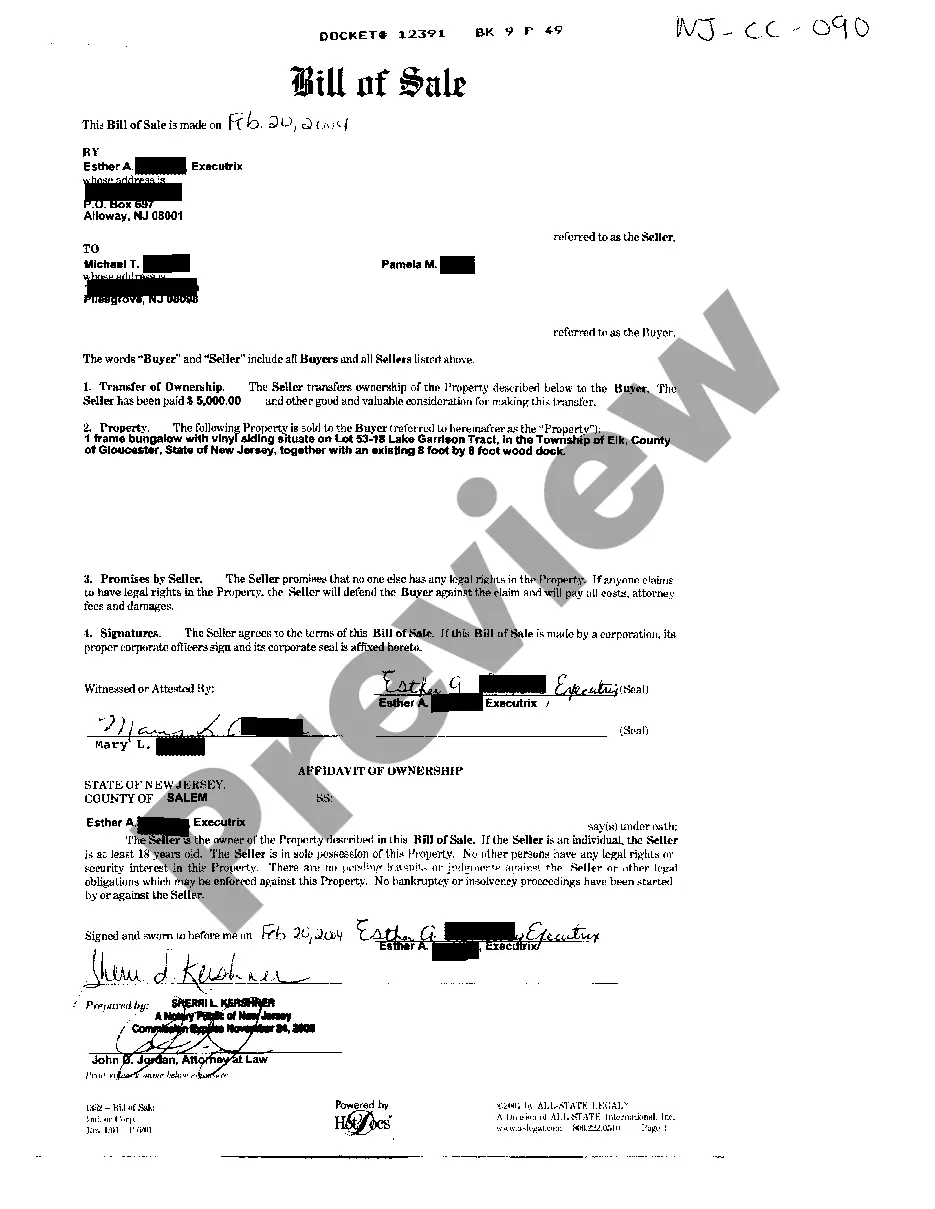

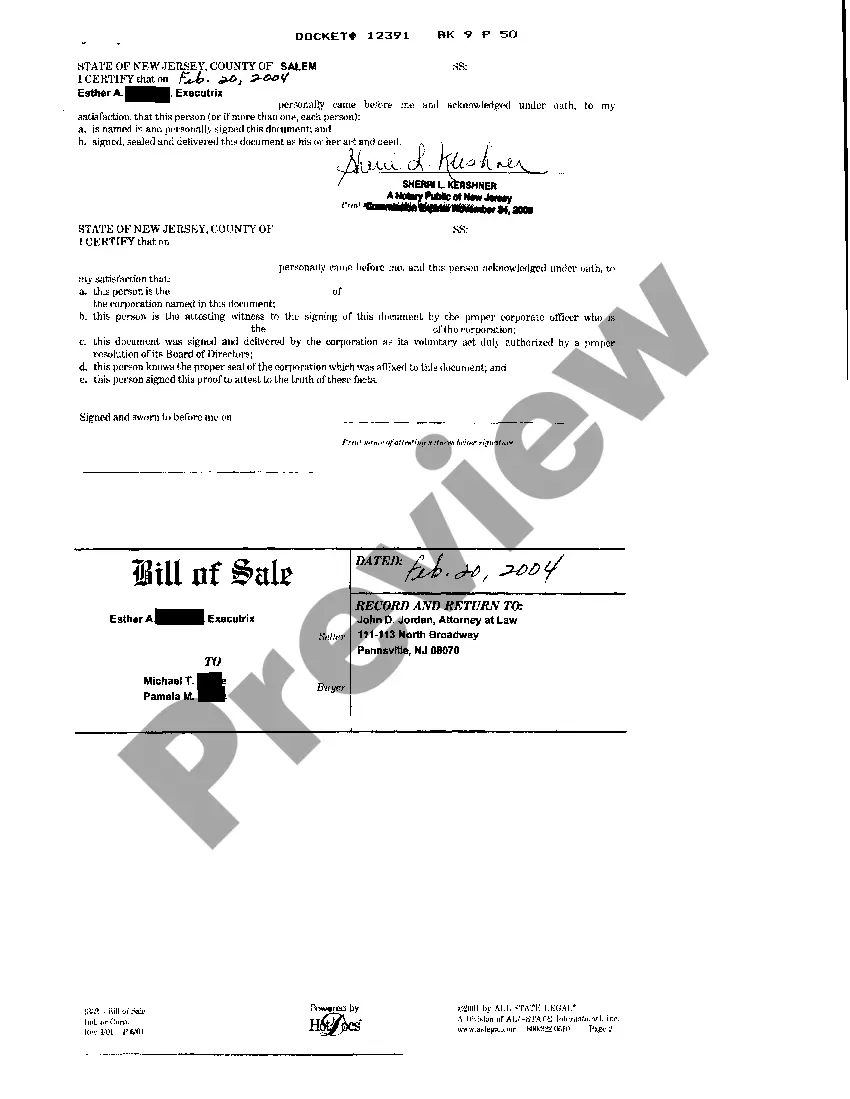

The Newark New Jersey Bill of Sale for Improvements to Land Including Bungalow is a legal document used to outline the transfer of ownership of a property along with any improvements made on the land, specifically including a bungalow. This bill of sale serves as proof of the transaction and protects the rights of both the buyer and the seller. Keywords: Newark New Jersey, Bill of Sale, Improvements to Land, Bungalow, legal document, transfer of ownership, transaction, buyer, seller, rights. Different types of Newark New Jersey Bill of Sale for Improvements to Land Including Bungalow may include: 1. Residential Property Bill of Sale: This specific type of bill of sale is used when the property being sold is primarily used for residential purposes, such as a single-family home or a bungalow. 2. Commercial Property Bill of Sale: In cases where the property includes a bungalow that is used for commercial purposes, such as a rented office space or a small shop, a commercial property bill of sale would be applicable. 3. Investment Property Bill of Sale: If the property, along with the bungalow, is being sold with the intention of earning rental income or as an investment, an investment property bill of sale would be required. 4. Renovation or Restoration Property Bill of Sale: This type of bill of sale is used when the improvements made to the land, including the bungalow, involve significant renovation or restoration work. It may include detailed information on the costs and scope of the renovations. 5. Land Development Bill of Sale: When the property being sold includes a bungalow, but the main focus is on the potential for further development of the land, a land development bill of sale is necessary. It may include details on zoning restrictions, potential construction plans, or any existing permits. Note: It is advisable to consult with a legal professional or seek guidance from the appropriate authorities in Newark New Jersey to determine the specific type of bill of sale required for a particular transaction involving the sale of land and its improvements, including a bungalow.

The Newark New Jersey Bill of Sale for Improvements to Land Including Bungalow is a legal document used to outline the transfer of ownership of a property along with any improvements made on the land, specifically including a bungalow. This bill of sale serves as proof of the transaction and protects the rights of both the buyer and the seller. Keywords: Newark New Jersey, Bill of Sale, Improvements to Land, Bungalow, legal document, transfer of ownership, transaction, buyer, seller, rights. Different types of Newark New Jersey Bill of Sale for Improvements to Land Including Bungalow may include: 1. Residential Property Bill of Sale: This specific type of bill of sale is used when the property being sold is primarily used for residential purposes, such as a single-family home or a bungalow. 2. Commercial Property Bill of Sale: In cases where the property includes a bungalow that is used for commercial purposes, such as a rented office space or a small shop, a commercial property bill of sale would be applicable. 3. Investment Property Bill of Sale: If the property, along with the bungalow, is being sold with the intention of earning rental income or as an investment, an investment property bill of sale would be required. 4. Renovation or Restoration Property Bill of Sale: This type of bill of sale is used when the improvements made to the land, including the bungalow, involve significant renovation or restoration work. It may include detailed information on the costs and scope of the renovations. 5. Land Development Bill of Sale: When the property being sold includes a bungalow, but the main focus is on the potential for further development of the land, a land development bill of sale is necessary. It may include details on zoning restrictions, potential construction plans, or any existing permits. Note: It is advisable to consult with a legal professional or seek guidance from the appropriate authorities in Newark New Jersey to determine the specific type of bill of sale required for a particular transaction involving the sale of land and its improvements, including a bungalow.