legal Forms, everything is readily accessible.

- Here’s how to obtain the Jersey City New Jersey Modification Of Mortgage in moments using our reliable service.

- If you are an existing user, you can proceed to Log In to your account to download the relevant form.

- However, if you are a newcomer to our site, please ensure to follow these instructions before downloading the Jersey City New Jersey Modification Of Mortgage.

Form popularity

FAQ

Yes, you can modify a house with a mortgage, especially through options available in Jersey City, New Jersey. Modifying your mortgage allows you to either change payment terms or access additional funds for renovations and repairs. Each modification has specific qualifications and requirements, so it's important to communicate openly with your lender. Again, utilizing platforms such as USLegalForms can provide the clarity and guidance needed during the modification process.

Yes, you can use your mortgage for home improvements in Jersey City, especially if you are pursuing a mortgage modification. Many lenders allow you to tap into your home equity or finance improvements as part of the modification process. This approach not only boosts your home’s value but also enhances your living experience. Consult your lender to explore various options for financing your home improvements effectively.

To qualify for a mortgage modification in Jersey City, New Jersey, you typically need to demonstrate financial hardship. This can include loss of income, high medical expenses, or significant changes to your financial situation. Lenders will review your income, expenses, and any other financial documents to ascertain your ability to make modified payments. Additionally, reaching out to tools like USLegalForms can provide useful guidance throughout the qualification process.

Yes, you can include upgrades in a mortgage, especially during the Jersey City New Jersey Modification Of Mortgage process. Lenders often allow homeowners to finance renovations if the upgrades enhance the home's value. Discussing your plans with your lender can help you understand the options available to you. Make sure to clearly outline your intended upgrades to ensure they are accounted for in the modified mortgage.

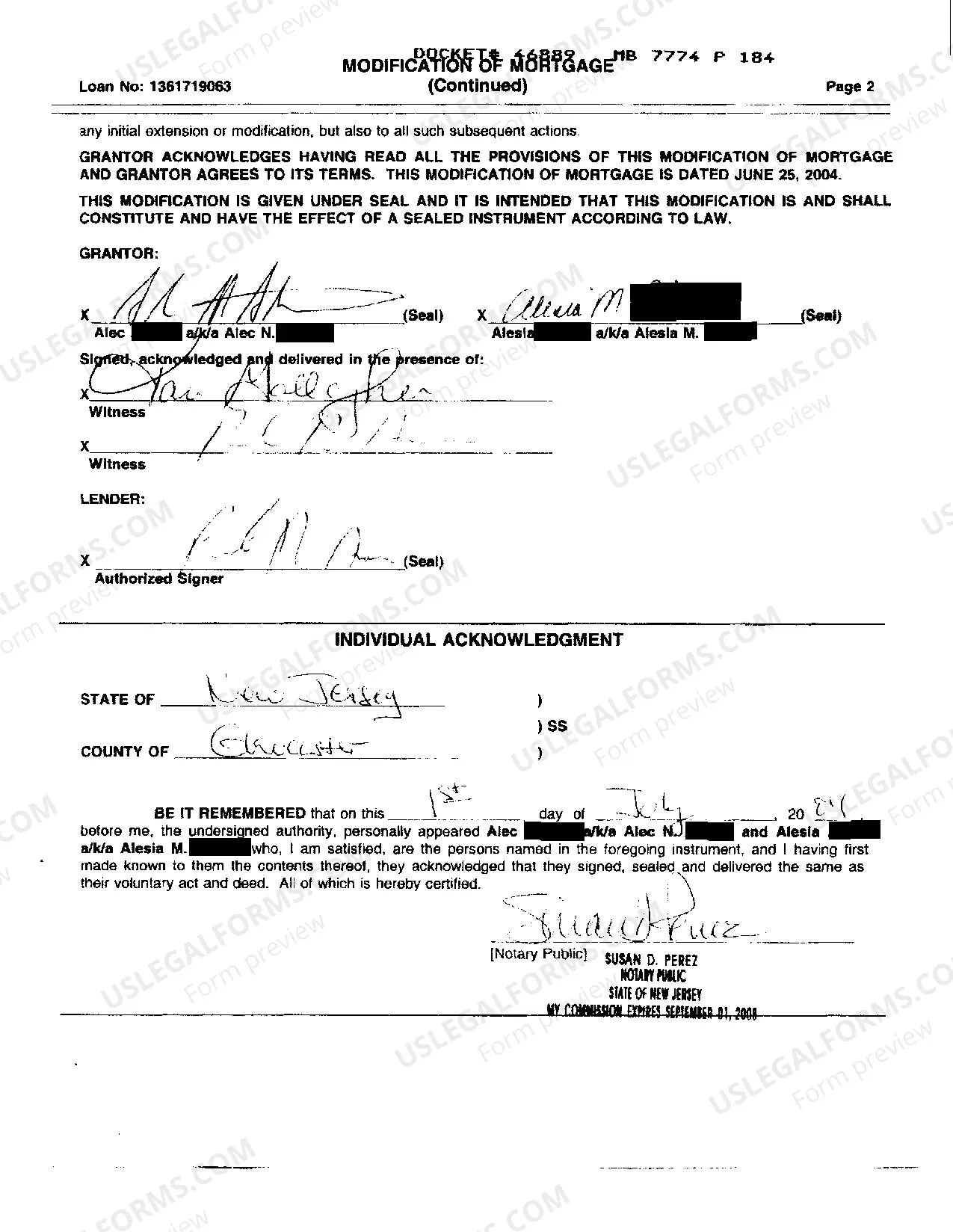

Yes, a mortgage modification typically needs to be recorded to protect your rights. When you modify your mortgage in Jersey City, New Jersey, you create a legal record of the changes. Recording the modification ensures that future buyers or lenders are aware of the updated terms. This is an important step in securing your investment and maintaining clarity in your financial commitments.

Homeowners should consider requesting a Jersey City New Jersey Modification Of Mortgage as soon as they face difficulties in making their payments. Early communication with your lender can demonstrate your willingness to resolve the situation. Waiting too long can lead to missed payments and potential foreclosure. If you notice a significant financial change, take action sooner rather than later.

The approval timeline for a Jersey City New Jersey Modification Of Mortgage can vary, but it usually takes 30 to 90 days. Some factors that influence this timeline include the lender's workload and the complexity of your case. To expedite the process, ensure that you provide all required documentation accurately and promptly. Staying in constant communication with your lender is also beneficial.

Qualifying for a Jersey City New Jersey Modification Of Mortgage typically depends on your current financial status. Lenders will consider factors like your income, expenses, and payment history. It’s important to demonstrate that you are experiencing financial hardship and need assistance. Preparing your financial documents ahead of time can strengthen your application.

To get a Jersey City New Jersey Modification Of Mortgage, start by contacting your lender. They will guide you through the application process and provide the necessary forms. You will need to submit documents that support your financial situation. Additionally, using services like uslegalforms can simplify the paperwork and ensure you follow the correct procedures.