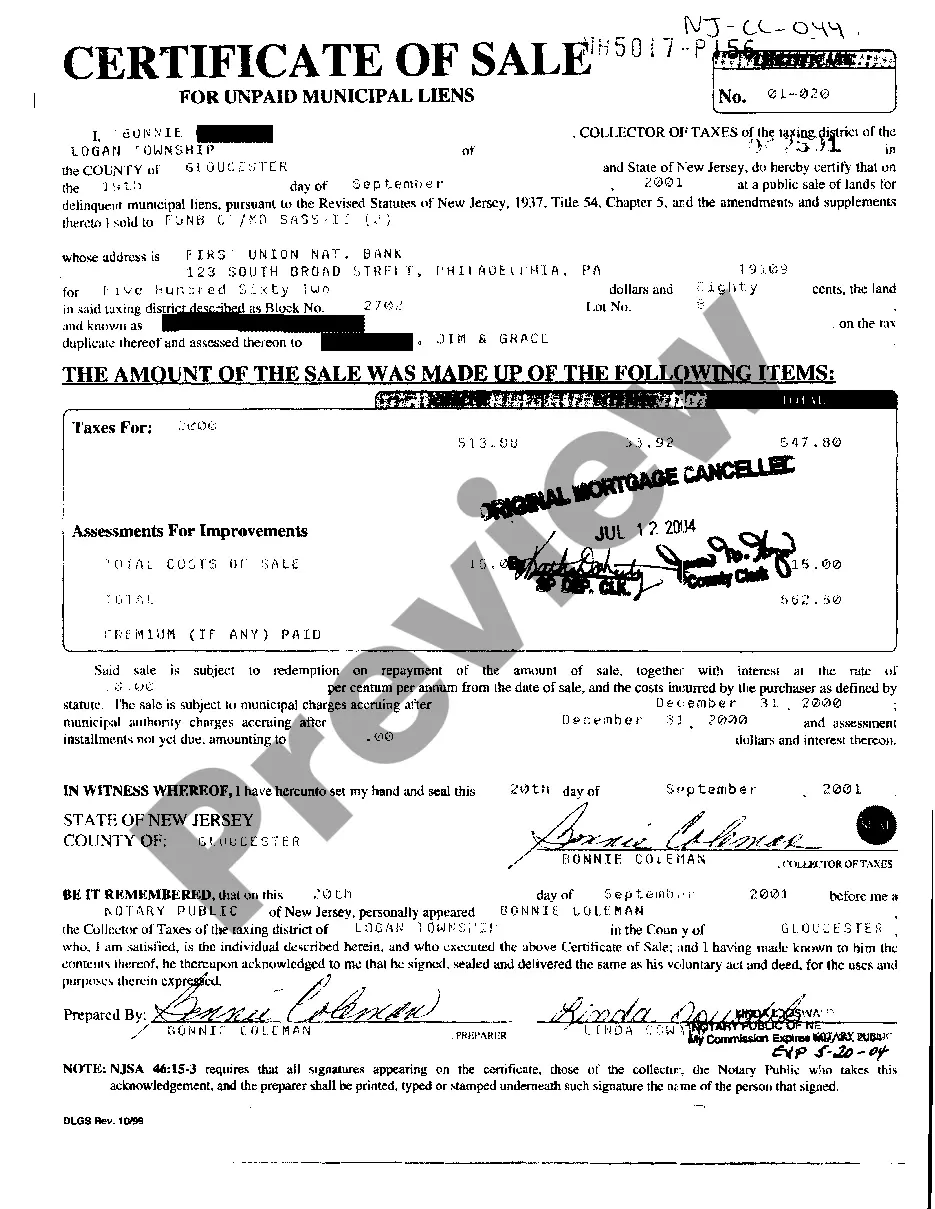

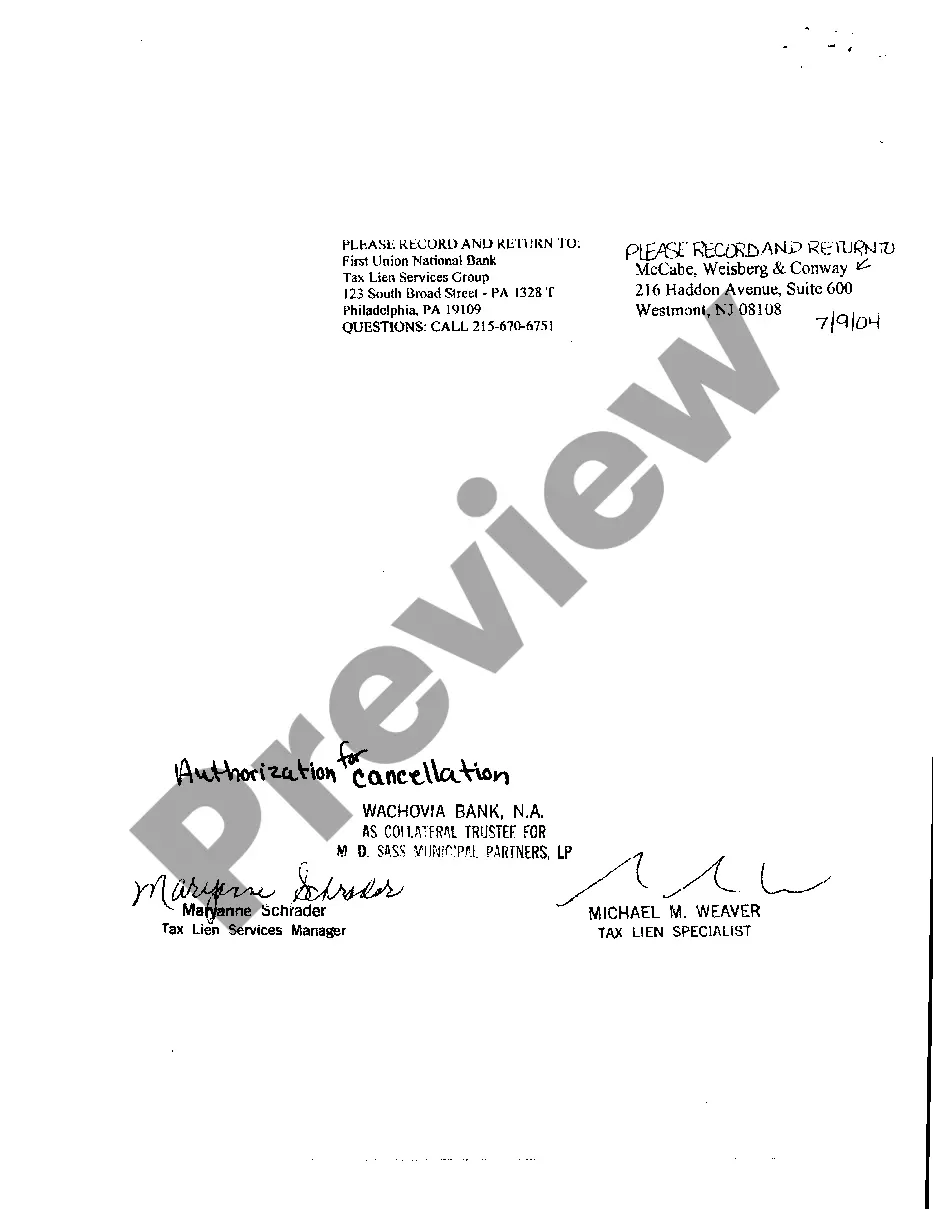

The Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens is a legal document used by the city of Paterson to enforce the collection of unpaid municipal liens. When property owners fail to pay their property taxes, water and sewer bills, or other municipal charges, a lien is placed on their property by the city. The Certificate of Sale is one of the methods used by the city to recover the outstanding debt. It allows the city to sell the property at a public auction to the highest bidder. The proceeds from the sale are then used to pay off the outstanding liens and any associated fees. There are different types of Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens, including: 1. Tax Sale Certificate: This type of certificate is issued when there are unpaid property taxes. The city has the authority to sell the delinquent property at a tax sale auction to recoup the owed taxes. 2. Water and Sewer Lien Sale Certificate: When property owners fail to pay their water and sewer bills, the city can issue a Water and Sewer Lien Certificate. This certificate entitles the city to sell the property to recover the unpaid charges. 3. Municipal Assessment Lien Certificate: If property owners have failed to pay any other municipal charges, such as code violations or fines, the city may issue a Municipal Assessment Lien Certificate. This certificate authorizes the city to sell the property and use the proceeds to settle the outstanding debts. The Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens is an important tool for the city to collect unpaid debts and ensure the financial well-being of the community. Property owners are encouraged to promptly pay their municipal charges to avoid the issuance of a Certificate of Sale, which may result in the loss of their property. It is essential for property owners to stay current with their municipal obligations to maintain control over their property.

Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens

State:

New Jersey

City:

Paterson

Control #:

NJ-CC-044

Format:

PDF

Instant download

This form is available by subscription

Description

Certificate of Sale for Unpaid Municipal Liens

The Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens is a legal document used by the city of Paterson to enforce the collection of unpaid municipal liens. When property owners fail to pay their property taxes, water and sewer bills, or other municipal charges, a lien is placed on their property by the city. The Certificate of Sale is one of the methods used by the city to recover the outstanding debt. It allows the city to sell the property at a public auction to the highest bidder. The proceeds from the sale are then used to pay off the outstanding liens and any associated fees. There are different types of Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens, including: 1. Tax Sale Certificate: This type of certificate is issued when there are unpaid property taxes. The city has the authority to sell the delinquent property at a tax sale auction to recoup the owed taxes. 2. Water and Sewer Lien Sale Certificate: When property owners fail to pay their water and sewer bills, the city can issue a Water and Sewer Lien Certificate. This certificate entitles the city to sell the property to recover the unpaid charges. 3. Municipal Assessment Lien Certificate: If property owners have failed to pay any other municipal charges, such as code violations or fines, the city may issue a Municipal Assessment Lien Certificate. This certificate authorizes the city to sell the property and use the proceeds to settle the outstanding debts. The Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens is an important tool for the city to collect unpaid debts and ensure the financial well-being of the community. Property owners are encouraged to promptly pay their municipal charges to avoid the issuance of a Certificate of Sale, which may result in the loss of their property. It is essential for property owners to stay current with their municipal obligations to maintain control over their property.

Free preview

How to fill out Paterson New Jersey Certificate Of Sale For Unpaid Municipal Liens?

If you’ve already utilized our service before, log in to your account and save the Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Paterson New Jersey Certificate of Sale for Unpaid Municipal Liens. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!