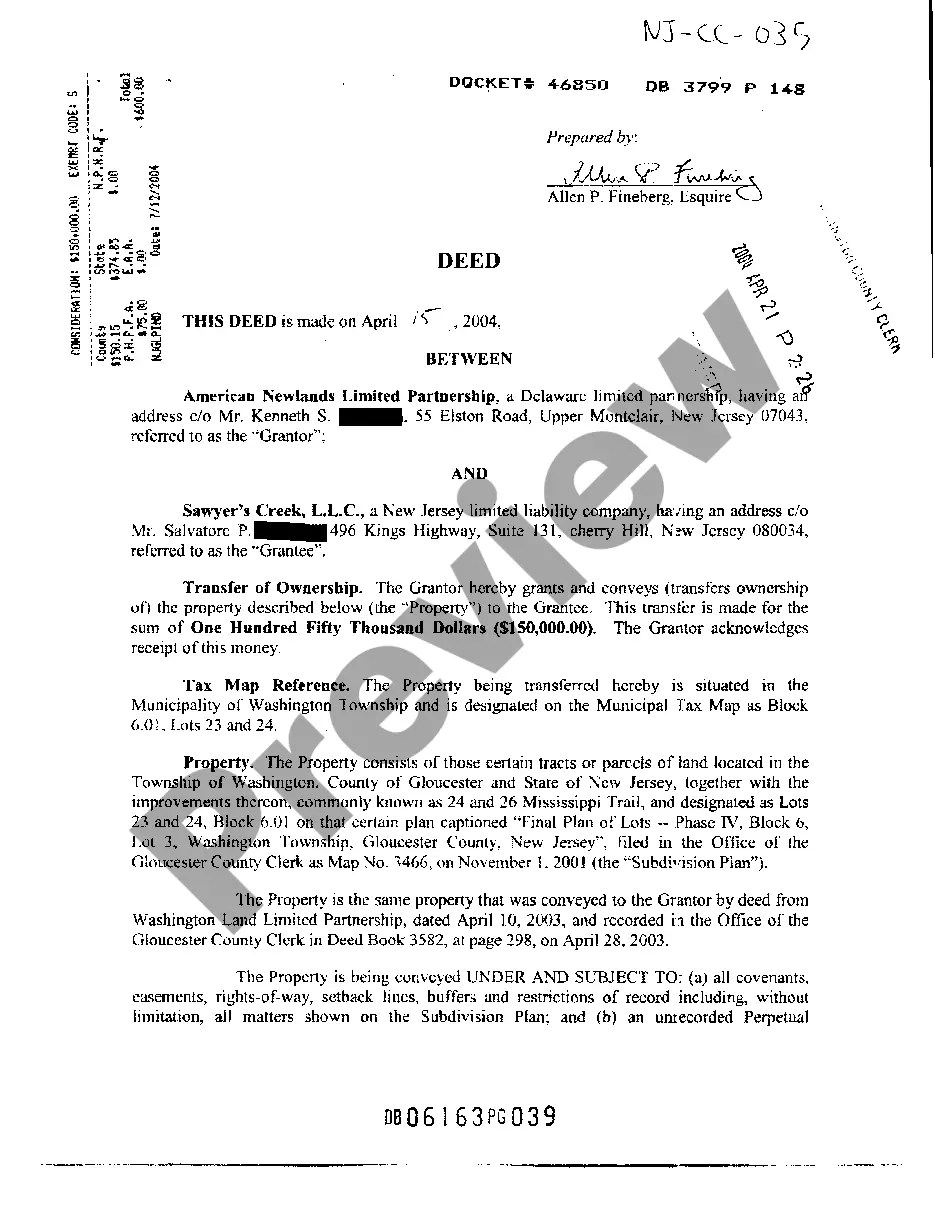

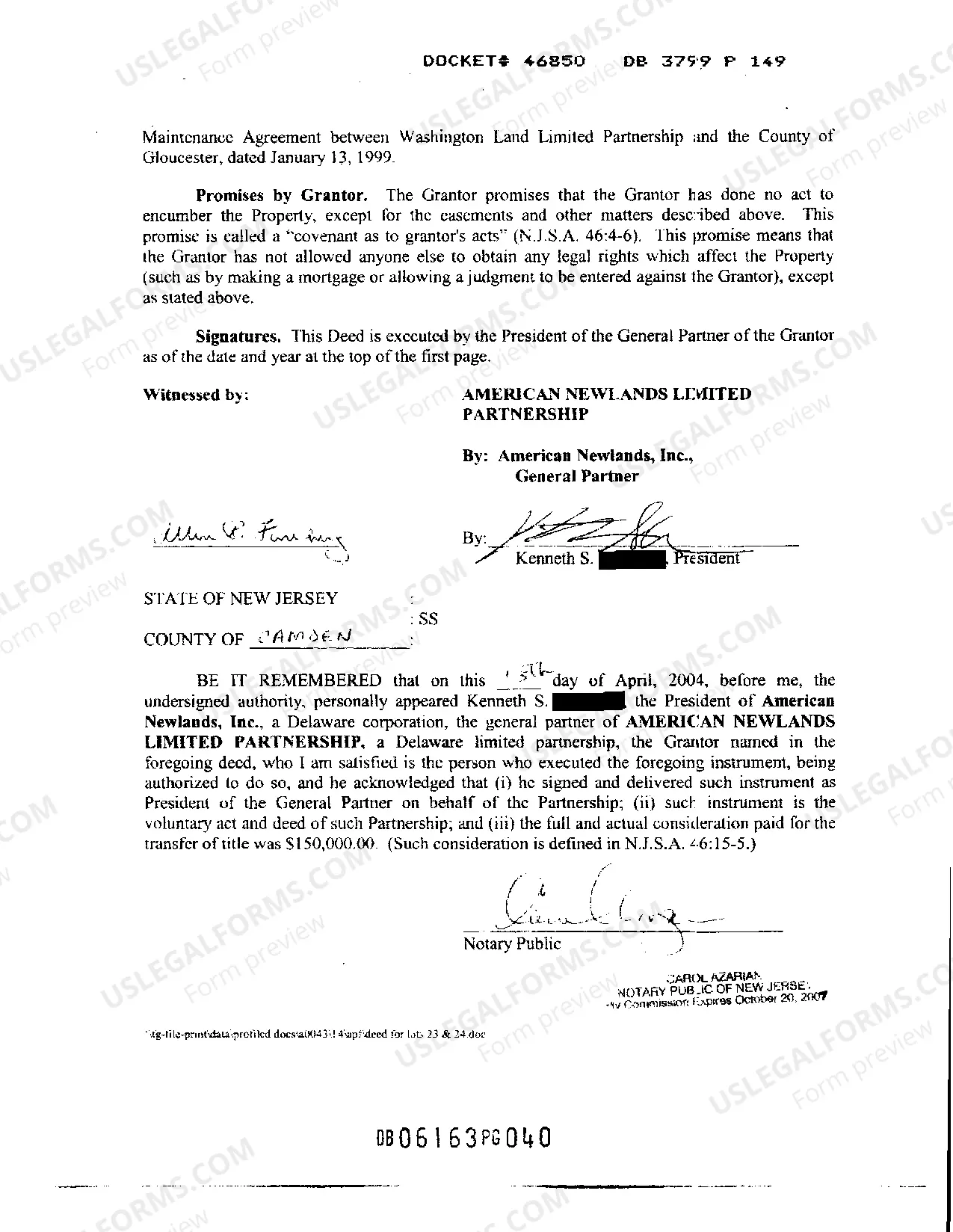

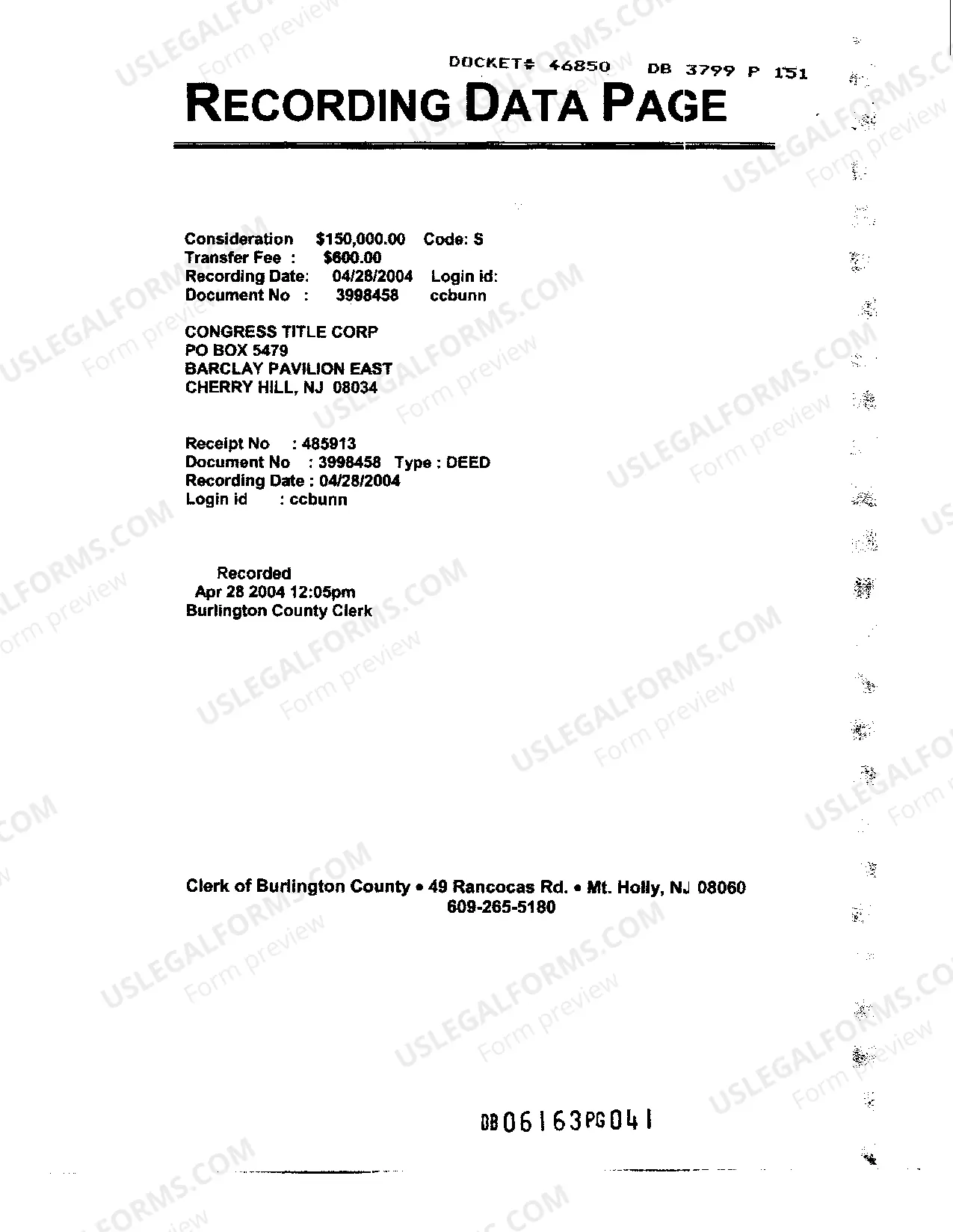

Title: Elizabeth, New Jersey Deed Between Limited Partnership and LLC Explained — Types, Process, and Key Considerations Introduction: In the real estate industry, the transfer of property ownership often involves legal agreements such as deeds. Elizabeth, New Jersey, a vibrant city in Union County, often witnesses such transactions. Specifically, when a Limited Partnership (LP) and Limited Liability Company (LLC) are party to a property transfer, a specialized deed is used. This article will delve into the intricacies of Elizabeth, New Jersey Deed Between Limited Partnership and LLC, exploring its types, process, and highlighting vital considerations. Types of Elizabeth New Jersey Deed Between Limited Partnership and LLC: 1. General Warranty Deed: A General Warranty Deed conveys the property ownership from a limited partnership to an LLC. It guarantees that the property is free from any encumbrances or defects in title, offering the highest level of protection to the purchaser. 2. Special Warranty Deed: Under a Special Warranty Deed, the limited partnership transfers the property interest to the LLC. However, it only warrants against any title defects or encumbrances that may have arisen during the limited partnership's ownership, and not before. 3. Quitclaim Deed: A Quitclaim Deed releases the limited partnership's interest in a property, allowing it to be transferred to the LLC without making any warranties or guarantees. It provides the least level of protection to the LLC and is often used in certain situations, such as inter-entity transfers within a related group of companies. The Process of Elizabeth New Jersey Deed Between Limited Partnership and LLC: 1. Agreement and Due Diligence: The limited partnership and LLC should first agree on the terms of the property transfer, including the type of deed to be used. Both parties should thoroughly conduct due diligence to ensure a clear title and an equitable transaction. 2. Preparation of the Deed: The limited partnership's legal representative prepares the deed, including a concise legal description of the property, the names of the parties involved, and the transfer terms. The document must adhere to the legal requirements of Elizabeth, New Jersey. 3. Execution of the Deed: The limited partnership, represented by its general partner, executes the deed by signing it in the presence of a notary public. The deed is then delivered to the LLC. 4. Recording the Deed: To make the transfer official, the completed deed must be recorded with the Union County Registrar's Office. This action ensures transparency and provides public notice of the property transfer. Key Considerations for Parties Involved: 1. Legal Consultation: Engaging legal professionals well-versed in New Jersey real estate law is crucial for both the limited partnership and the LLC to protect their interests during the Deed transfer. 2. Tax Implications: The limited partnership and LLC should consider the potential tax consequences associated with the property transfer, such as capital gains taxes or transfer taxes. 3. Financing and Liens: The LLC must be aware of any existing liens, mortgages, or financing obligations tied to the property being conveyed by the limited partnership. Any reciprocal agreements or financial arrangements between the entities should be addressed appropriately. 4. Compliance with Local Regulations: Adhering to the specific rules and regulations governing property transfers in Elizabeth, New Jersey, is vital to avoid legal complications or challenges in the future. Conclusion: The Elizabeth, New Jersey Deed Between a Limited Partnership and LLC plays a crucial role in transferring property ownership rights. Understanding the different types of deeds, the associated process, and key considerations is essential for both parties involved. By following the appropriate legal procedures, consulting professionals, and conducting due diligence, the limited partnership and LLC can execute a seamless and legally compliant property transfer in Elizabeth, New Jersey.

Elizabeth New Jersey Deed Between Limited Partnership and LLC

Description

How to fill out Elizabeth New Jersey Deed Between Limited Partnership And LLC?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, usually, are extremely expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Elizabeth New Jersey Deed Between Limited Partnership and LLC or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Elizabeth New Jersey Deed Between Limited Partnership and LLC complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Elizabeth New Jersey Deed Between Limited Partnership and LLC is proper for your case, you can select the subscription plan and proceed to payment.

- Then you can download the document in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!