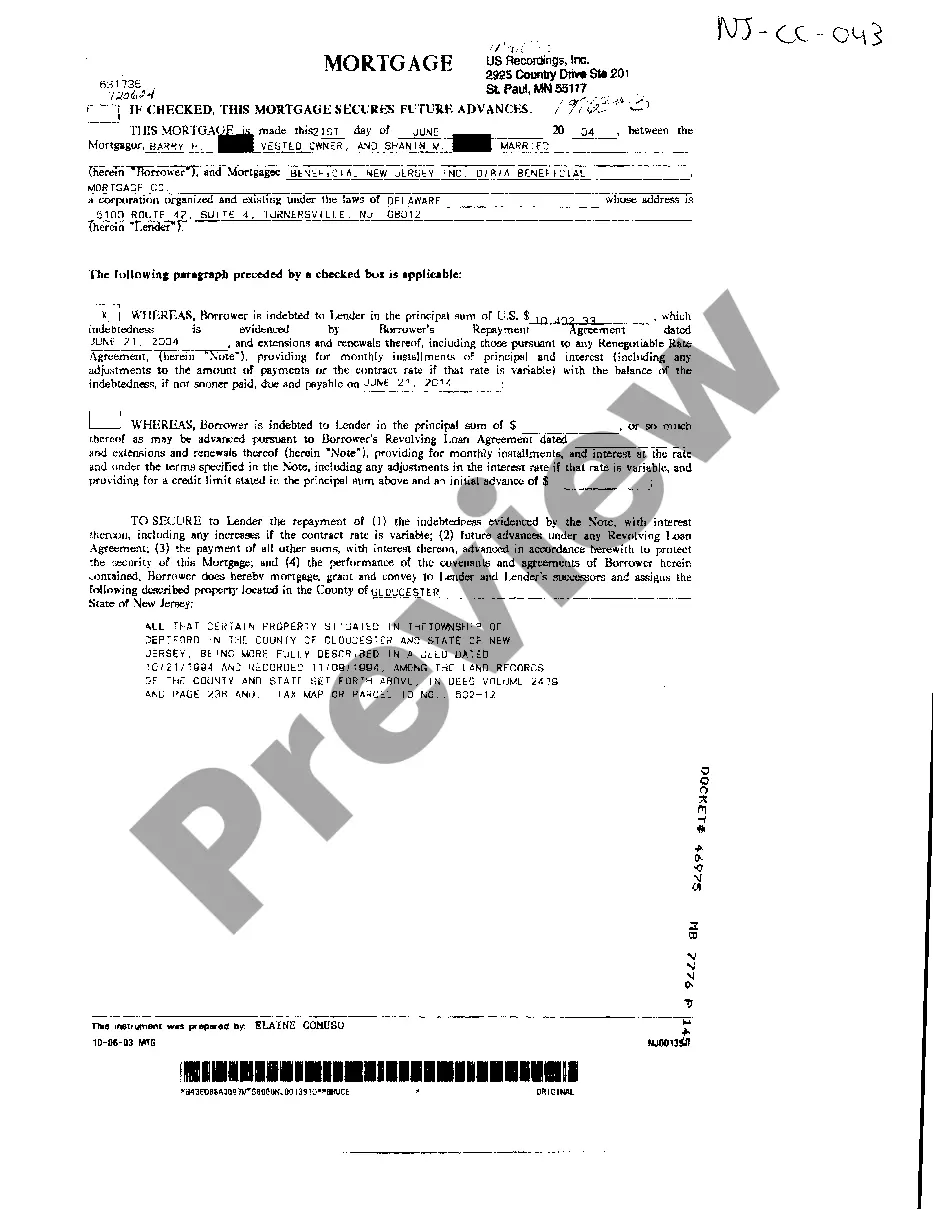

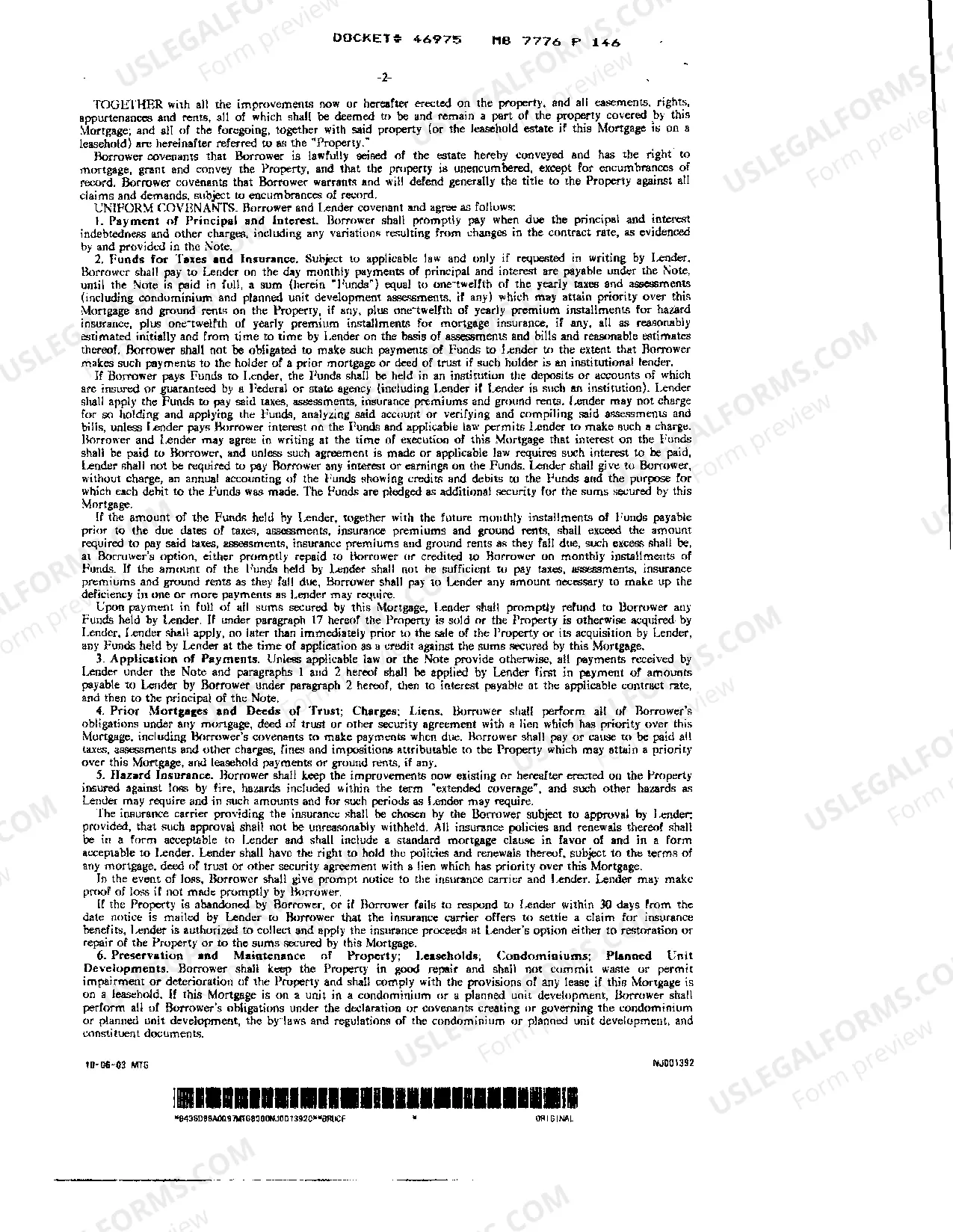

Elizabeth, New Jersey Sample Mortgage: A Comprehensive Overview of Mortgage Options In Elizabeth, New Jersey, obtaining a mortgage is a crucial step towards fulfilling your dream of owning a home. A sample mortgage in Elizabeth, NJ refers to the various types of mortgage loans available in this area. Let's explore some key types of mortgages available to homebuyers in Elizabeth, NJ and delve into their features, benefits, and eligibility criteria. 1. Fixed-Rate Mortgage: A fixed-rate mortgage is a popular choice for many homebuyers in Elizabeth, NJ. With this type of mortgage, the interest rate remains constant throughout the entire loan term, offering stability and predictability. Typically, fixed-rate mortgages are available for 15, 20, or 30 years, allowing borrowers to plan their long-term finances effectively. 2. Adjustable-Rate Mortgage (ARM): An adjustable-rate mortgage appeals to those seeking flexibility in their mortgage terms. Initially, an ARM often features a lower interest rate than a fixed-rate mortgage, making it an attractive option. However, after a set initial period (e.g., 5 or 7 years), the interest rate adjusts periodically based on prevailing market rates. Arms are ideal for homeowners planning to sell or refinance before the rate adjustment period. 3. Federal Home Loan Mortgage Corporation (FILM) Loan: Also known as Freddie Mac loans, FILM loans are government-backed mortgages, widely available in Elizabeth, NJ. These loans typically require a lower down payment and income-to-debt ratio, making them accessible to many first-time homebuyers. Additionally, Freddie Mac loans offer various financing options, including fixed-rate and adjustable-rate mortgages. 4. Federal Housing Administration (FHA) Loan: FHA loans are government-insured mortgages designed to assist homebuyers with low to moderate incomes, providing them with more accessible lending terms. FHA loans commonly require a lower down payment, making it easier for buyers to enter the real estate market. This type of mortgage is insured by the Federal Housing Administration, reducing the risk for lenders and enabling them to offer favorable terms. 5. Veterans Affairs (VA) Loan: VA loans fulfill the housing needs of eligible veterans, active-duty service members, and surviving spouses. Offered by the Department of Veterans Affairs, VA loans provide unique benefits, such as no down payments, no private mortgage insurance requirements, and competitive interest rates. These loans aim to honor and support those who have served or are serving in the U.S. military. 6. Jumbo Mortgage: When purchasing a high-value property in Elizabeth, NJ, exceeding the conforming loan limits set by the Federal Housing Finance Agency (FIFA), a jumbo mortgage may be necessary. Jumbo mortgages accommodate loan amounts that surpass the limits, enabling homebuyers to finance their high-end dream homes. However, these mortgages often require higher down payments and stringent eligibility criteria due to the associated risk. Now that you have an overview of different mortgage types available in Elizabeth, NJ, it is vital to consult with a reputable mortgage lender or broker who can guide you through the process. They will analyze your financial situation, credit history, and preferences to recommend the most suitable mortgage options tailored to your needs. Remember, understanding and selecting the right mortgage type is key to ensuring a smooth home buying experience in Elizabeth, New Jersey. Conduct thorough research, compare offers, and seek professional advice to secure the best mortgage suited to your unique requirements.

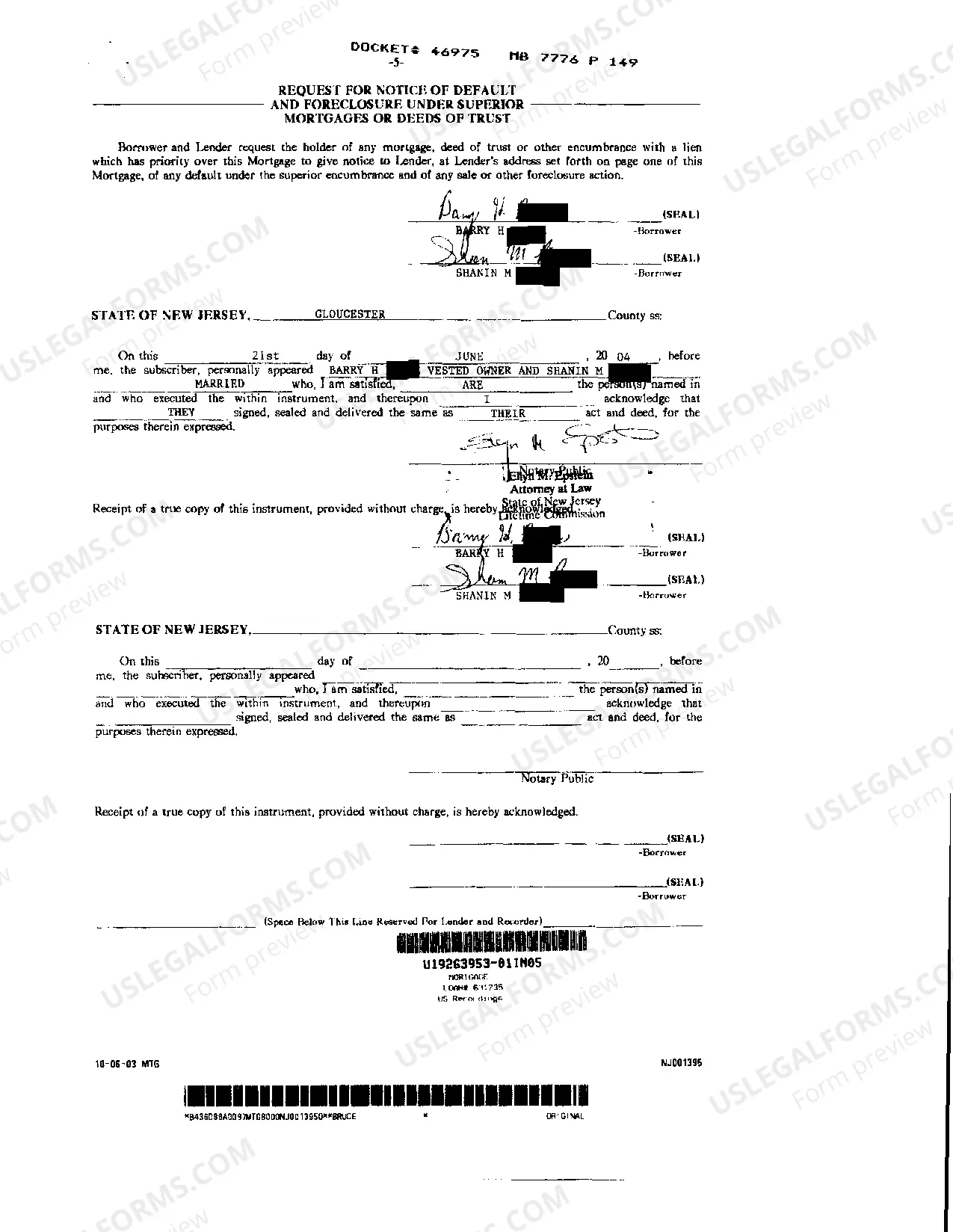

Elizabeth New Jersey Sample Mortgage

Description

How to fill out Elizabeth New Jersey Sample Mortgage?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person without any legal education to draft this sort of paperwork from scratch, mainly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our service provides a massive collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you require the Elizabeth New Jersey Sample Mortgage or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Elizabeth New Jersey Sample Mortgage in minutes using our trustworthy service. In case you are already an existing customer, you can go on and log in to your account to get the needed form.

However, if you are a novice to our platform, make sure to follow these steps before downloading the Elizabeth New Jersey Sample Mortgage:

- Be sure the form you have found is specific to your location because the rules of one state or area do not work for another state or area.

- Review the document and go through a short outline (if available) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your requirements, you can start over and search for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Elizabeth New Jersey Sample Mortgage as soon as the payment is completed.

You’re all set! Now you can go on and print the document or fill it out online. In case you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.