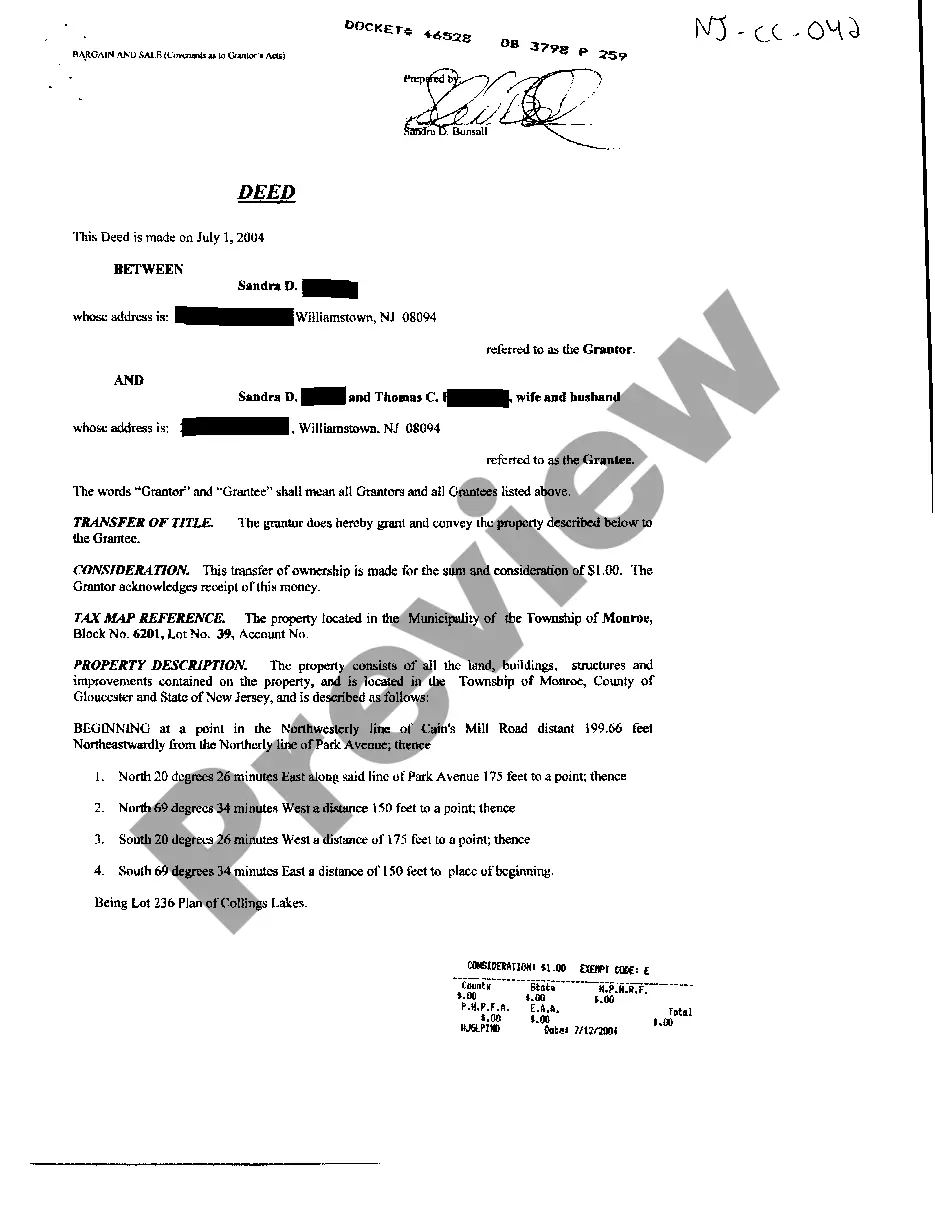

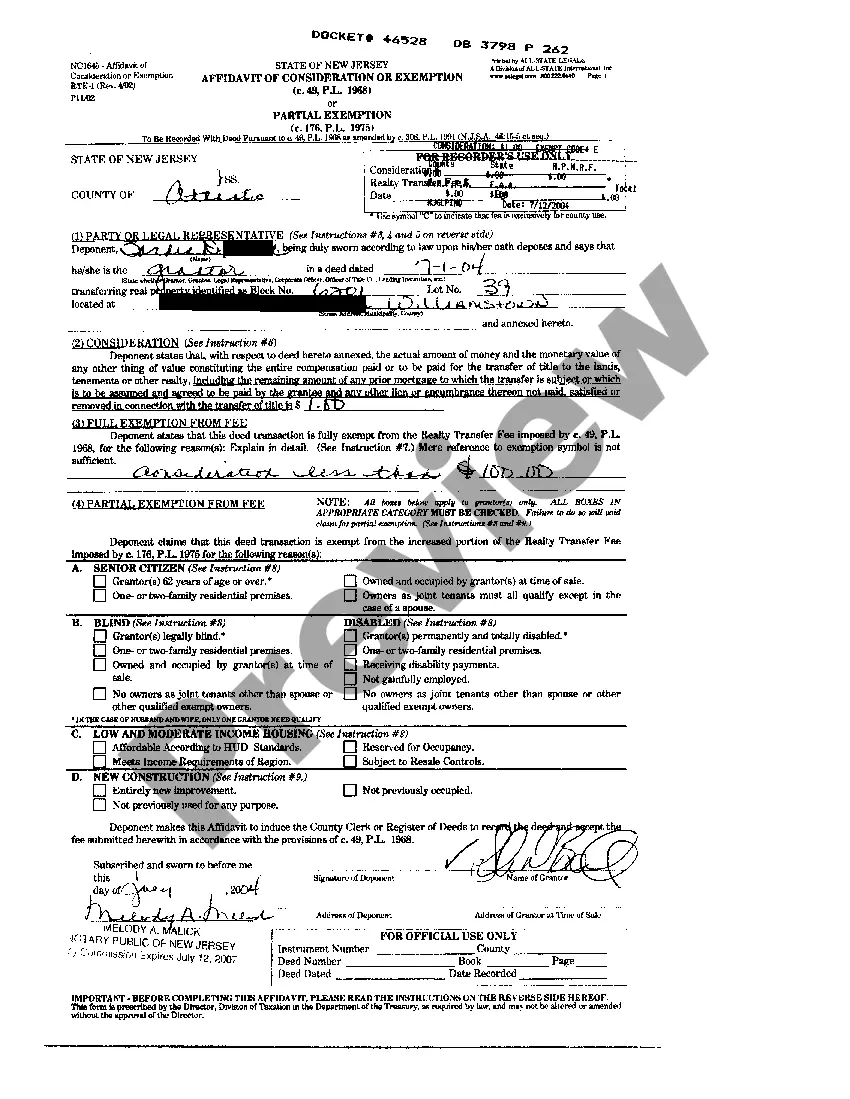

One of the most important legal documents when it comes to real estate transactions in Paterson, New Jersey is the Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption. This deed is used to transfer the ownership of a property from an individual or a married couple to another individual or married couple. It provides a legally recognized record of the transfer and ensures that all parties involved are protected. The Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption is designed to specifically cater to the needs of individual sellers or married couples who wish to sell their property to another individual or married couple. It contains various clauses and provisions that outline the terms and conditions of the transfer, as well as the rights and responsibilities of both parties involved. In addition to documenting the transfer of ownership, this deed also includes an Affidavit of Consideration or Exemption. This document serves as a declaration of the sale price or value of the property being transferred. In Paterson, New Jersey, it is mandatory to provide this affidavit to ensure compliance with local laws regarding property transfer taxes and exemptions. There are different types of Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption, depending on the specific circumstances of the transaction. Some common variations include: 1. General Warranty Deed: This type of deed guarantees that the property being transferred is free from any defects or claims against its title. The seller provides a warranty that they have the legal right to sell the property and that there are no undisclosed encumbrances or liens on the property. 2. Special Warranty Deed: Unlike the general warranty deed, this type of deed only provides limited warranties. The seller guarantees that they have not personally caused any defects in the property's title, but they do not warrant against defects caused by previous owners. 3. Quitclaim Deed: This type of deed transfers the ownership interest of the property without making any warranties or guarantees. The seller simply relinquishes their claim or interest in the property, making no promises about the property's title status. It is important to consult with a qualified real estate attorney or title company to ensure that the correct type of Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption is used in a specific transaction. This will help parties involved in the transaction to comply with legal requirements and protect their interests.

Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption

Description

How to fill out Paterson New Jersey Deed Between Individual And Married Couple With Affidavit Of Consideration Or Exemption?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney services that, as a rule, are extremely costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption would work for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!

Form popularity

FAQ

To add your spouse to your deed in New Jersey, you must prepare a new deed that includes both names. This process can involve a Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption to confirm any consideration involved. Using a reliable service like uslegalforms can assist in crafting the deed correctly so you can reflect the updated ownership efficiently.

To transfer a property title to a family member in New Jersey, you will need to execute a deed that outlines the transfer. This may include a Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption, which specifies the relationship and considerations involved. It's also wise to file the deed with your local county clerk's office after ensuring all details are accurate.

While hiring a lawyer is not mandatory to transfer a deed in New Jersey, it can be beneficial in complicated situations. A lawyer can help clarify the nuances of the Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption. If you feel uncertain about the process, consult with a legal professional to ensure everything is correct and compliant.

Yes, you can prepare your own deed in New Jersey. Using resources like uslegalforms can streamline your experience and ensure you include all necessary elements. It's crucial that the deed adheres to requirements specific to a Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption for it to be legally valid. Additionally, clear instructions will help avoid common mistakes.

The affidavit of consideration is typically signed by both parties involved in the transaction. This includes both the individual and the married couple when transferring a property. By signing, they confirm the details regarding the Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption. Proper execution of this document is essential for a valid property transfer.

Yes, you can transfer a deed in Paterson, New Jersey without an attorney. However, it is advisable to ensure that all legal requirements are met to avoid complications. A well-prepared Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption can help facilitate this process. Consider using platforms like uslegalforms for guidance and templates.

To transfer ownership of a house in New Jersey, you need to execute a deed that clearly identifies the parties and the property. The deed must be signed by the seller and should include the affidavit of consideration to reflect the transaction details. After preparing the deed, you’ll file it with the county clerk’s office to finalize the transfer. For assistance with the paperwork, consider uslegalforms, which offers resources to help you navigate this process smoothly.

In a Paterson New Jersey deed between an individual and a married couple, both parties involved typically sign the affidavit of consideration. This document serves to outline the terms of the transaction and the value exchanged. It’s crucial for ensuring transparency and compliance with state laws. Using platforms like uslegalforms can simplify this process and help you prepare the necessary documents accurately.

To add a spouse to a deed in New Jersey, you will generally need to execute a new deed that reflects the addition. This document must include both names and be notarized before filing it with the county clerk. Utilizing a Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption can simplify this process, and platforms like US Legal Forms can provide the appropriate templates and detailed instructions to help you.

Yes, you can add your wife to the deed without adding her to the mortgage. This situation can create a Paterson New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption, giving her ownership rights while keeping the mortgage obligations solely in your name. However, it’s important to discuss the implications of this arrangement, especially regarding financial responsibility and potential liabilities.