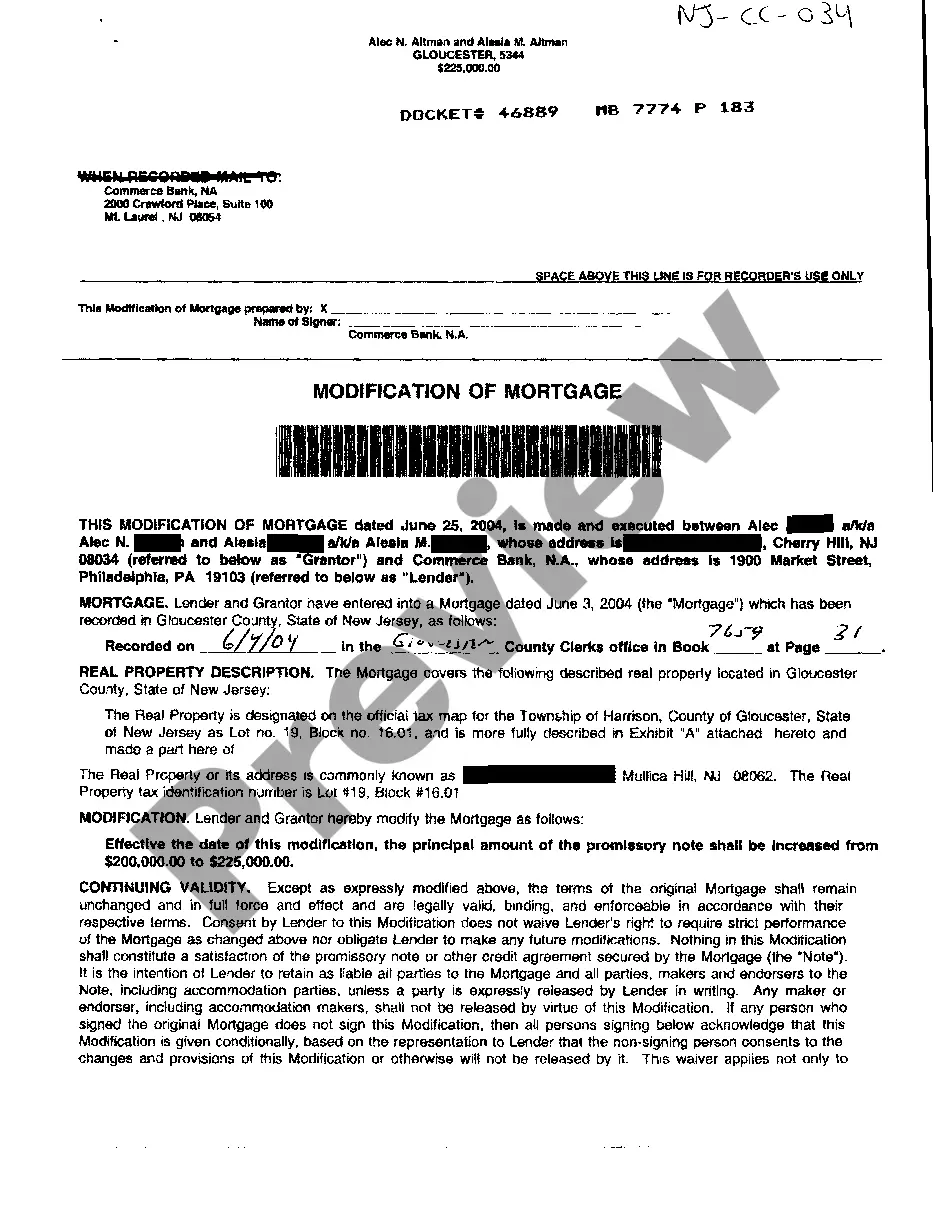

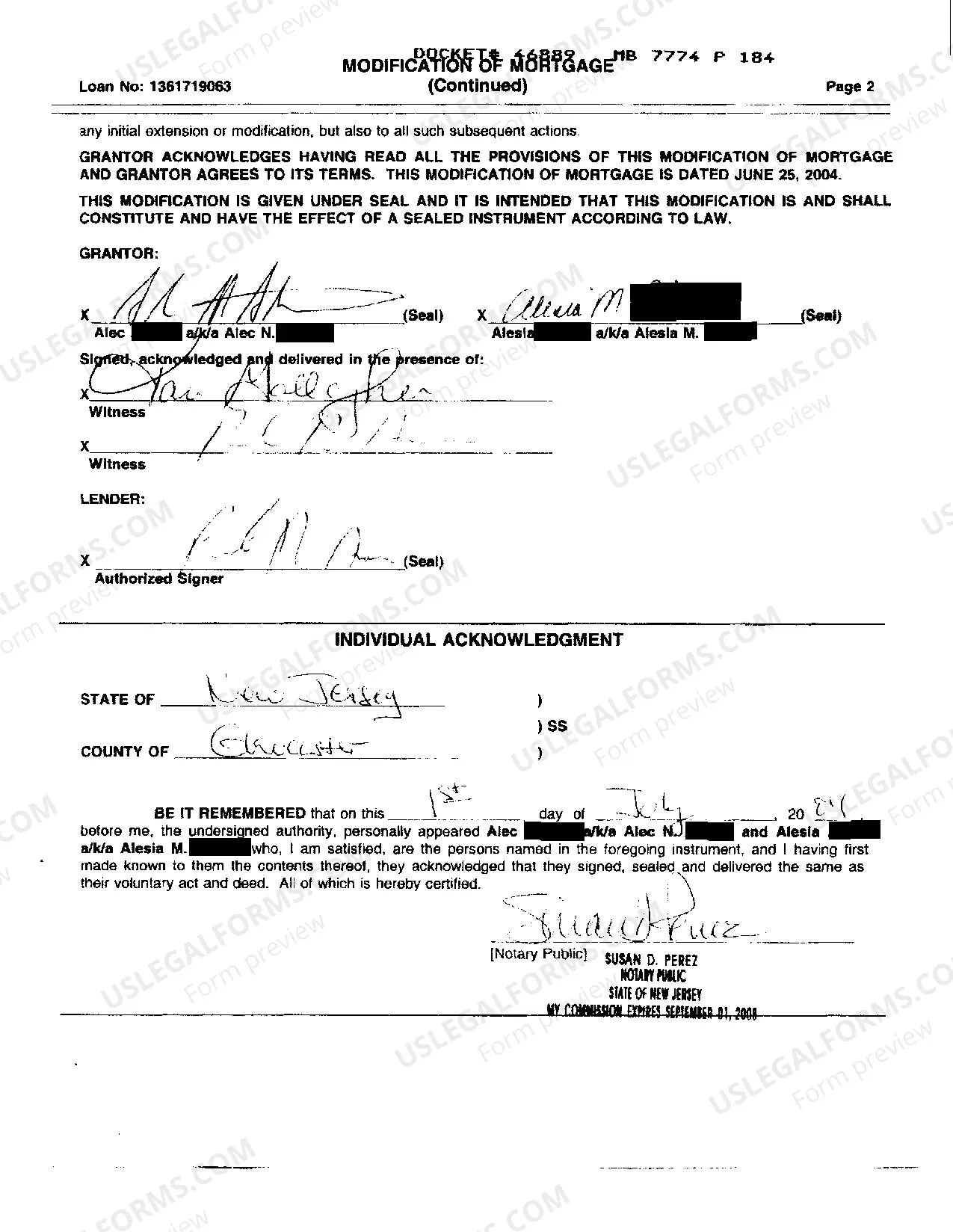

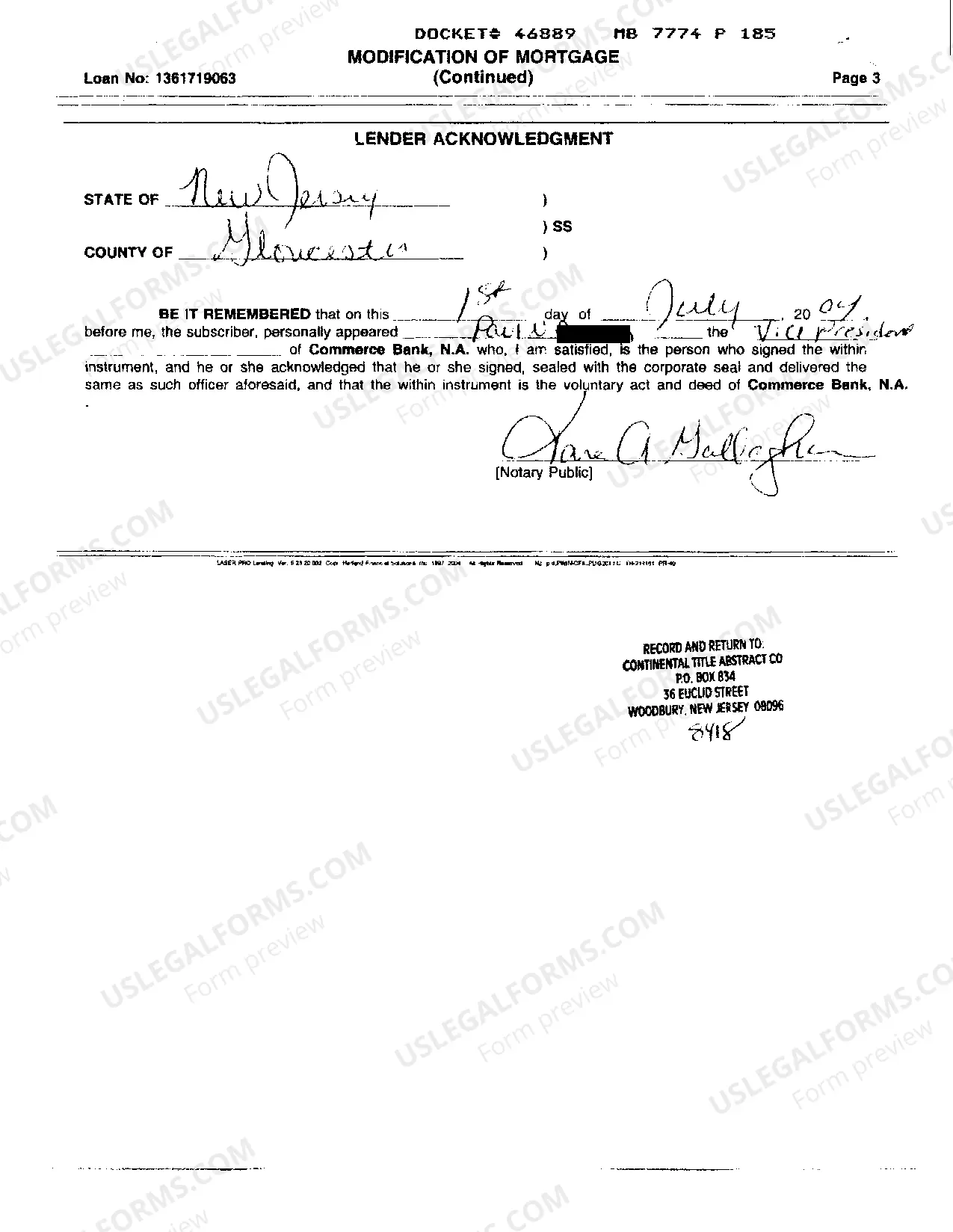

Newark, New Jersey Modification of Mortgage is a legal process that allows homeowners in Newark to make changes to the terms of their existing mortgage to alleviate financial hardship and avoid foreclosure. This modification program aims to provide viable options for homeowners who are struggling to meet their mortgage payments in Newark, New Jersey. The Newark New Jersey Modification of Mortgage program offers several types of modifications tailored to suit the unique requirements of homeowners. These modifications include: 1. Interest Rate Reduction: This type of modification involves lowering the interest rate on the mortgage loan, which can result in reduced monthly payments for the homeowner. It is particularly helpful for individuals facing financial difficulties due to high interest rates. 2. Principal Reduction: In some cases, homeowners may be eligible for a reduction in the principal balance or the total amount owed on the mortgage. This modification can help homeowners who owe more on their mortgage than the current market value of their property. 3. Term Extension: This modification involves extending the term or duration of the loan, which can result in reduced monthly payments. It is suitable for homeowners who need a more affordable monthly payment by spreading out the remaining balance over a longer period. 4. Forbearance Agreement: A forbearance agreement allows homeowners to temporarily suspend or reduce their mortgage payments for a specific period. This is beneficial for homeowners facing temporary financial hardships, such as job loss or medical emergencies. 5. Loan Refinancing: Refinancing involves obtaining a new mortgage with better terms to replace the existing one. It can help homeowners secure a lower interest rate or change from an adjustable-rate mortgage to a fixed-rate mortgage, resulting in lower monthly payments. To qualify for a Newark New Jersey Modification of Mortgage, homeowners typically need to demonstrate financial hardship and an inability to make their current mortgage payments. Homeowners may be required to provide proof of income, expenses, and other documentation to support their application. Overall, the Newark New Jersey Modification of Mortgage program aims to provide homeowners in Newark with alternatives to foreclosure and help them regain financial stability by tailoring their mortgage terms to better suit their current financial situation.

Newark New Jersey Modification Of Mortgage

Description

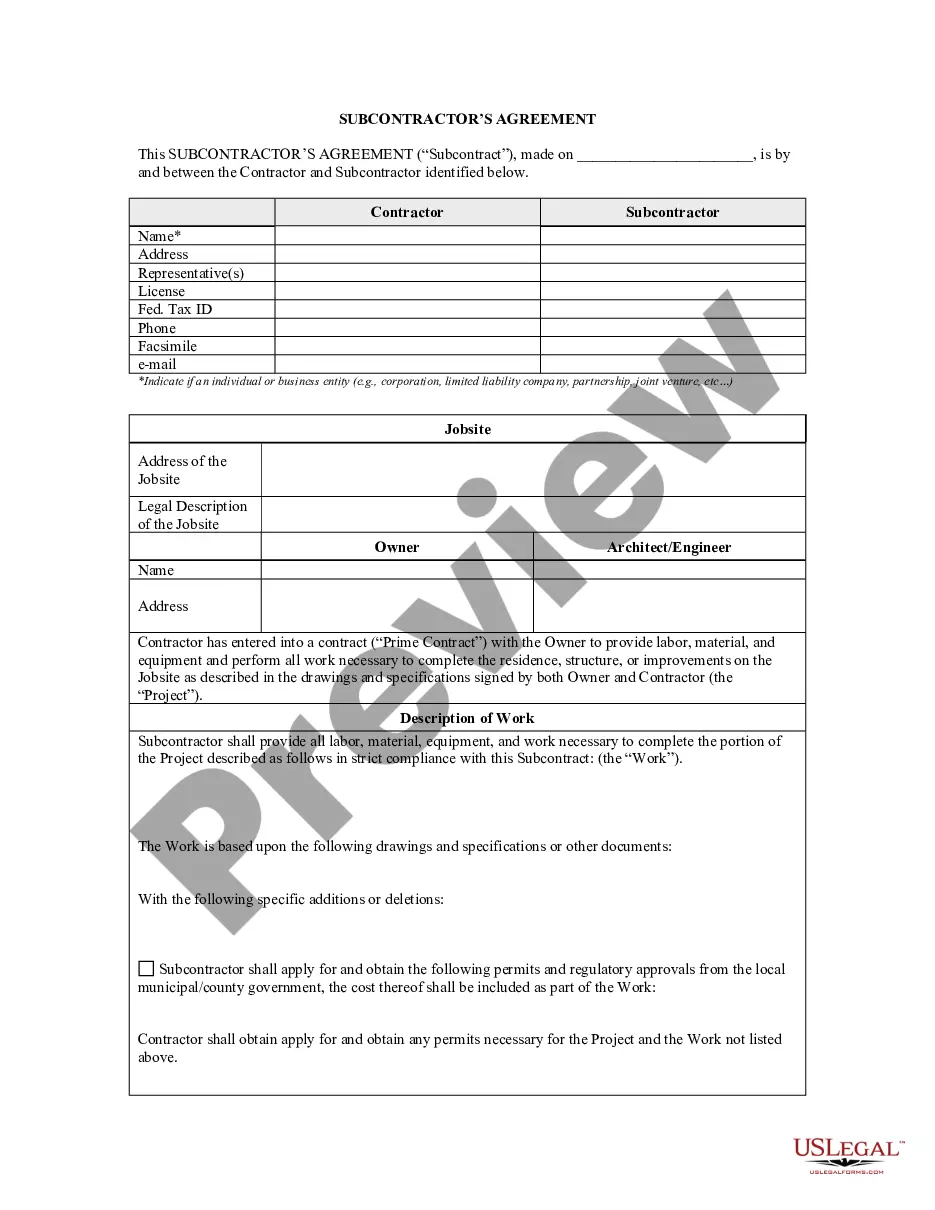

How to fill out Newark New Jersey Modification Of Mortgage?

If you are looking for a valid form template, it’s extremely hard to find a more convenient service than the US Legal Forms site – probably the most considerable online libraries. Here you can get thousands of document samples for organization and personal purposes by types and states, or key phrases. With our advanced search function, getting the latest Newark New Jersey Modification Of Mortgage is as easy as 1-2-3. Furthermore, the relevance of each record is verified by a group of skilled lawyers that on a regular basis check the templates on our platform and update them according to the newest state and county regulations.

If you already know about our system and have a registered account, all you need to receive the Newark New Jersey Modification Of Mortgage is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have found the sample you need. Look at its information and make use of the Preview function (if available) to check its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to find the needed file.

- Affirm your selection. Click the Buy now button. Following that, pick your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Newark New Jersey Modification Of Mortgage.

Every single form you save in your account has no expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to receive an additional copy for editing or creating a hard copy, you can return and download it once again whenever you want.

Take advantage of the US Legal Forms professional catalogue to get access to the Newark New Jersey Modification Of Mortgage you were seeking and thousands of other professional and state-specific templates on a single website!