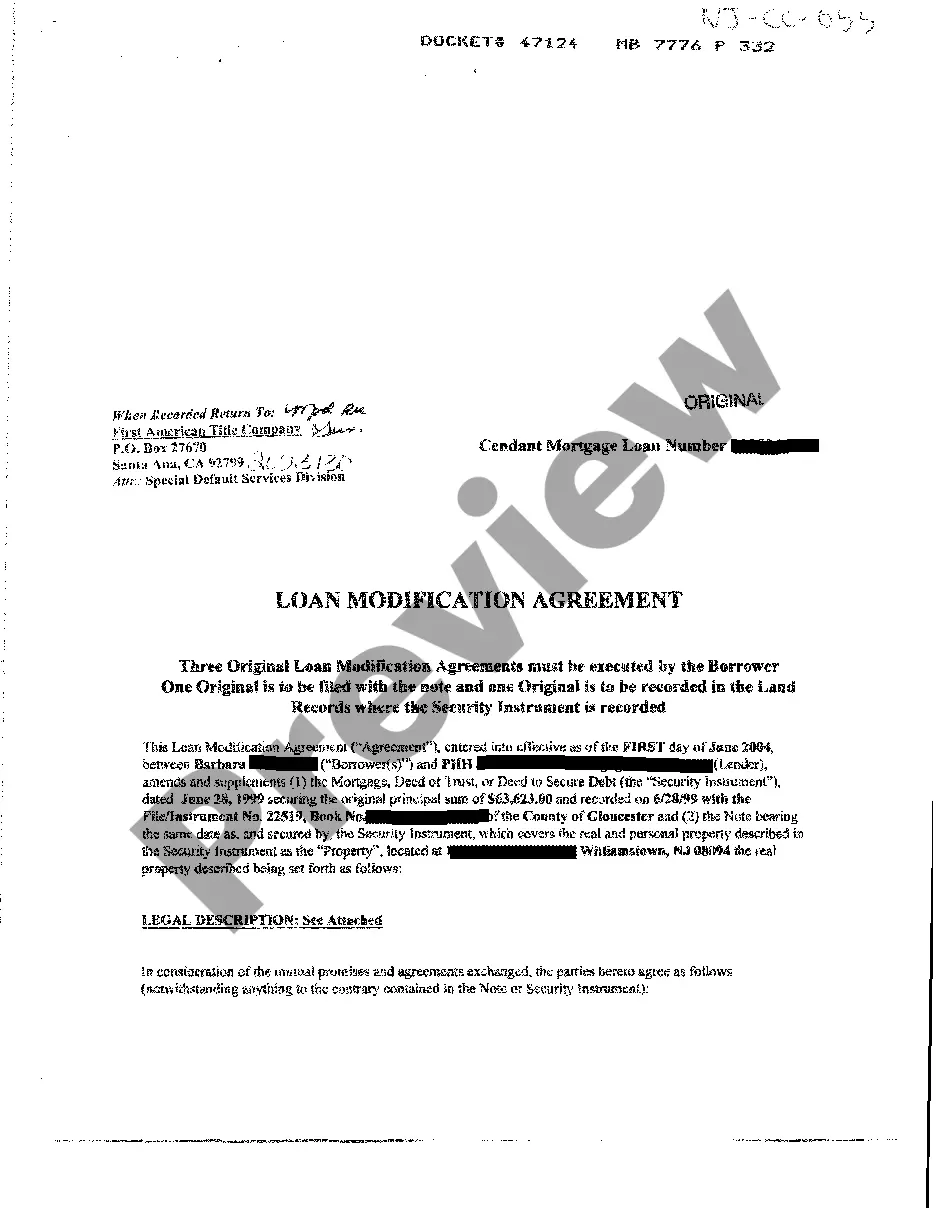

Newark New Jersey Loan Modification Agreement

Description

How to fill out New Jersey Loan Modification Agreement?

Are you in search of a dependable and affordable provider of legal documents to purchase the Newark New Jersey Loan Modification Agreement? US Legal Forms is your ideal option.

Whether you need a fundamental agreement to establish guidelines for living with your partner or a set of papers to facilitate your separation or divorce through the court system, we have you covered. Our site offers over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and are designed according to the regulations of specific states and counties.

To obtain the form, you need to Log In to your account, locate the required template, and select the Download button adjacent to it. Please remember that you can access your previously acquired document templates at any time in the My documents section.

Are you unfamiliar with our website? No problem. You can easily create an account, but before that, ensure to do the following.

Now you are ready to create your account. Next, select the subscription option and move forward with the payment. Once the payment is finalized, download the Newark New Jersey Loan Modification Agreement in any available format. You can return to the website as needed and redownload the form at no additional cost.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and stop wasting hours navigating legal paperwork online.

- Verify that the Newark New Jersey Loan Modification Agreement meets the regulations of your state and locality.

- Review the description of the form (if available) to understand who it is intended for and its appropriate uses.

- Restart your search if the template does not suit your legal needs.

Form popularity

FAQ

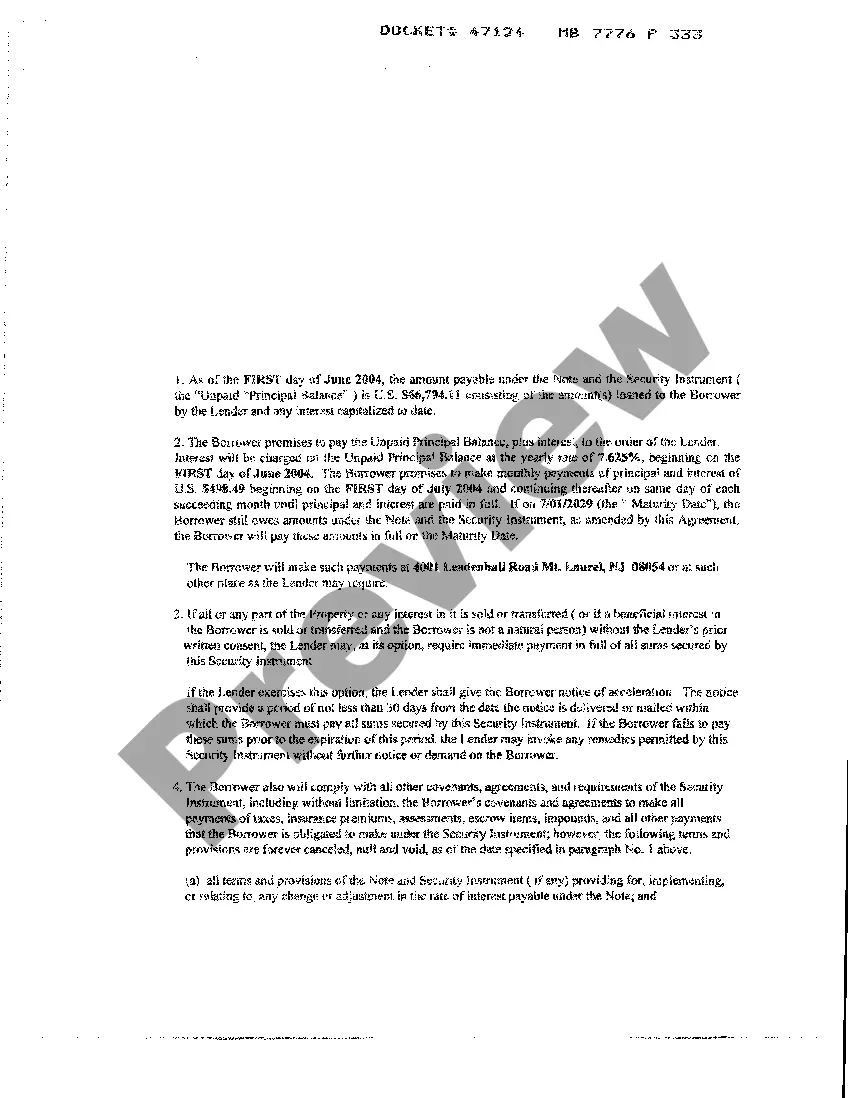

Some possible factors determining whether you'd qualify for a loan modification include: Your circumstances, why you fell behind on your mortgage and your ability to pay in the future. Your monthly income and how it compares to your housing costs. Your property value, the amount of your equity.

There are many reasons a lender might deny an application for a loan modification or claim you don't qualify for one, including but not limited to: An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment.

Who is eligible for a loan modification? To qualify for a loan modification, a borrower usually must have missed at least three mortgage payments and be in default. ?Sometimes, a borrower who has experienced financial setbacks, which makes a default imminent, can qualify for a loan modification.

Once approved for a modification, your lender will usually require you to go through a Trial Payment Plan (TPP) before they complete the modification. A TPP requires you to make a mortgage payment for a fixed number of months prior to fully modifying the loan.

Why Was I Denied for a Loan Modification? An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment. ?Lack of hardship,? or ability to pay the current mortgage payments without issue. You have already received the maximum number of loan modifications the lender allows.

There are many reasons why a loan modification application may be denied. Some common reasons include: -The borrower failed to provide all of the required documentation. -The borrower's income was not sufficient to support the modified payment amount.

To qualify for a loan modification under federal laws, the borrower's surplus income must total at least $300 and must constitute at least 15 percent of his or her monthly income.

You could receive your mortgage loan modification in as little as 30 days. Or you could be left waiting upwards of 90 days for everything to go through. It really comes down to the individual lender and their ability to quickly process mortgage modifications.

Why Was I Denied for a Loan Modification? An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment. ?Lack of hardship,? or ability to pay the current mortgage payments without issue. You have already received the maximum number of loan modifications the lender allows.