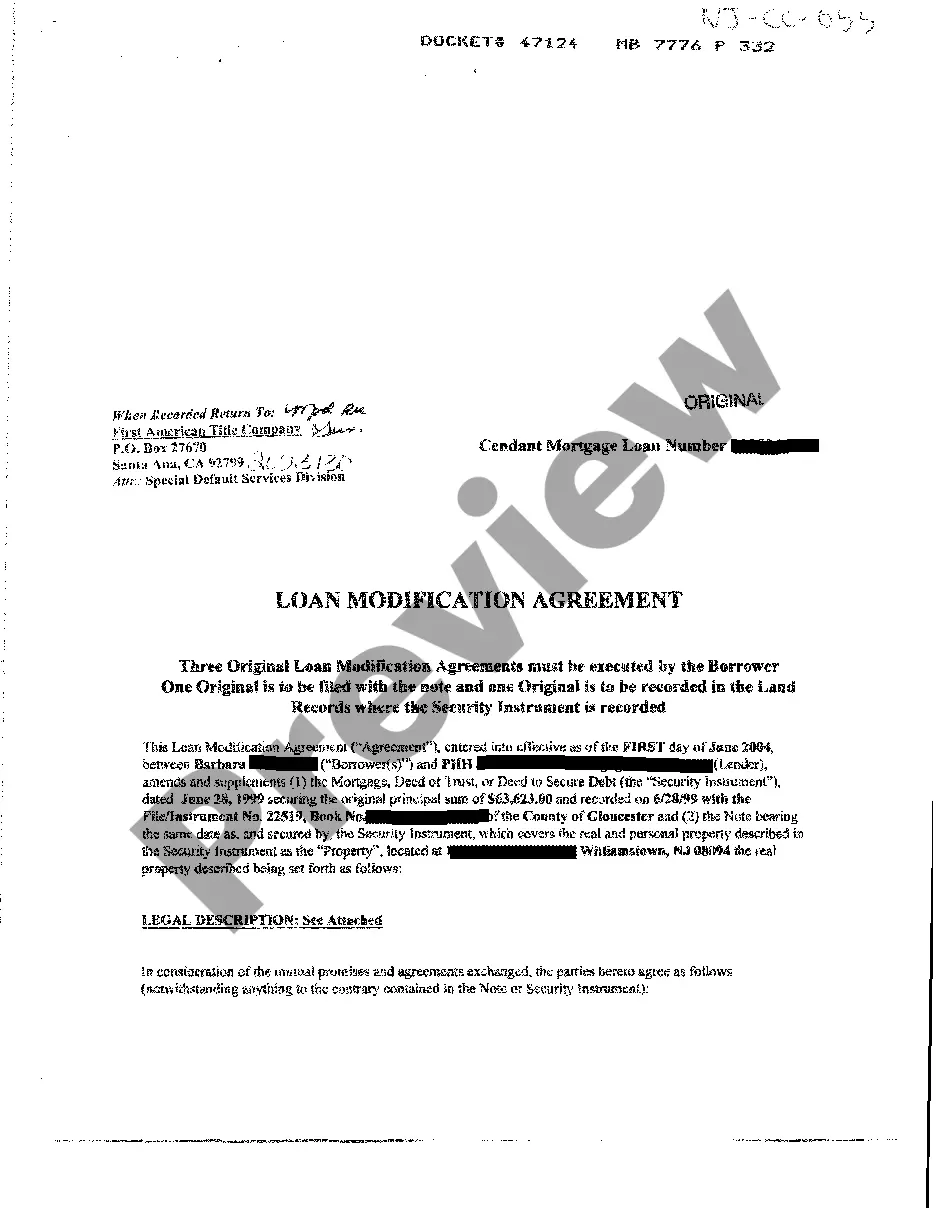

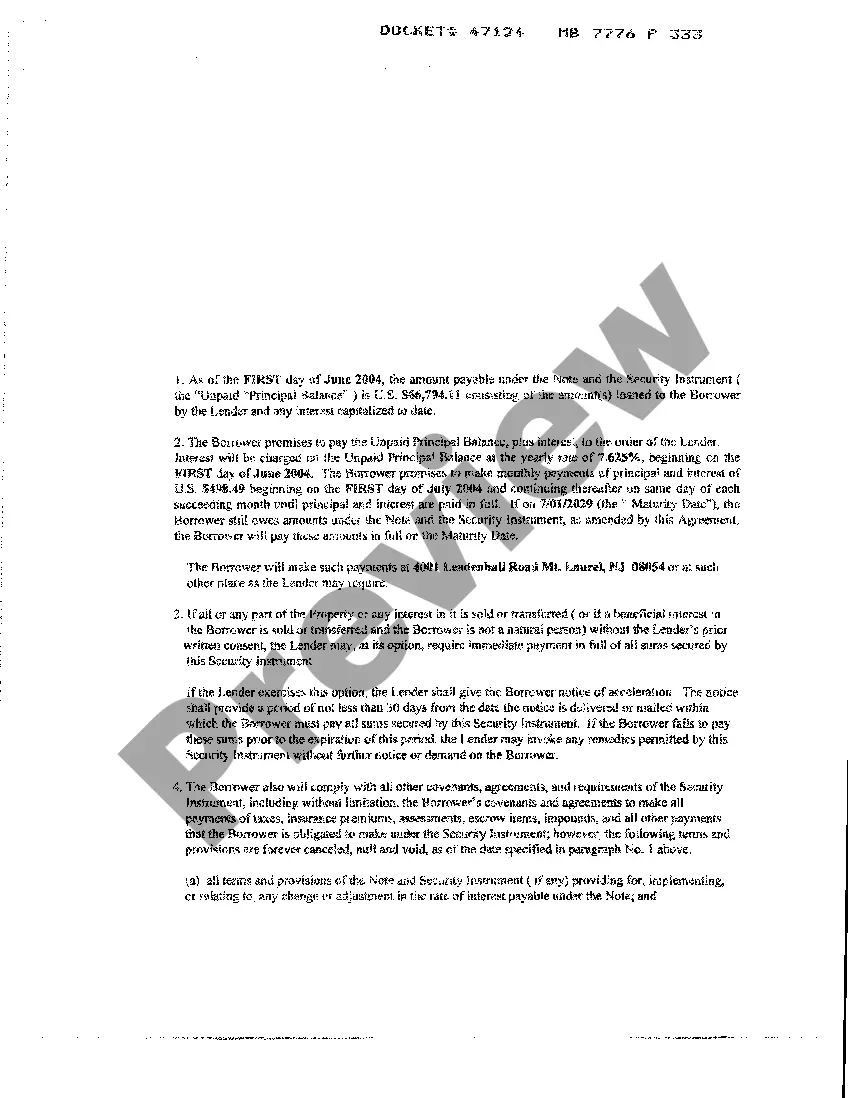

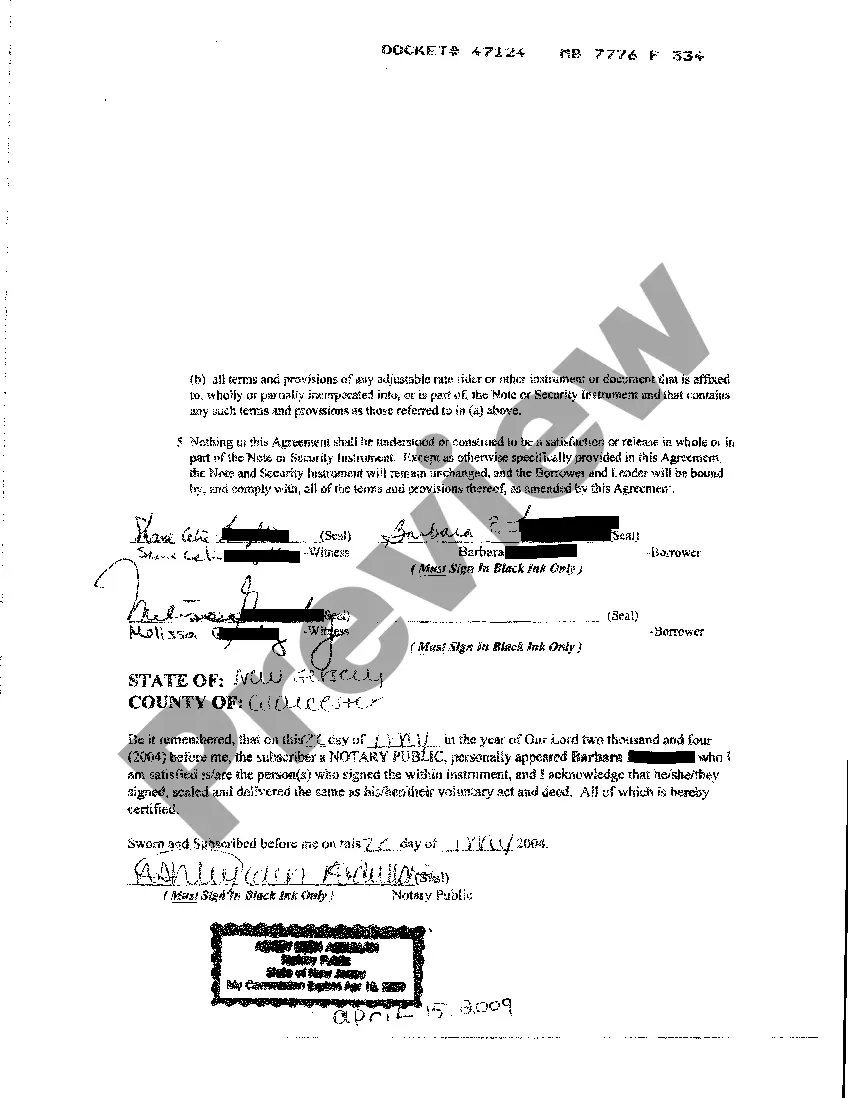

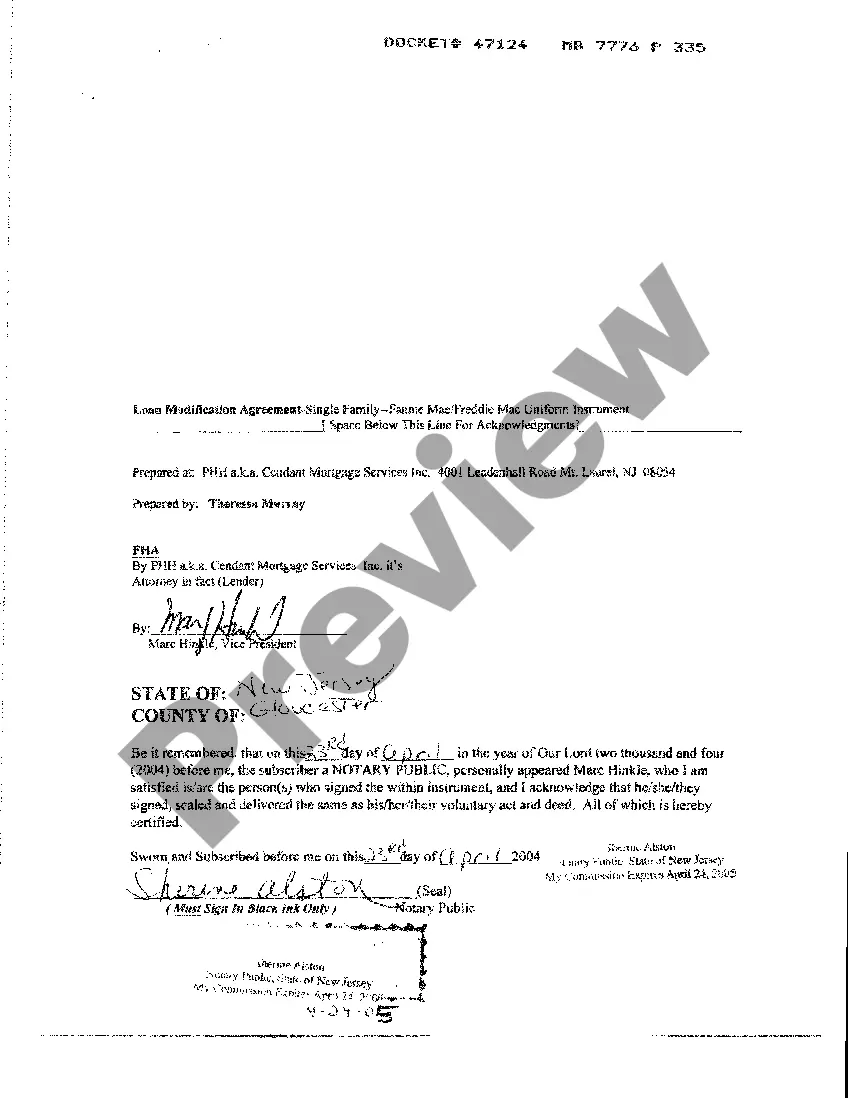

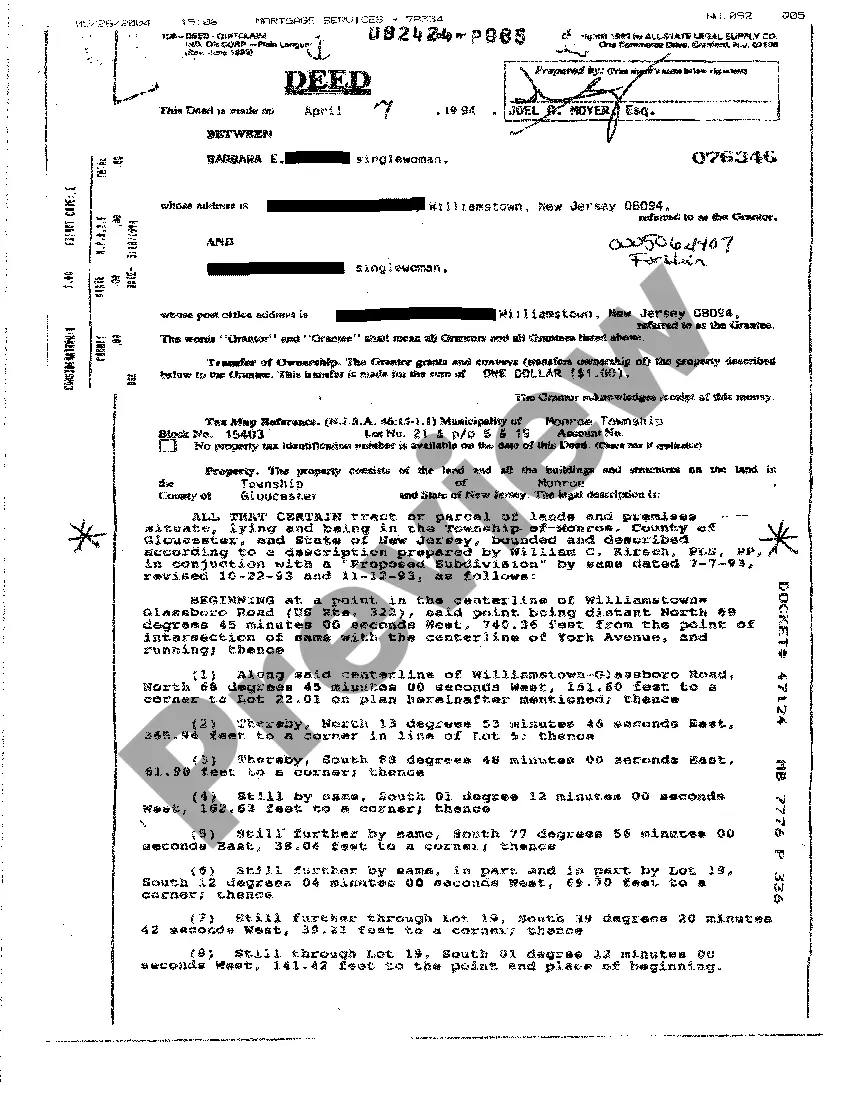

Paterson New Jersey Loan Modification Agreement: A Paterson New Jersey Loan Modification Agreement refers to a contractual agreement between a borrower and a lender, specifically in the city of Paterson, New Jersey. This agreement is designed to assist borrowers who are struggling to make their mortgage payments by providing them with more manageable terms that align with their financial situation. Keywords: Paterson New Jersey, Loan Modification Agreement, borrower, lender, mortgage payments, financial situation, manageable terms. In essence, a loan modification allows borrowers to modify the original terms of their mortgage, making it more affordable and sustainable. This can be a preferable option for homeowners facing financial hardship or experiencing difficulty in meeting their monthly mortgage obligations. Some common types of Paterson New Jersey Loan Modification Agreements include: 1. Interest Rate Reduction: In this type of modification, the lender may agree to lower the interest rate on the loan, thereby reducing the monthly mortgage payments. 2. Loan Term Extension: The lender may extend the duration of the loan, resulting in smaller monthly payments spread over a longer period. This can provide immediate relief for borrowers struggling to meet their current payment obligations. 3. Principal Forbearance: In certain cases, the lender may temporarily reduce the amount of principal owed or even suspend its payment altogether until the borrower's financial situation improves. This allows the borrower to make reduced payments or no payments for a specific period. 4. Loan Repayment Plan: This modification option involves creating a structured repayment plan, which includes adding any missed payments to the back end of the loan term. The borrower can catch up on arrears over an extended period while maintaining their current mortgage payment. When pursuing a Paterson New Jersey Loan Modification Agreement, borrowers typically need to provide documentation supporting their financial difficulties, such as income verification, bank statements, and any supplemental information requested by the lender. It is crucial to communicate and work closely with the lender to explore available options. It is worth noting that loan modification agreements are subject to lender approval and are not guaranteed. Borrowers should also be aware of potential fees or costs associated with modifying their loans. Ultimately, a Paterson New Jersey Loan Modification Agreement offers a potential lifeline for homeowners facing financial hardships, allowing them to adjust their mortgage terms to regain stability and avoid foreclosure.

Paterson New Jersey Loan Modification Agreement

Description

How to fill out Paterson New Jersey Loan Modification Agreement?

Do you need a trustworthy and affordable legal forms supplier to buy the Paterson New Jersey Loan Modification Agreement? US Legal Forms is your go-to solution.

Whether you require a simple agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of particular state and area.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Paterson New Jersey Loan Modification Agreement conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to find out who and what the form is intended for.

- Start the search over if the form isn’t good for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Paterson New Jersey Loan Modification Agreement in any available format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online once and for all.