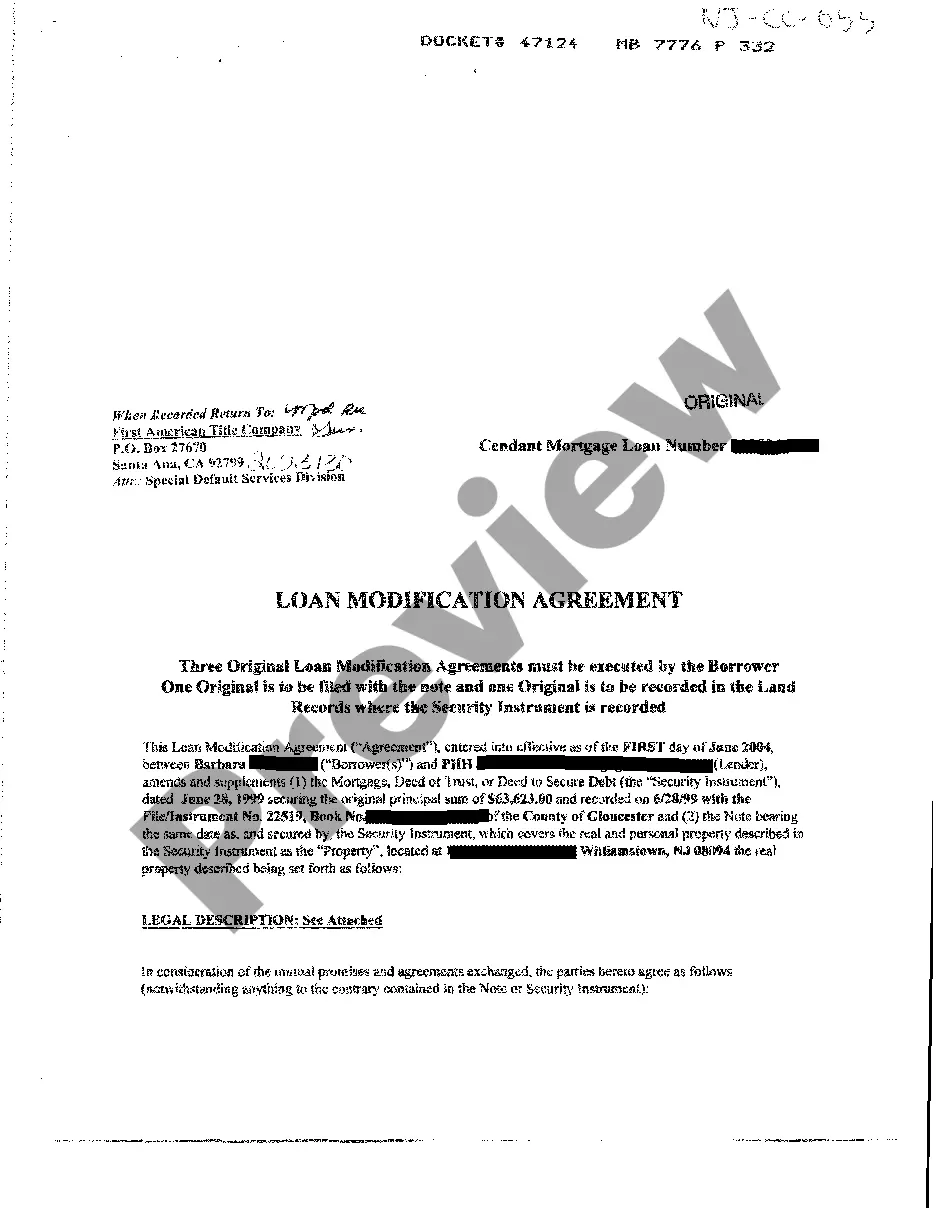

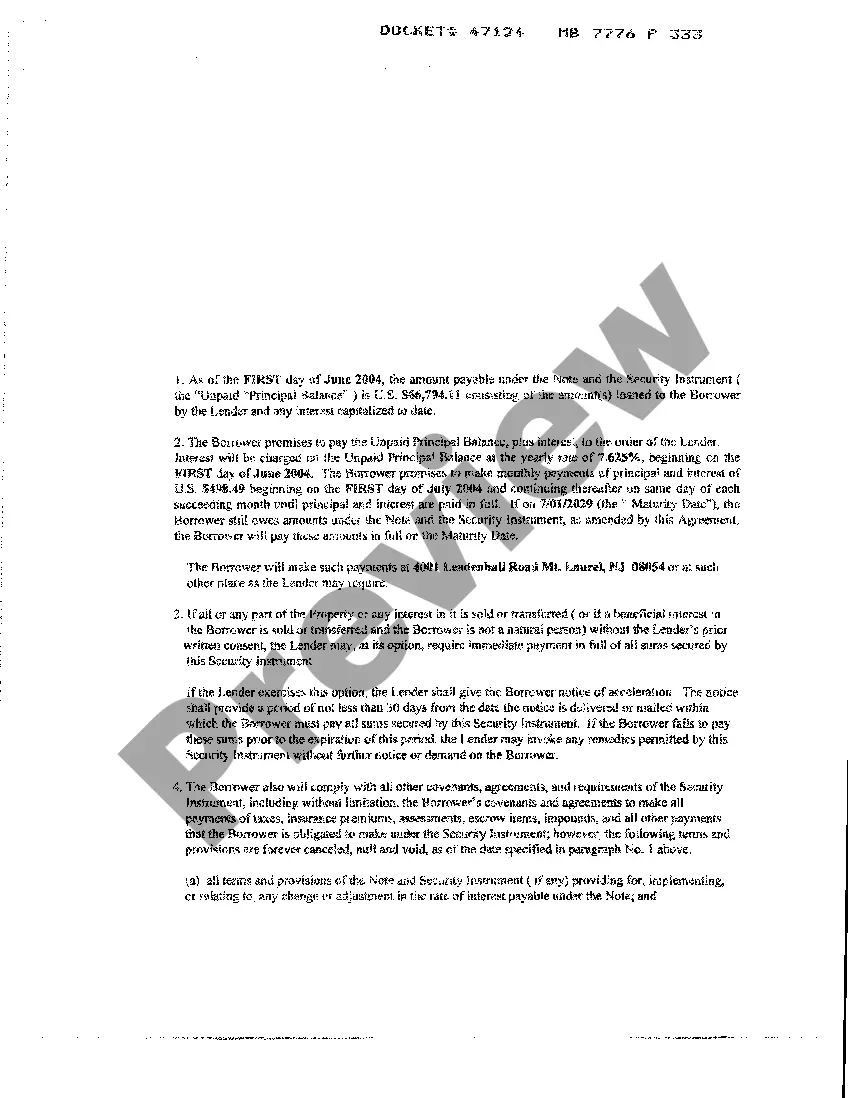

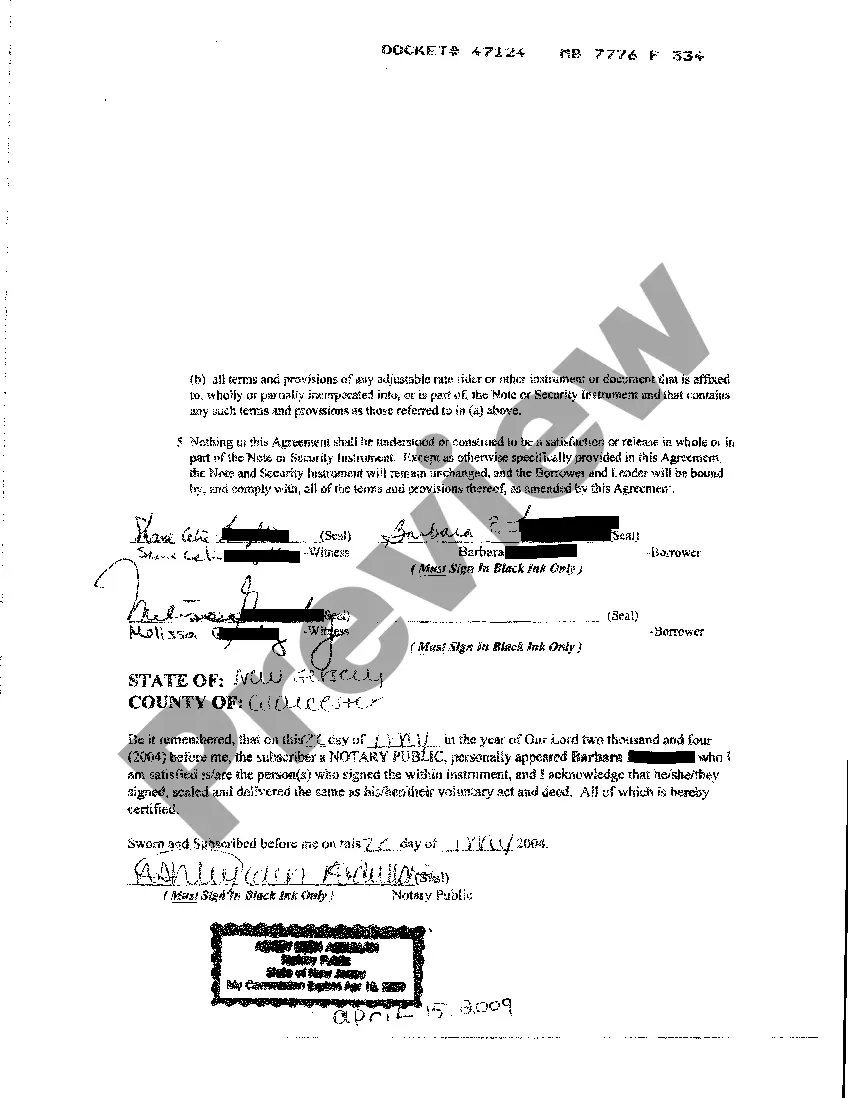

Elizabeth New Jersey Loan Modification Agreement refers to a legal contract that allows homeowners in Elizabeth, New Jersey, to modify the terms of their existing mortgage loan to make it more affordable and manageable. It is designed to help borrowers facing financial difficulties to avoid foreclosure and stay in their homes. A loan modification agreement typically involves negotiations between the borrower and the lender to revise the terms of the mortgage loan. The goal is to find a mutually beneficial solution that adjusts the interest rate, monthly payment, loan duration, or principal balance to provide the borrower with more affordable repayment options. This can help homeowners to avoid defaulting on their loans and retain homeownership. There are different types of loan modification agreements available in Elizabeth, New Jersey, depending on the specific needs and circumstances of the borrower: 1. Interest Rate Reduction: This type of loan modification involves lowering the interest rate on the mortgage loan, which effectively reduces the overall monthly payment. By decreasing the interest rate, homeowners can save money and afford their loan payments more easily. 2. Term Extension: With a term extension modification, the length of the loan is extended, allowing borrowers to spread their remaining payments over a longer period. This can lower the monthly payment amount, making it more affordable for homeowners, especially those who have experienced a significant reduction in income. 3. Principal Balance Reduction: In some cases, lenders may agree to reduce the outstanding principal balance of the loan. This means a portion of the loan amount is forgiven, decreasing the overall debt burden on the borrower. This modification is more difficult to obtain but can provide substantial relief for homeowners facing significant financial hardships. 4. Forbearance Agreement: A forbearance agreement is a temporary modification where the lender offers a reduction or suspension of loan payments for a specified period. This is typically granted when borrowers experience a temporary financial hardship, such as a job loss or medical emergency. The missed payments are often added back into the loan balance or repaid over time. It is important for homeowners in Elizabeth, New Jersey, to explore loan modification options if they find themselves struggling with mortgage payments. By working with lenders and considering the different types of loan modification agreements available, borrowers can potentially find a solution that enables them to keep their homes and regain financial stability.

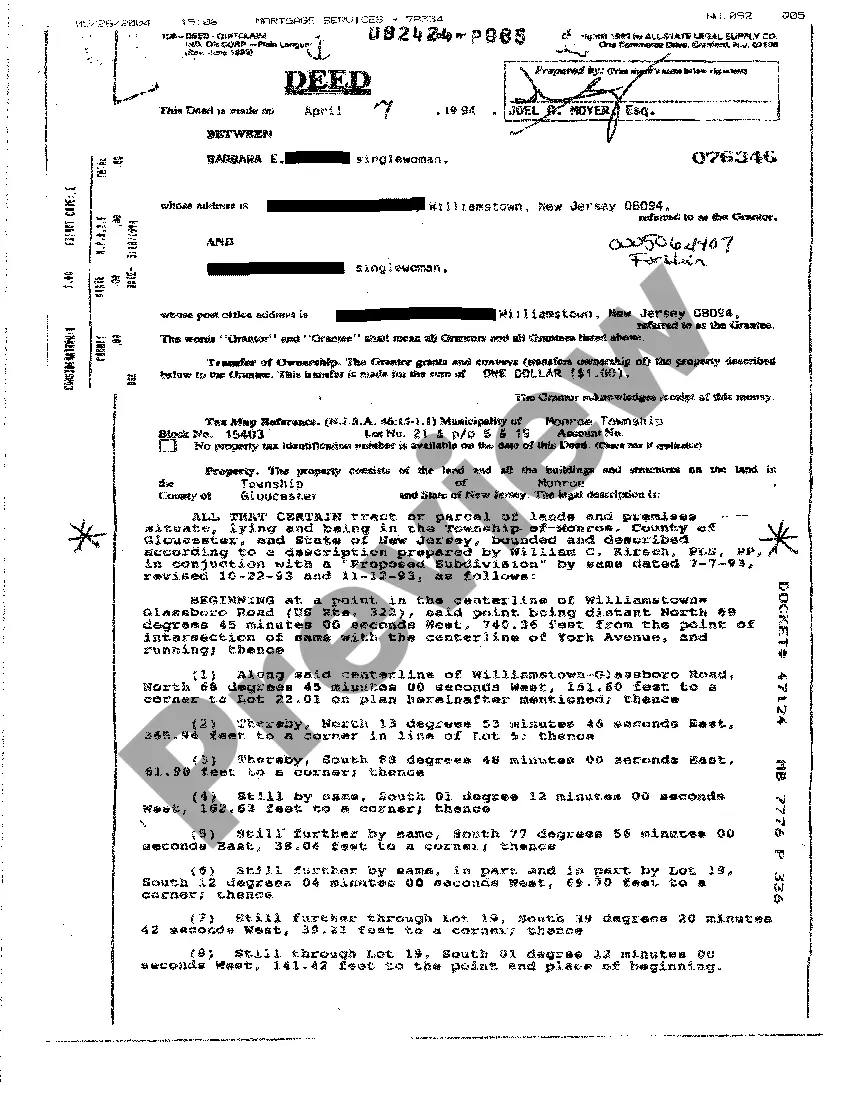

Elizabeth New Jersey Loan Modification Agreement

Description

How to fill out Elizabeth New Jersey Loan Modification Agreement?

Do you need a trustworthy and affordable legal forms provider to get the Elizabeth New Jersey Loan Modification Agreement? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Elizabeth New Jersey Loan Modification Agreement conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is good for.

- Start the search over if the template isn’t suitable for your specific situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the Elizabeth New Jersey Loan Modification Agreement in any provided file format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time researching legal paperwork online once and for all.