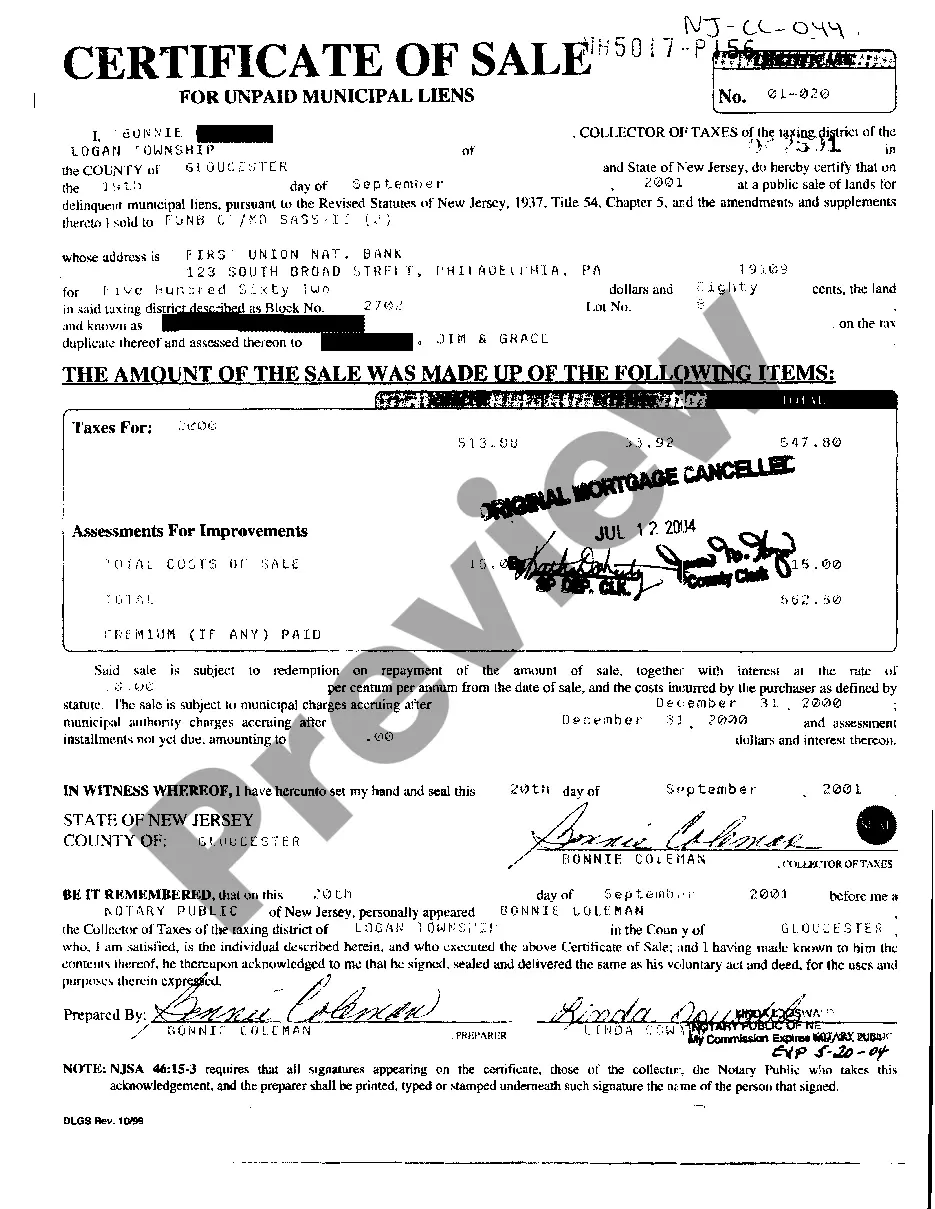

The Newark New Jersey Certificate of Sale for Unpaid Municipal Liens is a legal document that outlines the process by which the city of Newark can sell a property to recover unpaid municipal liens. Municipal liens are debts owed to the city for various reasons, such as unpaid property taxes, water bills, or code violations. When a property owner fails to pay these outstanding debts, the city has the authority to place a lien on the property. The Certificate of Sale for Unpaid Municipal Liens is issued by the city after a property has gone through a tax sale or foreclosure auction. This certificate serves as evidence of the sale and transfer of ownership of the property to the highest bidder. It also provides details about the property, including its legal description, assessed value, and the amount of unpaid municipal liens. There are different types of Newark New Jersey Certificate of Sale for Unpaid Municipal Liens, depending on the specific circumstances. Some examples include: 1. Tax Sale Certificate: This type of certificate is issued when a property owner fails to pay their property taxes. The city conducts a tax sale auction, where investors can bid on the tax liens. The highest bidder receives a Tax Sale Certificate, which grants them the right to collect the unpaid taxes, plus interest, from the property owner. 2. Foreclosure Certificate: In cases where a property owner fails to pay other municipal debts, such as water bills or code violation fines, the city may initiate a foreclosure process. This involves the city taking legal action to seize and sell the property to recover the outstanding debts. The Foreclosure Certificate is issued after the property has been sold at auction, transferring ownership to the highest bidder. 3. Redemption Certificate: If a property owner wishes to redeem their property after it has been sold at a tax sale or foreclosure auction, they have the opportunity to do so by paying off the outstanding debts, plus interest and any additional fees. The city issues a Redemption Certificate to the property owner once the full redemption amount is paid. This certificate restores the owner's rights to the property and releases the liens that were placed upon it. In conclusion, the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens is a crucial document in the process of recovering unpaid municipal debts. It provides legal proof of the sale and transfer of property ownership and is issued in different scenarios such as tax sales, foreclosures, and redemptions. These certificates are essential for both the city and property owners involved in these proceedings.

Newark New Jersey Certificate of Sale for Unpaid Municipal Liens

Description

How to fill out Newark New Jersey Certificate Of Sale For Unpaid Municipal Liens?

No matter the social or occupational position, completing legal documents is a regrettable requirement in the current professional landscape.

Often, it’s nearly unfeasible for an individual lacking any legal education to create this type of documentation from scratch, primarily because of the intricate terminology and legal subtleties they entail.

This is where US Legal Forms provides assistance.

Confirm that the form you have located is tailored to your locale, as the regulations of one state or region do not apply to another.

Review the document and read a brief overview (if available) of situations the document can address.

- Our service boasts an extensive assortment of over 85,000 state-specific documents that cater to nearly any legal scenario.

- US Legal Forms also serves as a valuable resource for associates or legal advisors looking to save time by utilizing our DIY papers.

- Whether you seek the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens or any other documentation that will be recognized in your region, with US Legal Forms, everything is accessible.

- Here’s how to quickly acquire the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens using our reliable service.

- If you're already a subscriber, you can proceed to Log In to your account to access the necessary form.

- However, if you're not familiar with our platform, ensure you follow these steps before obtaining the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens.

Form popularity

FAQ

If someone pays your delinquent property taxes, you may lose some rights to the property. Their payment can result in the issuance of a Newark New Jersey Certificate of Sale for Unpaid Municipal Liens, allowing them to recoup their investment. Consequently, it is essential to resolve any tax issues before they escalate into a lien or potential tax sale situation.

In New Jersey, you can typically claim property taxes that have gone unpaid for several years, depending on the local statutes. As a property owner, you may be liable for any back taxes when the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens is issued. Municipalities have specific timelines that dictate when these claims can occur, so it is vital to stay informed and address any outstanding taxes promptly to avoid penalties.

In New Jersey, businesses that sell goods or services are required to collect sales tax from their customers. This means that if you run a business, you not only need to understand the responsibility to collect sales tax, but also the implications that come with not doing so. Using resources like the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens can help ensure compliance and clear any outstanding municipal obligations.

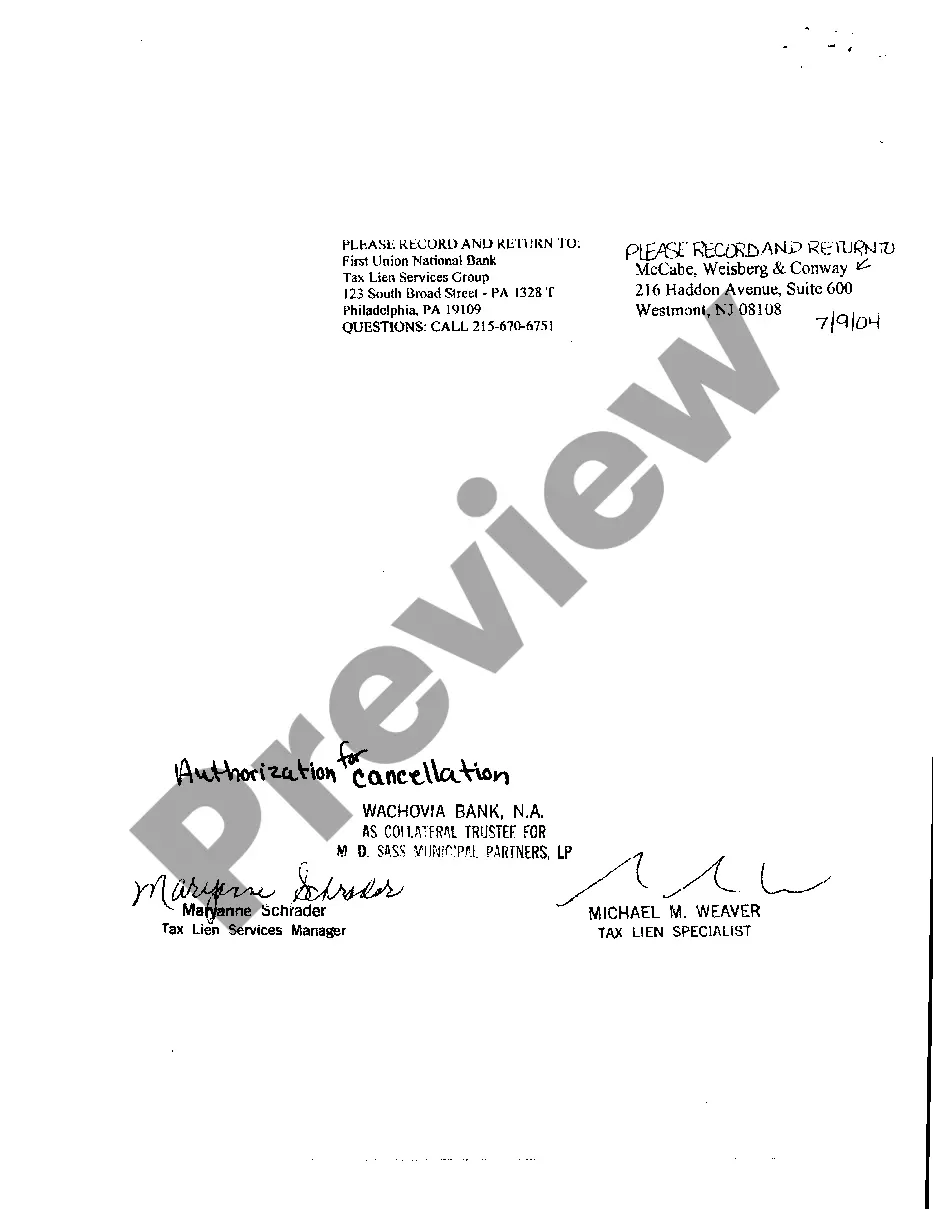

The property owner, other lienholders, or anyone holding a vested interest can redeem a tax sale certificate in New Jersey. This process allows the holder of the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens to reclaim their investment by settling the outstanding taxes. Once the lien is redeemed, it restores the property owner's right and clears the lien off the property records.

To look up tax liens in New Jersey, start by accessing your county's official website or tax collector's office. Many counties offer online databases where you can search for Newark New Jersey Certificate of Sale for Unpaid Municipal Liens. This process usually requires entering property details, such as the address or owner’s name. For additional assistance, US Legal Forms provides resources and templates that can help streamline your search and ensure you have all necessary documents.

You can buy tax lien certificates in various states across the U.S., including Florida, Arizona, Texas, and New Jersey. Each state has its own rules and auction processes, so it's crucial to understand these differences. For those interested specifically in the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens, New Jersey offers a structured system that supports informed investments, and resources from USLegalForms can aid in your journey.

New Jersey does sell tax lien certificates to interested buyers, allowing municipalities to collect on unpaid property taxes. It is an effective way to help maintain local funding for public services. If you're focused on acquiring the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens, USLegalForms can guide you through the legal requirements and documentation process.

Yes, you can buy tax liens in New Jersey, including in Newark. Municipalities auction off these liens to recover unpaid property taxes, offering a unique investment opportunity. If you wish to learn more about the process and find the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens, platforms such as USLegalForms can provide essential information and documentation.

To obtain a tax lien certificate, you typically participate in a public auction held by the municipality. It's essential to research local laws and requirements in Newark, as each location may have specific procedures. For the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens, you can access detailed guides and resources through platforms like USLegalForms, which simplify the process.

When considering the best state to buy tax lien certificates, various factors come into play, such as potential returns and property values. For instance, states like Florida and Arizona are known for attractive opportunities. However, if you're particularly interested in the Newark New Jersey Certificate of Sale for Unpaid Municipal Liens, New Jersey has robust regulations ensuring a fair auction process and investor protections.

Interesting Questions

More info

New Jersey Motor Home Real Estate is the largest, nationwide source for new and used motor homes, and RV's, in New Jersey, including the New York, New Jersey, PA, CT, DE, and DE in addition to NJ TRANSIT and NJ TRANSIT Commuter Rail. New Jersey Motor Home Real Estate, Inc. is a licensed and bonded retailer of the best used motor home brands, products and parts. Our fleet is extensive; over 15 years it includes more than 4,000 units. Buy your next motor home or RV today. Find Used RV's and Motor Homes for Sale online at New Jersey Motor Home Real Estate. NEW YORK Motor homes, motor homes, RV's and motor huts. Buy, sell and trade one of the most versatile and practical vehicles for sale. New York Motor Homes, Motor Huts and RVs. Buy, sell, trade, and have one in stock to show. Our inventory changes daily and varies depending on inventory available. It's a no-hassle process to find one that's perfect for your lifestyle.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.