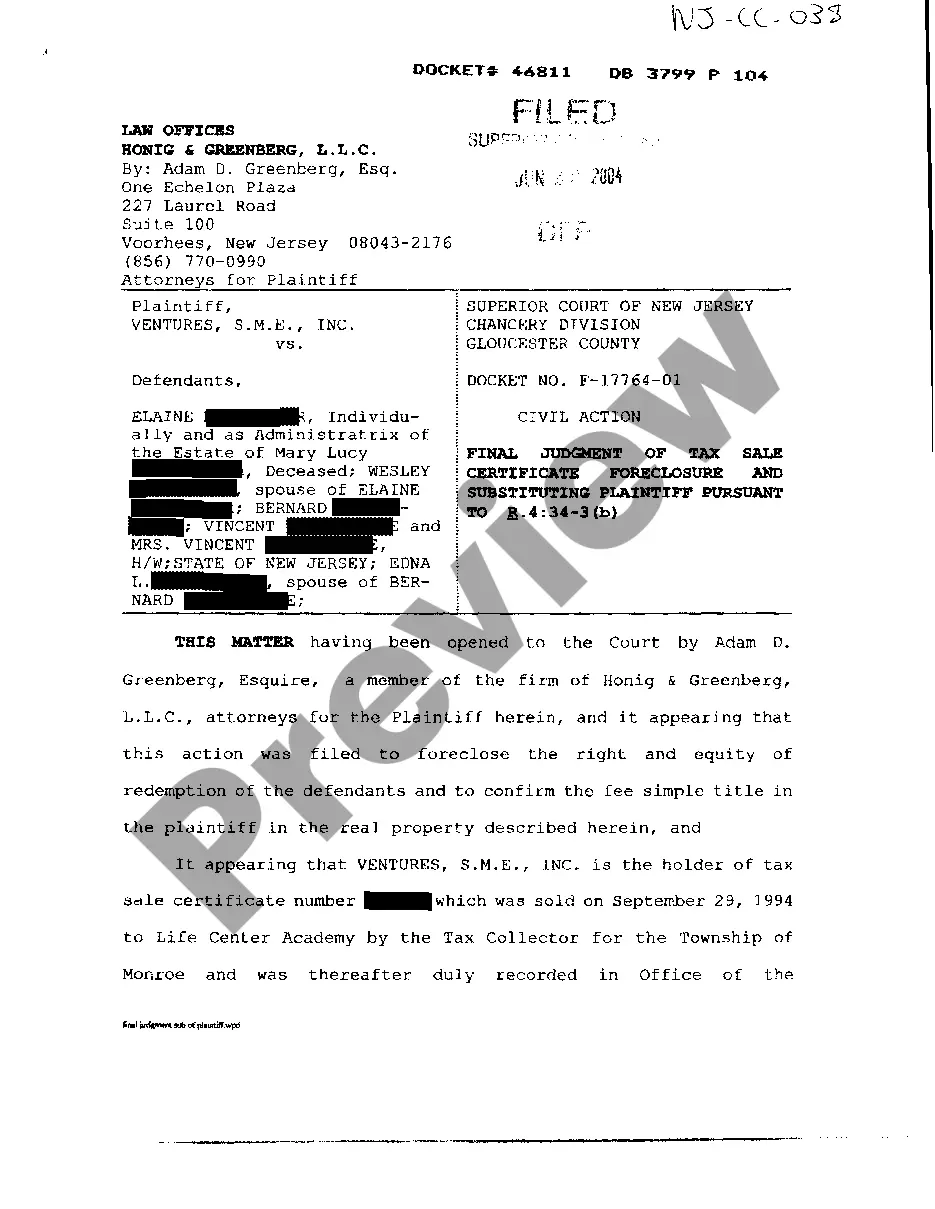

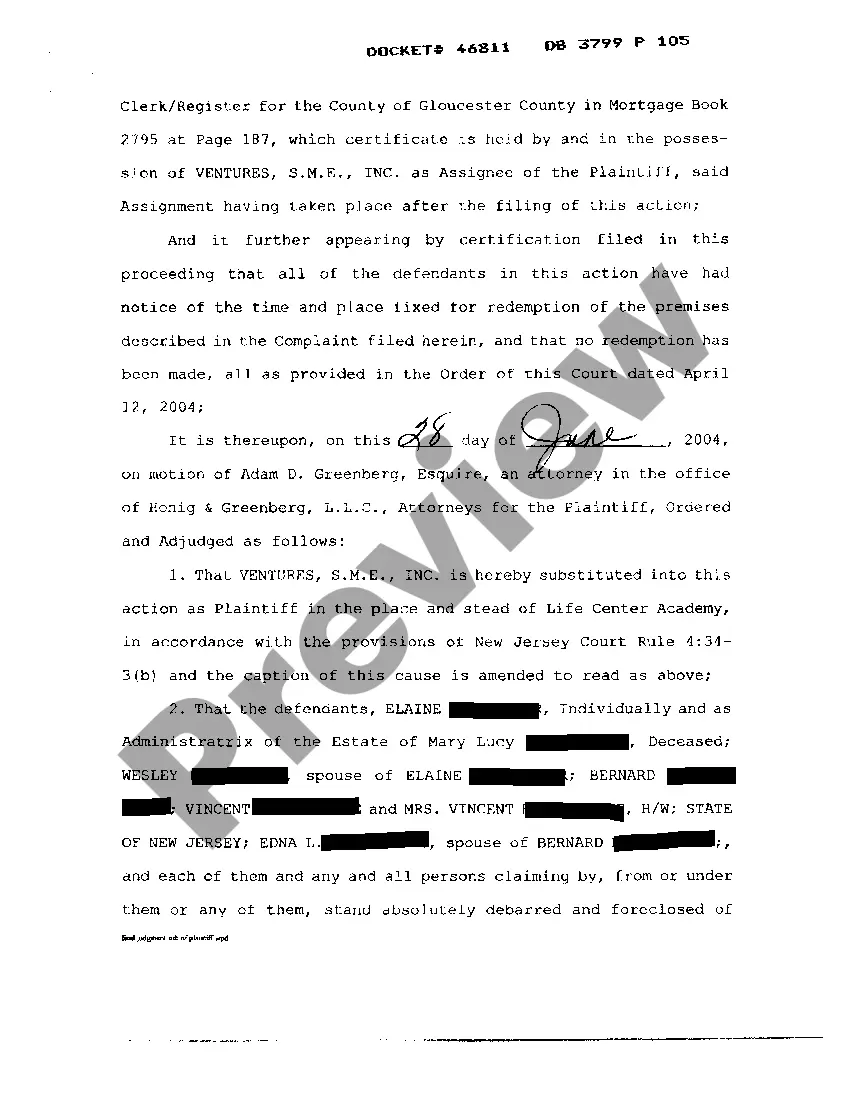

Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure is a legal process wherein a property with delinquent taxes is sold at a public auction to recover the outstanding tax amount. Subsequently, a judgment is obtained to complete the foreclosure process and transfer ownership to the winning bidder. The term "Substituting Plaintiff Pursuant" refers to an instance when the original plaintiff in the foreclosure case is replaced by a different party to continue the legal proceedings. There are several types of Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant, including: 1. Residential Property Foreclosure: This type of foreclosure involves residential properties, such as single-family houses, townhouses, and condominium units within Jersey City. These properties may have fallen into tax delinquency due to the owner's failure to pay property taxes. 2. Commercial Property Foreclosure: Commercial property foreclosure pertains to properties used for business purposes, such as office buildings, warehouses, retail stores, or industrial facilities, located in Jersey City. These properties may have accumulated tax arrears, leading to the foreclosure process. 3. Vacant Land Foreclosure: Vacant land foreclosure involves undeveloped properties, often used for agricultural, recreational, or future development purposes. If the property owners fail to pay their property taxes, the land may go through the foreclosure process. 4. Mixed-Use Property Foreclosure: Mixed-use property foreclosure involves properties that combine residential and commercial elements, such as apartment buildings with ground-floor retail spaces or office spaces. If the property owner fails to pay property taxes, the foreclosure process may be initiated. The Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant is an essential legal step that ensures the completion of the foreclosure process, leading to the transfer of property ownership from the delinquent taxpayer to the winning bidder or the substituting plaintiff. It establishes the new legal status of the property and facilitates its subsequent use or sale in compliance with the laws and regulations governing tax sale certificate foreclosure in Jersey City, New Jersey.

Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant

Description

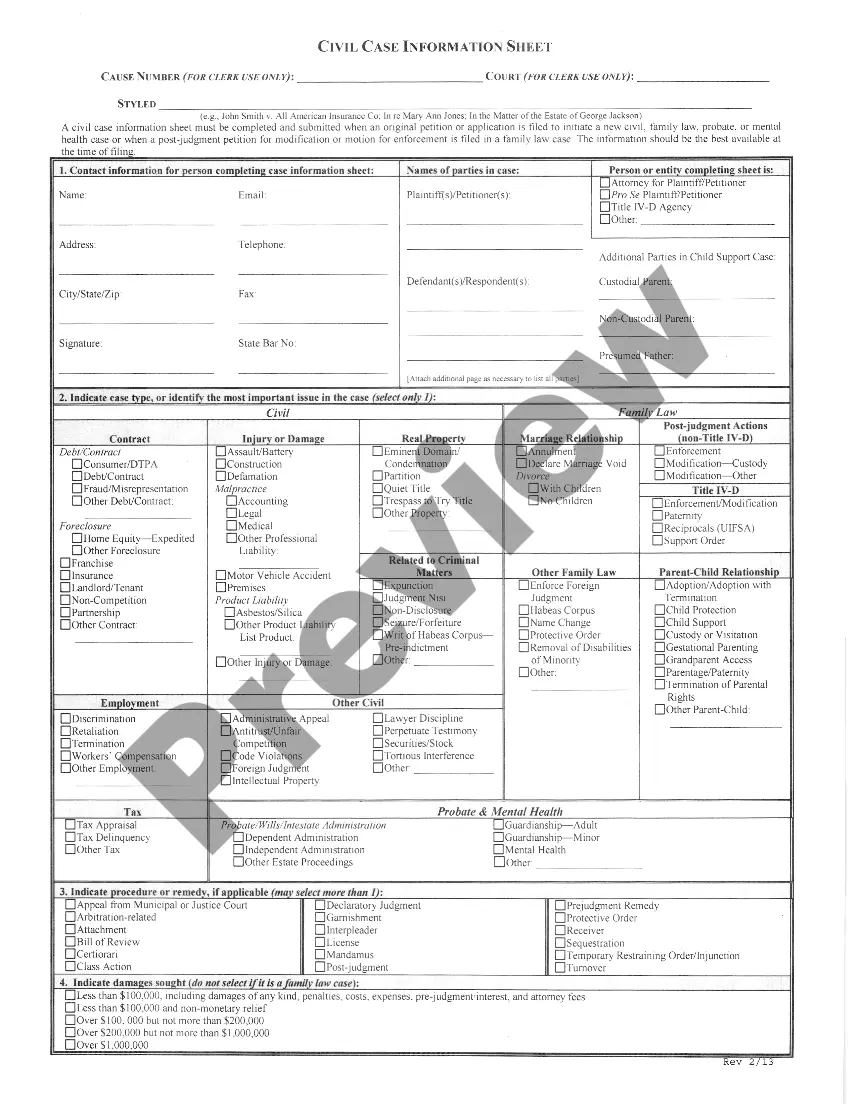

How to fill out Jersey City New Jersey Final Judgment Of Tax Sale Certificate Foreclosure And Substituting Plaintiff Pursuant?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!