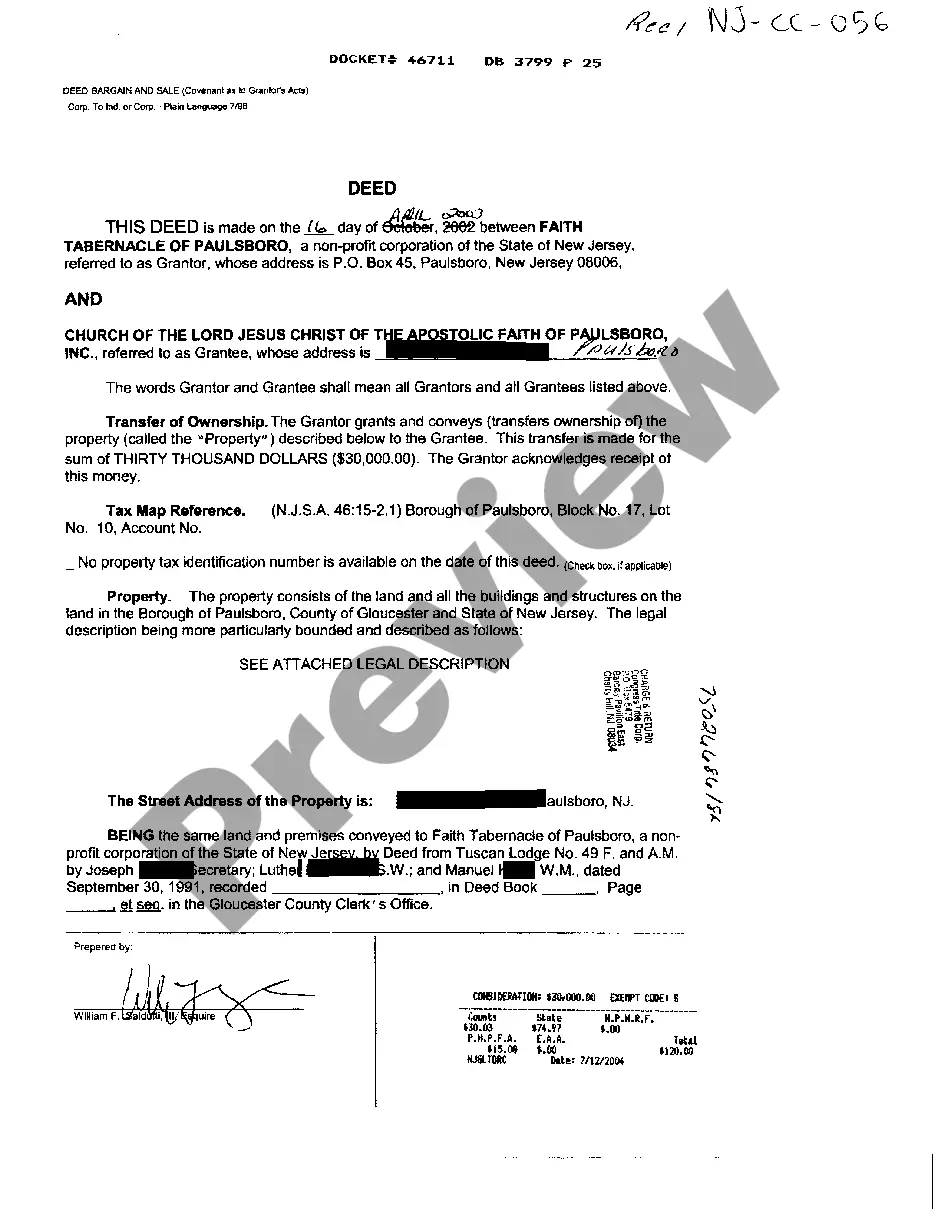

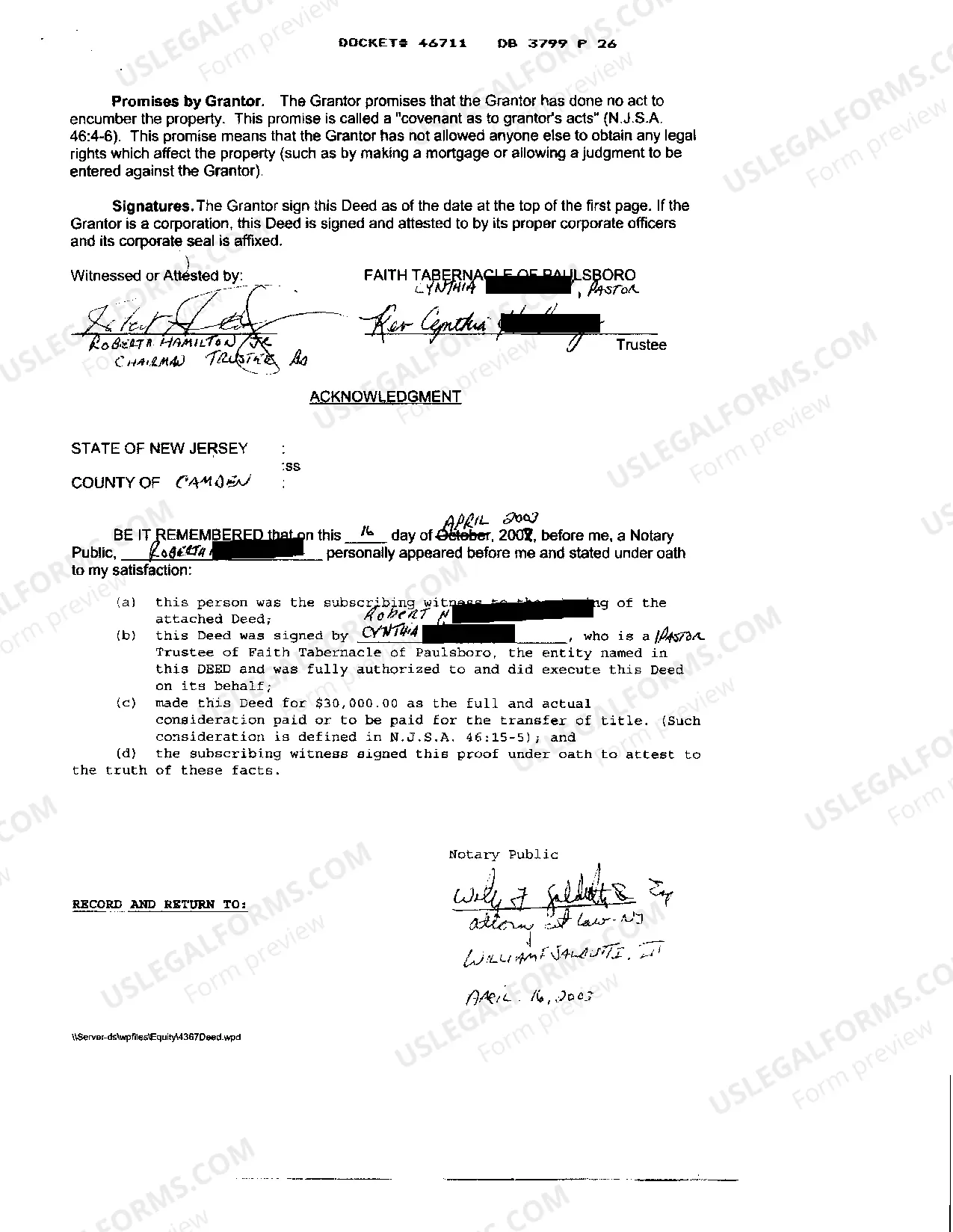

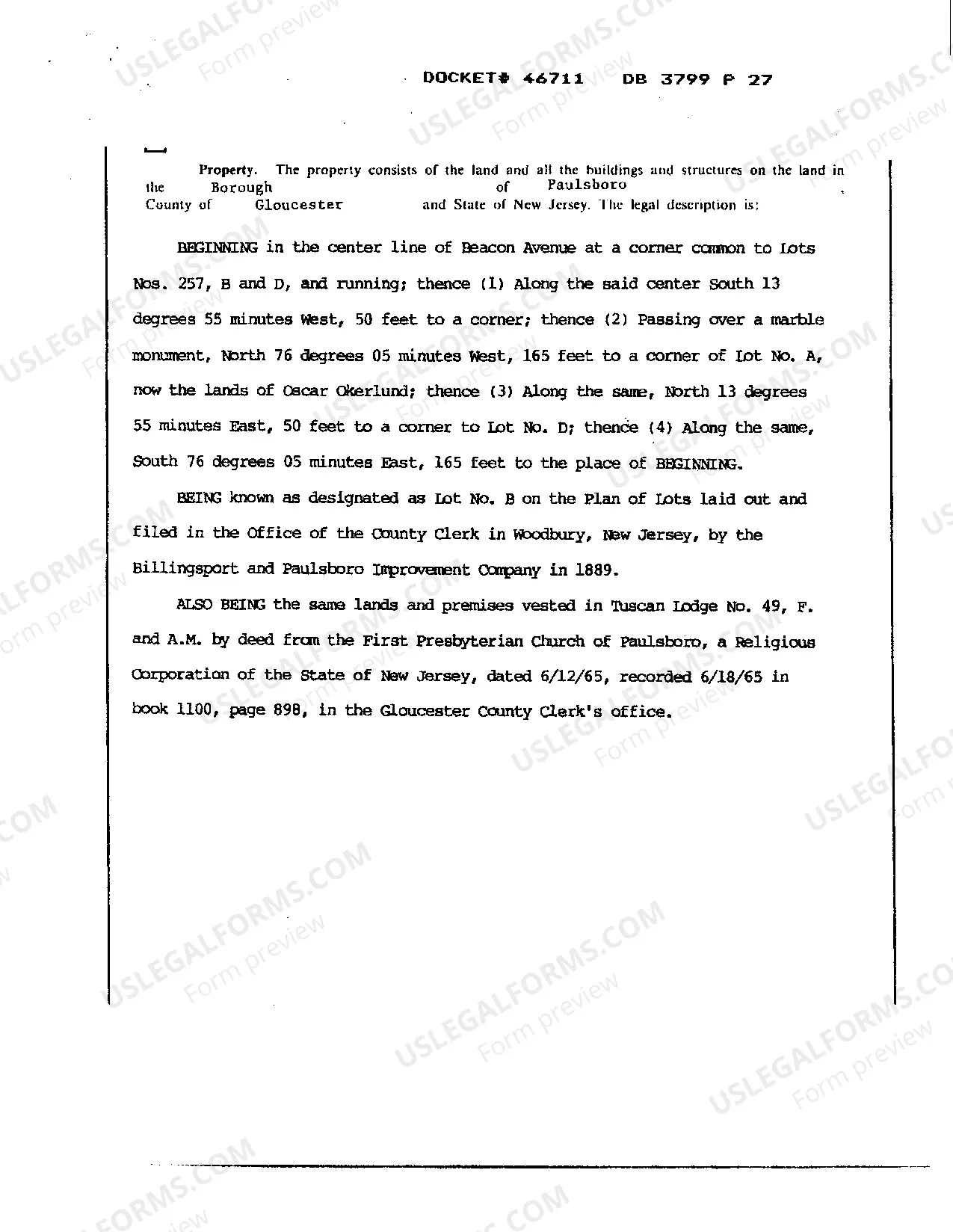

A Jersey City New Jersey Deed between Two Religious Institutions is a legal document that outlines the agreement and transfer of ownership or property rights between two religious organizations located in Jersey City, New Jersey. This comprehensive contract serves as evidence of the transaction and holds significant importance for the parties involved. The types of Jersey City New Jersey Deeds between Two Religious Institutions can vary based on the nature of the agreement and the properties involved. Some common types include: 1. Land Transfer Deed: This type of deed involves the transfer of land ownership between two religious institutions. It outlines the details of the property, including its boundaries, size, and any relevant restrictions or easements. 2. Building or Facility Transfer Deed: This deed focuses on the transfer of ownership or rights to a specific building or facility owned by one religious institution to another. It includes details such as the condition of the property, any existing leases or tenancy agreements, and warranty information. 3. Lease Agreement Deed: In some cases, religious institutions may enter into a lease agreement where one institution leases a property or facility from another. This type of deed outlines the terms of the lease, including rent, duration, maintenance responsibilities, and any other clauses or special conditions. 4. Shared Space Agreement Deed: When two religious institutions agree to share a specific space or property temporarily, a shared space agreement deed is typically used. It covers the terms and conditions of the shared arrangement, such as usage schedules, utility payments, and the division of maintenance and repair costs. These deeds must adhere to the legal requirements and guidelines set forth by the state of New Jersey. They should include key components such as the names and addresses of both religious institutions, a detailed description of the property or assets involved, the terms of the agreement, any financial considerations, and the signatures of authorized representatives from both parties. To ensure the legality and enforceability of the deed, it is advisable to involve legal professionals experienced in real estate and contract law. They will help draft the document, review any existing mortgages or liens on the property, conduct necessary title searches, and ensure compliance with local regulations. In conclusion, a Jersey City New Jersey Deed between Two Religious Institutions is a crucial legal document that facilitates the smooth transfer of property rights or agreements between religious organizations. Whether it involves land, buildings, leases, or shared spaces, these deeds play a significant role in protecting the interests of both parties and establishing a strong foundation for their future collaborations or property arrangements.

Jersey City New Jersey Deed Between Two Religious Institutions

Description

How to fill out Jersey City New Jersey Deed Between Two Religious Institutions?

If you’ve previously utilized our service, sign in to your account and retrieve the Jersey City New Jersey Deed Between Two Religious Institutions onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these uncomplicated steps to obtain your file.

You have continual access to each document you have acquired: you can find it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to effortlessly discover and store any template for your personal or professional requirements!

- Confirm you’ve found the right document. Browse through the description and use the Preview feature, if available, to verify if it aligns with your requirements. If it’s not suitable, employ the Search tab above to find the correct one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and proceed with payment. Use your credit card information or the PayPal method to finalize the transaction.

- Retrieve your Jersey City New Jersey Deed Between Two Religious Institutions. Choose the file format for your document and download it to your device.

- Complete your document. Print it out or use professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

To determine the transfer fee, calculate 1% of the total value of the consideration. Add another 1% to transactions worth more than $1 million. Visit an official county recording portal to determine the total amount of the transfer fee(s) based on the value of your transaction.

NJ Taxation The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence (main home). To qualify, you must meet all the eligibility requirements for each year from the base year through the application year.

This program provides property tax relief to New Jersey residents who owned or rented their principal residence (main home) on October 1, 2019, and met the income limits. Filing deadline: December 30, 2022.

In New Jersey, the preparation of legal documents such as a deed is considered the practice of law which may only be undertaken by an Attorney at Law of the State of New Jersey. The only exception to that rule is that an individual representing him/herself may prepare his/her own documents.

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

You must be age 65 or older, or disabled (with a Physician's Certificate or Social Security document) as of December 31 of the pretax year.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

The ST-5 exemption certificate grants your organization exemption from New Jersey sales and use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services.

To qualify, you must be age 65 or older, or a permanently and totally disabled individual or the unmarried surviving spouse, age 55 or more, of such person.

For the most part, the deeds are recorded fairly promptly, but take six to ten weeks to get back a recorded deed from the clerk's office, so be patient.