Elizabeth, New Jersey Order to Reopen Chapter 13: Avoiding Second and Third Mortgages When facing the overwhelming burden of debt, individuals in Elizabeth, New Jersey, may find relief through Chapter 13 bankruptcy. This legal process allows debtors to create a repayment plan to gradually settle their debts over a specific period, usually three to five years. However, circumstances may arise where one needs to reopen their Chapter 13 bankruptcy case to address second and third mortgages, which can hinder the debtor's financial recovery. Such cases include medical emergencies, unemployment, or unexpected financial setbacks. The Elizabeth, New Jersey Order to Reopen Chapter 13 bankruptcy provides debtors with an opportunity to address additional mortgages that were not accounted for in the initial repayment plan. By reopening the bankruptcy case, debtors can seek to eliminate or modify these mortgages to better align them with their financial capabilities. This order is designed to offer debtors a fair chance to regain control over their finances without being further burdened by excessive mortgages. By reopening their Chapter 13 bankruptcy cases, debtors in Elizabeth, New Jersey, can explore various options to address second and third mortgages. These options include: 1. Lien Stripping: If the value of the debtor's property has dropped below the amount owed on the first mortgage, debtors may be able to "strip" subsequent mortgages. This process eliminates the junior mortgages and reclassifies them as unsecured debts, meaning they would be treated similarly to credit cards or medical bills in the repayment plan. 2. Mortgage Modification: In some cases, debtors may be able to negotiate with lenders to modify the terms of their mortgages. This modification could involve reducing the interest rate, extending the repayment period, or adjusting the monthly payment amount. By doing so, debtors can make their mortgage payments more manageable within the structure of their Chapter 13 repayment plan. 3. Mortgage Cram down: If the debtor's property is worth less than the outstanding balance of the second or third mortgage, they may be able to cram down the mortgage. This process allows debtors to reduce the mortgage debt to the current value of the property. The remaining balance is then treated as unsecured debt and included in the repayment plan. 4. Mortgage Avoidance: In some cases, the bankruptcy court may allow debtors to avoid completely or partially certain junior mortgages that are unsecured. This would effectively remove these mortgages from the debtor's financial obligations, providing significant relief and an opportunity for a fresh start. It is important to note that reopening a Chapter 13 bankruptcy case to address second and third mortgages should be done with the guidance of an experienced bankruptcy attorney. They can evaluate the debtor's specific situation, assess the available options, and guide them through the complex legal process. This will help ensure that the debtor maximizes the benefits of reopening their case and takes the necessary steps to secure their financial future. In summary, the Elizabeth, New Jersey Order to Reopen Chapter 13 bankruptcy serves as a lifeline for individuals burdened by second and third mortgages. By utilizing this order and exploring the various options available, debtors can work towards eliminating or modifying these mortgages to regain control over their financial situation, ultimately paving the way for a fresh start.

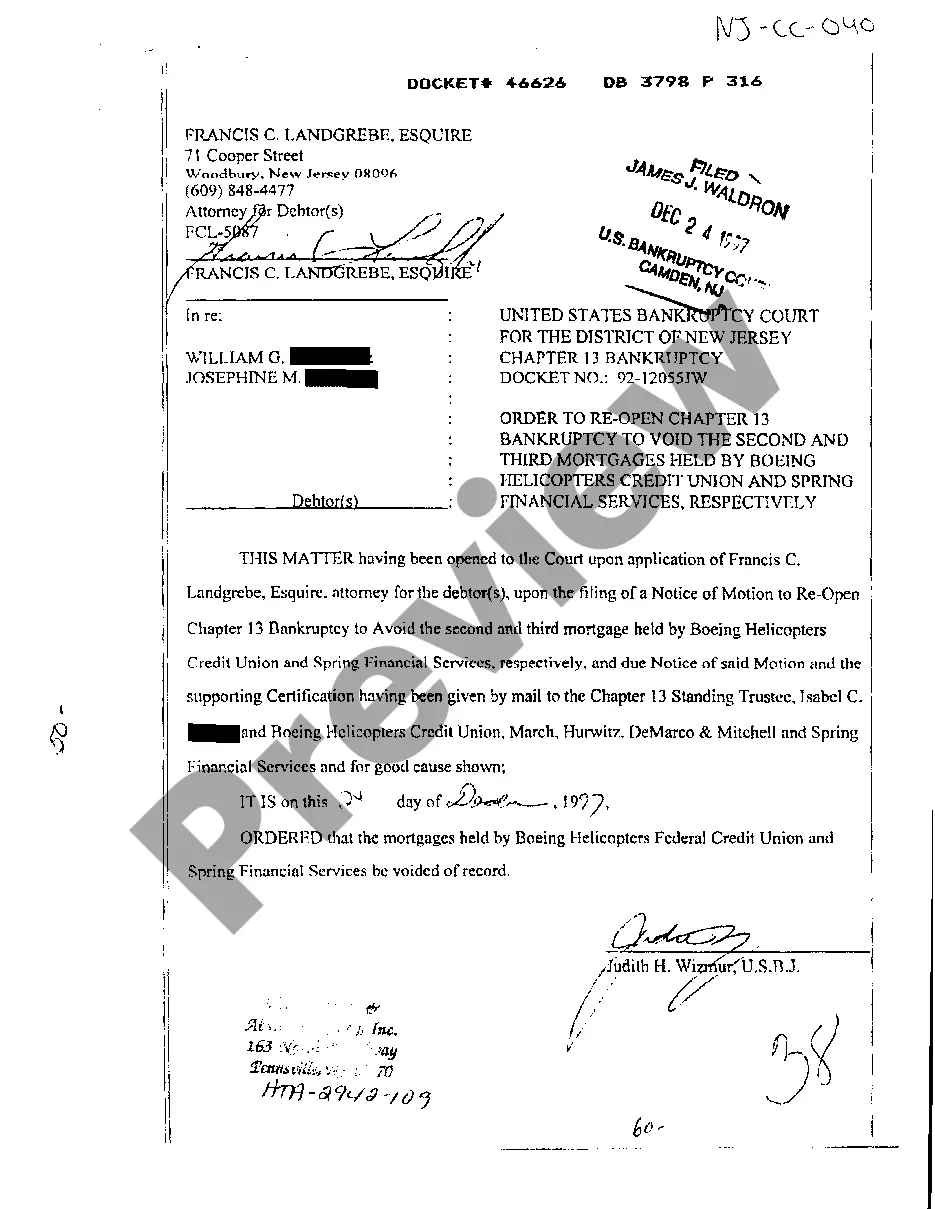

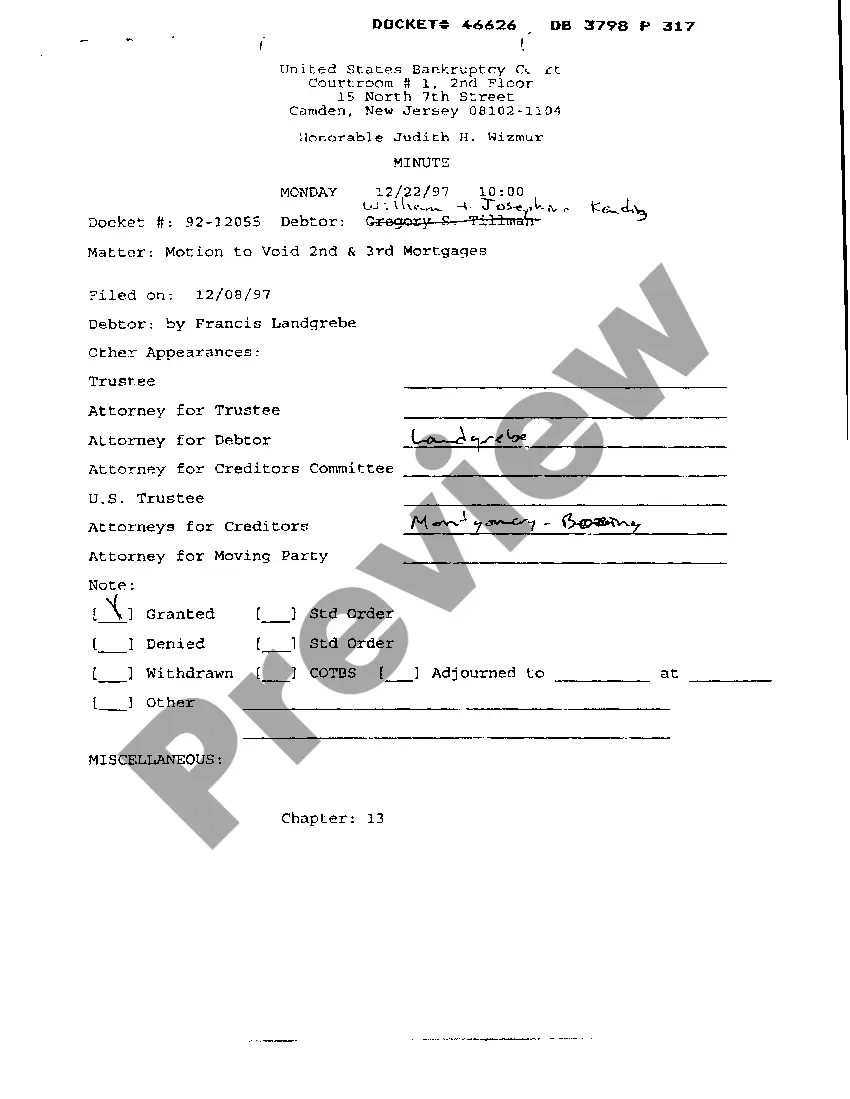

Elizabeth New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages

Description

How to fill out Elizabeth New Jersey Order To Reopen Chapter 13 To Avoid Second And Third Mortgages?

Take advantage of the US Legal Forms and obtain immediate access to any form you require. Our useful platform with a huge number of documents makes it easy to find and get almost any document sample you want. It is possible to download, complete, and sign the Elizabeth New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages in a few minutes instead of surfing the Net for several hours attempting to find the right template.

Utilizing our collection is a superb way to raise the safety of your record filing. Our experienced legal professionals on a regular basis check all the documents to make sure that the templates are relevant for a particular state and compliant with new laws and regulations.

How can you obtain the Elizabeth New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you view. In addition, you can find all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Open the page with the template you require. Make sure that it is the template you were hoping to find: verify its name and description, and use the Preview option when it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Indicate the format to obtain the Elizabeth New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable document libraries on the web. We are always happy to assist you in virtually any legal case, even if it is just downloading the Elizabeth New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!