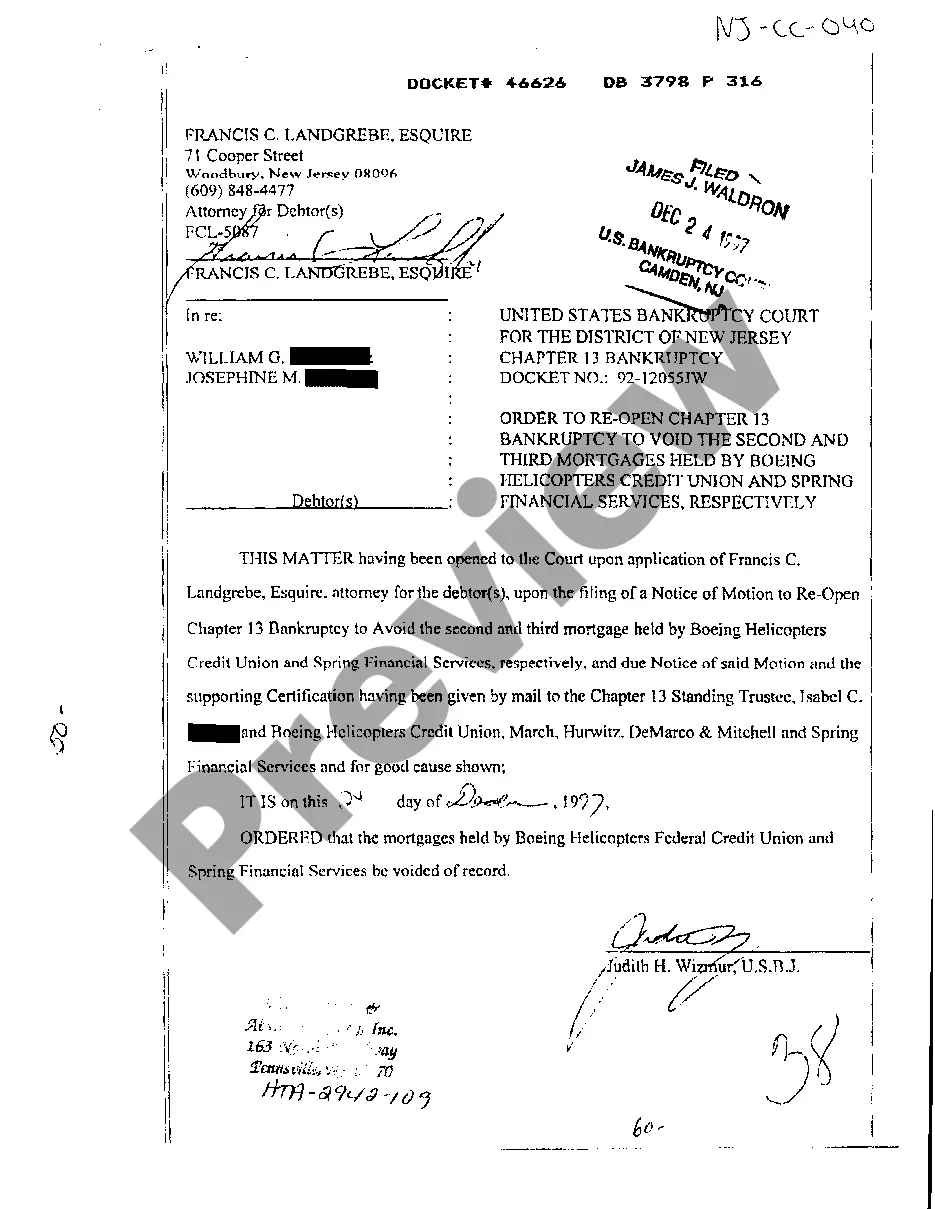

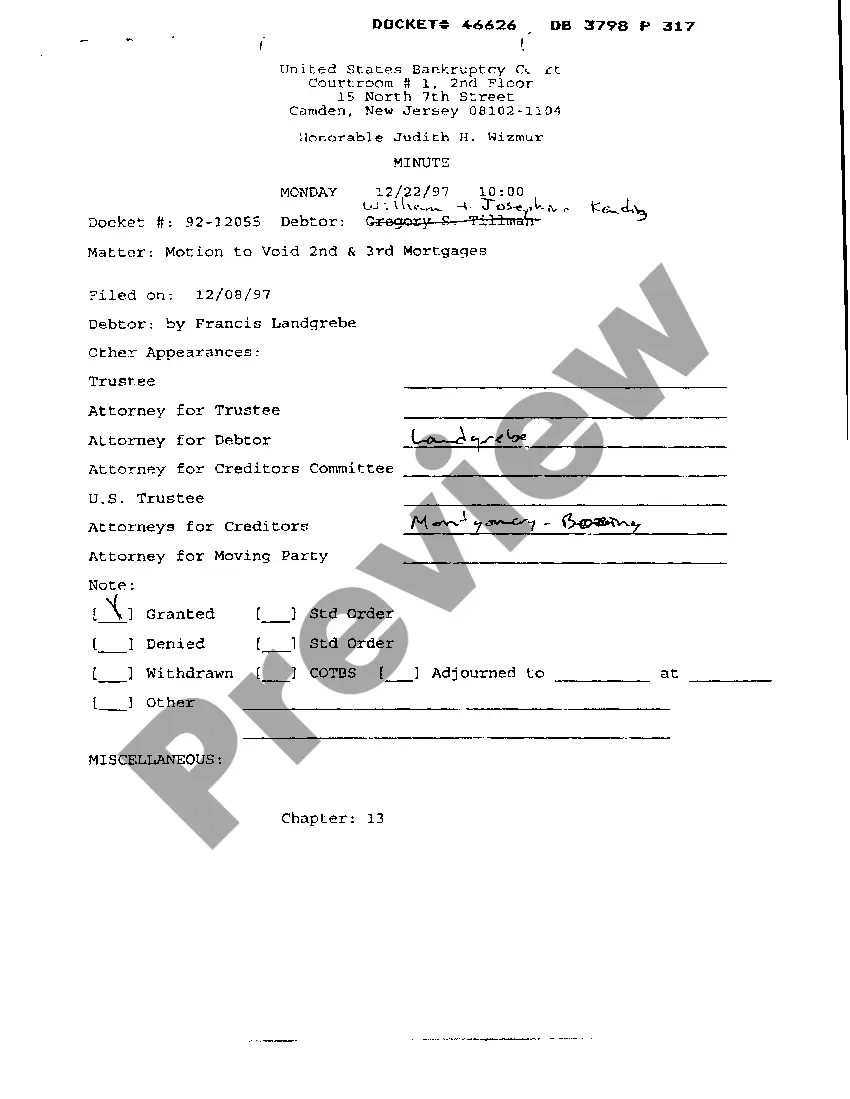

Jersey City New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages

Description

How to fill out New Jersey Order To Reopen Chapter 13 To Avoid Second And Third Mortgages?

If you have previously used our service, Log In to your account and save the Jersey City New Jersey Order to Reopen Chapter 13 to evade Second and Third Mortgages to your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your billing plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to swiftly discover and save any template for your personal or professional requirements!

- Verify you have found a suitable document. Review the description and utilize the Preview option, if available, to ensure it fulfills your requirements. If it does not meet your needs, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and submit payment. Use your credit card information or the PayPal method to finalize the purchase.

- Retrieve your Jersey City New Jersey Order to Reopen Chapter 13 to evade Second and Third Mortgages. Choose the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editing tools to fill it out and sign it electronically.

Form popularity

FAQ

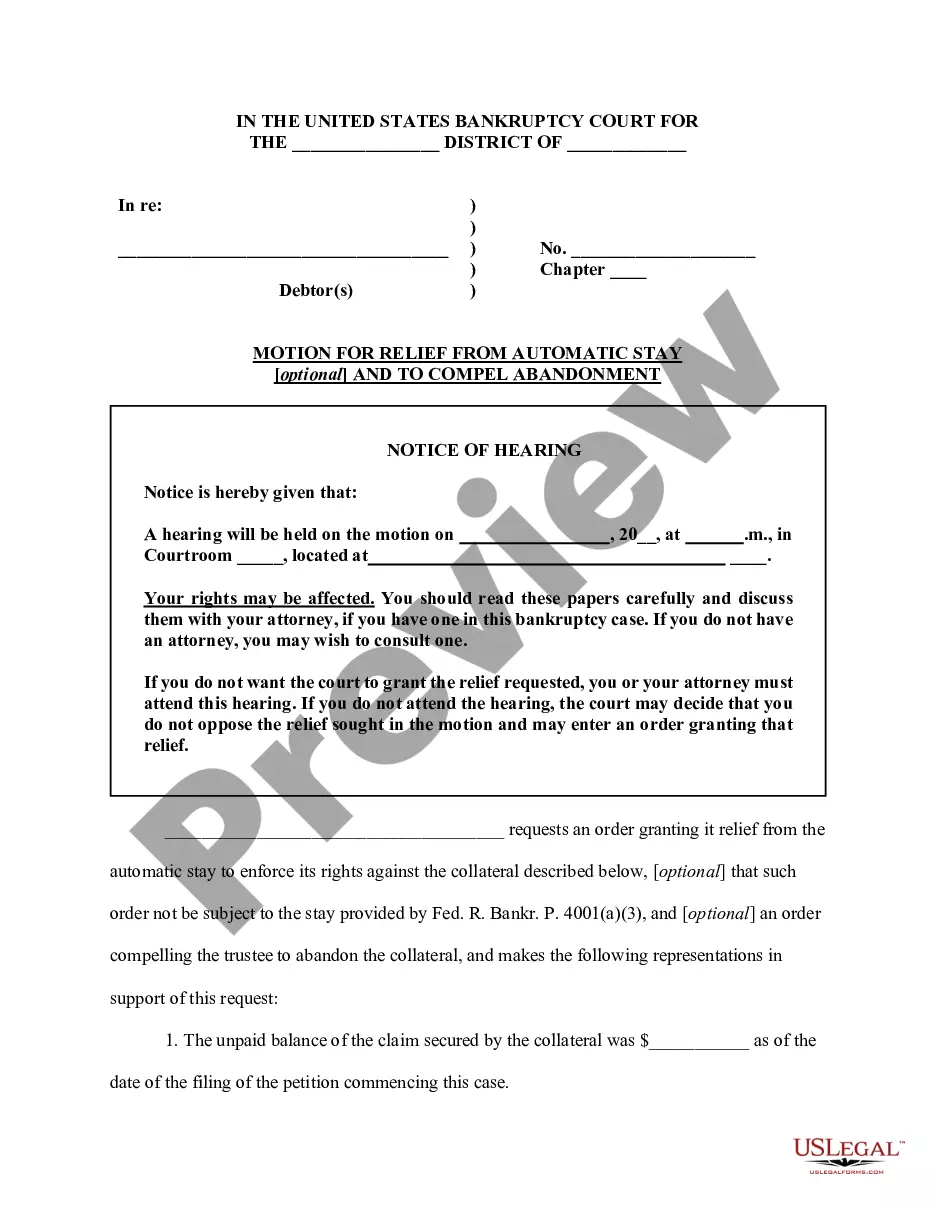

A relief from stay in Chapter 13 allows a creditor to bypass the automatic stay protections of your bankruptcy. This action can lead to foreclosure, eviction, or collection activities unless successfully challenged. By understanding the implications and potential benefits of a Jersey City New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages, you can take proactive steps to protect your assets and financial future.

Relief from automatic stay in Chapter 13 allows creditors to take action against your property despite your bankruptcy filing. Creditors can ask the court for this relief if they believe their interests are not adequately protected. If you are considering protecting your home from unwanted creditor actions, a Jersey City New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages could be a solution to explore.

No, an order of relief and an automatic stay are not the same. The automatic stay halts actions by creditors upon filing for bankruptcy, while an order of relief allows creditors to proceed with actions against the debtor. To properly navigate these complex elements, consult legal resources or platforms like uslegalforms when considering a Jersey City New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages.

Waiving the automatic stay is not typical, as this stay protects your assets during bankruptcy proceedings. However, creditors can request to lift the stay under certain circumstances, and you can negotiate terms to protect your interests. If you are facing such a situation, consider filing a Jersey City New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages for better financial management.

When you receive a motion for relief from automatic stay, it's crucial to respond promptly to protect your assets. You must file an objection and potentially attend a hearing to present your case. By effectively working through legal avenues, such as initiating a Jersey City New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages, you may strengthen your position against the creditor's claims.

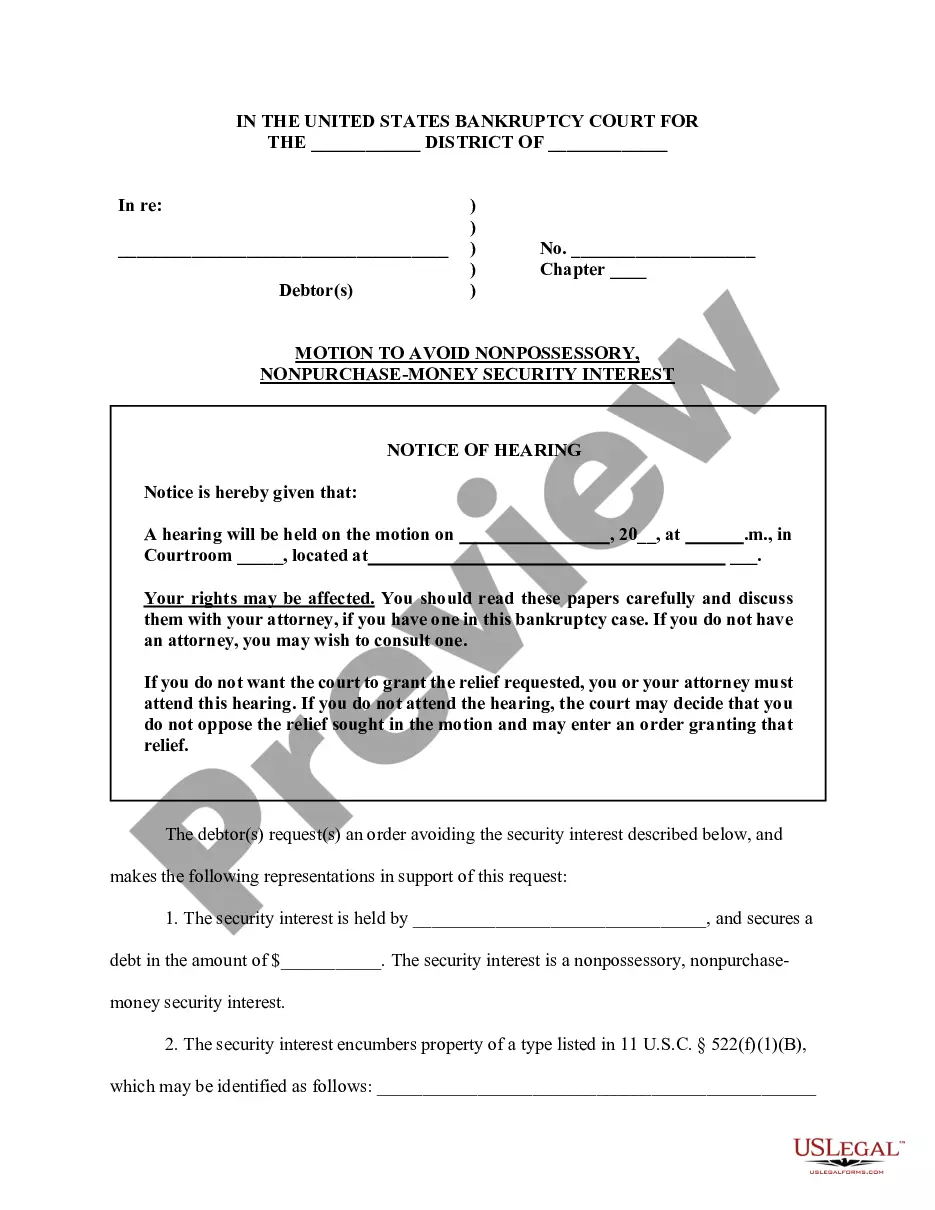

In a Chapter 13 bankruptcy, the treatment of your second mortgage may depend on how you structure your plan. If you successfully file a Jersey City New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages, you could potentially strip off the second mortgage if your home is worth less than the first mortgage. This means you would not need to repay that second mortgage through the plan, offering you significant financial relief.

To eliminate a second mortgage, consider filing for Chapter 13 bankruptcy. In Jersey City, New Jersey, once you determine that your home’s value is less than what you owe on your first mortgage, you may qualify to strip the second mortgage. Engaging with professionals can help you file an Order to Reopen Chapter 13 effectively. This approach can offer significant relief and pave the way to financial stability.

Chapter 13 in New Jersey allows individuals to propose a repayment plan to restructure debt over three to five years. This process can help you keep your home while repaying secured debts like second and third mortgages. By filing an Order to Reopen Chapter 13, you can address any mortgage issues and regain control of your financial situation. Local legal resources, such as uslegalforms, can make navigating this process easier.

In some cases, a second mortgage can be written off through bankruptcy proceedings. If you successfully file an Order to Reopen Chapter 13 in Jersey City, New Jersey, the court may allow you to discharge your obligation on the second mortgage if you qualify. This can potentially relieve you of the financial burden associated with multiple loans. Always seek guidance from legal professionals to understand your options.

Taking out a second mortgage may be beneficial in certain situations. It can provide funds for home improvements or consolidate debt. However, in Jersey City, New Jersey, it’s crucial to weigh the risks thoroughly since second mortgages can lead to complicated financial situations. Always consider your ability to manage additional debt before proceeding.